Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Locating the appropriate legal document format can be challenging. Naturally, there are numerous templates accessible online, but how do you acquire the legal form you require? Utilize the US Legal Forms website.

The service provides a vast array of templates, including the Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, which can be employed for both business and personal purposes. All forms are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Use your account to browse through the legal documents you have previously obtained. Visit the My documents section of your account to download another copy of the document you need.

Complete, modify, print, and sign the obtained Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. US Legal Forms is the largest repository of legal templates from which you can find numerous document formats. Use the service to acquire professionally crafted paperwork that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

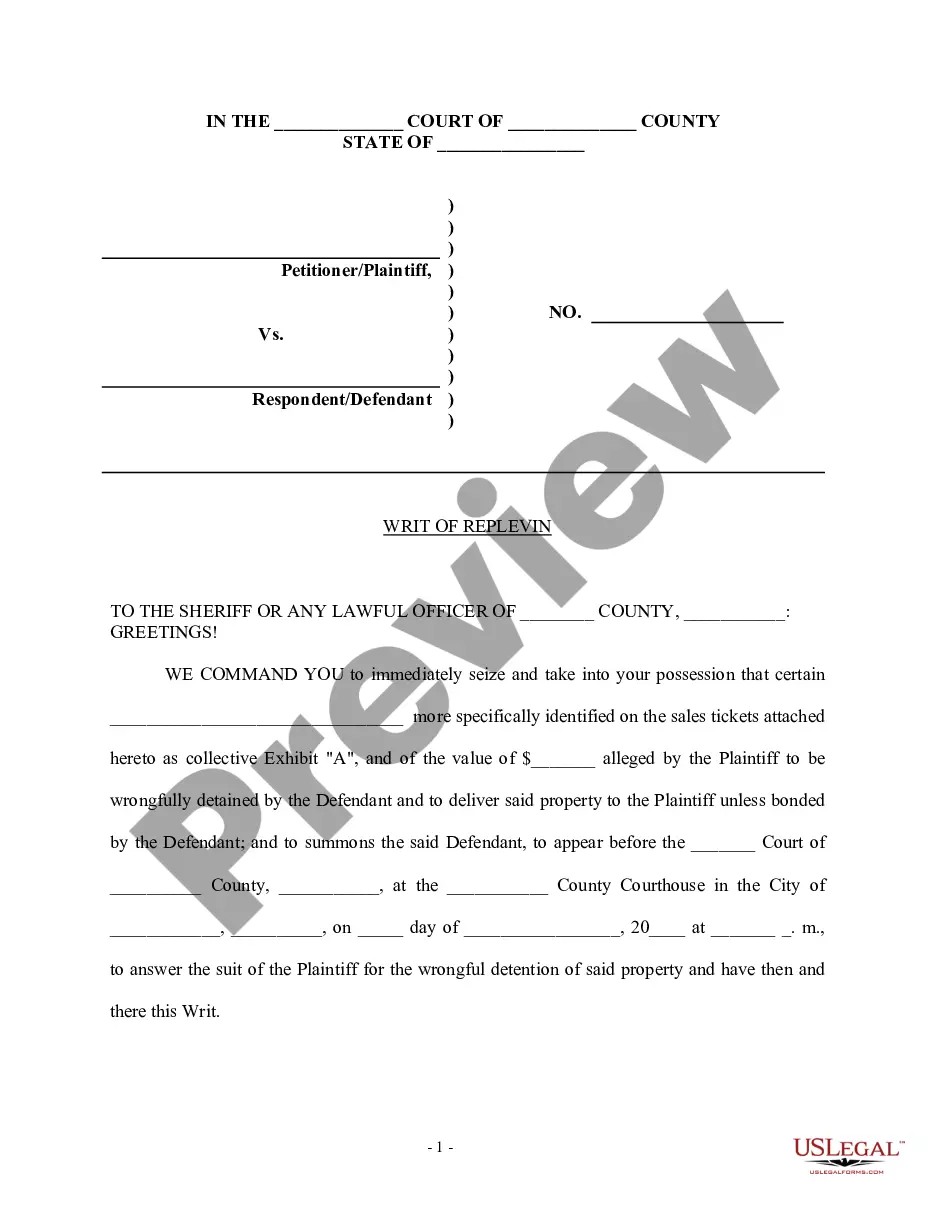

- First, ensure you have selected the correct form for your locality/county. You can view the form using the Preview button and review the form details to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search box to find the appropriate form.

- Once you are certain the form is appropriate, click the Purchase now button to acquire the form.

- Choose the pricing option you desire and enter the required information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

Form popularity

FAQ

Negotiating a personal guarantee can be straightforward when you approach it with clarity. Start by outlining the specific terms you are comfortable with, such as the duration and scope of the guarantee. It's important to communicate these terms clearly to the other party, while also highlighting the value you're bringing to the contract. For those dealing with a Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, utilizing platforms like USLegalForms can provide valuable templates and guidance to help you draft and negotiate effectively.

In Pennsylvania, a personal guaranty does not always need to be notarized to be enforceable; however, notarization adds an extra layer of legitimacy. Including proper signatures and clear language in your Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is essential. Notarization can protect both parties and prevent future disputes. US Legal Forms offers templates that clarify these requirements, ensuring you create a watertight agreement.

A personal guaranty on a lease is a legal commitment where an individual agrees to be responsible for the terms of the lease if the tenant fails to comply. In the context of a Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, this means the guarantor can face financial consequences if the lease is violated. This arrangement gives landlords additional security and assurance. Crafting this document through US Legal Forms can help ensure it meets all necessary legal standards.

Yes, personal guarantees generally hold up in court, especially when they comply with Pennsylvania's legal requirements. When drafting a Pennsylvania Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, ensure it is clear and specific. Courts often enforce these agreements when they demonstrate mutual intent between parties. Utilizing a reliable platform like US Legal Forms can simplify the process of creating a strong personal guaranty.

By agreeing to a personal guarantee, the business borrower is agreeing to be 100 percent personally responsible for repayment of the entire loan amount, in addition to any collection, legal, or other costs related to the loan.

A personal guaranty is not enforceable without consideration A contract is an enforceable promise. The enforceability of a contract comes from one party's giving of consideration to the other party. Here, the bank gives a loan (the consideration) in exchange for the guarantor's promise to repay it.

A business owner will often sign a personal guarantee if a company needs to make a purchase on credit for things such as real estate, inventory, supplies, or services. By signing the agreement, the owner commits to paying the debt with personal (nonbusiness) funds if the company can't satisfy the obligation.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.