Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

If you need to complete, download, or create legitimate document templates, utilize US Legal Forms, the premier selection of legal forms that are accessible online.

Leverage the site's straightforward and convenient search feature to find the documents you require.

Many templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

- You can also access forms you previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have chosen the form for your correct location/area.

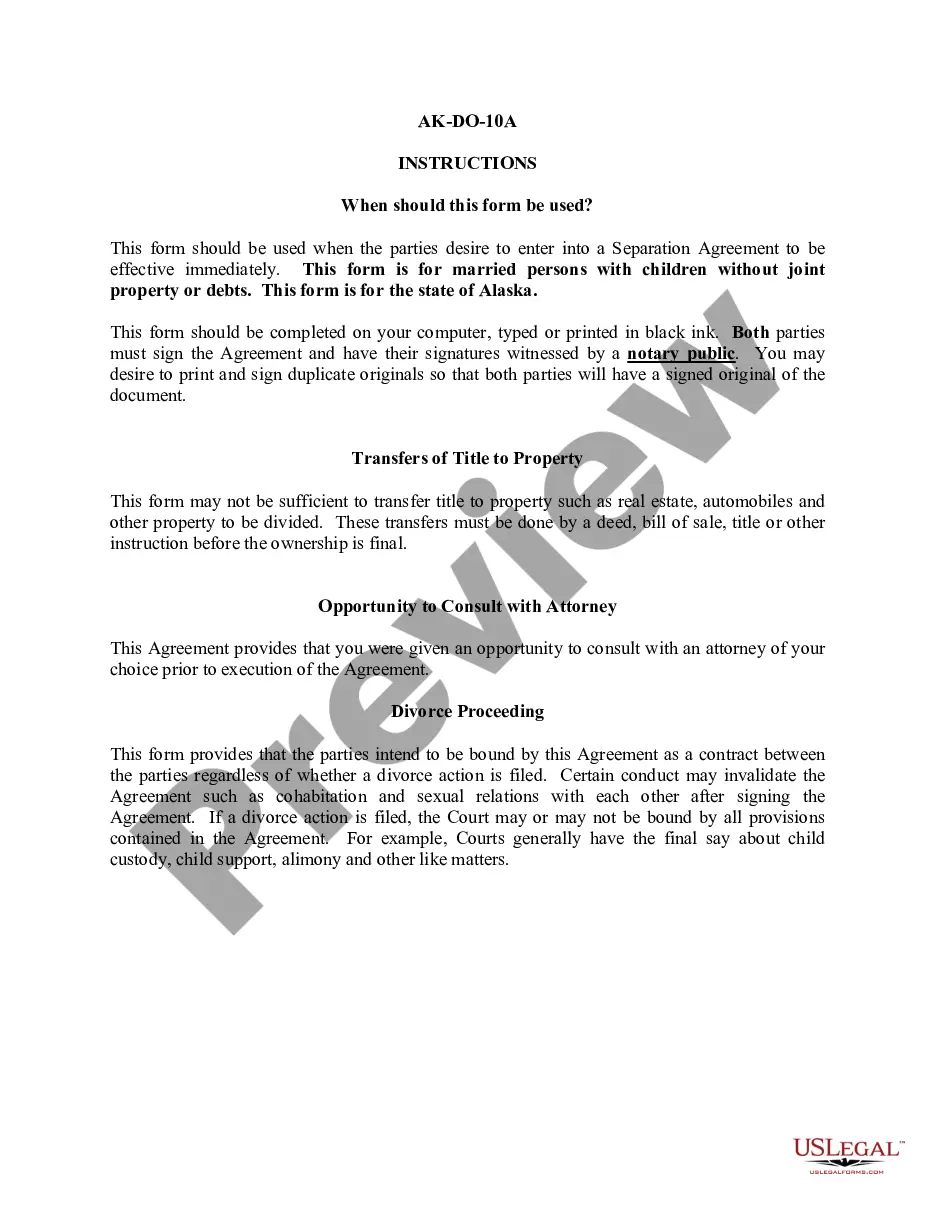

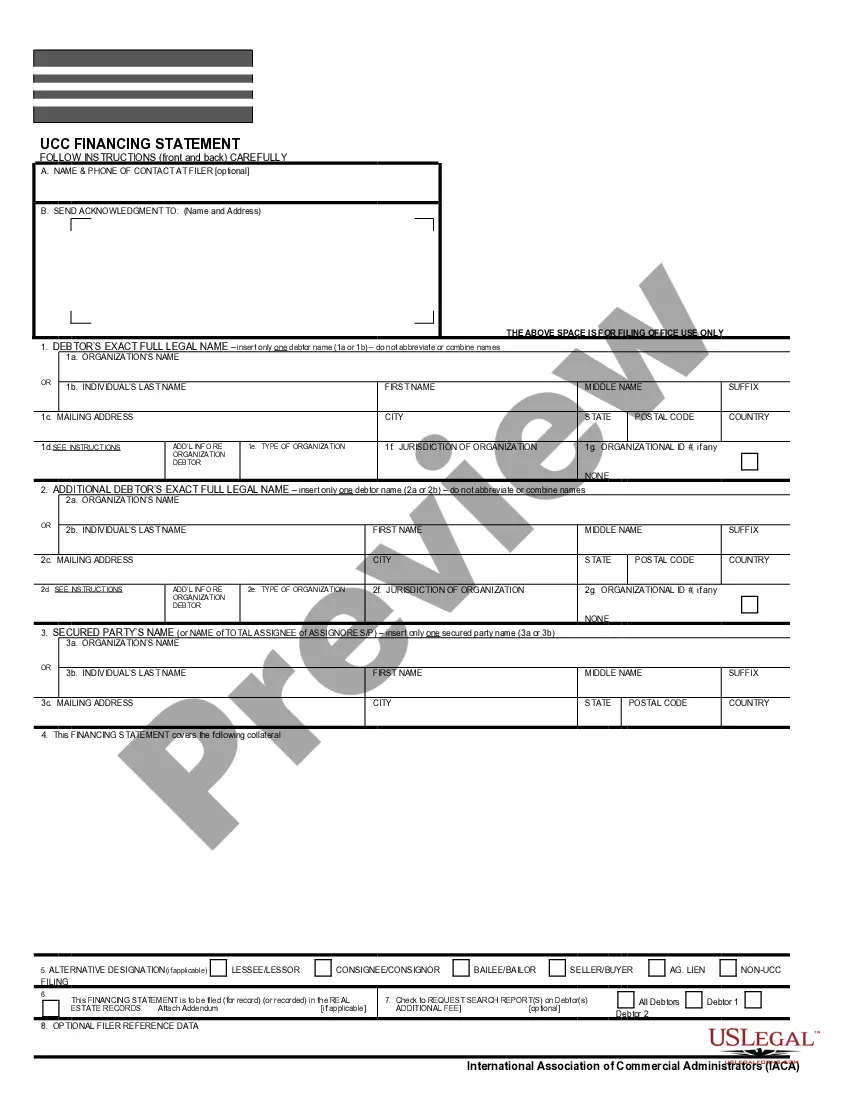

- Step 2. Utilize the Review option to inspect the form's contents. Don't forget to view the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variants of the legal form template.

Form popularity

FAQ

The PA apportionment factor determines how a company divides its income among different jurisdictions for tax purposes. It is typically calculated using a formula that includes the company’s sales, property, and payroll in Pennsylvania compared to its total across all locations. Understanding this factor is vital for companies engaging in a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, as it affects overall financial considerations.

If 10% of a company's value is $100,000, the total company valuation would be $1,000,000. This calculation is derived by dividing the part by the percentage expressed as a decimal. Understanding the complete valuation is crucial when negotiating a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Determining the value of a company for acquisition requires analyzing multiple factors including assets, revenue, and market position. You should also assess the company’s earnings history and future growth potential. Engaging in due diligence helps uncover hidden value and liabilities. A Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets provides a structured approach to formalize the valuation process.

Valuing an asset sale involves determining the fair market value of all assets included in the transaction. You can leverage recent sales of similar assets as benchmarks, adjusting for condition and market demand. Additionally, consider the potential for future earnings from intangible assets. Utilizing a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets helps outline the transaction, ensuring both parties understand the value of each asset.

To value a company based on its assets, you should assess both tangible and intangible assets thoroughly. Start with a detailed inventory of physical assets like real estate, equipment, and inventory. Then, evaluate intangible assets such as intellectual property, customer relationships, and brand value. A Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets can simplify this process by providing a clear framework for valuation.

PA 65 Schedule A is a form used for reporting the income, deductions, and related items of partnerships and similar entities in Pennsylvania. When executing a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, having this form handy can facilitate the reporting process. It allows for a clear breakdown of income sources and expenses. Utilizing tools like uslegalforms can simplify this reporting and ensure accuracy in your filings.

The tax implications of asset acquisition can vary greatly depending on how you structure the transaction. In a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, you may encounter capital gain taxes, transfer taxes, and other considerations. It’s essential to analyze both the tangible and intangible assets involved. A thorough understanding can significantly impact your financial outcomes and help in planning your tax strategy.

Yes, Pennsylvania does allow section 754 depreciation, but it comes with specific conditions. When dealing with a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, understanding these conditions is crucial. Section 754 allows for adjustments in basis that can lead to tax benefits for asset acquisitions. It's advisable to consult a tax professional to ensure compliance and optimize your tax liabilities.

PA Schedule 19 is a tax form utilized in Pennsylvania for the reporting of income and deductions related to a corporation's assets. When you engage in a Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, this schedule becomes crucial. It assists in itemizing the assets and ensuring proper tax treatment. Understanding this form can help streamline your tax processes during asset transactions.