Pennsylvania Sample Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons

Description

How to fill out Sample Letter To Foreclosure Attorney - General Demand To Stop Foreclosure And Reasons?

If you wish to complete, download, or produce authorized document layouts, use US Legal Forms, the most important assortment of authorized types, which can be found on the Internet. Take advantage of the site`s easy and practical lookup to discover the files you need. A variety of layouts for enterprise and personal functions are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Pennsylvania Sample Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons in just a few clicks.

If you are already a US Legal Forms consumer, log in to your accounts and click the Down load button to have the Pennsylvania Sample Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons. You can also access types you formerly delivered electronically inside the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions beneath:

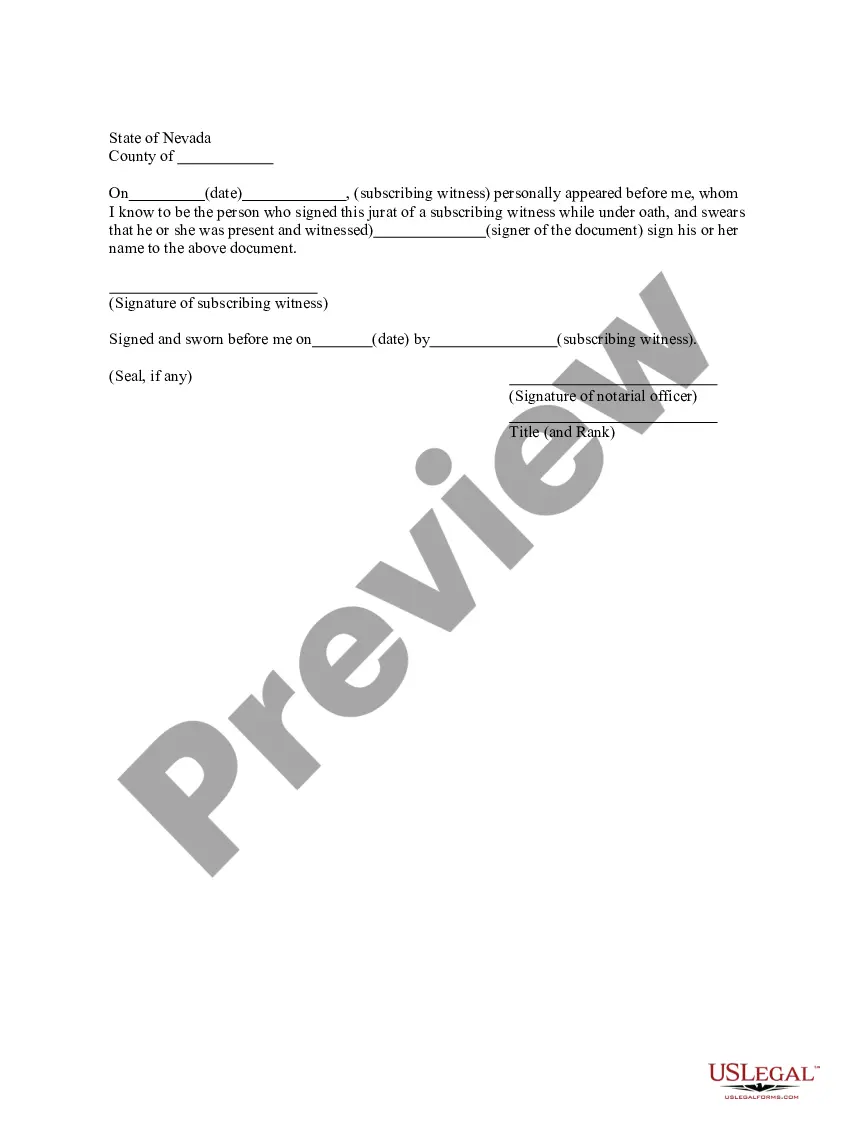

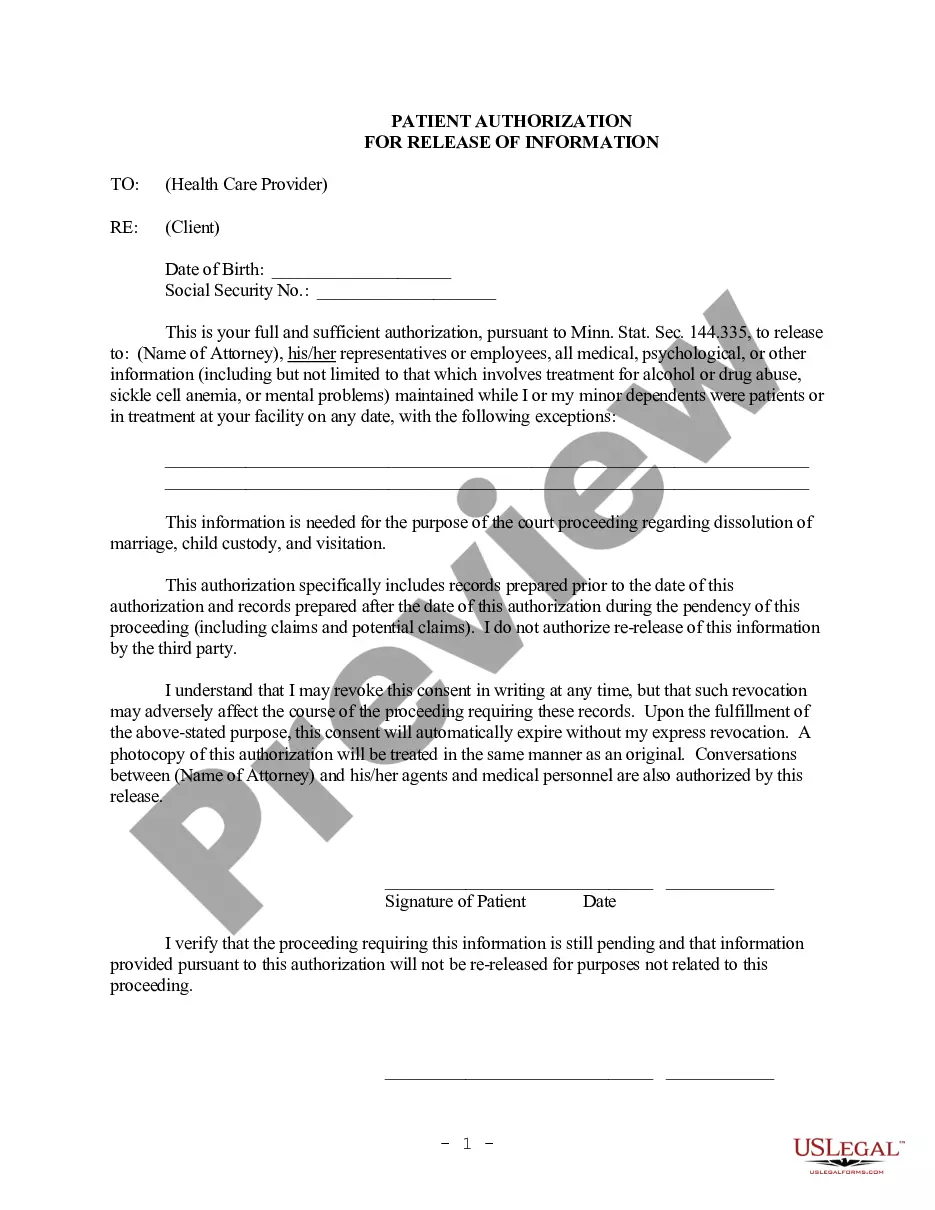

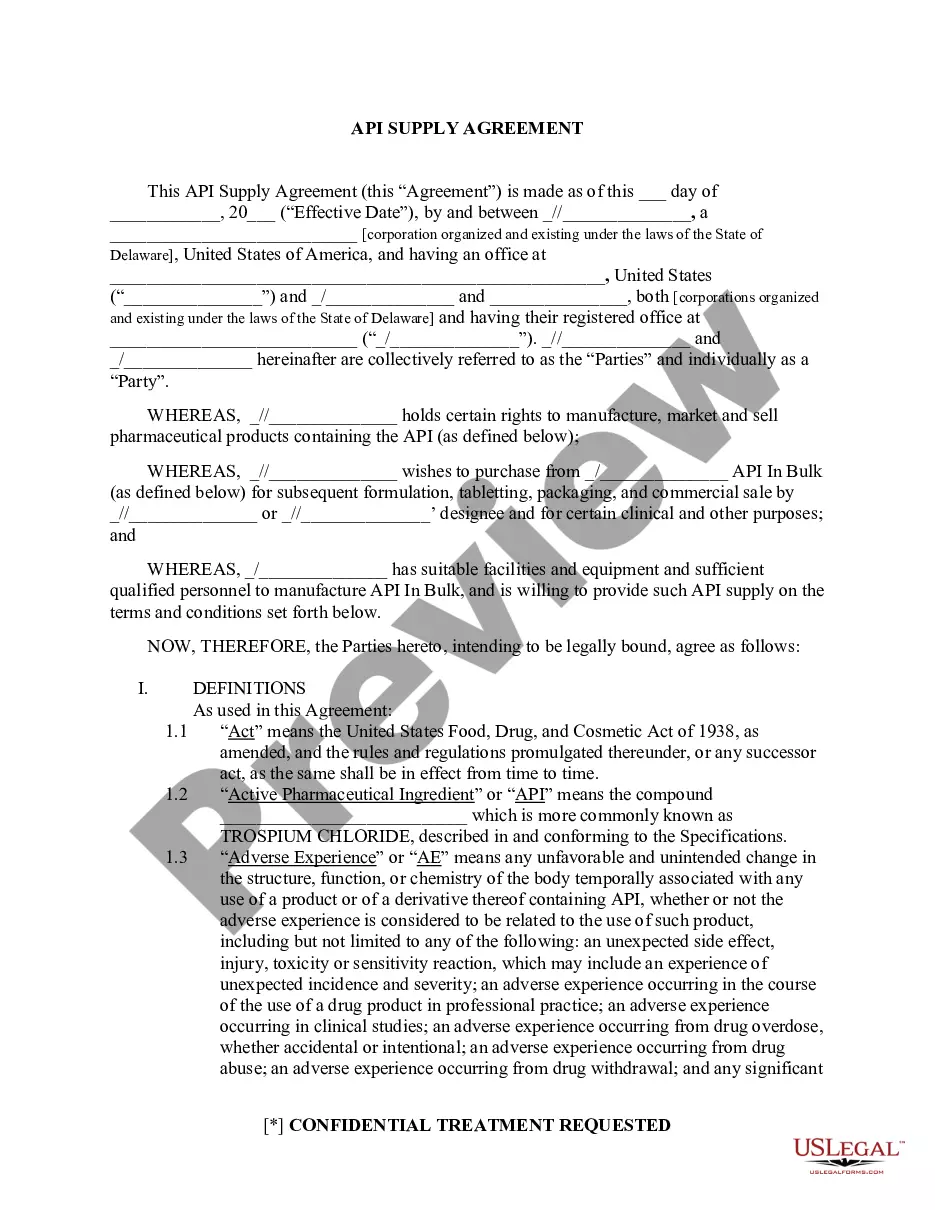

- Step 1. Ensure you have selected the shape to the correct area/land.

- Step 2. Utilize the Preview choice to examine the form`s articles. Never forget to read the description.

- Step 3. If you are not satisfied using the develop, utilize the Lookup field on top of the monitor to discover other models from the authorized develop format.

- Step 4. Upon having identified the shape you need, select the Buy now button. Opt for the costs program you favor and add your qualifications to register for the accounts.

- Step 5. Method the purchase. You can utilize your credit card or PayPal accounts to perform the purchase.

- Step 6. Pick the structure from the authorized develop and download it in your product.

- Step 7. Full, modify and produce or sign the Pennsylvania Sample Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons.

Each authorized document format you purchase is the one you have forever. You have acces to every develop you delivered electronically inside your acccount. Go through the My Forms section and choose a develop to produce or download again.

Compete and download, and produce the Pennsylvania Sample Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons with US Legal Forms. There are many skilled and condition-distinct types you may use to your enterprise or personal requirements.

Form popularity

FAQ

An Act 91 notice is the signal of the beginning stages of a mortgage foreclosure. Pennsylvania is a judicial state regarding mortgage foreclosures. This means that all paperwork from a mortgage servicer needs to be sent officially and through the court system.

Yes. Generally, under Pennsylvania law, if you can catch up on the mortgage payments before the foreclosure sale actually occurs, the foreclosure has to stop. To stop the sale, you will also have to pay court costs and the lender's reasonable attorney's fees, however.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

Filing a Chapter 13 Bankruptcy Petition To Stop Foreclosure Philadelphia lawyers often choose the bankruptcy option. By filing a Chapter 13 Bankruptcy Petition you immediately stop mortgage foreclosure. You are able to file a Plan which gives you up to five years to get caught up on your mortgage delinquency.

Notice of intent to foreclose letters are relatively standard documents. The letter you receive from the lender will name you, the property owner, and explain that you are in serious default on your loan. The document will also explain that you have 30 days to cure your mortgage.

There are particular steps that lenders must follow to foreclose once you fall behind on a mortgage. Foreclosures in Pennsylvania don't have a fixed time frame, but depending on your case's specifics and whether you decide to fight the foreclosure, it might take anywhere from a few months to over a year.