This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

You can spend numerous hours online searching for the legal document template that matches the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that can be examined by professionals.

You can obtain or print the Pennsylvania Equine or Horse Donation Contract from our services.

If you want another version of your document, utilize the Search field to find the template that fits your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, modify, print, or sign the Pennsylvania Equine or Horse Donation Contract.

- Every legal document template you purchase is yours permanently.

- To get another copy of any acquired document, visit the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have chosen the correct document template for the area/city of your interest.

- Review the document information to confirm that you have selected the right form.

Form popularity

FAQ

Filling out a donation slip requires careful attention to the details of your donation. Start by providing your contact information, followed by the specifics of your donation, including the type and value of the asset being donated. If applicable, ensure you mention that you are using a Pennsylvania Equine or Horse Donation Contract to formalize your generosity, as this will help streamline the process and clarify ownership.

A letter of intent to donate to charity serves as a preliminary communication expressing your desire to make a donation. When creating a Pennsylvania Equine or Horse Donation Contract, a letter of intent can outline your intentions while providing essential details about the donation. Although it is not legally binding, it sets the stage for further discussions and formal agreements regarding your charitable intentions.

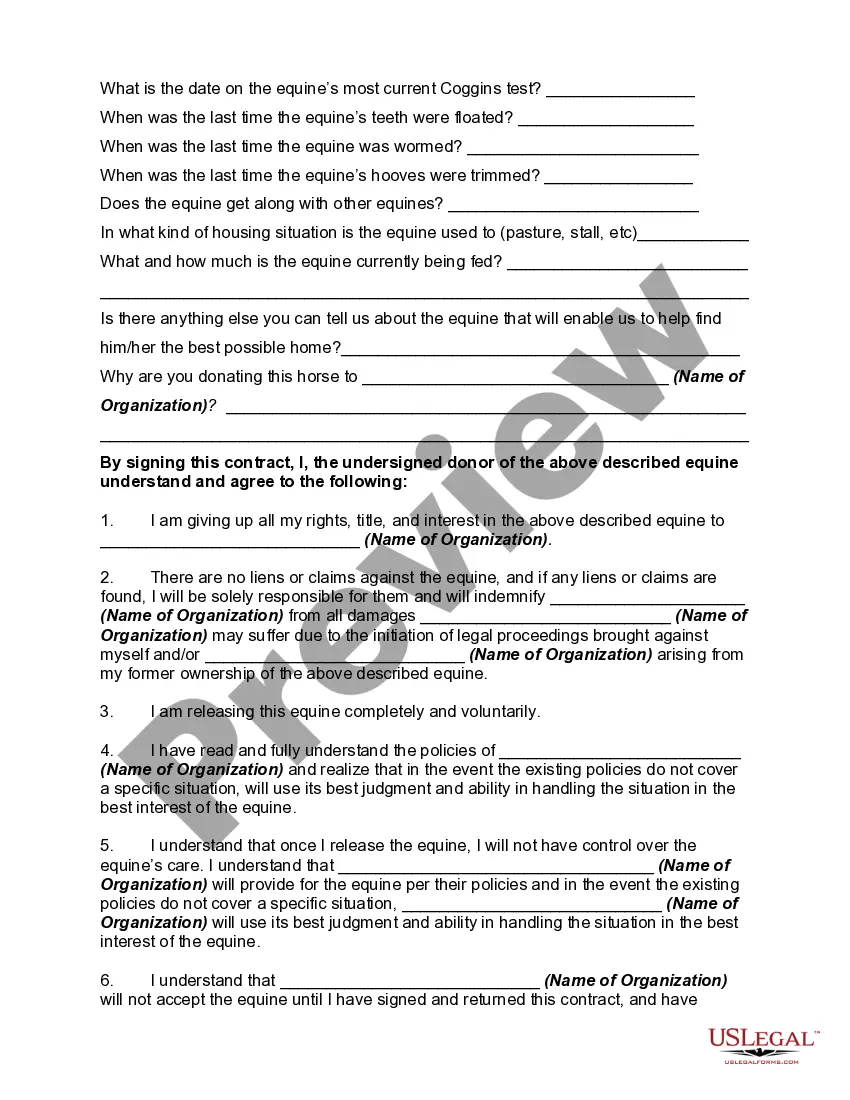

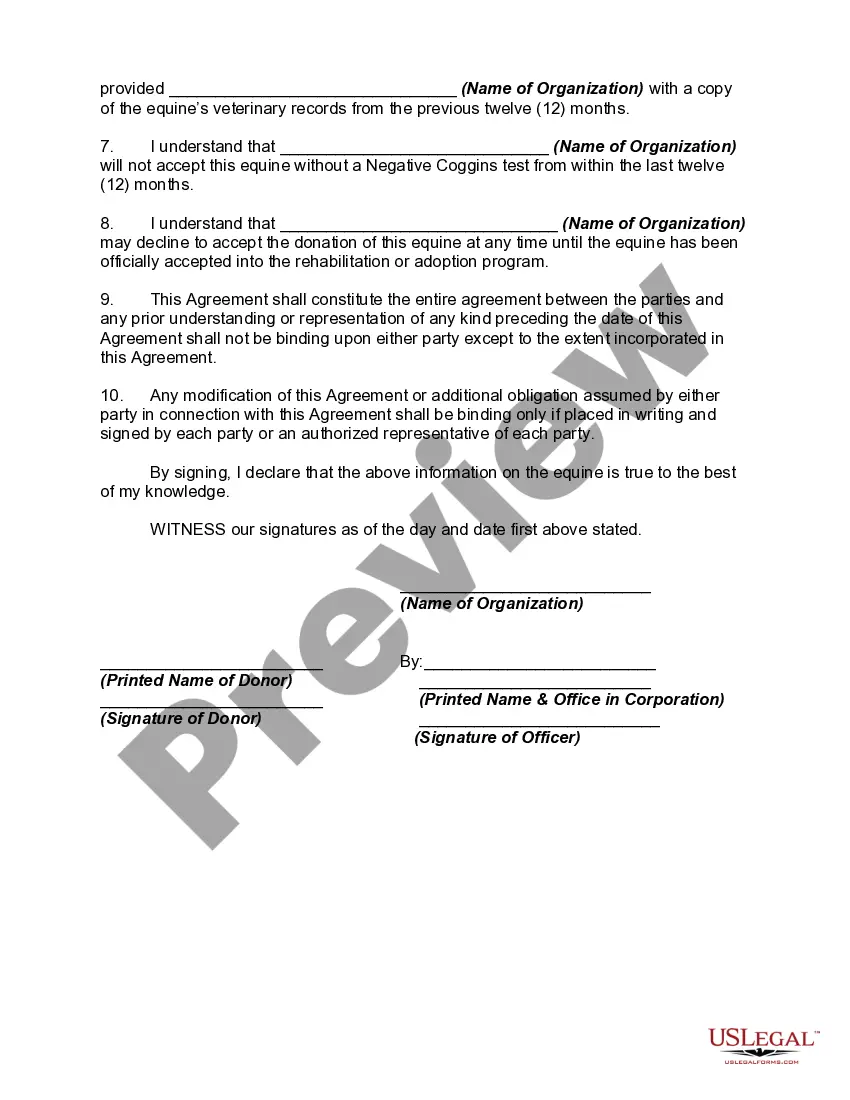

A formal agreement to make donations to charity is typically structured as a written contract outlining the donor's commitment. Such agreements, including a Pennsylvania Equine or Horse Donation Contract, document the specific contributions, timelines, and any expectations for the use of the donated assets. This type of formalization can strengthen trust between donors and charities, ensuring accountability.

A donation agreement is a formal document that outlines the terms of a charitable contribution. In the context of a Pennsylvania Equine or Horse Donation Contract, this agreement specifies what is being donated, to whom it is being given, and any conditions or restrictions that apply. This clarity helps both donors and recipients understand their rights and obligations, enhancing transparency in charitable giving.

A pledge to charity can be legally binding, depending on the specifics of the Pennsylvania Equine or Horse Donation Contract. If you make a formal written pledge that includes clear terms and conditions, it can be enforceable in court. However, verbal pledges may not hold the same legal weight. It's advisable to use a written agreement to ensure clarity and legal protection.

You can receive a tax write-off for donating a horse, provided you donate to a qualified charity. Make sure to document the donation properly, including any valuation of the horse's fair market value. A Pennsylvania Equine or Horse Donation Contract can assist you in maintaining accurate records for your tax records.

Yes, donating a horse can be tax-deductible if the recipient organization is a registered charity. To ensure you can claim this deduction, keep thorough documentation, including a Pennsylvania Equine or Horse Donation Contract. This will help guide you through the tax deduction process.

To write a simple donation letter, start by clearly stating your intention to donate a horse and include important details, such as the horse's name, age, and health status. Mention any conditions or considerations about the donation. Finally, consider attaching a Pennsylvania Equine or Horse Donation Contract to formalize the process and provide clarity.

Yes, you can donate a horse to charity, and many organizations appreciate such contributions. Be sure to research charities that accept horse donations to ensure they align with your intentions. For proper documentation, use a Pennsylvania Equine or Horse Donation Contract to facilitate your donation.

A donation contract is a formal agreement between a donor and a recipient regarding the donation of goods, such as horses. This contract outlines the conditions of the donation, rights, and responsibilities of both parties. When donating a horse, it's vital to use a Pennsylvania Equine or Horse Donation Contract to clearly define the terms and protect both parties.