Pennsylvania Sample Letter regarding Motion to Sell Property of an Estate

Description

How to fill out Sample Letter Regarding Motion To Sell Property Of An Estate?

If you wish to comprehensive, acquire, or produce legitimate file layouts, use US Legal Forms, the most important selection of legitimate kinds, that can be found online. Make use of the site`s easy and practical search to discover the documents you require. Numerous layouts for company and person reasons are categorized by groups and states, or keywords and phrases. Use US Legal Forms to discover the Pennsylvania Sample Letter regarding Motion to Sell Property of an Estate in just a few mouse clicks.

When you are previously a US Legal Forms customer, log in to the accounts and then click the Down load button to obtain the Pennsylvania Sample Letter regarding Motion to Sell Property of an Estate. You can even accessibility kinds you previously saved from the My Forms tab of the accounts.

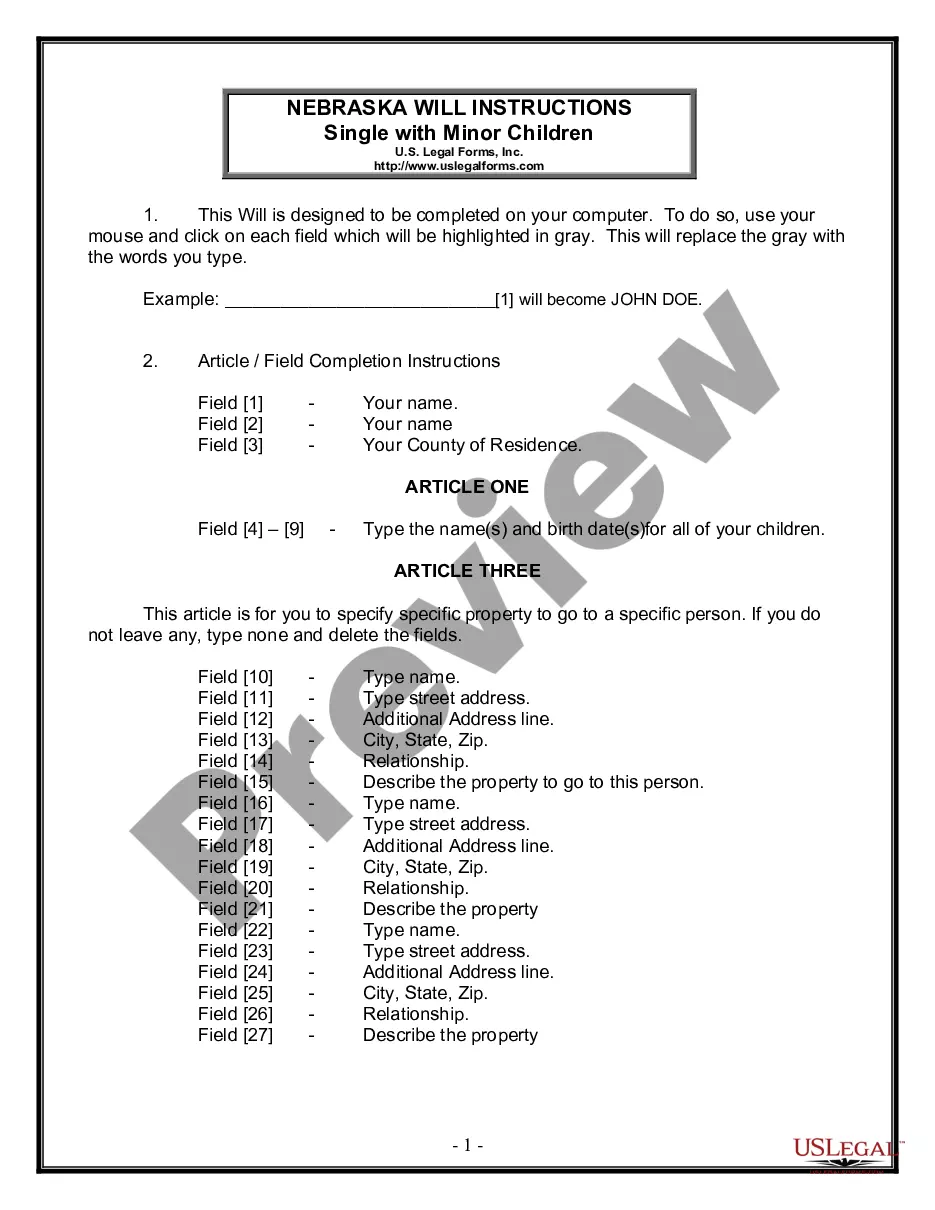

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for your appropriate town/country.

- Step 2. Use the Preview option to check out the form`s articles. Do not neglect to read through the information.

- Step 3. When you are not happy with the type, make use of the Research field near the top of the display to find other models of the legitimate type template.

- Step 4. Upon having discovered the form you require, click on the Acquire now button. Pick the prices program you favor and put your credentials to sign up on an accounts.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the deal.

- Step 6. Find the formatting of the legitimate type and acquire it on the gadget.

- Step 7. Full, edit and produce or indicator the Pennsylvania Sample Letter regarding Motion to Sell Property of an Estate.

Each legitimate file template you acquire is yours forever. You have acces to each type you saved in your acccount. Select the My Forms section and decide on a type to produce or acquire yet again.

Be competitive and acquire, and produce the Pennsylvania Sample Letter regarding Motion to Sell Property of an Estate with US Legal Forms. There are thousands of skilled and express-particular kinds you can use for the company or person needs.

Form popularity

FAQ

The executor has to perform certain duties to settle the estate in Pennsylvania, including paying debts and taxes, determining the value of the estate and distributing remaining assets, ing to the wishes of the decedent.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

A beneficiary who suspects that the executor is not properly handling the distribution of assets or failing to perform their duties should submit a petition to the court to remove the executor.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

Selling a House in Pennsylvania with Multiple Inheritors In such cases, the first step is to come to an agreement on selling or buying the property with the other inheritors. You can appoint a neutral party (non-beneficiary) as the head person for the sale.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.