Pennsylvania Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

How to fill out Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Are you currently in the place that you need papers for either company or individual reasons almost every time? There are tons of lawful record web templates accessible on the Internet, but finding types you can rely on isn`t simple. US Legal Forms gives a large number of develop web templates, such as the Pennsylvania Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, which can be composed to meet federal and state needs.

In case you are currently acquainted with US Legal Forms site and get a free account, simply log in. Following that, it is possible to obtain the Pennsylvania Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee web template.

Should you not offer an accounts and want to begin to use US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for your correct area/region.

- Make use of the Review key to review the shape.

- Look at the explanation to actually have selected the proper develop.

- If the develop isn`t what you are looking for, make use of the Look for area to get the develop that fits your needs and needs.

- Whenever you get the correct develop, click Acquire now.

- Opt for the prices plan you want, fill out the required details to create your bank account, and purchase an order making use of your PayPal or bank card.

- Select a hassle-free paper structure and obtain your backup.

Get all the record web templates you possess bought in the My Forms food list. You can obtain a further backup of Pennsylvania Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee anytime, if possible. Just go through the needed develop to obtain or printing the record web template.

Use US Legal Forms, by far the most comprehensive assortment of lawful kinds, in order to save time as well as prevent blunders. The assistance gives skillfully made lawful record web templates which you can use for a variety of reasons. Create a free account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

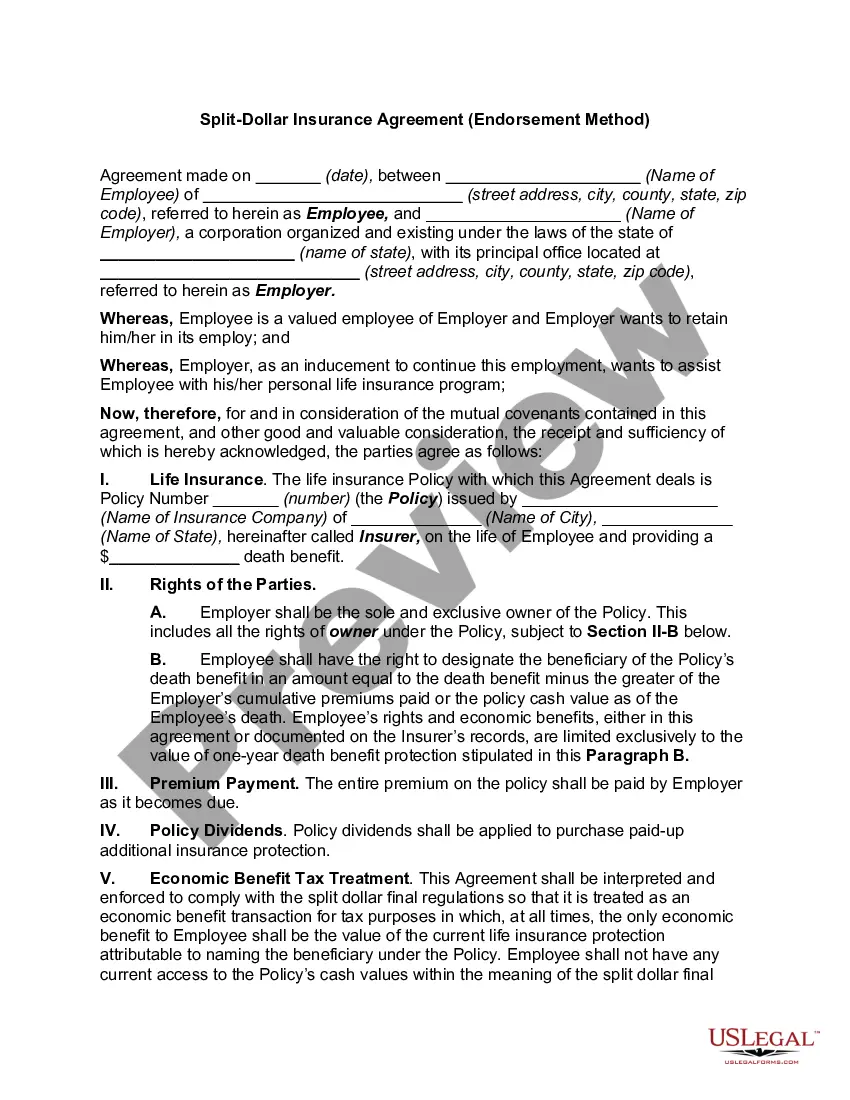

Reverse Split Dollar is an arrangement in which an employee owns a life insurance policy on her own life and endorses death benefit to her employer. How it works during life.

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.

Under an endorsement split dollar arrangement, the business purchases an insurance policy on the life of a key employee. The employee then names the beneficiary while the company retains ownership of the policy and pays the premiums. The employee is taxed on the fair market value of the life insurance policy.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.

The two most common forms of split-dollar life insurance are economic benefit and loan arrangements.

Split-dollar insurance plans: In an economic benefit arrangement, the employer owns the policy, covers the premiums, and has the authority to grant the rights and benefits. For example, an employer may permit the employee to name their beneficiaries, ensuring that the employee control who receives their death benefits.

There are 2 types of split dollar plans. Collateral assignment / loan regime. Endorsement split dollar / economic benefit regime.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability.