Pennsylvania Contract for Sale of Goods on Consignment

Description

How to fill out Contract For Sale Of Goods On Consignment?

Selecting the ideal legal document format can be challenging. There are numerous templates accessible online, but how do you find the legal document you need? Utilize the US Legal Forms site.

The platform offers thousands of templates, including the Pennsylvania Contract for Sale of Goods on Consignment, usable for both business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you are already an account holder, Log In to your account and then click the Obtain button to acquire the Pennsylvania Contract for Sale of Goods on Consignment. Use your account to access the legal forms you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Utilize the service to download properly crafted paperwork that complies with state regulations.

- First, ensure you have chosen the correct form for your locality. You can review the document using the Review button and examine the document details to confirm that it is the right one for you.

- If the document does not meet your requirements, use the Search field to find the appropriate form.

- Once you are certain that the document is suitable, click the Acquire now button to obtain the form.

- Select the pricing plan you wish to choose and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal document format to your device.

- Complete, modify, print, and sign the obtained Pennsylvania Contract for Sale of Goods on Consignment.

Form popularity

FAQ

The three types of consignments include traditional consignment, where goods remain the property of the consignor until sold; sink-or-swim consignment, where the retailer purchases goods upfront but can return unsold items; and wholesale consignment, which operates more like a standard wholesale agreement. Understanding these types helps you choose the best fit for your business model. When you use a Pennsylvania Contract for Sale of Goods on Consignment, you can specify the type to match your needs.

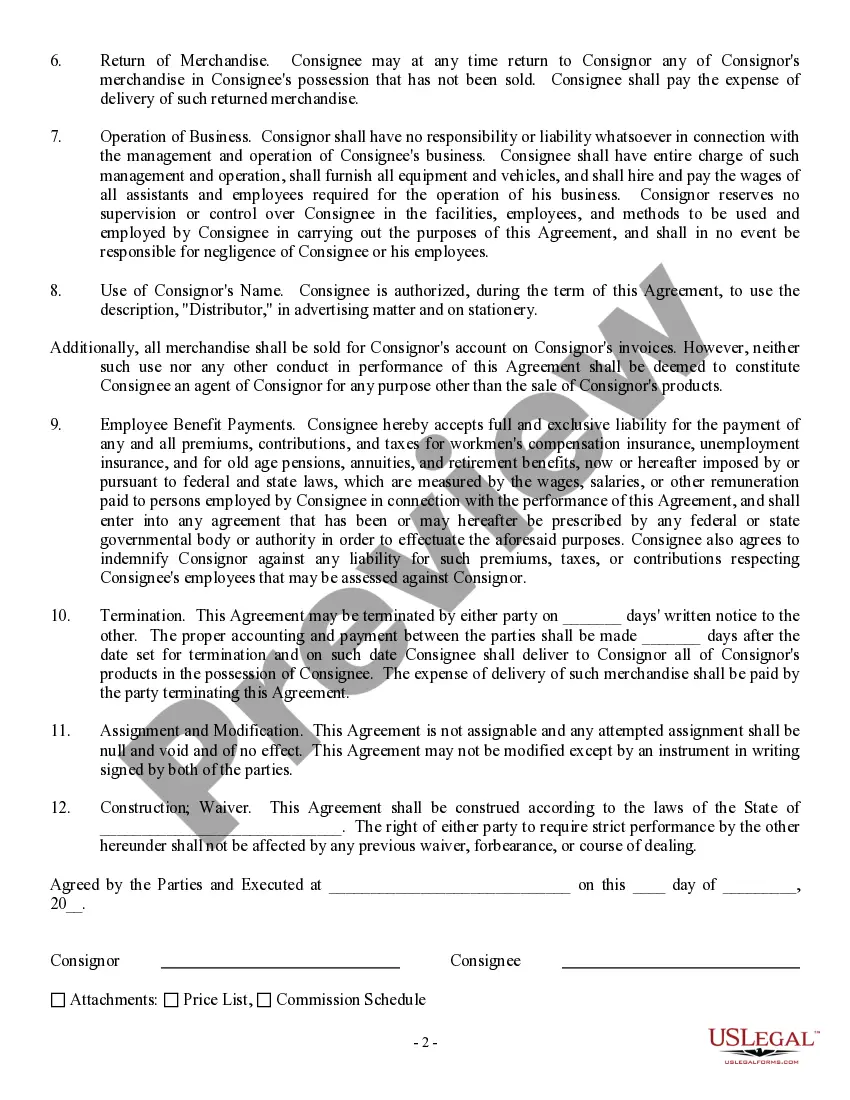

Structuring a consignment agreement begins with specifying the roles of both consignor and consignee, detailing the terms of sale, payment schedules, and duration of the agreement. You should outline the responsibilities regarding unsold goods and condition of items upon return. Including a Pennsylvania Contract for Sale of Goods on Consignment is beneficial, as it provides a solid legal framework and helps avoid misunderstandings. Clarity and thoroughness are key to an effective agreement.

In many cases, you do need to issue a 1099 for consignment sales when the payments to the consignor exceed $600 within the tax year. The IRS requires you to report these payments if you are selling someone else's goods and making a profit. This compliance becomes easier with a proper Pennsylvania Contract for Sale of Goods on Consignment, which outlines the financial arrangements clearly. Keeping good records helps you meet your tax obligations seamlessly.

A typical consignment arrangement involves a supplier delivering goods to a retailer with the understanding that payment is made only after the sale. The retailer displays the products in their store and retains a percentage from each sale as commission. This arrangement allows suppliers to reach new markets while retailers can offer a wider product range without upfront costs. For this agreement, using a Pennsylvania Contract for Sale of Goods on Consignment ensures both parties protect their interests.

Goods sold on consignment can often be returned, but this depends on the specific terms outlined in the Pennsylvania Contract for Sale of Goods on Consignment. Typically, the agreement should specify conditions under which unsold or defective items may be returned to the consignor. Both parties should clarify their responsibilities regarding returns to prevent disputes. This flexibility is beneficial for maintaining a good working relationship.

The typical consignment split varies, but it generally ranges between 40% to 60% for the seller and the consignment shop. In a Pennsylvania Contract for Sale of Goods on Consignment, the terms can be adjusted based on mutual agreement. It's essential to negotiate a split that reflects the value of both parties' contributions. Normally, the consignment shop takes a higher percentage due to overhead costs and marketing efforts.

Yes, you should issue a 1099 for consignment sales if you meet the payment threshold of $600 or more in a calendar year to the seller. This requirement is essential for tax compliance. Always ensure you document your financial transactions accurately when engaging in Pennsylvania Contract for Sale of Goods on Consignment.

Accounting for consignment sales involves tracking the inventory and revenue separately. You should recognize revenue only when sales occur, and maintain detailed records of how much has been sold and what remains unsold. This approach will allow you to accurately reflect your financial position under a Pennsylvania Contract for Sale of Goods on Consignment.

Yes, proceeds from consignment sales count as taxable income. When you receive payments for goods sold under a Pennsylvania Contract for Sale of Goods on Consignment, you must report these earnings on your tax return. Keeping accurate records will help you manage the financial aspects efficiently.

Yes, a consignment is indeed a type of contract that outlines the terms under which goods are sold on behalf of the owner. This contract details the responsibilities of both the owner and the consignee. When you create a Pennsylvania Contract for Sale of Goods on Consignment, make sure it clearly defines these responsibilities to prevent any misunderstandings.