Pennsylvania Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Finding the appropriate official document template can be challenging. It goes without saying that there are numerous templates available online, but how can you acquire the official form you require? Utilize the US Legal Forms website.

The platform offers a vast array of templates, including the Pennsylvania Letter from Debtor to Credit Card Company Requesting a Reduced Interest Rate for a Specific Duration, which can be utilized for both professional and personal needs. All documents are verified by experts and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click the Obtain button to download the Pennsylvania Letter from Debtor to Credit Card Company Requesting a Reduced Interest Rate for a Specific Duration. Use your account to access the official forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the file format and download the official document template to your device. Complete, modify, print, and sign the Pennsylvania Letter from Debtor to Credit Card Company Requesting a Reduced Interest Rate for a Specific Duration. US Legal Forms represents the largest collection of official templates where you can browse a variety of document formats. Leverage the service to obtain professionally created documents that adhere to state regulations.

- First, make sure you have chosen the correct form for your city/state.

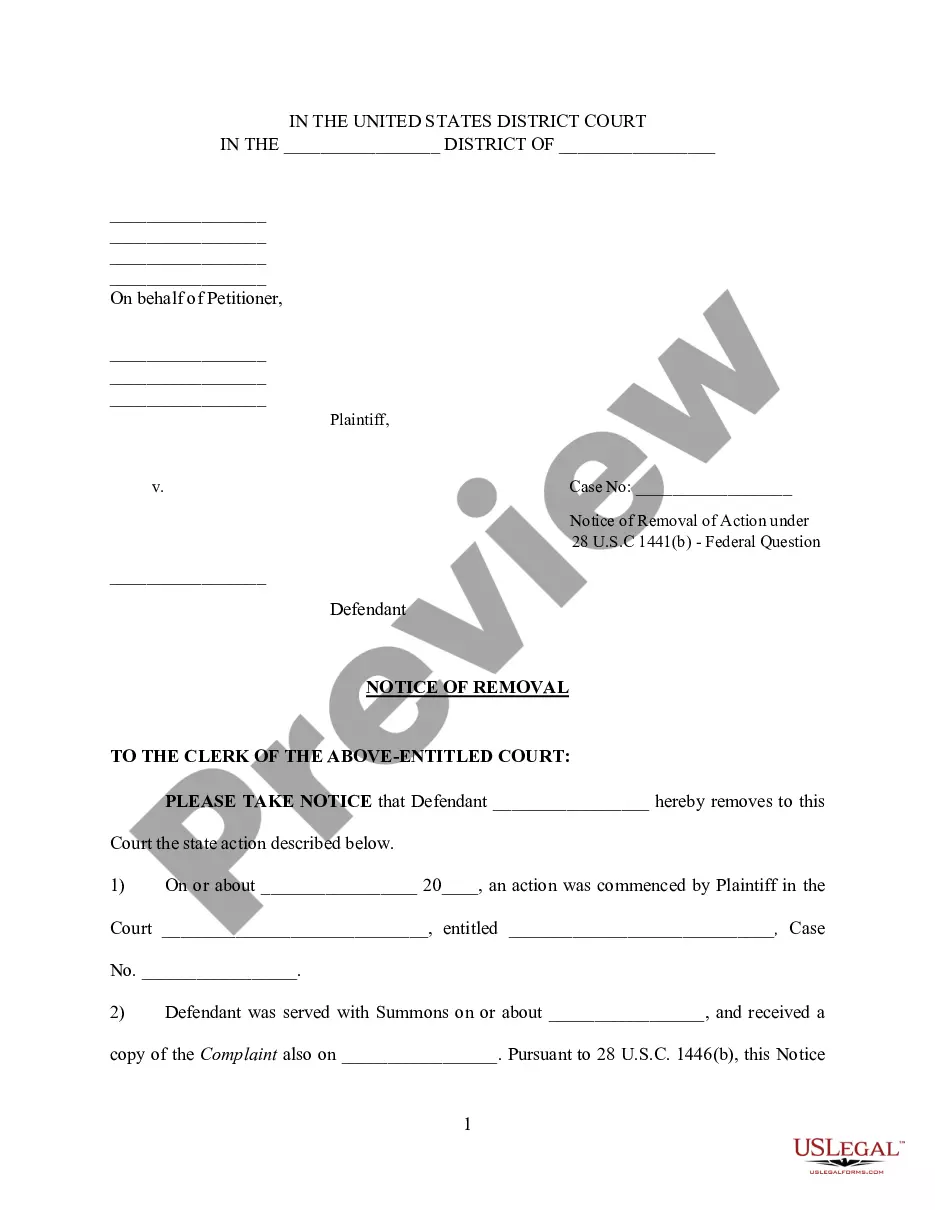

- You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not fulfill your requirements, utilize the Search field to find the correct template.

- Once you are confident the form is appropriate, click the Buy now button to obtain the template.

- Select the pricing plan you prefer and input the necessary information.

- Create your account and complete the purchase using your PayPal account or a debit/credit card.

Form popularity

FAQ

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

Credit counseling companiesA credit counseling agency may be able to help you negotiate credit card debt under an arrangement known as a debt management plan. A debt management plan, or DMP, may help you consolidate your debts and lower your interest rates.

Here are 11 ways to pay off high interest credit cards.Try Paying With Cash.Consider a Credit Card Balance Transfer.Pay More Than the Minimum Amount Due.Lower Your Expenses.Increase Your Income.Sell Your Old Stuff.Ask for Lower Interest Rates.Pay Off High Interest Credit Cards First.More items...?03-Dec-2019

You can negotiate a lower interest rate on your credit card by calling your credit card issuerparticularly the issuer of the account you've had the longestand requesting a reduction.

Call your card provider: Contact your credit card issuer and explain why you would like an interest rate reduction. You could start by pointing out your history with the company and mention your good credit or on-time payment history.

If you're unhappy with your credit card's interest rate, securing a lower one may be as simple as asking your credit card issuer. They may decline your request, but it doesn't hurt to ask. If you've established a history of on-time payments and other responsible behavior with the issuer, your odds may be good.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

They don't. Scammers may claim that the lower interest rates they're promising are only available for a limited time. They say you need to act now. But they're just trying to rush you into a quick decision.

Most cards have a variable interest rate, meaning it can fluctuate based on several factors, including your card issuer's discretion. You can negotiate a lower interest rate on your credit card by calling your credit card issuerparticularly the issuer of the account you've had the longestand requesting a reduction.

State in the letter you are requesting an interest rate reduction for the following reasons and be specific. Include competitor offers with lower rates, your creditor's own new introductory rates, and state your timely payment history and length of time you've had the account.