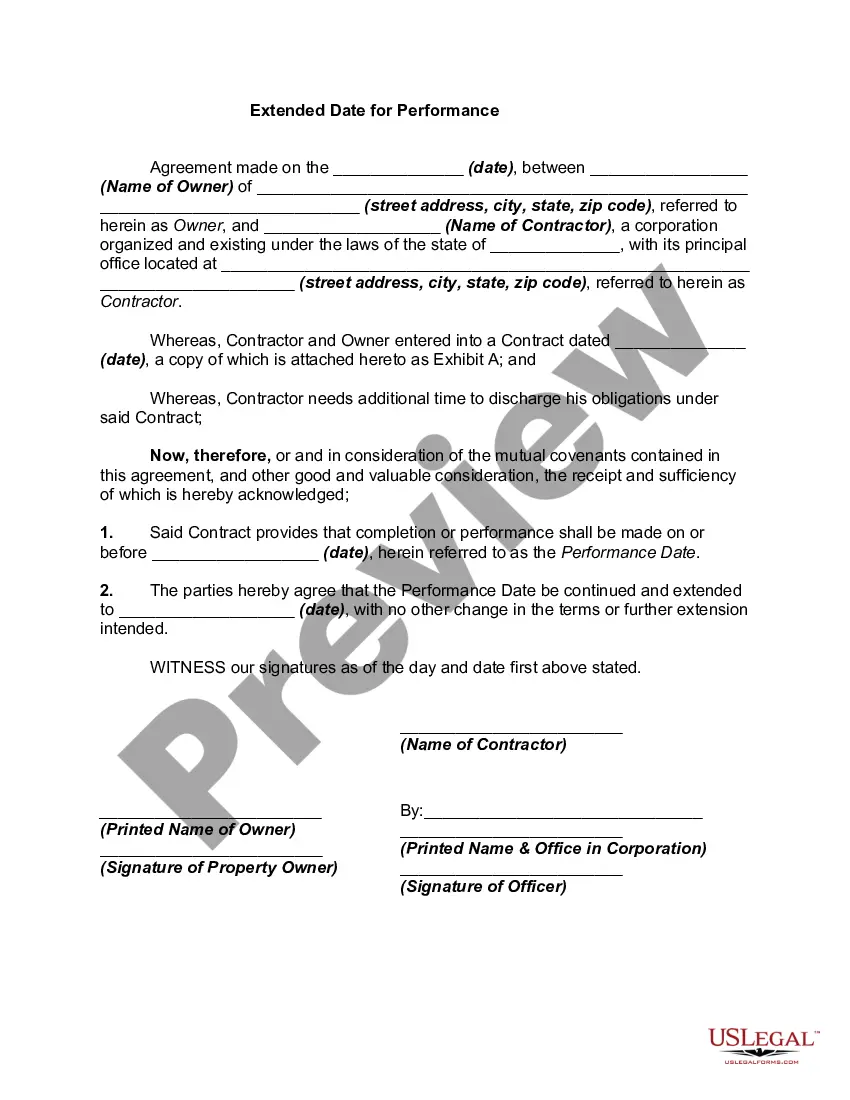

Pennsylvania Extended Date for Performance is an important legal concept related to contract law in the Commonwealth of Pennsylvania. It refers to the extension of the deadline or timeframe within which a party is obligated to perform its contractual duties or obligations. This extension is granted by the law or by the consent of the parties involved. Under certain circumstances, a situation may arise where a party is unable to fulfill its contractual obligations within the agreed-upon time frame due to uncontrollable events or unforeseen circumstances. In such cases, the party can invoke the Pennsylvania Extended Date for Performance to seek additional time for completion. The Pennsylvania Extended Date for Performance acts as a safeguard that ensures fairness and flexibility in contract enforcement. It acknowledges that contractual obligations can be affected by various factors such as natural disasters, labor strikes, supply chain interruptions, or any other events beyond the control of the parties involved. By granting extra time, it enables both parties to better adapt and mitigate any potential damages or losses resulting from a delay in performance. It is worth noting that the Pennsylvania Extended Date for Performance may vary depending on the type of contract and the specific circumstances. Different types or categories of the extended date for performance can be: 1. Force Mature Clause: Many contracts include a force majeure clause, which provides relief from performance obligations in the event of an unforeseen event that is outside the control and not reasonably foreseeable by the parties. This clause may specify the types of events that qualify under force majeure, such as acts of God, wars, pandemics, government regulations, and acts of terrorism. 2. Excusable Delay: This type of extension may be granted if the delay is caused by circumstances beyond the control of the party, but the event does not fall under the force majeure clause. It takes into account situations such as a sudden illness, unexpected equipment failure, or an unavoidable accident. 3. Contractual Extension: Parties may, by mutual agreement, extend the performance deadline beyond what was initially specified in the contract. This extension can address both parties' concerns and allows them to adapt to changing circumstances or unforeseen delays. It often requires the parties to formally document the extension in writing to avoid any misunderstandings or disputes. In conclusion, the Pennsylvania Extended Date for Performance is a crucial legal concept that provides flexibility and accommodation when performing contractual obligations. Whether through a force majeure clause, excusable delay, or contractual extension, it ensures fairness and the ability to adapt to unforeseen challenges.

Pennsylvania Extended Date for Performance

Description

How to fill out Pennsylvania Extended Date For Performance?

You are able to spend hours on-line attempting to find the legal papers format that meets the federal and state demands you require. US Legal Forms provides thousands of legal kinds which are reviewed by pros. You can easily down load or produce the Pennsylvania Extended Date for Performance from your services.

If you currently have a US Legal Forms account, you can log in and then click the Down load option. Next, you can full, modify, produce, or indication the Pennsylvania Extended Date for Performance. Every single legal papers format you purchase is your own property forever. To obtain one more duplicate of any acquired type, go to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms internet site initially, follow the straightforward guidelines below:

- Initial, ensure that you have chosen the proper papers format for that region/area that you pick. Browse the type outline to make sure you have selected the appropriate type. If offered, take advantage of the Review option to appear from the papers format at the same time.

- If you wish to discover one more edition of the type, take advantage of the Look for discipline to find the format that meets your requirements and demands.

- Once you have discovered the format you need, click Get now to move forward.

- Pick the pricing plan you need, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You should use your credit card or PayPal account to pay for the legal type.

- Pick the formatting of the papers and down load it for your product.

- Make modifications for your papers if required. You are able to full, modify and indication and produce Pennsylvania Extended Date for Performance.

Down load and produce thousands of papers web templates utilizing the US Legal Forms web site, that offers the biggest selection of legal kinds. Use specialist and status-distinct web templates to take on your business or individual requirements.

Form popularity

FAQ

The last day for tax extension in Pennsylvania typically falls six months after the original due date. Hence, if you file for an extension, remember that the Pennsylvania Extended Date for Performance means you must submit your taxes by this new date. Staying informed about deadlines is vital in order to avoid unnecessary penalties. Using tools or services from uslegalforms can help you track important dates and submit your filings on time.

Pennsylvania does provide an automatic extension for individual filers, offering a six-month extension on state income taxes. This aligns with the concept of the Pennsylvania Extended Date for Performance, allowing taxpayers to manage their tax responsibilities more efficiently. It is crucial to file for this extension properly to avoid penalties. You can utilize platforms like uslegalforms to find guidance and forms to ensure you meet all necessary requirements.

Yes, Pennsylvania does honor federal extensions for tax filings. This allows taxpayers to enjoy the Pennsylvania Extended Date for Performance, giving them added time to fulfill their state tax obligations. However, it is important to note that while the extension is recognized, some conditions may apply depending on the specifics of the tax situation. Always check for any updates or requirements through the Pennsylvania Department of Revenue.

Yes, Pennsylvania accepts the federal extension form 1120S. This means that if your business files a federal extension, you can also apply that extension to your Pennsylvania business taxes. Leveraging the Pennsylvania Extended Date for Performance can provide additional time to prepare accurate tax filings. It's essential to complete any required state forms to ensure compliance.

The PA 65 Schedule A is specifically designed for partners in a partnership to report their share of income or loss from that partnership. This schedule details the income earned, deductions claimed, and the overall financial performance of the partnership. Understanding the Pennsylvania Extended Date for Performance is crucial for partners, as timely filing ensures compliance and avoids potential penalties. USLegalForms can guide you in navigating this form, making the process more efficient and straightforward.

The PA-40 Schedule E is a form used by Pennsylvania residents to report income from various sources, such as rental properties, partnerships, and S corporations. This schedule is essential for taxpayers who wish to accurately reflect their total income and deductions, ensuring compliance with Pennsylvania tax laws. By understanding the Pennsylvania Extended Date for Performance, you can better prepare and file your taxes on time without penalties. Utilizing platforms like USLegalForms simplifies the process, offering guidance on completing your PA-40 Schedule E.

Yes, Pennsylvania does offer an extension related to the Pennsylvania Extended Date for Performance. This extension allows individuals and businesses extra time to fulfill their obligations, providing much-needed flexibility. For those navigating deadlines, understanding this extension can be crucial for project completion. If you need assistance with the legal aspects, consider using the US Legal Forms platform for guidance and resources tailored to Pennsylvania's regulations.

Schedule SP in Pennsylvania refers to the form that individuals use to apply for property tax rebates. It is specifically designed for senior citizens and individuals with disabilities who meet the eligibility criteria. Correctly filling out this schedule is crucial to ensuring you receive the necessary rebates, allowing you to feel confident and supported, especially in conjunction with the Pennsylvania Extended Date for Performance.

In Pennsylvania, SSP stands for State Supplementary Payment. This program provides additional financial assistance to individuals who qualify under certain income requirements. It aims to help support individuals facing financial hardships and is an essential resource to consider when planning your finances. Understanding SSP can complement your financial strategies related to Pennsylvania Extended Date for Performance.

The Pennsylvania State Supplementary Payment, often referred to as SSP, is a benefit for low-income individuals receiving Supplemental Security Income. This payment helps eligible individuals cover living expenses, ensuring a basic standard of living. If you are eligible for this program, applying timely can significantly benefit you and align with the Pennsylvania Extended Date for Performance guidelines for receipt.