Pennsylvania Sample Letter for Annual Report - Dissolved Corporation

Description

How to fill out Sample Letter For Annual Report - Dissolved Corporation?

US Legal Forms - one of many largest libraries of legal types in the USA - delivers a wide range of legal document templates you can download or produce. Using the site, you will get a huge number of types for organization and person reasons, categorized by categories, says, or key phrases.You can get the most up-to-date types of types such as the Pennsylvania Sample Letter for Annual Report - Dissolved Corporation within minutes.

If you have a subscription, log in and download Pennsylvania Sample Letter for Annual Report - Dissolved Corporation through the US Legal Forms library. The Download switch can look on each and every type you look at. You get access to all in the past acquired types from the My Forms tab of the bank account.

If you wish to use US Legal Forms for the first time, listed here are simple instructions to help you started:

- Be sure to have selected the best type for your metropolis/area. Go through the Review switch to check the form`s content. See the type description to actually have chosen the correct type.

- When the type does not match your specifications, make use of the Search field near the top of the display to find the one which does.

- In case you are pleased with the form, confirm your selection by simply clicking the Buy now switch. Then, select the costs program you want and provide your qualifications to register for the bank account.

- Procedure the transaction. Make use of charge card or PayPal bank account to complete the transaction.

- Select the format and download the form on the device.

- Make modifications. Load, edit and produce and signal the acquired Pennsylvania Sample Letter for Annual Report - Dissolved Corporation.

Every single design you included with your bank account lacks an expiration particular date and it is your own property eternally. So, in order to download or produce one more duplicate, just check out the My Forms area and then click in the type you want.

Get access to the Pennsylvania Sample Letter for Annual Report - Dissolved Corporation with US Legal Forms, one of the most extensive library of legal document templates. Use a huge number of professional and state-specific templates that meet your company or person requires and specifications.

Form popularity

FAQ

After you've registered your LLC, you must renew your registration and pay the required business taxes. If you've hired employees, you also probably need to pay employer taxes. Let's look at the ongoing requirements for your Pennsylvania LLC.

Dissolving a Church or Nonprofit in Pennsylvania Take an Official Vote of the Board of Directors/Members. ... Obtain Tax Certificates. ... Obtain Attorney General Approval. ... Obtain Court Approval to Sell Real Estate. ... Ensure that Money Left Over is Transferred to a Similar Nonprofit.

The document required to form a corporation in Pennsylvania is called the Articles of Incorporation. The information required in the formation document varies by state. Pennsylvania's requirements include: Officers.

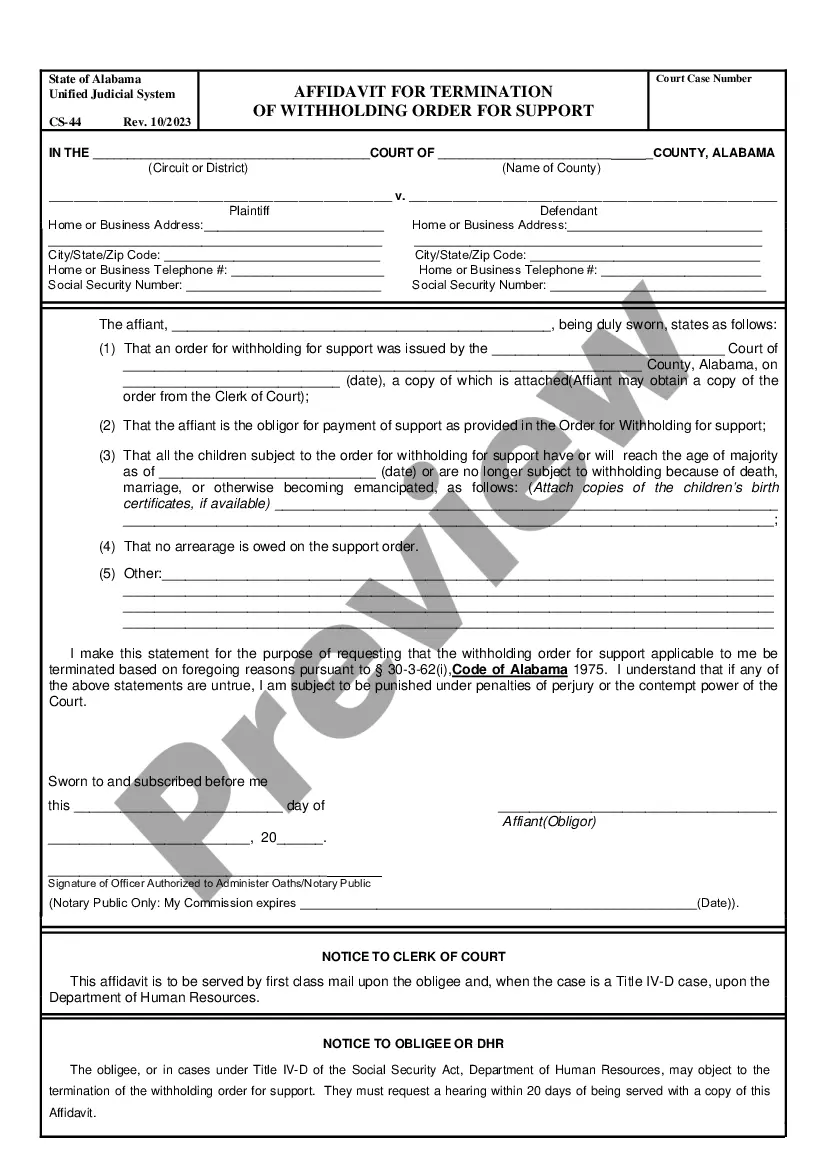

To withdraw or cancel your foreign corporation in Pennsylvania, you provide the completed Application for Termination of Authority Foreign Corporation (DSCB: 15-4129/6129) form to the Department of State by mail, in person, or online, along with the filing fee.

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

Your company is required to file annual reports to maintain good standing and continue operating. Failure to file annual reports on time can result in late fees.

Most states require an annual report, also called a periodic report, statement of information, or annual registration. However, there are exceptions. For example, Arizona doesn't require an LLC annual report, and if you formed your company in Indiana, you only need to send the report every two years.

An annual report is a document that describes a company's financial condition and business operations for the previous year. Any publicly traded business is required by law to prepare and publish an annual report, which helps current and potential investors decide whether to provide funding.