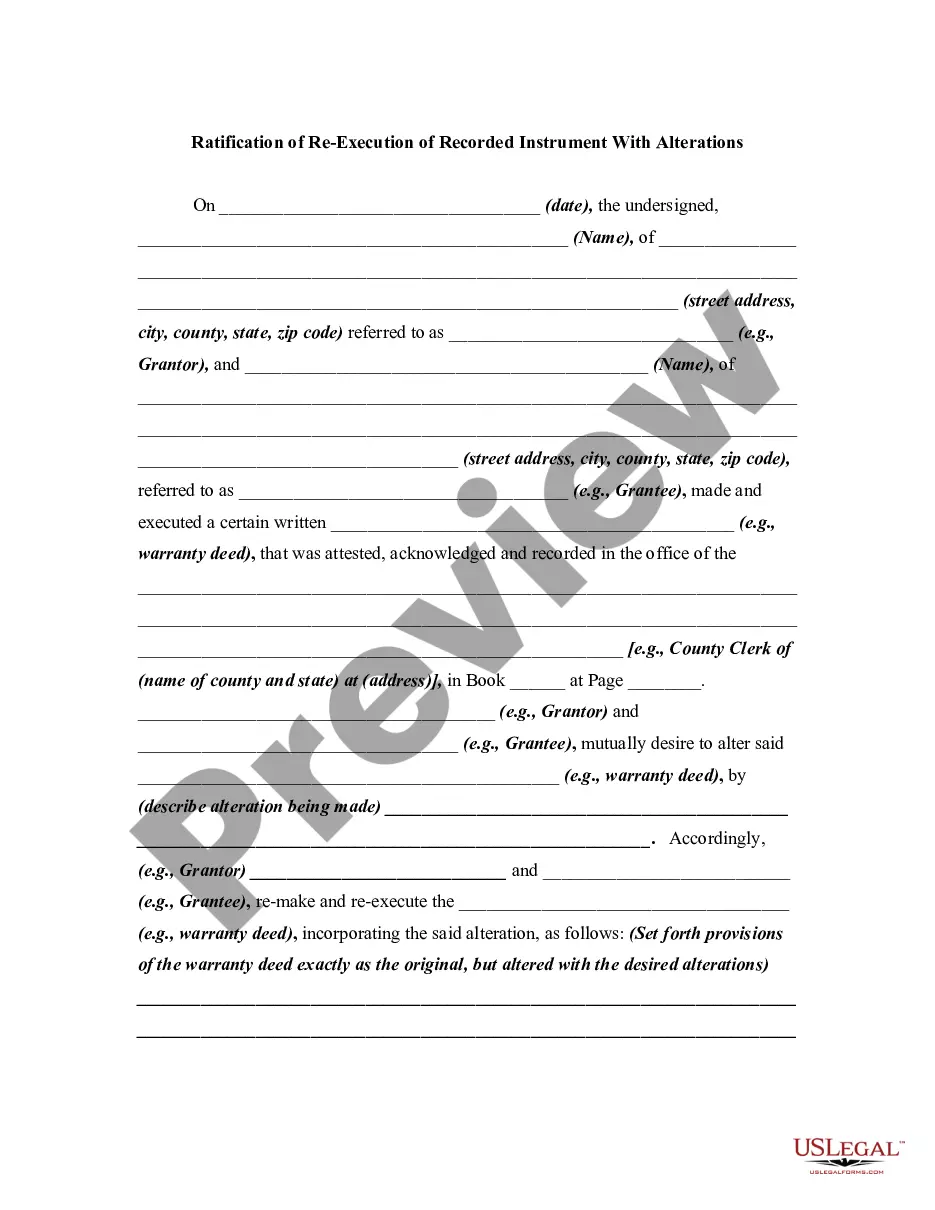

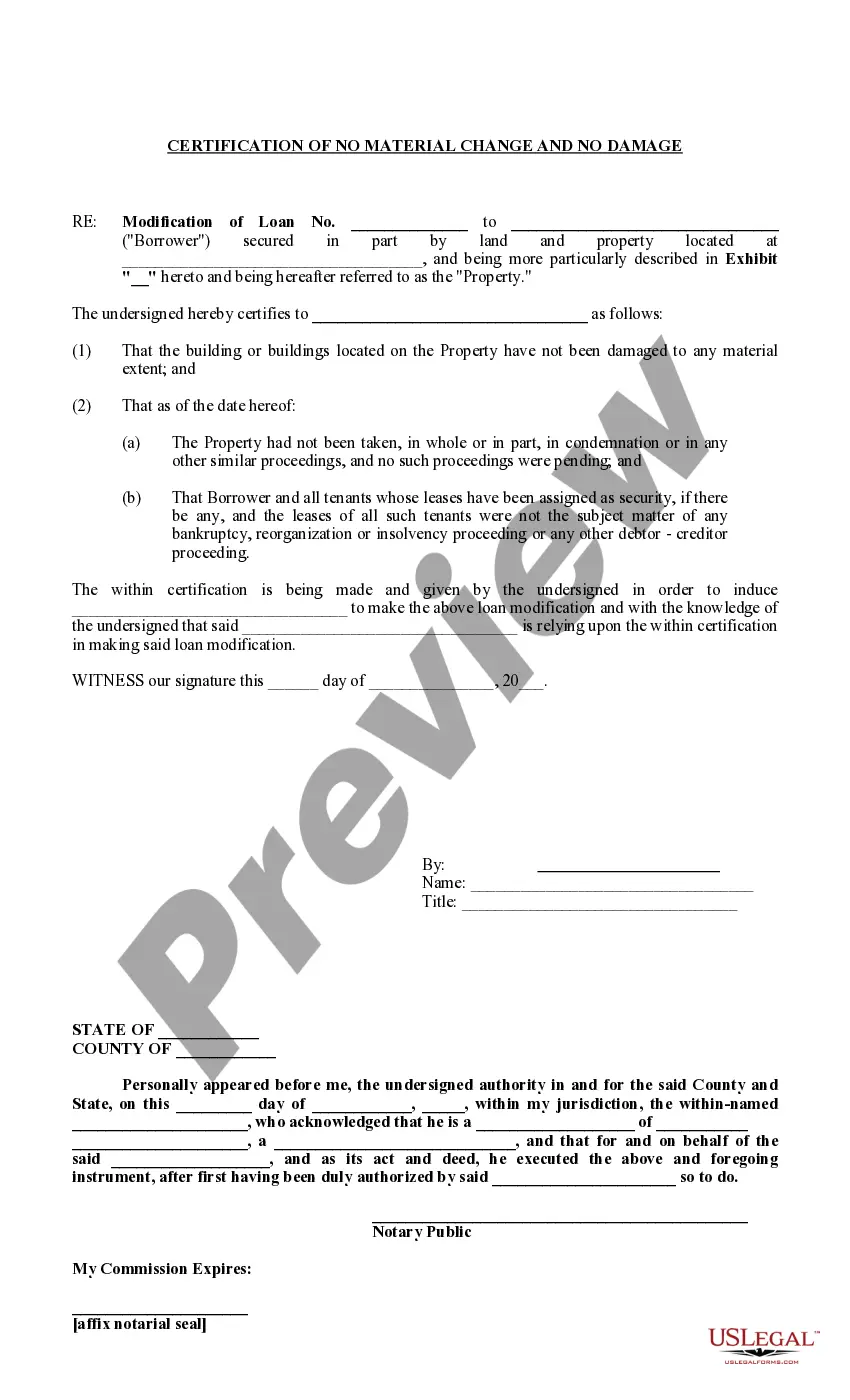

Pennsylvania Borrowers Certification of No Material Change No Damage

Description

How to fill out Borrowers Certification Of No Material Change No Damage?

US Legal Forms - one of several biggest libraries of lawful types in the USA - offers an array of lawful file layouts it is possible to download or print out. Using the website, you can get 1000s of types for business and specific uses, categorized by groups, claims, or key phrases.You can find the newest variations of types much like the Pennsylvania Borrowers Certification of No Material Change No Damage in seconds.

If you already possess a monthly subscription, log in and download Pennsylvania Borrowers Certification of No Material Change No Damage in the US Legal Forms collection. The Download button will show up on every single develop you look at. You have access to all in the past acquired types within the My Forms tab of the bank account.

If you want to use US Legal Forms for the first time, allow me to share simple recommendations to get you started off:

- Be sure to have selected the best develop for your personal area/area. Select the Review button to examine the form`s articles. Browse the develop explanation to actually have selected the correct develop.

- In the event the develop does not suit your specifications, utilize the Search field on top of the display screen to discover the one which does.

- If you are happy with the shape, validate your decision by clicking on the Acquire now button. Then, opt for the costs prepare you want and provide your accreditations to register for an bank account.

- Method the purchase. Make use of charge card or PayPal bank account to complete the purchase.

- Find the formatting and download the shape in your system.

- Make adjustments. Complete, edit and print out and indicator the acquired Pennsylvania Borrowers Certification of No Material Change No Damage.

Each and every design you put into your account does not have an expiration particular date and is also your own for a long time. So, if you wish to download or print out another copy, just proceed to the My Forms segment and click in the develop you want.

Obtain access to the Pennsylvania Borrowers Certification of No Material Change No Damage with US Legal Forms, by far the most considerable collection of lawful file layouts. Use 1000s of expert and express-specific layouts that satisfy your company or specific needs and specifications.

Form popularity

FAQ

When individuals get loans from the U.S. Department of Agriculture or the Federal Housing Administration, they will get Act 6 notices of foreclosure when they have entered into mortgage default. These notices must be sent at least 30 days before a lender can file a foreclosure claim with the court in Pennsylvania.

Many mortgages fall into one of two categories: conforming loans and non-conforming loans (also known as jumbo loans). A conforming loan meets either Freddy or Fannie's underwriting and loan limit guidelines while non-conforming loans do not. In most cases, lenders will be able to offer you a conforming loan.

The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

Pennsylvania is a foreclosure recourse state, meaning lenders can take legal steps to get the remaining balance on loans from borrowers after foreclosure. One way lenders try to get the remaining balance on a loan is through deficiency judgments.

Conforming Loan vs. Nonconforming Loan. Conforming loans are backed by Fannie Mae and Freddie Mac, and can't exceed FHFA loan limits (typically $726,200). Nonconforming loans can be bigger but may cost more.

A nonconforming mortgage is a home loan that does not adhere to government-sponsored enterprises (GSE) guidelines and, therefore, cannot be resold to agencies such as Fannie Mae or Freddie Mac. These loans often carry higher interest rates than conforming mortgages.

Yes and no. Conventional loans and conforming loans are considered by many to be the same type of loan because there is overlap between them. You see, all conforming loans are conventional loans, but not all conventional loans are conforming loans. Conventional loans are defined by the type of lender who offers them.

conforming loan doesn't meet Fannie Mae and Freddie Mac's purchase standards and may have lower down payment and credit requirements. As a result, you may still be able to buy a home with a nonconforming loan if you have a negative mark on your credit report, such as a bankruptcy.