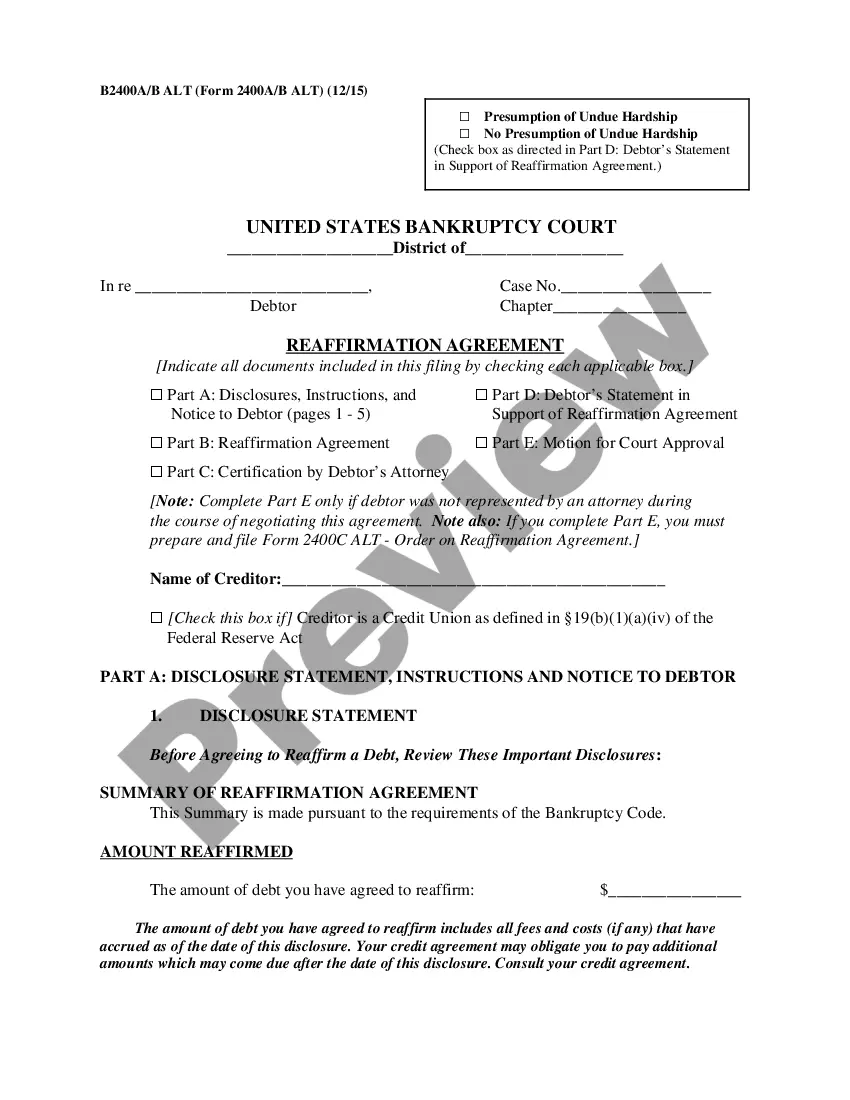

Pennsylvania Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

Choosing the best lawful document web template might be a have a problem. Needless to say, there are tons of templates available online, but how will you get the lawful develop you require? Take advantage of the US Legal Forms website. The service provides a large number of templates, such as the Pennsylvania Reaffirmation Agreement, Motion and Order, that can be used for enterprise and personal requirements. All the types are inspected by experts and meet state and federal demands.

When you are currently signed up, log in in your accounts and click the Obtain option to get the Pennsylvania Reaffirmation Agreement, Motion and Order. Make use of accounts to appear from the lawful types you have acquired formerly. Proceed to the My Forms tab of your own accounts and acquire an additional backup in the document you require.

When you are a new consumer of US Legal Forms, here are straightforward recommendations that you should stick to:

- Very first, ensure you have selected the right develop to your town/region. It is possible to check out the form using the Review option and read the form description to make certain it is the right one for you.

- In the event the develop is not going to meet your needs, take advantage of the Seach area to discover the right develop.

- Once you are certain the form is suitable, click on the Get now option to get the develop.

- Opt for the costs strategy you desire and type in the required details. Build your accounts and pay for an order with your PayPal accounts or credit card.

- Choose the document structure and obtain the lawful document web template in your system.

- Total, modify and produce and indicator the attained Pennsylvania Reaffirmation Agreement, Motion and Order.

US Legal Forms is definitely the biggest library of lawful types for which you can find various document templates. Take advantage of the service to obtain professionally-produced documents that stick to status demands.

Form popularity

FAQ

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

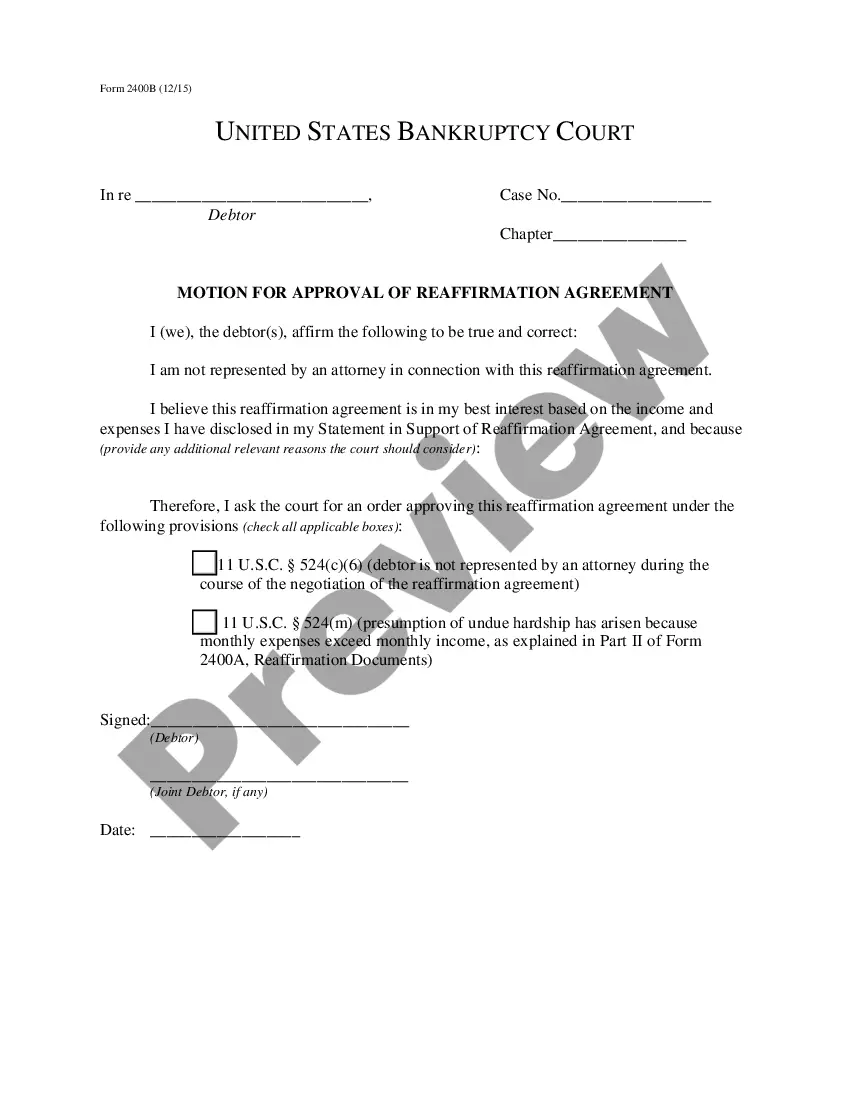

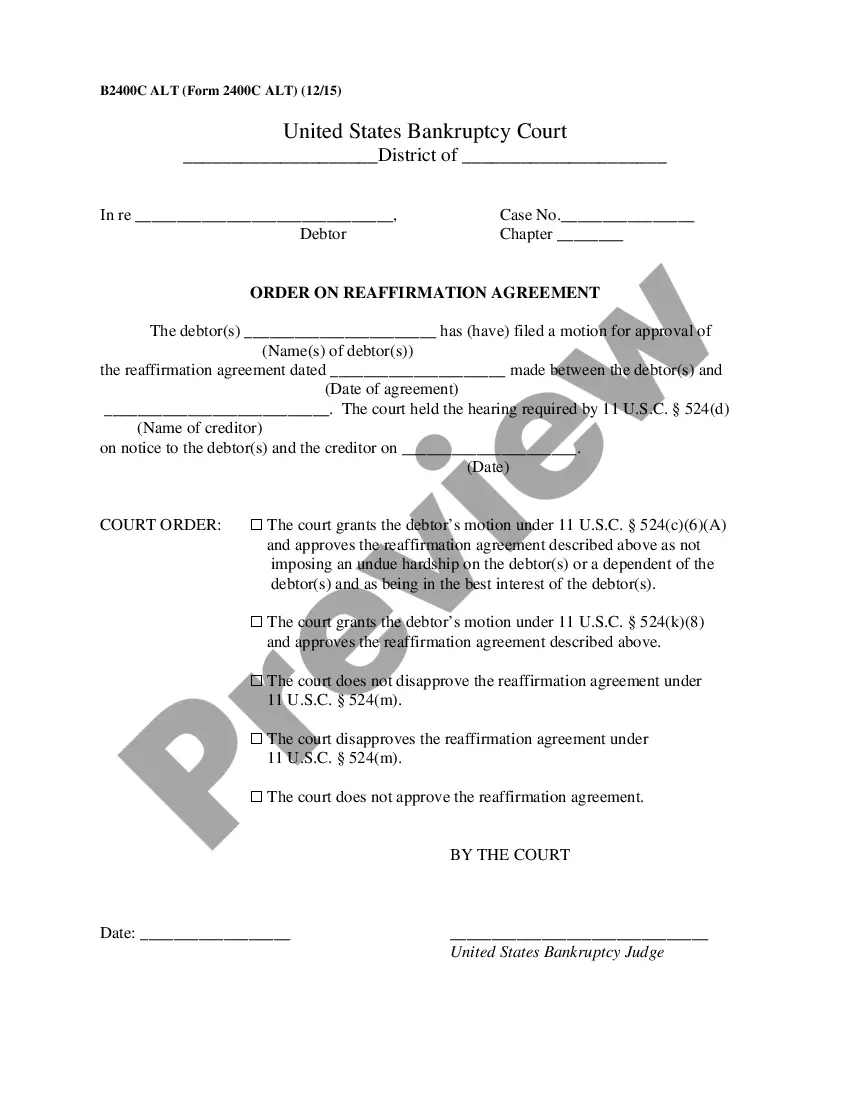

A reaffirmation agreement allows you to retain a specific asset (commonly a house or car) during bankruptcy in exchange for agreeing to pay the outstanding debt. If you would like to request a reaffirmation agreement, you must submit a Statement of Intent to the court and contact the lender to establish terms.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.

A debtor may enter into a reaffirmation agreement in order to take a debt owed on an automobile (for example) and agree to remove that debt from being dischargeable. This is the case for many debtors who want to desire to keep their vehicle even though money is still owed on the car loan.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

You may rescind (cancel) your Reaffirmation Agreement at any time before the bankruptcy court enters your discharge, or during the 60-day period that begins on the date your Reaffirmation Agreement is filed with the court, whichever occurs later.

Opting for a reaffirmation agreement can be helpful if you need to keep your home, car or some other asset. That's an especially salient point since bankruptcies stay on your credit report for up to 10 years. During that time, it'll be harder to apply for new credit, such as personal loans, mortgages or auto loans.

For example, if a debtor reaffirms a car loan for $15,000 and the car securing the loan is worth $8,000, then, if the debt or defaults, the creditor may repossess the car and the debtor may still be liable to the creditor for $7,000 (the difference between the amount of the l oan and the value of the car at the time it ...