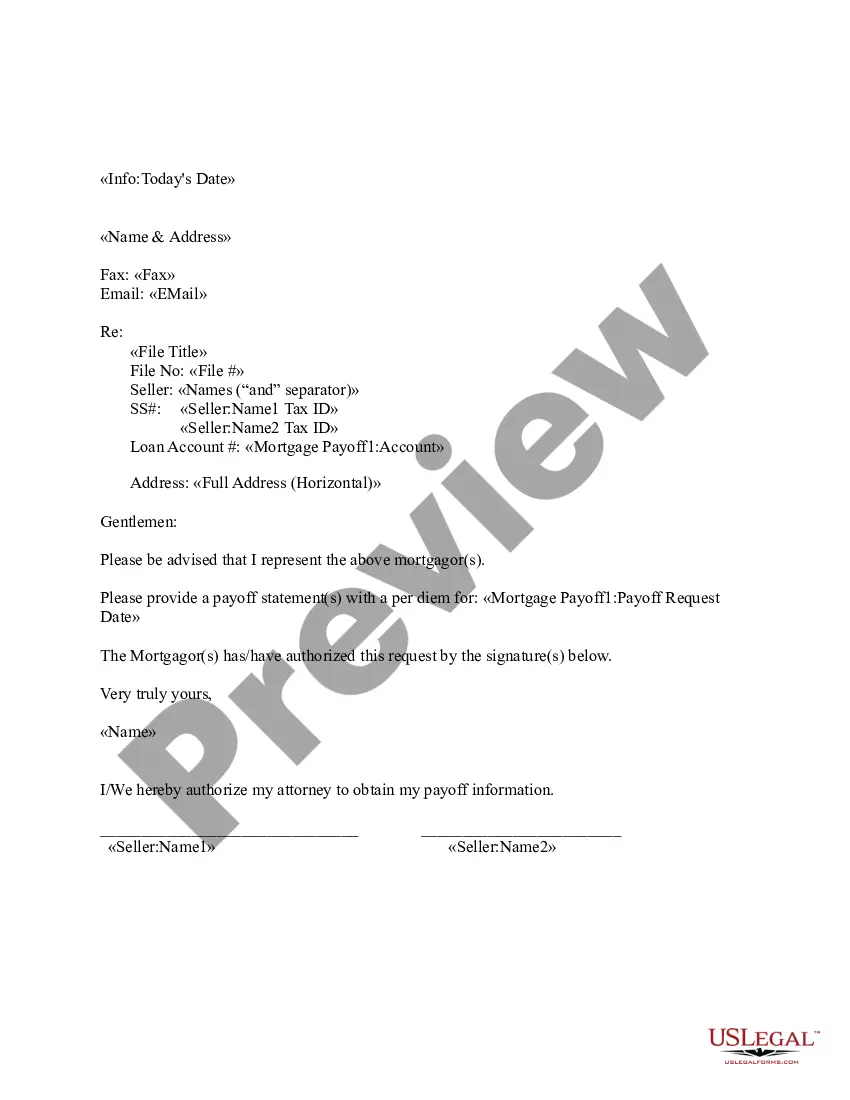

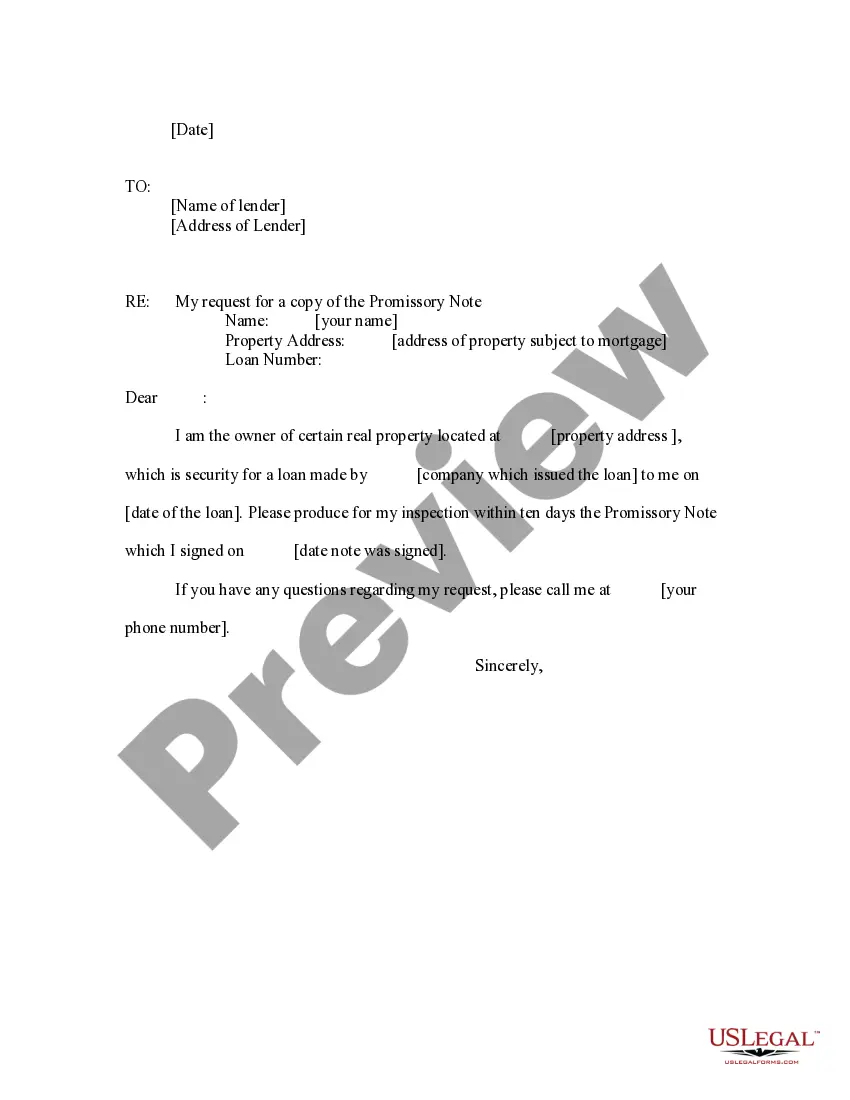

Pennsylvania Letter to Lender for Produce the Note Request

Description

How to fill out Letter To Lender For Produce The Note Request?

If you want to finalize, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the website's straightforward and convenient search tool to locate the documents you require.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Pennsylvania Letter to Lender for Produce the Note Request.

- Utilize US Legal Forms to obtain the Pennsylvania Letter to Lender for Produce the Note Request with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Pennsylvania Letter to Lender for Produce the Note Request.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review option to view the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To become a lender in Pennsylvania, you must first understand the lending laws and regulations specific to the state. You can start by completing any required licensing and registration processes, which may vary depending on your lending type. Additionally, understanding how to draft a Pennsylvania Letter to Lender for Produce the Note Request can be crucial to streamline your lending procedures and communicate effectively with borrowers.

In Pennsylvania, the foreclosure process typically begins when a borrower defaults on their mortgage. The lender first files a complaint in court, and the borrower must be served with this complaint. Afterward, a judgment may be entered, leading to a sheriff's sale of the property. Throughout this process, a Pennsylvania Letter to Lender for Produce the Note Request can be an essential tool for borrowers in understanding their rights and negotiating with lenders.

When writing a mortgage letter of explanation, be clear and concise about the reasons behind any unusual transactions or credit events. Start with a brief introduction, followed by specific details that address the lender's concerns. Using a structured approach will enhance understanding, and you can incorporate a Pennsylvania Letter to Lender for Produce the Note Request to clarify any documentation issues with the mortgage.

To obtain a copy of a mortgage note, you generally need to contact your lender directly. They should provide you with a copy upon request, assuming you have a valid reason for needing it. If you're facing difficulties, using a Pennsylvania Letter to Lender for Produce the Note Request can help formalize your request and prompt the lender to respond more effectively.

If you are listed on the mortgage but not on the promissory note, your obligations may differ from those of the borrower. You might still be responsible for the mortgage payments, but you may lack certain rights typically held by note signers. In this scenario, it's beneficial to send a Pennsylvania Letter to Lender for Produce the Note Request to understand your position and rights clearly.

A promissory note does not need to be notarized in Pennsylvania to be enforceable. While notarization is not mandatory, it can lend credibility to the document. If you need to address any concerns with your lender, a Pennsylvania Letter to Lender for Produce the Note Request can assist in creating a legal request for the note.

Yes, a promissory note is legal in Pennsylvania without notarization. The essential elements are the agreement terms, signatures, and clarity in language. However, using a Pennsylvania Letter to Lender for Produce the Note Request can strengthen your case if there is any need for legal clarity regarding the note.

Typically, it is the borrower who issues the promissory note as a promise to repay the borrowed amount to the lender. In exchange, the lender provides funds to the borrower. For more transparent communication about your obligations, a Pennsylvania Letter to Lender for Produce the Note Request can help clarify the terms between both parties.

In Pennsylvania, a promissory note does not require notarization to be legally binding. However, having the note notarized can provide additional proof of authenticity if disputes arise. If you are uncertain about the validity of your note, a Pennsylvania Letter to Lender for Produce the Note Request can clarify any questions with your lender.

To ensure a promissory note is valid in Pennsylvania, it must include the names of both the borrower and lender, the amount to be repaid, and the terms of repayment. Additionally, it should be written in clear language and signed by the borrower. If you need to communicate effectively with your lender regarding this, consider using a Pennsylvania Letter to Lender for Produce the Note Request.