The Pennsylvania Relocation Expense Agreement is a legally binding document that outlines the terms and conditions of relocation expenses for individuals or employees who are required to move to Pennsylvania for employment purposes. This agreement serves as a means to protect both parties involved — the employer and themployedye— - by clearly stating their rights and responsibilities related to relocation costs. The agreement specifies the relocation benefits provided to the employee, such as reimbursement for transportation expenses, moving and storage costs, as well as temporary housing allowances. It also covers other relocation-related costs, such as visa or work permit fees, utility connections, and realtor fees. Different types of Pennsylvania Relocation Expense Agreements may exist, depending on the employer's relocation policies and the specific circumstances of the relocation. Some common variations include: 1. Temporary Relocation Expense Agreement: This type of agreement is applicable when an employee is required to move to Pennsylvania for a limited period. It details the duration of the temporary relocation, the exact benefits provided, and any conditions or restrictions associated with it. 2. Permanent Relocation Expense Agreement: In contrast to a temporary agreement, this type applies when an employee is expected to permanently move to Pennsylvania. It covers a wider range of expenses, such as home purchase or sale costs, lease termination fees, and spousal employment assistance. 3. Lump Sum Relocation Expense Agreement: This agreement provides a fixed amount of money to the employee to cover relocation expenses. It allows the individual to manage their own relocation, from hiring moving services to finding suitable accommodations. The lump sum amount is typically negotiated based on factors such as the employee's position, distance of the move, and local cost of living. 4. Individualized Relocation Expense Agreement: In some cases, an employer may tailor the relocation benefits to the specific needs of the employee. This type of agreement allows flexibility in determining the benefits, which could include additional perks like language classes, cultural integration support, or childcare assistance. It is important for both the employer and the employee to carefully review and understand the terms and conditions of the Pennsylvania Relocation Expense Agreement before signing it. Seeking legal advice is advisable to ensure that all parties are protected and obligations are clear.

Pennsylvania Relocation Expense Agreement

Description

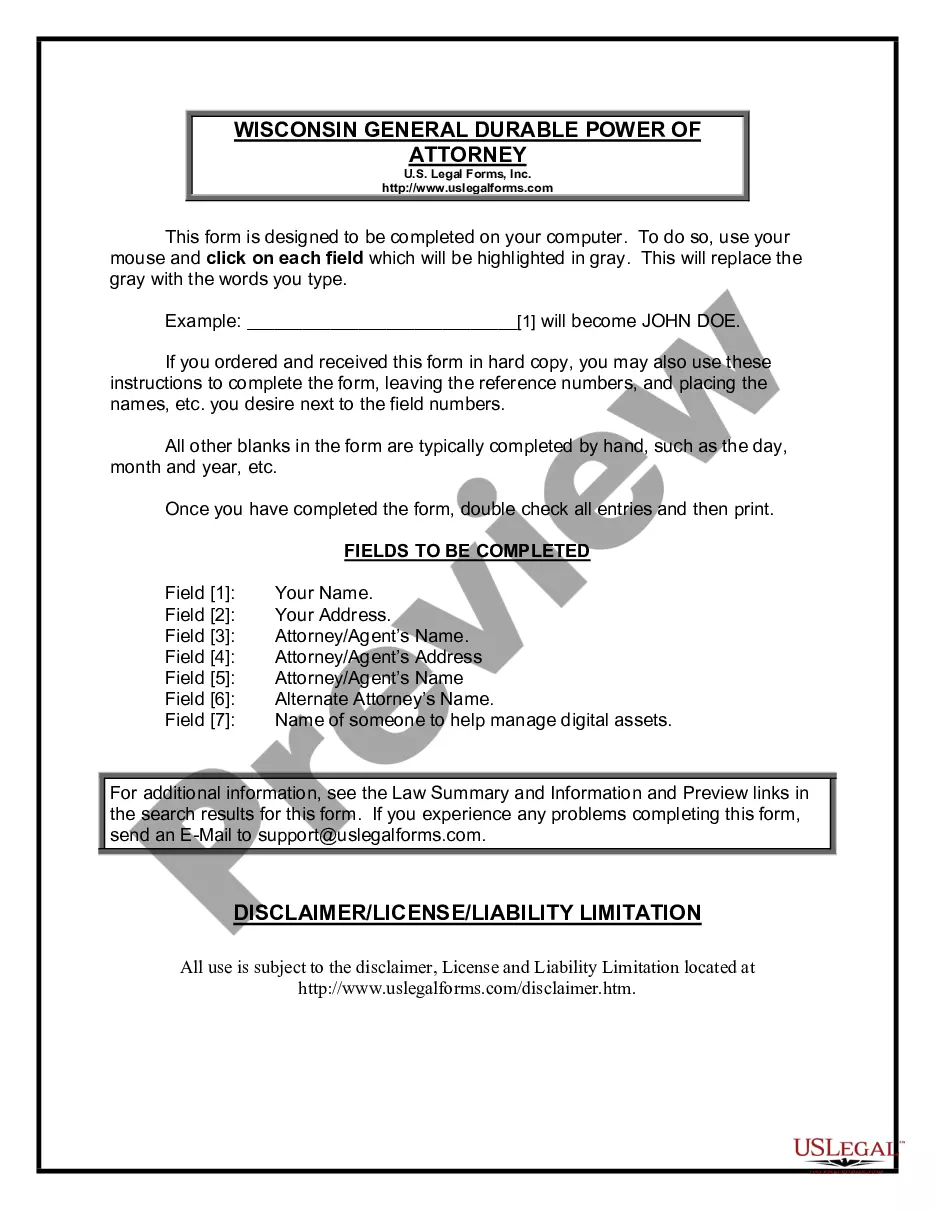

How to fill out Pennsylvania Relocation Expense Agreement?

If you have to comprehensive, obtain, or print authorized record layouts, use US Legal Forms, the biggest collection of authorized kinds, which can be found on-line. Take advantage of the site`s basic and convenient search to get the documents you require. Numerous layouts for organization and person uses are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Pennsylvania Relocation Expense Agreement with a handful of clicks.

In case you are currently a US Legal Forms customer, log in in your bank account and click the Down load switch to have the Pennsylvania Relocation Expense Agreement. Also you can gain access to kinds you in the past acquired in the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for your proper city/country.

- Step 2. Take advantage of the Preview solution to check out the form`s articles. Never forget to learn the description.

- Step 3. In case you are unsatisfied using the form, utilize the Look for industry near the top of the display screen to discover other versions of your authorized form design.

- Step 4. Upon having located the shape you require, click the Acquire now switch. Choose the pricing prepare you like and add your qualifications to register for an bank account.

- Step 5. Method the purchase. You can use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Select the format of your authorized form and obtain it on your own system.

- Step 7. Comprehensive, change and print or indication the Pennsylvania Relocation Expense Agreement.

Each and every authorized record design you acquire is your own permanently. You have acces to every single form you acquired with your acccount. Click on the My Forms section and decide on a form to print or obtain once again.

Compete and obtain, and print the Pennsylvania Relocation Expense Agreement with US Legal Forms. There are thousands of skilled and condition-certain kinds you can utilize for your organization or person requirements.

Form popularity

FAQ

If there was no contractual agreement to repay, you would not have to pay your employer for relocation costs. If there was a contract requiring reimbursement of relocation expense, such an agreement is valid and enforceable and you would be contractually obligated to repay the expenses.

A relocation agreement, sometimes referred to as an employee relocation agreement, is a legal contract executed by an employer and an employee in which the employer agrees to compensate an employee for relocating for business purposes.

How much do employers spend on employee relocation options?Travel to the new location.Packing and moving service costs.Moving insurance.Short-term housing.Storage units or other temporary storage solutions.Home sale or purchase.Tax gross up for benefits.Relocation taxes.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

Most relocation contracts require you to work for the new company for one to two years, and repay if you voluntarily leave, or are fired for cause.

How much should a lump sum relocation package be? For a flat lump sum, you should expect typically between $1,000 and $7,500. According to Dwellworks, employees across the nation receive an average lump sum of $7,200.

The most common relocation repayment requires repayment in full if termination of employment is within 12 months after relocation or a prorated amount for up to 2 years. If a move is in process when employment ends, unused benefits typically cease immediately.

The average relocation package costs between $21,327 and $24,913 for renters and between $61,622 and $79,429 for homeowners, according to a 2016 report by Worldwide ERC, a relocation services trade group.

A Repayment Agreement is a legally enforceable contract stating that if the employee resigns or is terminated by the Company within a certain time frame following relocation, the employee agrees to repay the company any relocation expenses that were paid by the company.

An average relocation package costs between $21,327-$24,913 for a transferee who is a renter and $61,622-$79,429 for a transferee who is a homeowner. Of course, this number is just an average of what larger corporations are spending on employee relocation the relocation amount can be anywhere from $2,000 - $100,000.