Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

Have you found yourself in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

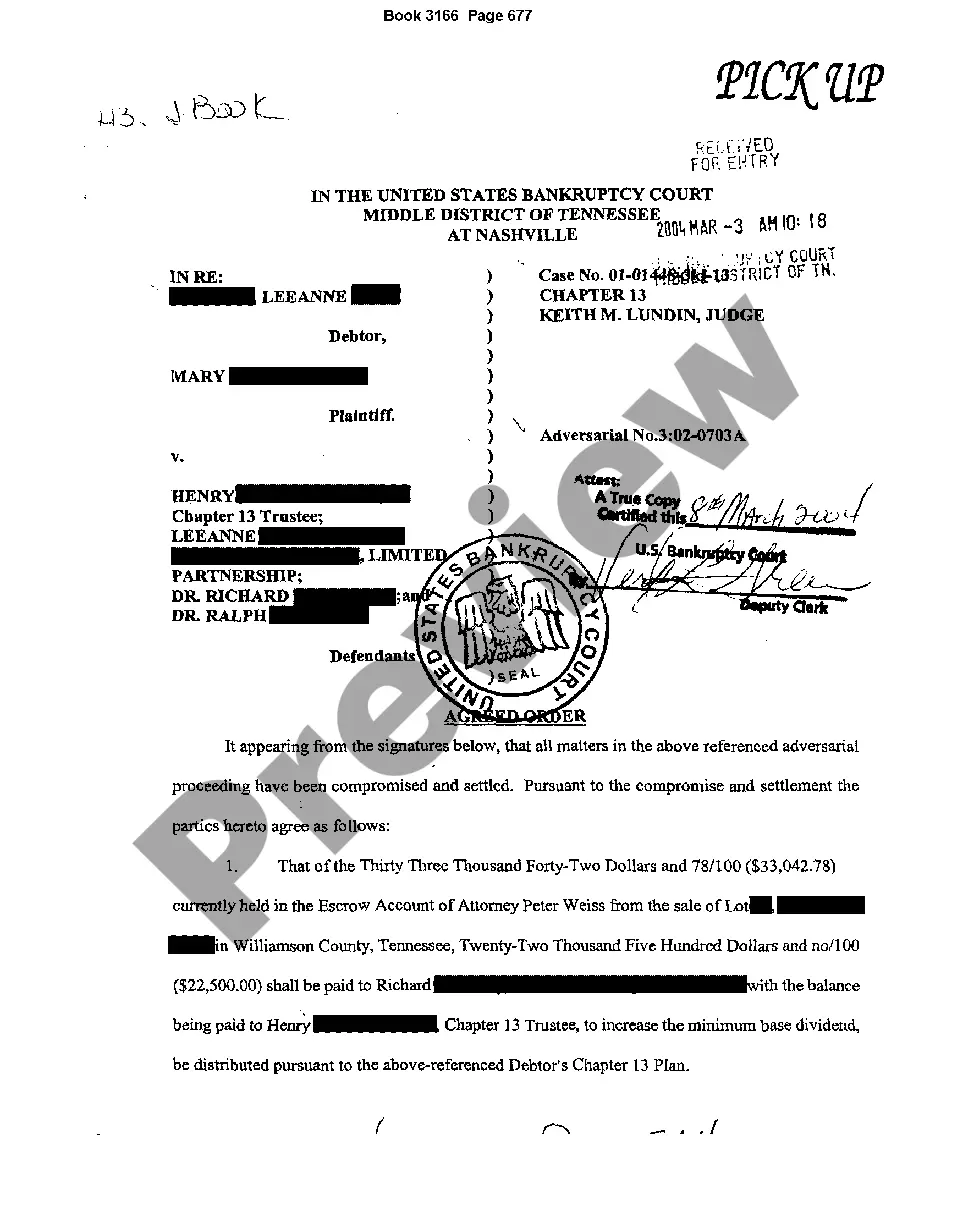

US Legal Forms provides thousands of form templates, such as the Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement, which are crafted to comply with federal and state regulations.

Once you have acquired the correct form, click Buy now.

Select the pricing plan you want, fill in the required information to create your account, and complete your order using your PayPal or credit card. Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents list. You can obtain another copy of the Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement anytime if needed. Just access the required form to download or print the document template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Qualifying Subchapter-S Revocable Trust Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/region.

- Utilize the Preview button to examine the form.

- Review the details to confirm that you have selected the appropriate form.

- If the form is not what you are seeking, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

A trust may be "qualified" or "non-qualified," according to the IRS. A qualified plan carries certain tax benefits. To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument.

For IRA beneficiary purposes, there generally are two types of trusts: one that meets certain IRS requirements is often called a qualified trust, also known as a look-through trust, and one that does not meet the IRS requirements if often called a nonqualified trust.

Grantor Trusts and Revocable TrustsGrantor trusts other than settlor-revocable trusts are required to file the PA-41 Fiduciary Income Tax Return. The beneficiaries of the trust are taxed on income required to be distributed currently or actually distributed or credited to them.

Since a revocable trust is not treated as separate from the grantor, it is an eligible S corporation shareholder while the grantor is alive.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

A trust corpus, containing Pennsylvania real estate, is subject to Pennsylvania Inheritance Tax where the settlor retained certain rights over the real estate until her death.

A revocable trust, either a revocable land trust or revocable living trust, does not require a tax return filing as long as the grantor is still alive or not incapacitated.

Although a trust (including a Living Trust) can be a permitted shareholder in an S corporation, only certain kinds of trusts are so permitted under Section 1361 of the Internal Revenue Code.

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

Revocable trusts are the simplest of all trust arrangements from an income tax standpoint. Any income generated by a revocable trust is taxable to the trust's creator (who is often also referred to as a settlor, trustor, or grantor) during the trust creator's lifetime.