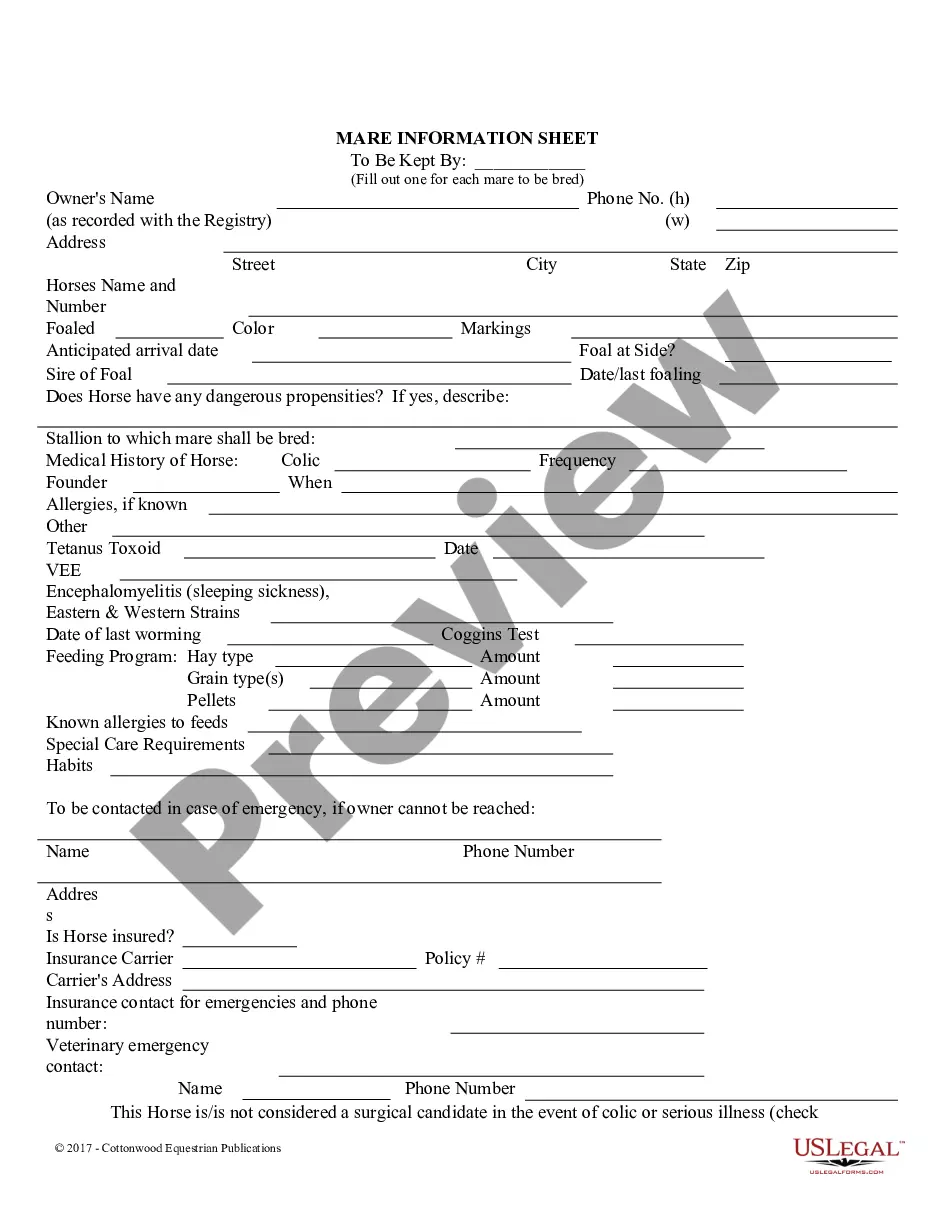

This form may be used to establish an Irrevocable Reversionary Living Trust, with the United States as Grantor; to provide secondary payment for medical benefits to the beneficiary named in the form.

Pennsylvania Irrevocable Reversionary Inter Vivos Medical Trust

Description

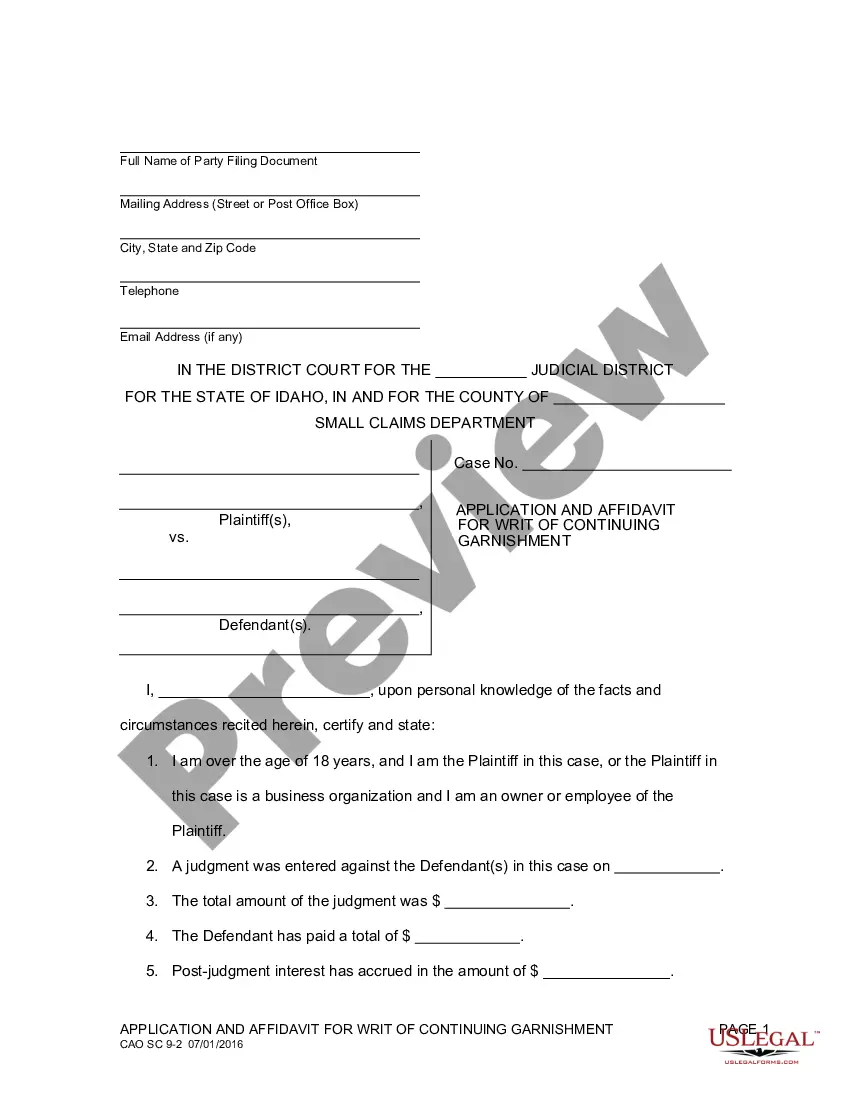

How to fill out Irrevocable Reversionary Inter Vivos Medical Trust?

Finding the right legitimate file format can be a have difficulties. Naturally, there are tons of templates available on the net, but how do you find the legitimate type you will need? Utilize the US Legal Forms web site. The services offers a large number of templates, including the Pennsylvania Irrevocable Reversionary Inter Vivos Medical Trust, which you can use for organization and private requires. All of the kinds are inspected by pros and fulfill federal and state demands.

Should you be already registered, log in to the account and click on the Down load switch to find the Pennsylvania Irrevocable Reversionary Inter Vivos Medical Trust. Use your account to look through the legitimate kinds you possess purchased earlier. Go to the My Forms tab of your own account and obtain an additional version from the file you will need.

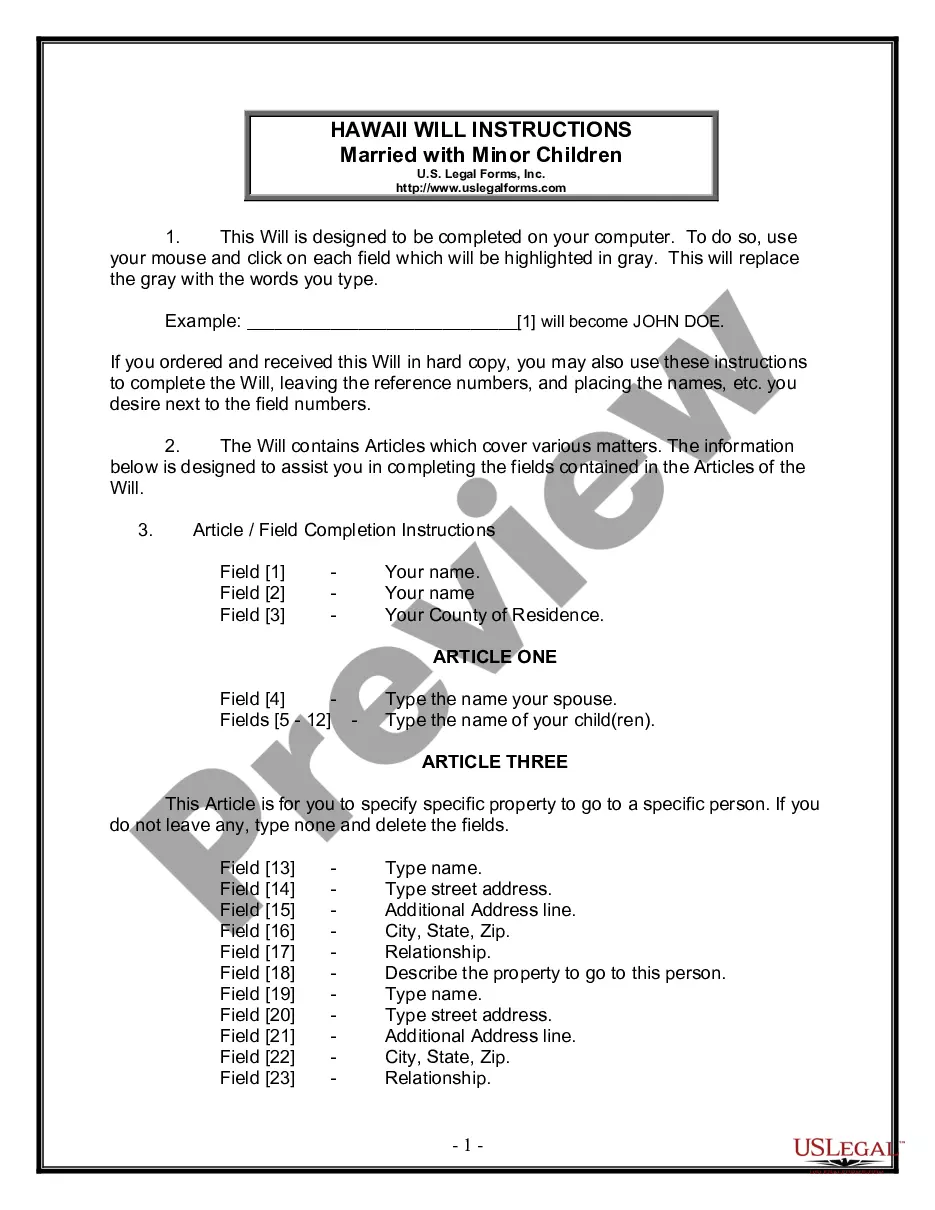

Should you be a brand new customer of US Legal Forms, here are easy instructions for you to follow:

- Initially, make certain you have chosen the right type to your metropolis/state. You can look over the shape using the Review switch and study the shape outline to ensure this is the best for you.

- When the type will not fulfill your expectations, make use of the Seach area to get the correct type.

- When you are certain that the shape would work, click the Buy now switch to find the type.

- Select the costs strategy you desire and type in the necessary information and facts. Make your account and pay for the transaction making use of your PayPal account or charge card.

- Pick the submit format and acquire the legitimate file format to the product.

- Comprehensive, modify and print out and indication the acquired Pennsylvania Irrevocable Reversionary Inter Vivos Medical Trust.

US Legal Forms is definitely the most significant local library of legitimate kinds where you can see a variety of file templates. Utilize the company to acquire professionally-created papers that follow state demands.

Form popularity

FAQ

If you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

Estates and trusts report income on the PA-41 Fiduciary Income Tax return. Estates and trusts are entitled to deduct from their income any distribution of income that they are required to distribute (under the governing instrument or state law) or actually pay or credit to a beneficiary.

Pennsylvania requires the Trustee of an irrevocable trust to send a notice to any beneficiary or potential beneficiary over the age of 25 since courts in Pennsylvania do not enforce a trust except when a Trustee or beneficiary makes a request.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

Generally, a decedent (while alive) does not control an irrevocable trust ? so there's no inheritance tax on an irrevocable trust. Typically, the executor or administrator will complete PA Department of Revenue Form 1500 if the decedent was a Pennsylvania resident.

Unlike a Revocable Trust the Grantor does not own the assets. All of the property held in an Irrevocable Trust is out of your taxable estate (care must be taken in the case of life insurance to avoid includability). The Irrevocable Trust is a tax efficient way to transfer accumulated wealth onto your beneficiaries.

Assuming all beneficiaries agree to the final accounting, to the plan of distribution, and to sign the Receipt, Release, & Refunding Agreement, the trust may be terminated without court authorization. Alternatively, it may be necessary to obtain a court order to approve the accountings and terminate the trust.