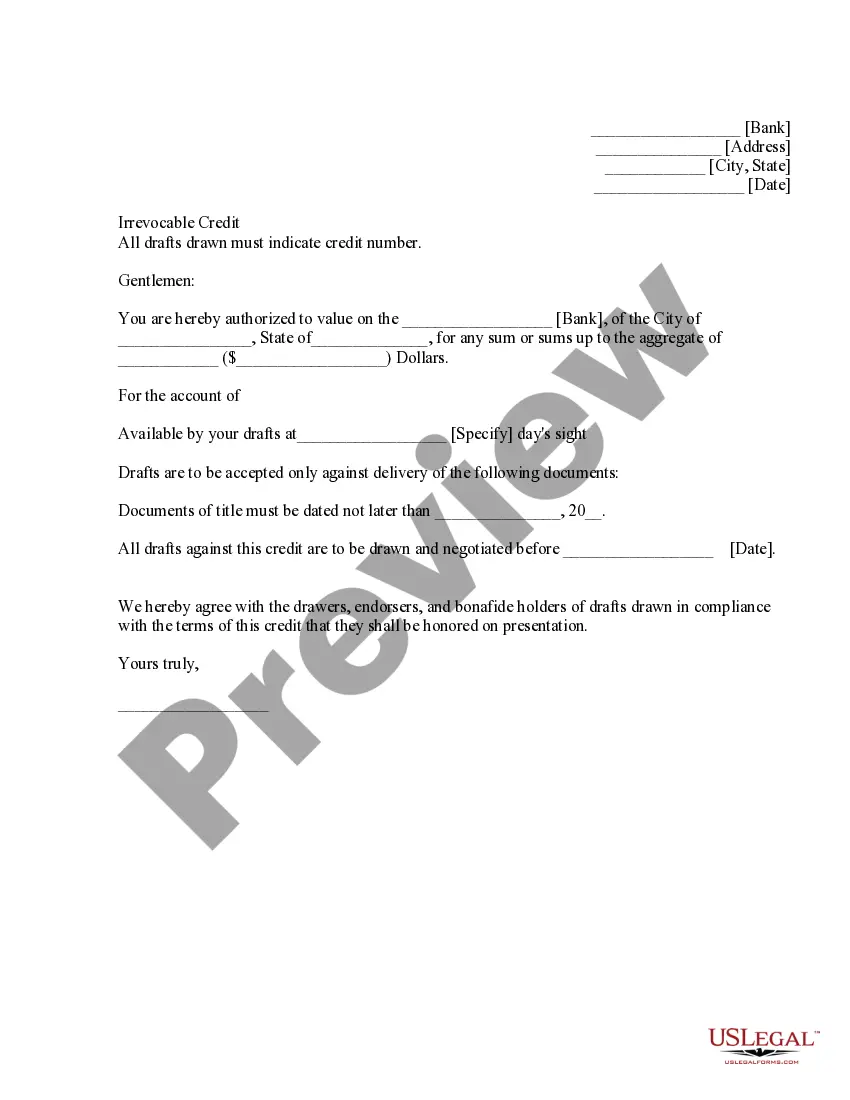

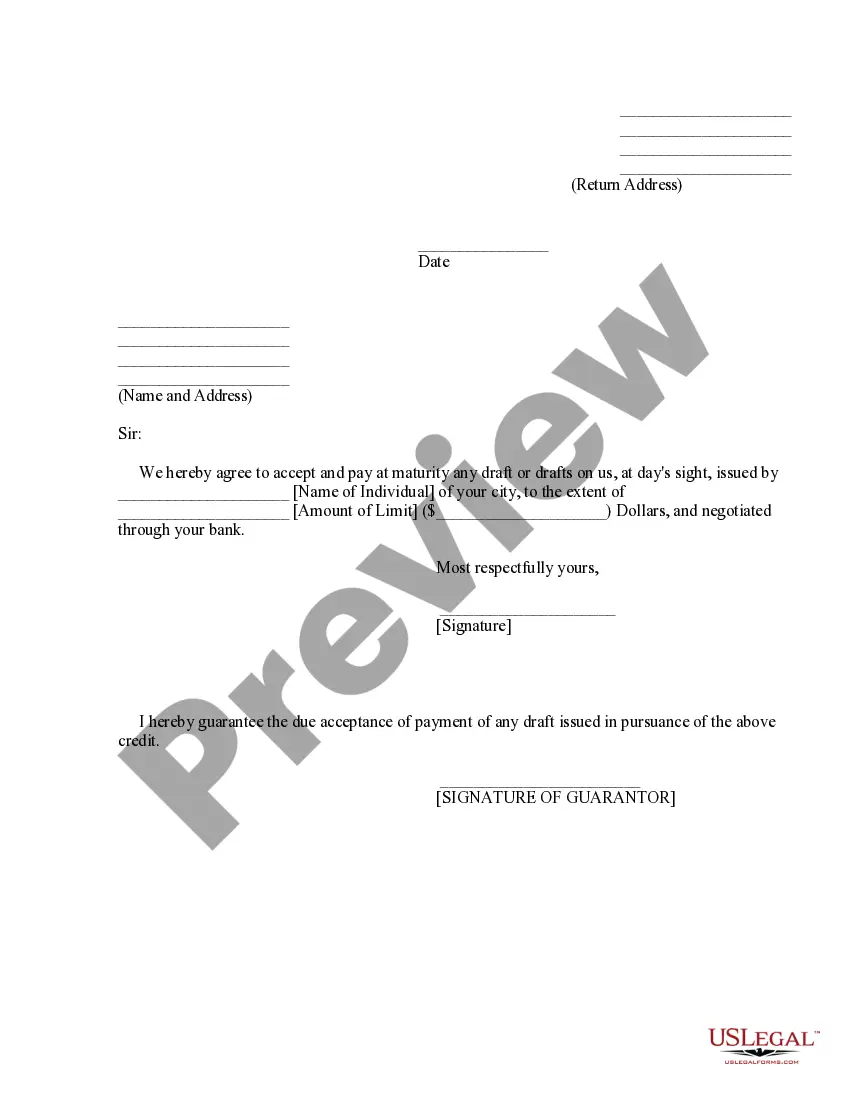

Pennsylvania General Letter of Credit with Account of Shipment

Description

How to fill out General Letter Of Credit With Account Of Shipment?

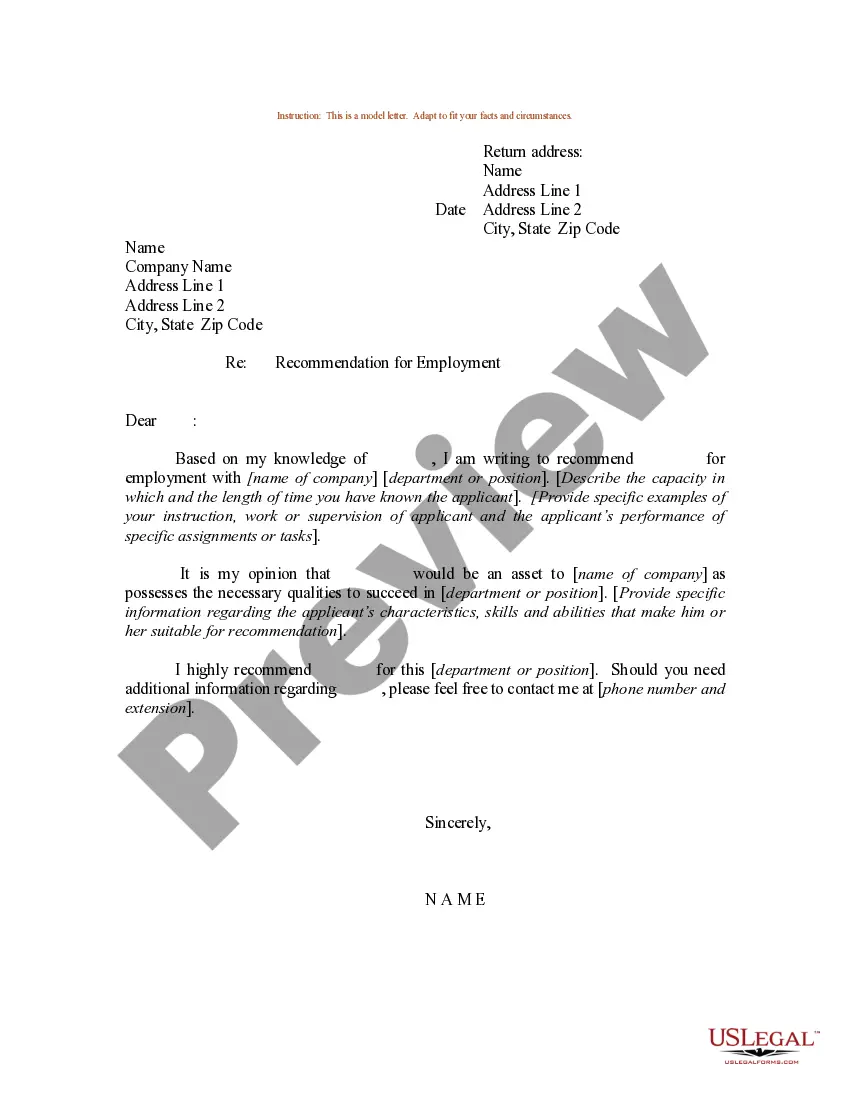

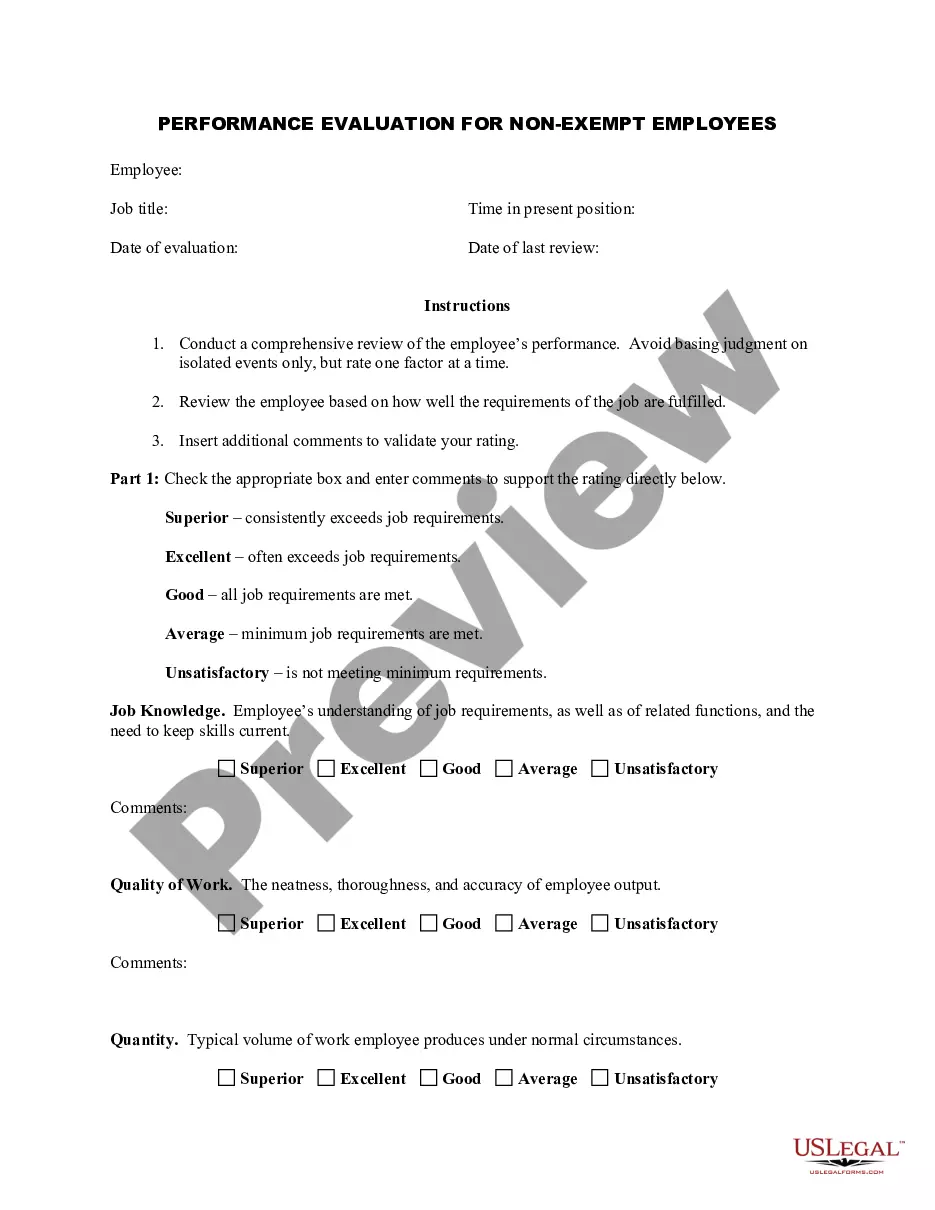

It is possible to spend several hours online attempting to find the lawful papers design which fits the federal and state requirements you need. US Legal Forms supplies a large number of lawful kinds which can be reviewed by pros. It is possible to download or print the Pennsylvania General Letter of Credit with Account of Shipment from your assistance.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Down load switch. Following that, it is possible to complete, modify, print, or signal the Pennsylvania General Letter of Credit with Account of Shipment. Every single lawful papers design you purchase is the one you have forever. To obtain one more backup for any bought kind, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms site for the first time, follow the basic directions listed below:

- Initial, make certain you have selected the right papers design for your county/area of your liking. See the kind description to ensure you have picked out the appropriate kind. If offered, make use of the Review switch to check with the papers design as well.

- If you would like get one more edition in the kind, make use of the Look for area to discover the design that fits your needs and requirements.

- After you have located the design you want, click Acquire now to carry on.

- Select the prices program you want, type in your qualifications, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to cover the lawful kind.

- Select the structure in the papers and download it to your device.

- Make adjustments to your papers if possible. It is possible to complete, modify and signal and print Pennsylvania General Letter of Credit with Account of Shipment.

Down load and print a large number of papers themes using the US Legal Forms site, which provides the most important variety of lawful kinds. Use expert and condition-particular themes to deal with your small business or individual needs.

Form popularity

FAQ

Essentially, it occurs when the warrantor fails to provide the assurance warranted. A seller can expressly or implicitly assure the buyer about the quality or title of an item sold. If such assurance is proved to be untrue, the buyer has a claim for breach of warranty.

Warranty of title is a guarantee a real estate seller provides to the buyer. A complete warranty or title in Pennsylvania consists of several covenants of title?legal promises about the transferred property's title: Covenant of seisin. The seller holds complete title to the property.

Pennsylvania, unlike many states, does not have a ?buyer's remorse? statute on the books, which means that consumers do not have legal grounds to return a vehicle unless they have a valid reason for doing so that is related to fraud, a serious defect, or misrepresentation.

Another implied warranty is the warranty of title, which implies that the seller of goods has the right to sell them (e.g., they are not stolen, or patent infringements, or already sold to someone else).

--Except in a finance lease, a warranty that the goods will be merchantable is implied in a lease contract if the lessor is a merchant with respect to goods of that kind.

The Implied Warranty of Merchantability applies only to merchants with respect to goods they are in the business of selling. The warranty implies into the sale that the goods are not defective and are fit for the ordinary purpose for which such goods are used.