Pennsylvania Sample Letter for Closing of Estate

Description

How to fill out Sample Letter For Closing Of Estate?

If you have to comprehensive, acquire, or produce legitimate document layouts, use US Legal Forms, the largest selection of legitimate varieties, that can be found on the Internet. Use the site`s simple and easy handy research to get the files you need. Numerous layouts for company and personal functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to get the Pennsylvania Sample Letter for Closing of Estate with a couple of mouse clicks.

In case you are currently a US Legal Forms customer, log in in your profile and click on the Obtain key to have the Pennsylvania Sample Letter for Closing of Estate. You may also entry varieties you in the past delivered electronically from the My Forms tab of your profile.

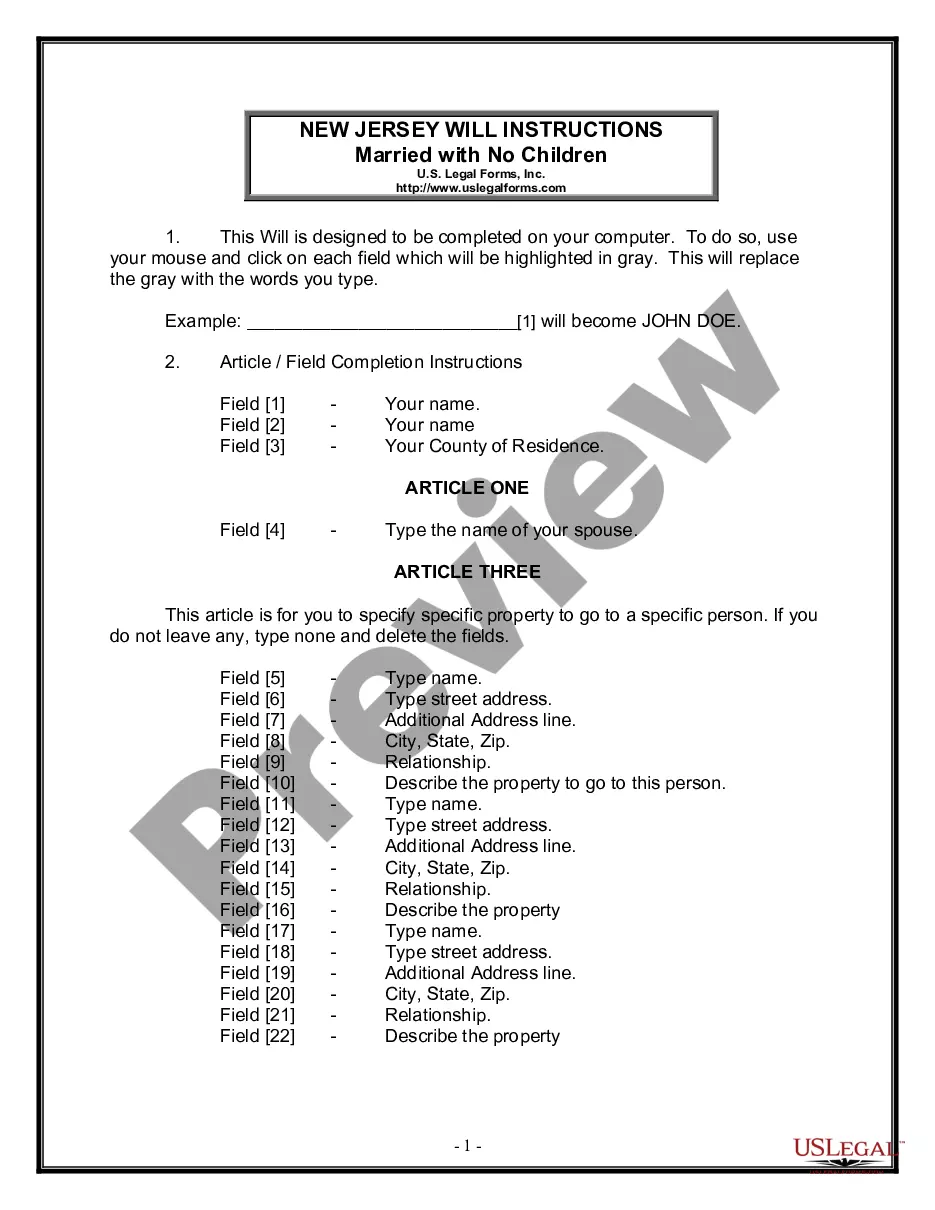

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for the appropriate area/land.

- Step 2. Utilize the Review choice to check out the form`s content material. Don`t neglect to read the outline.

- Step 3. In case you are not happy together with the develop, take advantage of the Look for field at the top of the monitor to locate other types in the legitimate develop design.

- Step 4. Upon having found the shape you need, click on the Get now key. Pick the prices plan you choose and add your accreditations to sign up for the profile.

- Step 5. Process the purchase. You should use your bank card or PayPal profile to perform the purchase.

- Step 6. Choose the file format in the legitimate develop and acquire it on the device.

- Step 7. Total, change and produce or indication the Pennsylvania Sample Letter for Closing of Estate.

Every legitimate document design you purchase is your own forever. You have acces to each develop you delivered electronically inside your acccount. Click the My Forms section and pick a develop to produce or acquire once more.

Be competitive and acquire, and produce the Pennsylvania Sample Letter for Closing of Estate with US Legal Forms. There are millions of professional and condition-particular varieties you can utilize for your company or personal requirements.

Form popularity

FAQ

It is extremely important to have a Pennsylvania Family Settlement Agreement prepared by an experienced PA probate lawyer. The second way to close an estate in PA is to file an accounting with the local county Orphans' Court. The executor or administrator must file a legal breakdown of the estate assets and expenses.

Most Pennsylvania estates are closed informally, by release agreement. A release agreement or waiver allows the beneficiaries of the Pennsylvania estate to approve of the administration of the estate and consent to the final distribution of the estate assets.

It is extremely important to have a Pennsylvania Family Settlement Agreement prepared by an experienced PA probate lawyer. The second way to close an estate in PA is to file an accounting with the local county Orphans' Court. The executor or administrator must file a legal breakdown of the estate assets and expenses.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

Pennsylvania Probate Fee Schedule ? Attorney Fees For Estate Settlement In PA Value of Estate% of EstateFee$50,000.01 to $100,000.005%$2,500.00$100,000.01 to $200,000.004%$4,000.00$200,000.01 to $1,000,000.003%$24,000.00$1,000,000.01 to $2,000,000.002%$20,000.005 more rows

Rule 10.5. This is a document required by PA law, certifying that all heirs to an estate have been notified of the opening of the estate. The Certification of Notice can be mailed to our office with a $25 check or filed online through our portal at no charge.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.