Pennsylvania Application for Extension of Time Period for Reservation of Corporate Name

Description

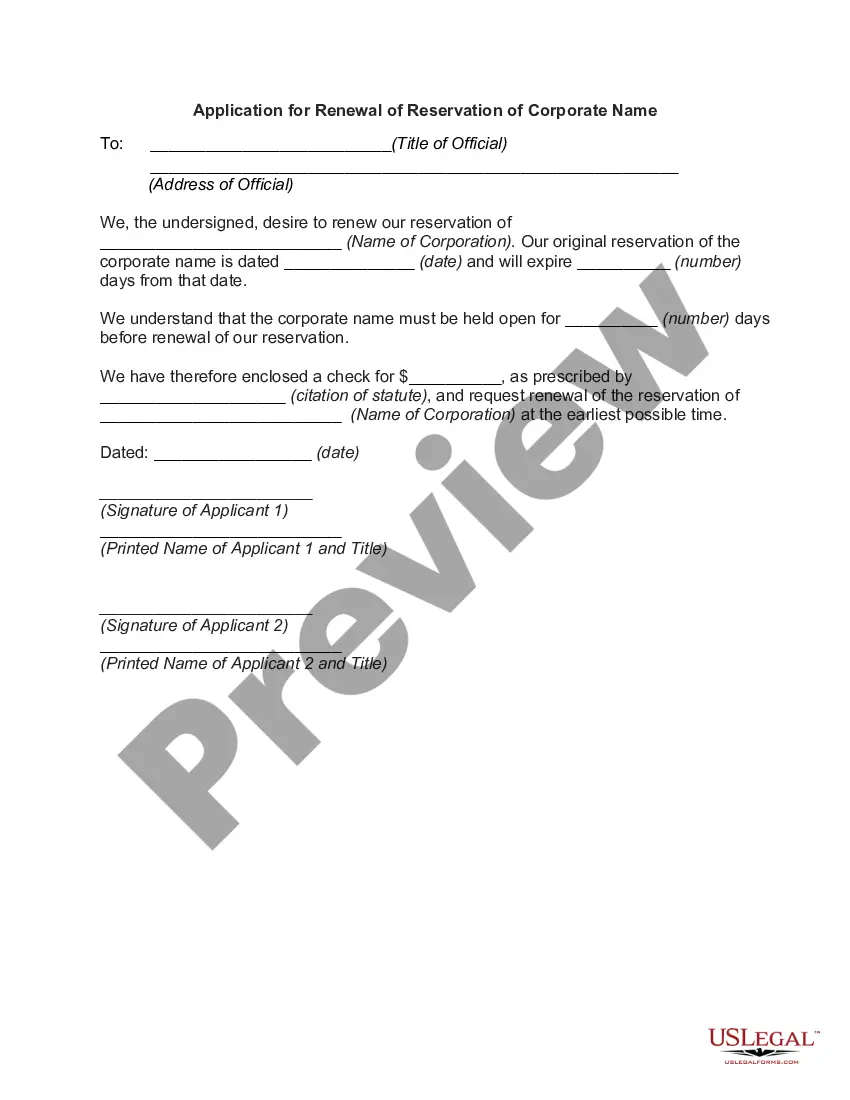

How to fill out Application For Extension Of Time Period For Reservation Of Corporate Name?

It is possible to spend hrs on the Internet trying to find the legitimate document template that fits the federal and state specifications you will need. US Legal Forms offers a huge number of legitimate varieties which are reviewed by professionals. You can actually down load or printing the Pennsylvania Application for Extension of Time Period for Reservation of Corporate Name from the service.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load button. Next, it is possible to total, change, printing, or sign the Pennsylvania Application for Extension of Time Period for Reservation of Corporate Name. Each and every legitimate document template you buy is yours forever. To obtain an additional duplicate associated with a obtained form, proceed to the My Forms tab and click the related button.

If you work with the US Legal Forms site the very first time, keep to the easy instructions beneath:

- First, be sure that you have selected the best document template for the county/town of your choosing. Look at the form explanation to make sure you have picked out the correct form. If readily available, use the Review button to look through the document template as well.

- In order to locate an additional variation from the form, use the Lookup discipline to get the template that meets your requirements and specifications.

- When you have located the template you need, simply click Buy now to carry on.

- Find the costs program you need, enter your accreditations, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal bank account to pay for the legitimate form.

- Find the formatting from the document and down load it to your gadget.

- Make adjustments to your document if required. It is possible to total, change and sign and printing Pennsylvania Application for Extension of Time Period for Reservation of Corporate Name.

Down load and printing a huge number of document themes making use of the US Legal Forms Internet site, which provides the greatest selection of legitimate varieties. Use specialist and state-certain themes to take on your business or personal demands.

Form popularity

FAQ

Penalty is calculated by multiplying the total tax due by 5 percent for each month or portion of a month the tax remains unpaid. Interest is calculated by multiplying the total tax due by the number of days late by the daily interest rate.

When paper filing, include with Form PA-40 a copy of federal extension (Form 4868). Also, if Form REV-276 is filed, a copy of the extension is not required to be attached to Form PA-40.

Use this form for an extension of time to file a PA-40, PA-41 or PA-20S/PA-65 if you do not apply for a federal extension or if your request for a federal extension was denied. If you owe tax on your PA-40, PA-41 or PA-20S/PA-65 return, you must submit this extension form along with your payment.

Pennsylvania Tax Extension Form: To request a Pennsylvania extension, file Form REV-276 by the original due date of your return. If you have an approved Federal tax extension (IRS Form 4868), you will automatically receive a Pennsylvania tax extension.

You can get an automatic six-month extension without mailing REV-276. Visit the Revenue e-Services Center at .revenue.pa.gov for more information.

Pennsylvania automatically grants 6 months extensions on filing corporate income tax returns, if a federal extension is filed. This means you do not need to file for an extension in Pennsylvania.

Anyone planning to do business within the Commonwealth of Pennsylvania can reserve an entity name. Filing your name reservation prevents another entity from using that name to conduct business in the state during the time of your hold. An entity name reservation in Pennsylvania gives you a 120-day hold on that name.

If granted an extension period to file your BIRT return, it cannot exceed the end date of the federal extension period of up to six months from the original IRS filing due date. There's no specific filing extension form for Philadelphia's BIRT.