Church administration or management has to do with the organization of church ministry, and with the operations that govern that organization.

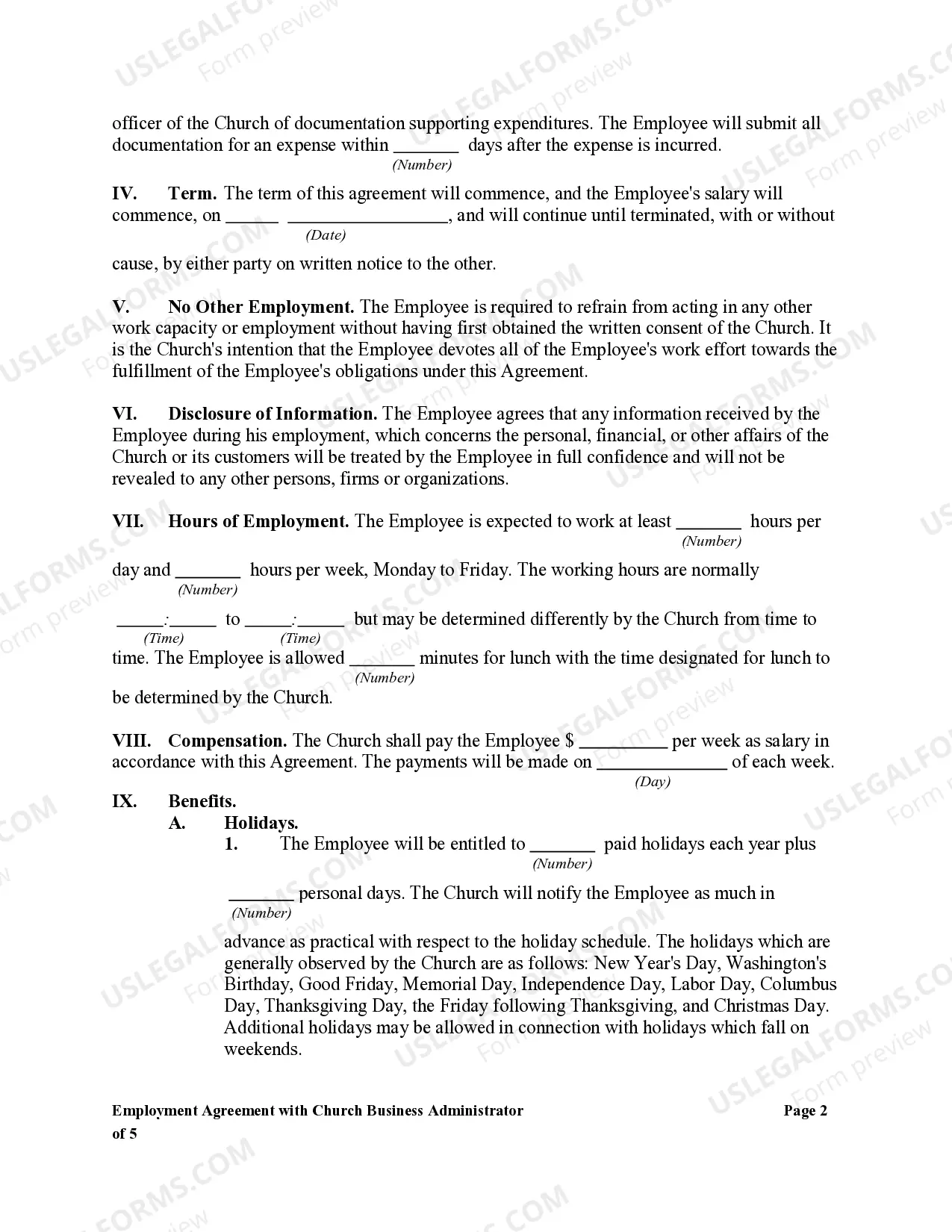

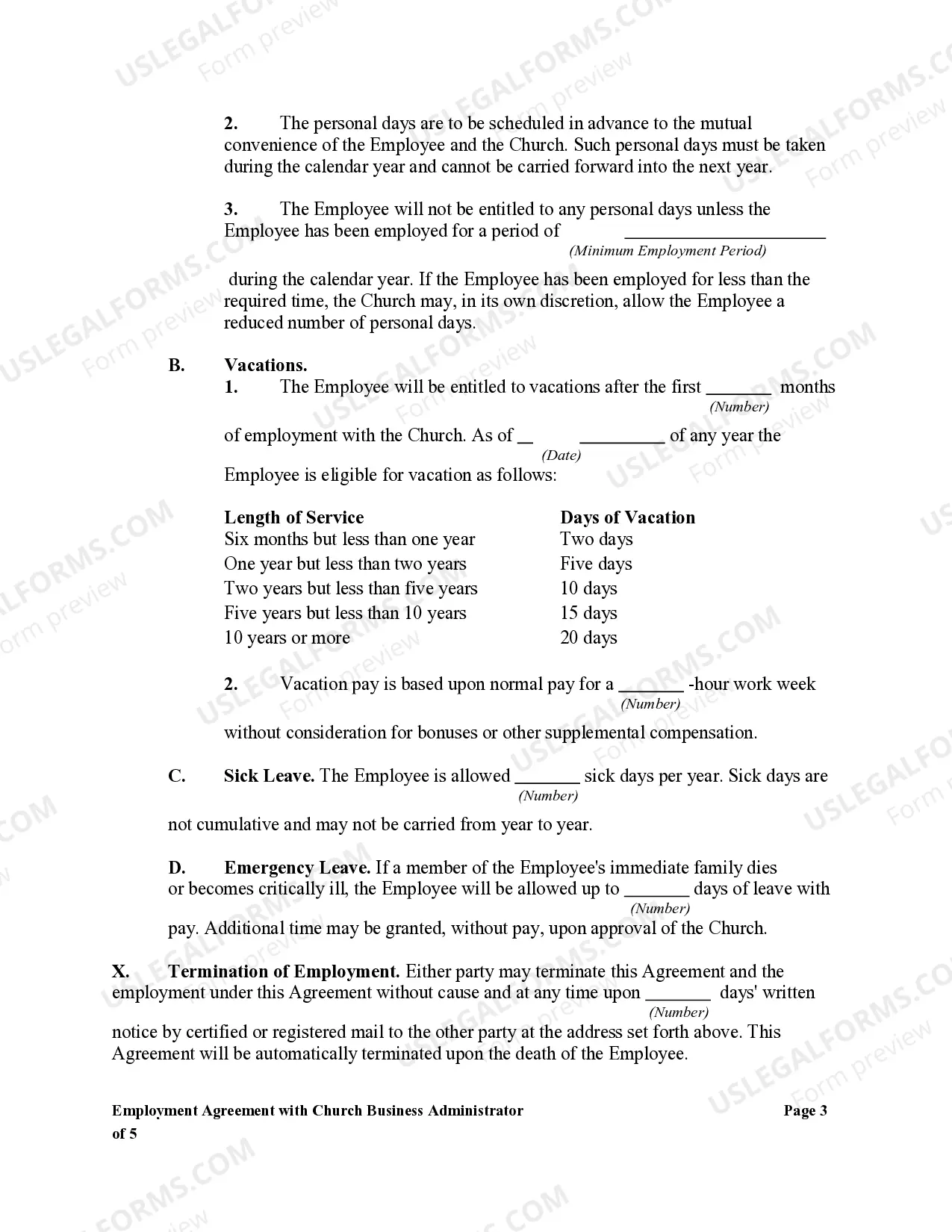

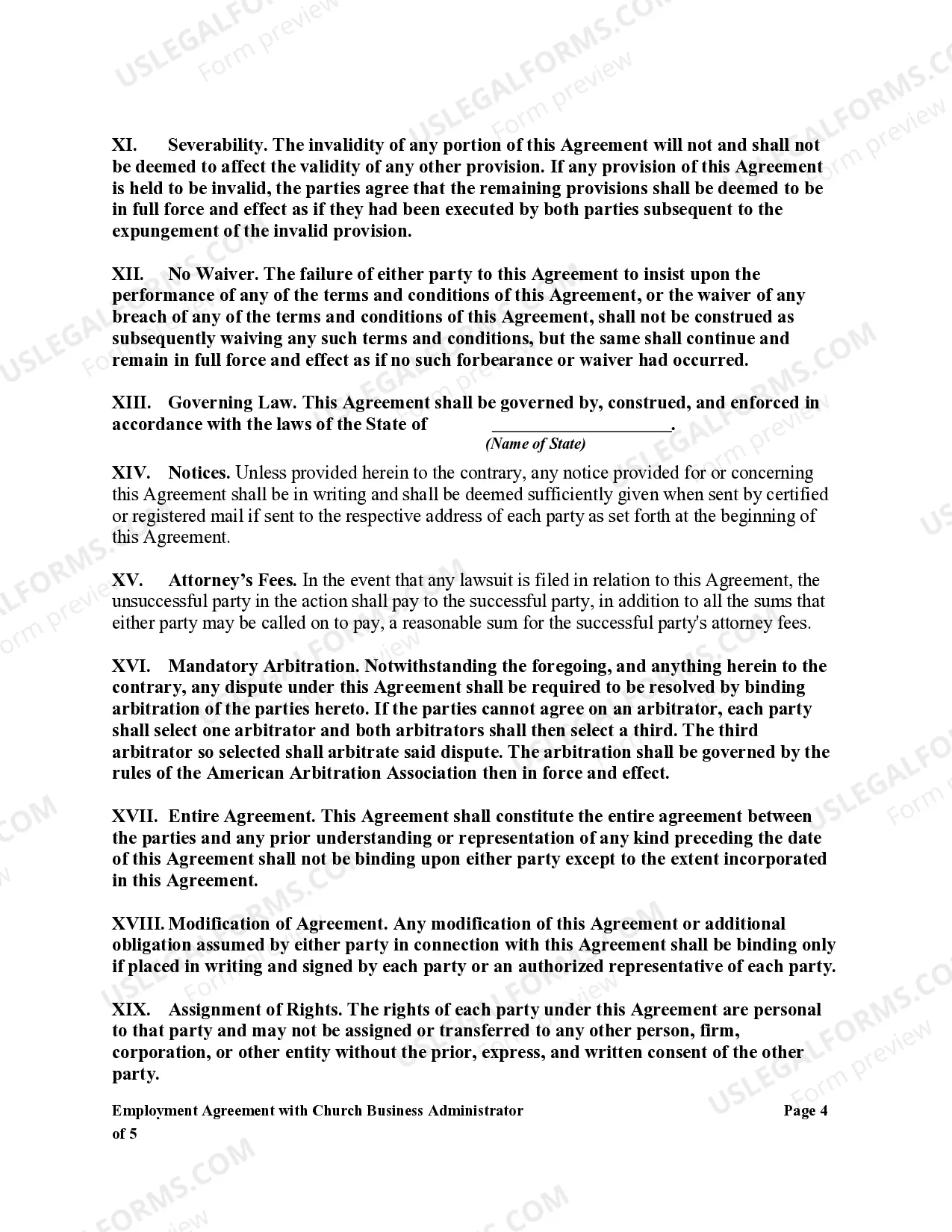

Pennsylvania Employment Agreement with Church Business Administrator

Description

How to fill out Employment Agreement With Church Business Administrator?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the Pennsylvania Employment Agreement with Church Business Administrator in moments.

If the form doesn’t fulfill your requirements, utilize the Search box at the top of the page to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred pricing plan and provide your details to create an account.

- If you already have an account, Log In to download the Pennsylvania Employment Agreement with Church Business Administrator from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms within the My documents section of your account.

- If you wish to try US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the proper form for your area/state.

- Click on the Review button to examine the details of the form.

Form popularity

FAQ

Purpose. Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.

Unlike many other states, Pennsylvania does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov. Clearly label W-4s used for state tax withholding as your state withholding form.

Required Employment Forms in PennsylvaniaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (template here)Federal W-4 Form.Pennsylvania New Hire Reporting Form.Employee Personal Data Form (template here)Company Health Insurance Policy Forms.More items...?

To qualify for nonwithholding, employees must have: Filed for Tax Forgiveness in the previous tax year. Qualified for a full refund (100%) of state taxes paid. Appear to qualify for a full refund in the current tax year.

Corporate Officers The claimant must provide information showing that he/she is not a self-employed businessperson to be eligible. The only exception with respect to ineligibility of corporate officers is provided in Section 402.4 of the Law.

These benefits are not taxable by the Commonwealth of Pennsylvania and local governments. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents (if any).

Individuals serving in positions which are designated as a major non-tenured policy-making or advisory position; and. Individuals serving in positions which are designated as a policy-making position the performance of the duties of which ordinarily does not require more than eight hours per week.

Under the SCRA, as amended, you may be exempt from PA personal income tax on your wages if (i) your spouse is a member of the armed forces present in PA in compli- ance with military orders; (ii) you are present in PA solely to be with your spouse; and (iii) you and your spouse both maintain domicile (state residency)

REV-419 Employee's No withholding Application Certificate (Pennsylvania) The REV- 419 form helps the employer withhold the correct state income tax from the employee's pay, should the employee wish to withhold a different amount for state taxes.

Sole Proprietorship: Wages paid to a sole proprietor, his or her spouse, parent(s), stepparent(s), children and stepchildren under the age of 18 are not subject to UC taxes. Anyone else who receives wages is an employee and their wages are taxable for UC purposes.