Pennsylvania Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption

Description

How to fill out Sample Letter For Tax Exemption - Discussion Of Office Equipment Qualifying For Tax Exemption?

You are able to devote hrs on the Internet searching for the legitimate papers format that suits the federal and state demands you will need. US Legal Forms gives 1000s of legitimate varieties that happen to be examined by experts. You can easily download or print out the Pennsylvania Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption from our support.

If you already possess a US Legal Forms account, you may log in and click on the Down load key. Following that, you may total, revise, print out, or indicator the Pennsylvania Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption. Every single legitimate papers format you get is the one you have for a long time. To have yet another copy associated with a purchased kind, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms internet site for the first time, adhere to the straightforward guidelines listed below:

- Initial, make certain you have selected the right papers format for the region/town of your choosing. Read the kind description to ensure you have picked the appropriate kind. If readily available, make use of the Review key to look through the papers format at the same time.

- If you wish to find yet another model from the kind, make use of the Look for industry to obtain the format that meets your requirements and demands.

- After you have located the format you need, just click Get now to carry on.

- Select the pricing prepare you need, key in your accreditations, and register for a merchant account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Select the file format from the papers and download it for your gadget.

- Make alterations for your papers if required. You are able to total, revise and indicator and print out Pennsylvania Sample Letter for Tax Exemption - Discussion of Office Equipment Qualifying for Tax Exemption.

Down load and print out 1000s of papers web templates utilizing the US Legal Forms website, that offers the greatest selection of legitimate varieties. Use specialist and express-distinct web templates to take on your small business or personal demands.

Form popularity

FAQ

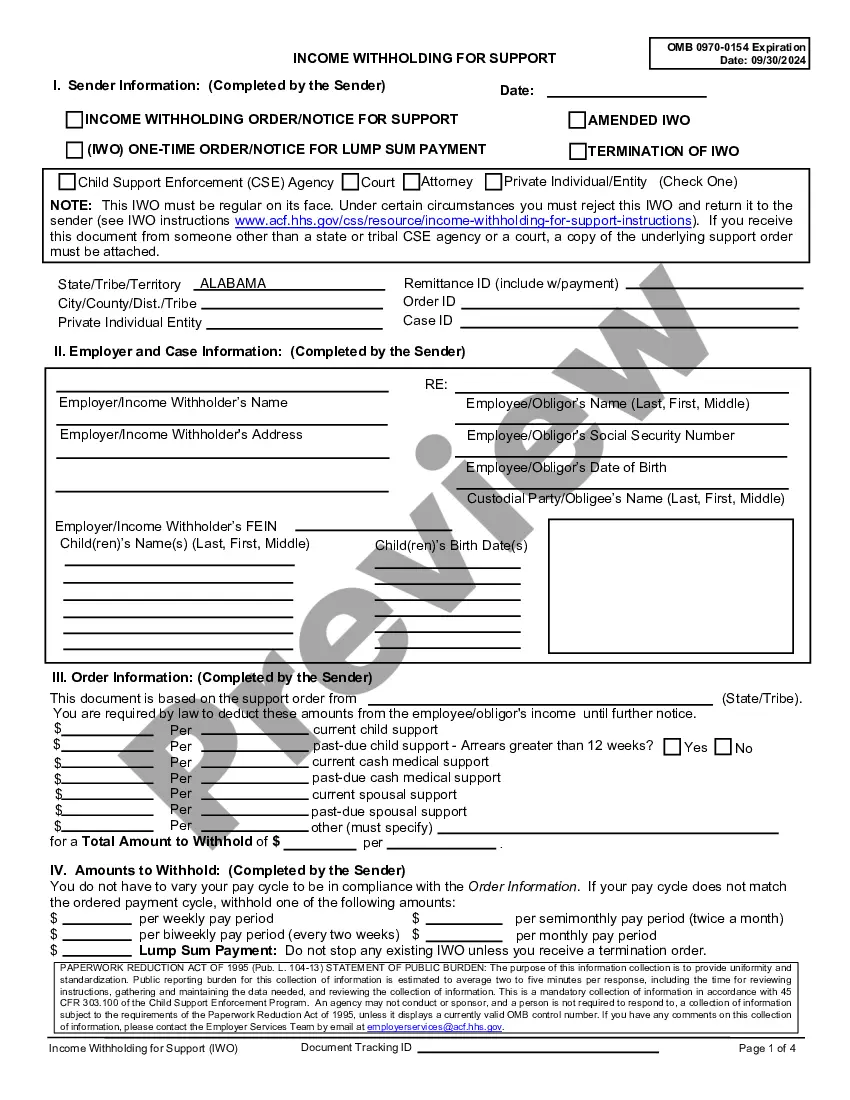

The purchase or use of tangible personal property or services performed thereon by a person engaged in the business of manufacturing or processing is exempt from tax if the property is predominantly used directly by him in manufacturing or processing operations.

This form is used to obtain a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania.

Property used for the personal comfort, convenience or use of employes, shall be subject to tax. However protective equipment, such as face masks, helmets, gloves, coveralls, goggles and the like, worn by production personnel shall be exempt from tax.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Equipment, machinery and supplies designed and used to control, abate or prevent air, water or noise pollution generated in the manufacturing or processing operation shall be deemed to be directly used in manufacturing or processing and, therefore, is not subject to tax.

You are not required to pay sales tax on items that you purchase for resale. You may be required by a vendor to provide a Pennsylvania Exemption Certificate (REV-1220). The certificate can be downloaded from the PA Department of Revenue's Sales, Use and Hotel Occupancy Tax Forms Search page.

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What Income Is Exempt in Pennsylvania? Capital gains from the sale of a principal residence for those who satisfy ownership and use requirements2. Personal use of employer-owned property. Child support. Alimony. Social security benefits, public and private pensions, and IRA distributions.