Pennsylvania Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership

Description

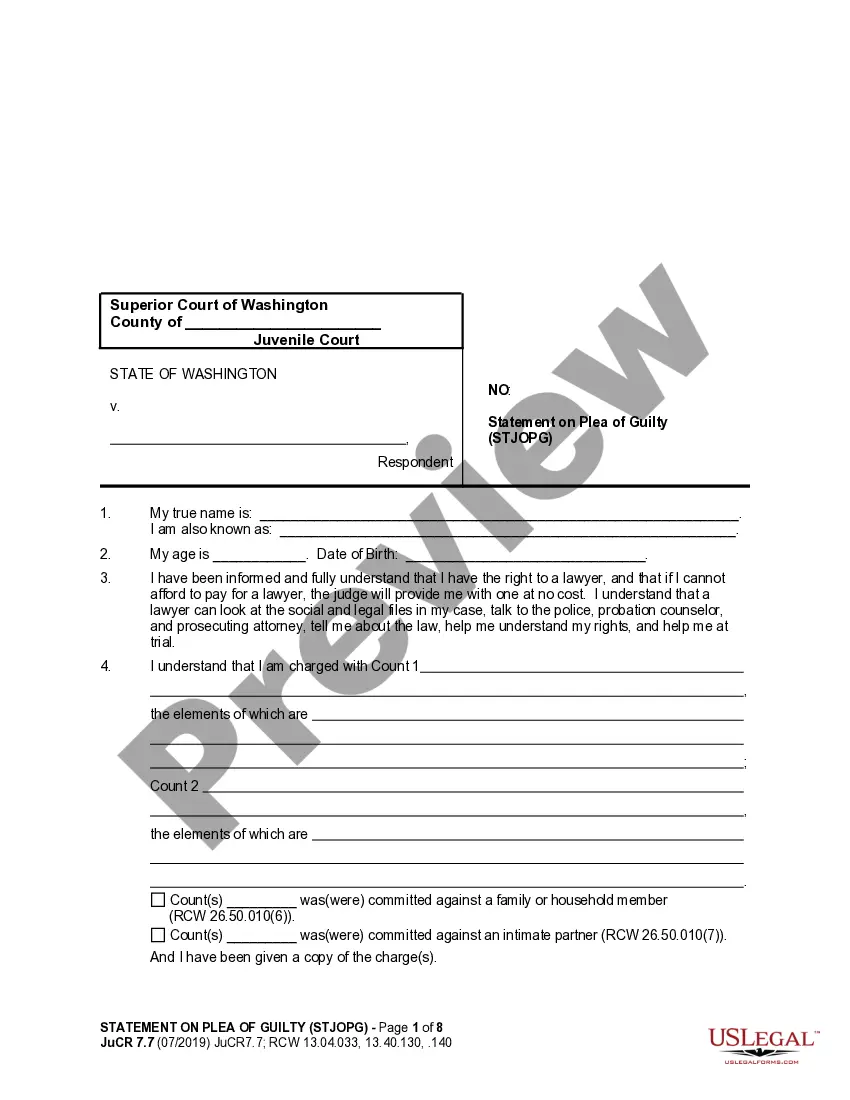

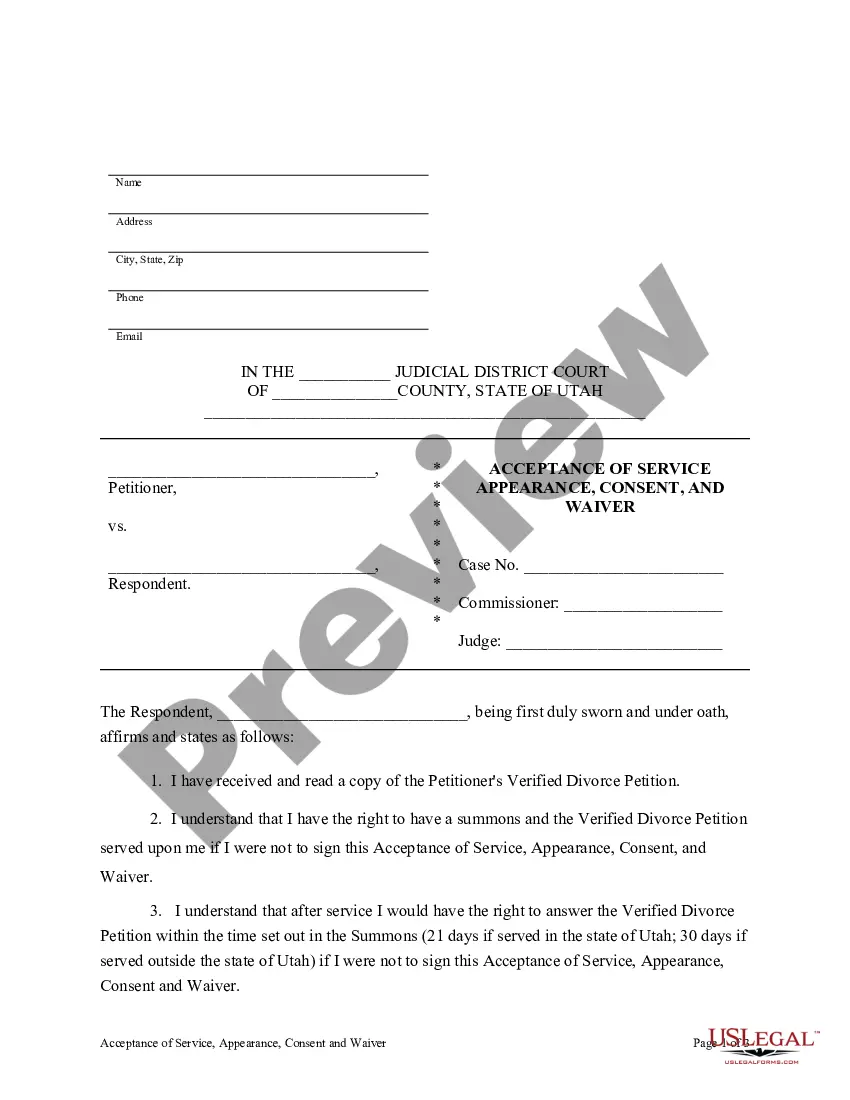

How to fill out Resolution Of Meeting Of LLC Members To Increase The Number Of Members And Specify The Conditions Of Membership?

It is feasible to dedicate hours online trying to locate the legal document template that fulfills the federal and state requirements you desire.

US Legal Forms provides thousands of legal documents which can be assessed by experts.

You can conveniently obtain or generate the Pennsylvania Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership from our service.

If available, utilize the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and then select the Acquire button.

- After that, you can complete, modify, generate, or sign the Pennsylvania Resolution of Meeting of LLC Members to Increase the Number of Members and Specify the Conditions of Membership.

- Every legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Check the form outline to confirm that you have chosen the right form.

Form popularity

FAQ

Corporate officer changes can be done by completing the REV1605(hyper-link) or updates can be done if your business is registered with the PA Dept of Revenue's e-Tides(hyper link) system. The REV 1605 form can be submitted to the PA Dept of Revenue by fax 717-787-3708 or email ra-btftregisfax@pa.gov.

To make amendments to your limited liability company in Pennsylvania, you must provide the completed Certificate of Amendment-Domestic Limited Liability Company (DSCB: 15-8512/8951) form to the Department of State Corporation Bureau by mail, in person, or online.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

To give people access to your business:Go to Business Settings.Click People.Click Add.Enter the work email address of the person you want to add.Select the role you'd like to assign them.Click Next.Select the asset and the task access you want to assign the person.Click Invite.

Single-member LLCs are taxed as sole proprietorships, but if a new member is added, making it a multi-member LLC, the taxation status will change. Multi-member LLCs can choose to be taxed as partnerships or corporations.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.