Pennsylvania Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

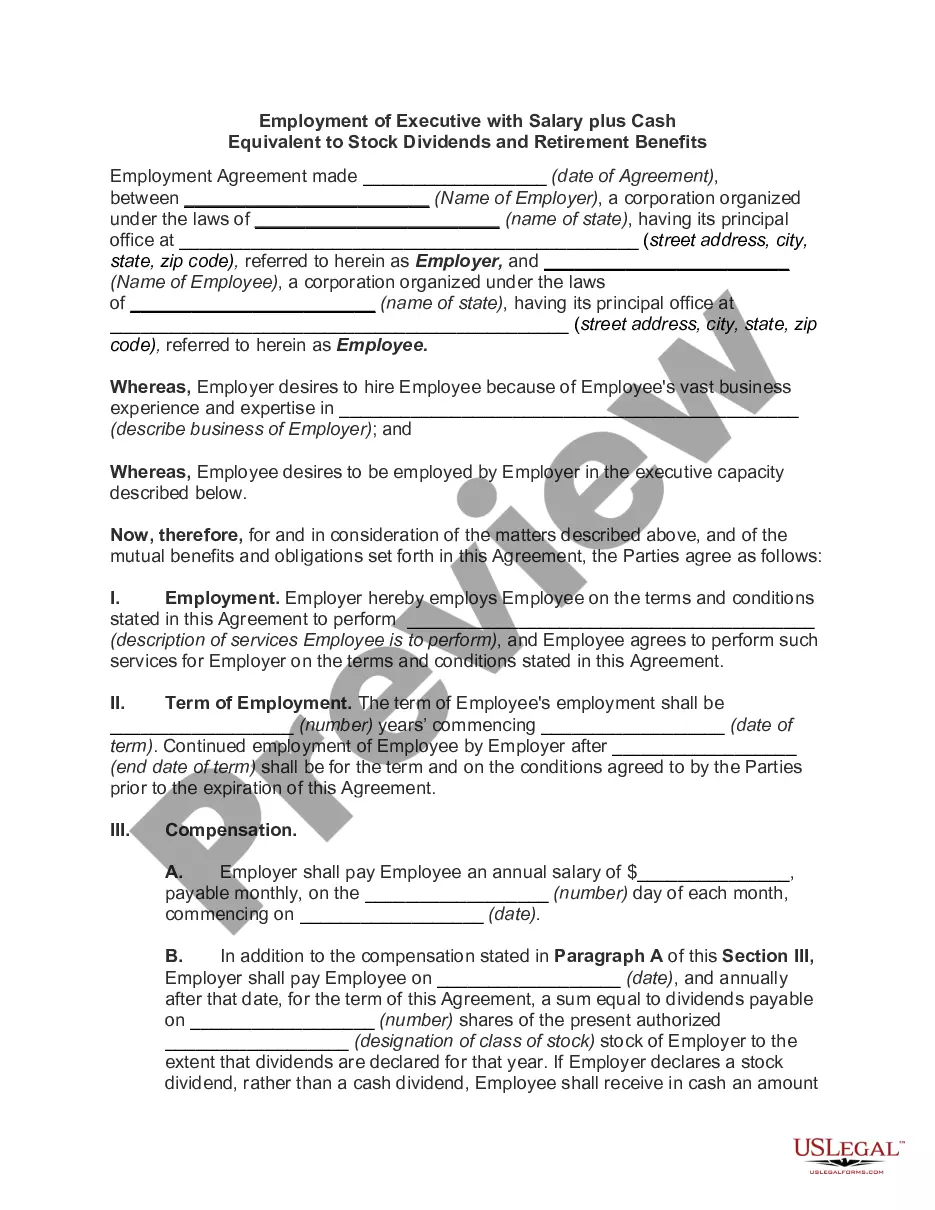

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Are you currently within a placement where you need to have documents for sometimes company or individual reasons virtually every time? There are tons of legitimate document themes accessible on the Internet, but getting versions you can rely is not effortless. US Legal Forms gives thousands of form themes, much like the Pennsylvania Sample Letter regarding Information for Foreclosures and Bankruptcies, which can be written in order to meet federal and state needs.

When you are already familiar with US Legal Forms website and also have your account, merely log in. After that, you are able to acquire the Pennsylvania Sample Letter regarding Information for Foreclosures and Bankruptcies template.

Unless you come with an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for that right town/region.

- Utilize the Preview key to examine the form.

- Read the information to actually have selected the proper form.

- When the form is not what you`re searching for, use the Search field to find the form that meets your requirements and needs.

- Once you get the right form, simply click Acquire now.

- Pick the rates program you would like, fill in the necessary info to produce your money, and pay money for an order using your PayPal or bank card.

- Select a hassle-free file structure and acquire your duplicate.

Discover all of the document themes you may have bought in the My Forms food list. You can obtain a extra duplicate of Pennsylvania Sample Letter regarding Information for Foreclosures and Bankruptcies anytime, if possible. Just click on the necessary form to acquire or printing the document template.

Use US Legal Forms, probably the most extensive collection of legitimate varieties, to save some time and stay away from blunders. The service gives expertly manufactured legitimate document themes which can be used for an array of reasons. Make your account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

§1797 (ACT VI), which sets forth the proper reimbursable amounts permitted for medical treatment arising out of a motor vehicle accident at 110% of what Medicare would pay a provider for the same service.

An Act 91 notice is the signal of the beginning stages of a mortgage foreclosure. Pennsylvania is a judicial state regarding mortgage foreclosures. This means that all paperwork from a mortgage servicer needs to be sent officially and through the court system.

When individuals get loans from the U.S. Department of Agriculture or the Federal Housing Administration, they will get Act 6 notices of foreclosure when they have entered into mortgage default. These notices must be sent at least 30 days before a lender can file a foreclosure claim with the court in Pennsylvania.

In Pennsylvania, lenders must send notice of intent to foreclose letters to homeowners 30 days before the foreclosure begins. This gives borrowers time to contact our Pennsylvania bankruptcy lawyers and create a plan to prevent foreclosure.

Notice of intent to foreclose letters are relatively standard documents. The letter you receive from the lender will name you, the property owner, and explain that you are in serious default on your loan. The document will also explain that you have 30 days to cure your mortgage.

--(a) Before any residential mortgage lender may accelerate the maturity of any residential mortgage obligation, commence any legal action including mortgage foreclosure to recover under such obligation, or take possession of any security of the residential mortgage debtor for such residential mortgage obligation, such ...

There are particular steps that lenders must follow to foreclose once you fall behind on a mortgage. Foreclosures in Pennsylvania don't have a fixed time frame, but depending on your case's specifics and whether you decide to fight the foreclosure, it might take anywhere from a few months to over a year.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.