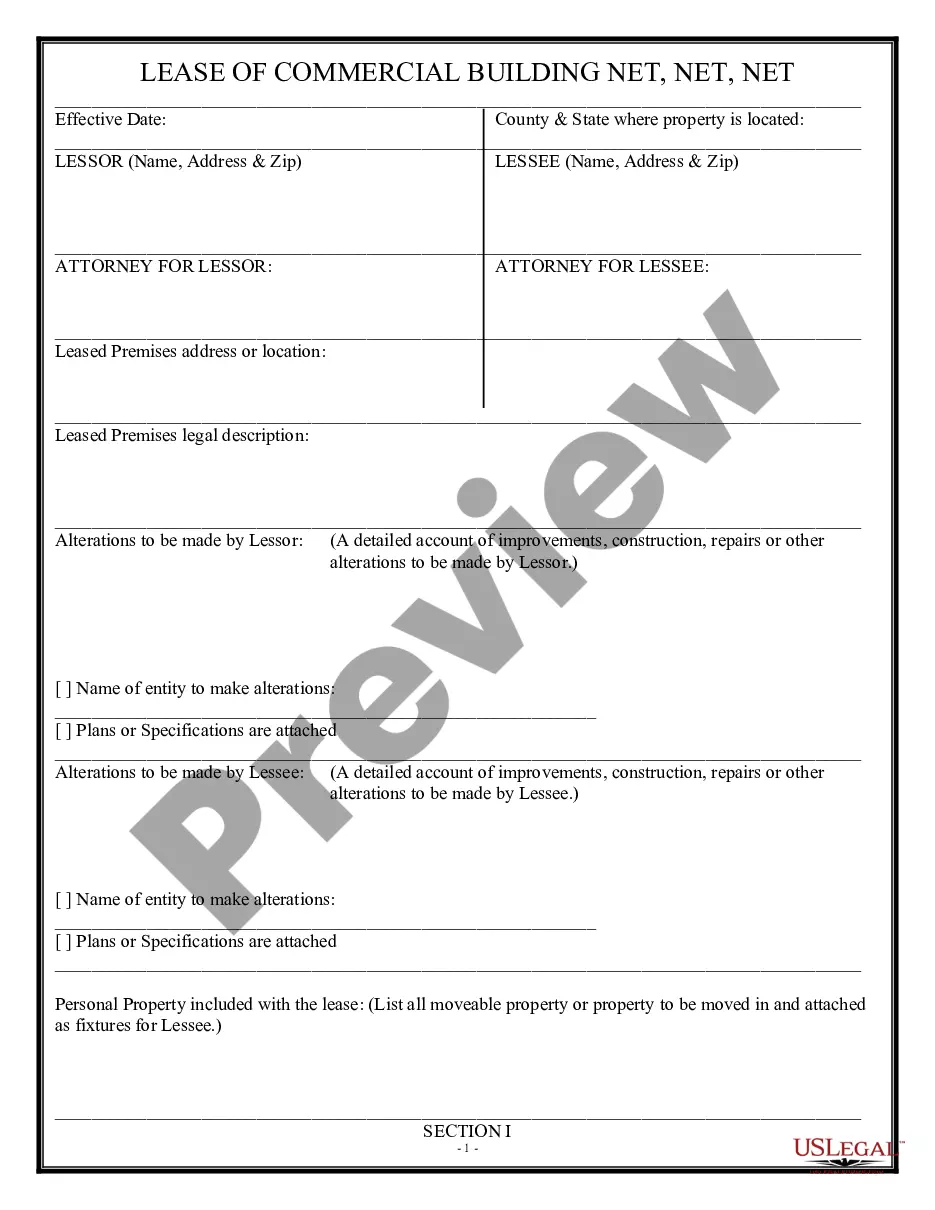

Pennsylvania Space, Net, Net, Net - Triple Net Lease

Description

How to fill out Space, Net, Net, Net - Triple Net Lease?

You can dedicate several hours online finding the official document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of official forms that are evaluated by experts.

You can truly purchase or print the Pennsylvania Space, Net, Net, Net - Triple Net Lease through my service.

If you wish to obtain another version of the form, use the Search field to find the template that fulfills your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire button.

- After that, you can complete, amend, print, or sign the Pennsylvania Space, Net, Net, Net - Triple Net Lease.

- Every official document template you obtain is yours forever.

- To get another copy of any obtained form, go to the My documents section and click the related button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your region/city of preference.

- Read the form description to confirm you have selected the correct form.

- If available, use the Preview button to look through the document template at the same time.

Form popularity

FAQ

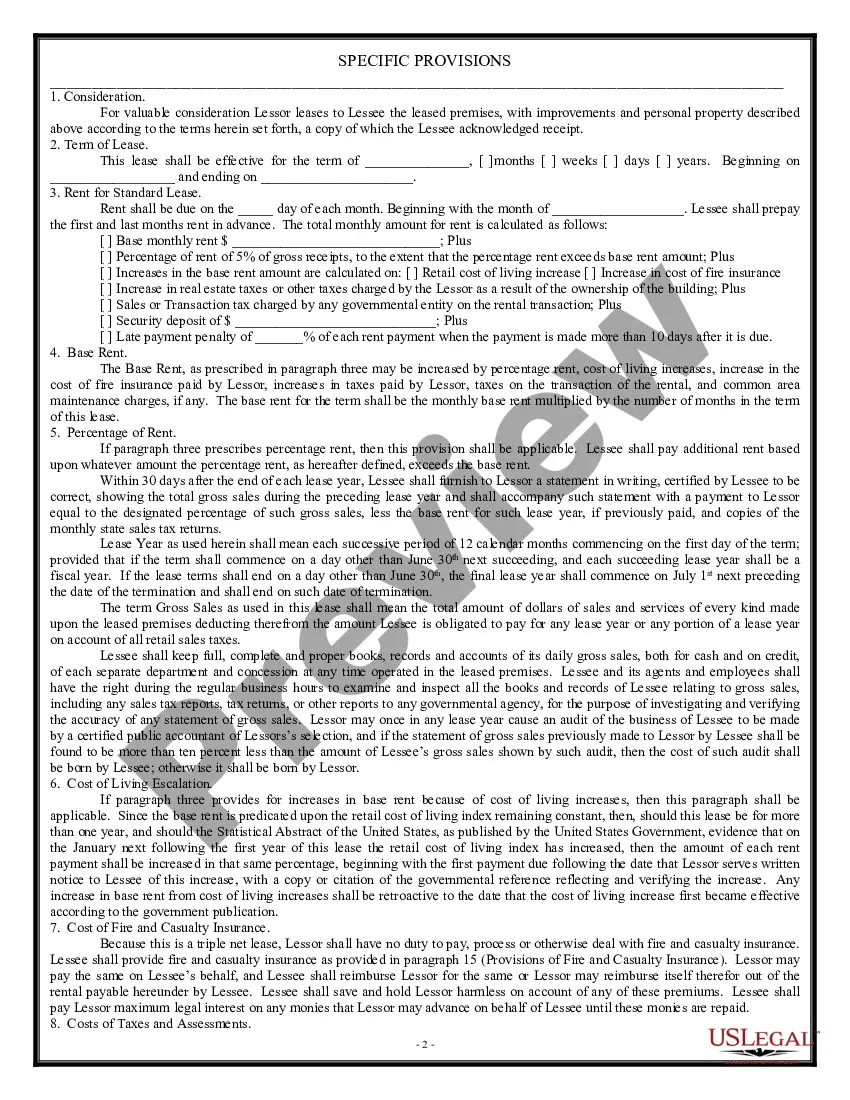

$20 nnn signifies a lease rate of $20 per square foot on a triple net basis. This means that, in addition to paying for the space itself, tenants are also liable for operating expenses, which can vary. Understanding this term is essential for budgeting and planning in any Pennsylvania Space, Net, Net, Net - Triple Net Lease scenario.

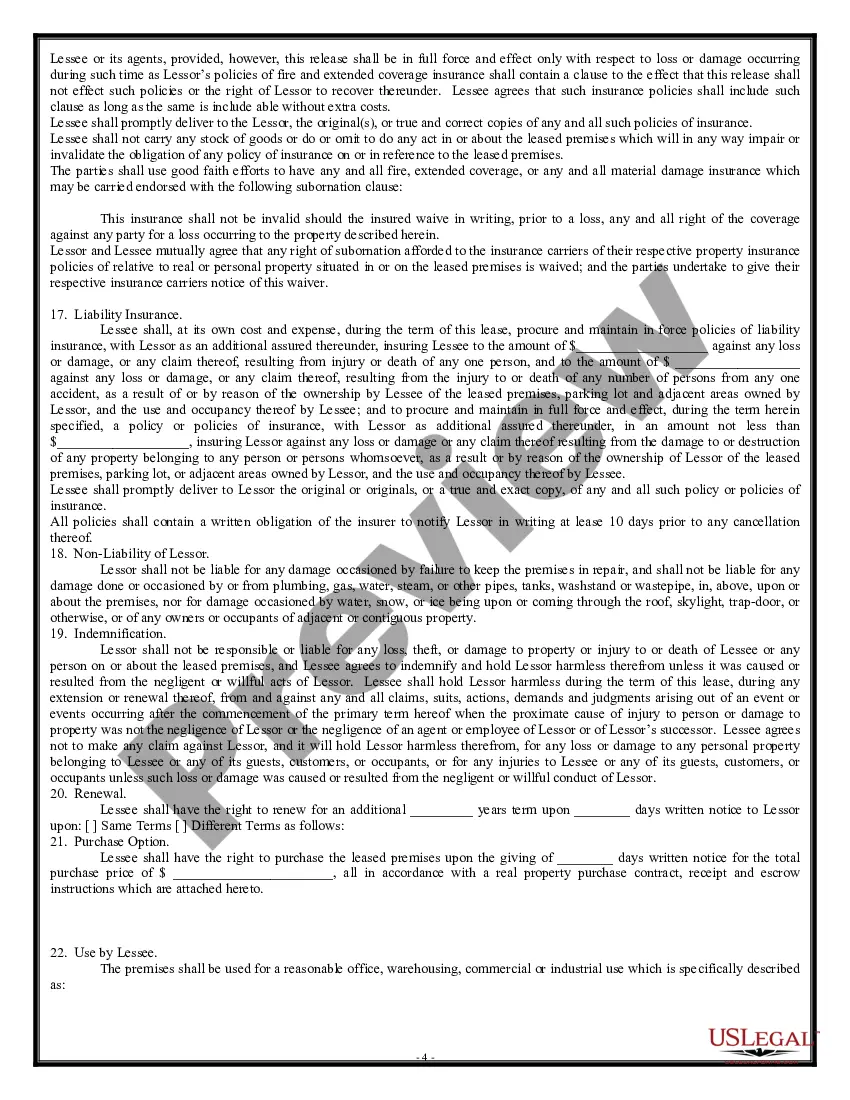

Structuring a triple net lease typically involves negotiating the terms between the landlord and tenant. Both parties should agree on the base rental amount and clarify which expenses the tenant will cover, including property taxes, insurance, and maintenance. A well-drafted lease agreement can address responsibilities and expectations clearly, allowing for a mutually beneficial Pennsylvania Space, Net, Net, Net - Triple Net Lease.

When you see $12 sf nnn, it denotes a lease rate of $12 per square foot on a triple net basis. This means that in addition to the base rent, tenants are responsible for their share of operational expenses like taxes, insurance, and maintenance. It's crucial to understand this term to accurately assess costs when considering Pennsylvania Space, Net, Net, Net - Triple Net Lease options.

Calculating triple net leases involves several steps to ensure accuracy. Start by assessing the base rent, followed by the operating expenses for the property, which include property taxes, insurance, and maintenance. These costs are usually divided among tenants based on their proportionate share of the property. This method provides a clear financial picture when evaluating a Pennsylvania Space, Net, Net, Net - Triple Net Lease.

Getting approved for a Pennsylvania Space, Net, Net, Net - Triple Net Lease requires demonstrating financial confidence. Prepare by gathering necessary documentation, such as income statements, credit reports, and business plans that highlight your ability to manage property expenses. A positive rental history can further enhance your chances of approval.

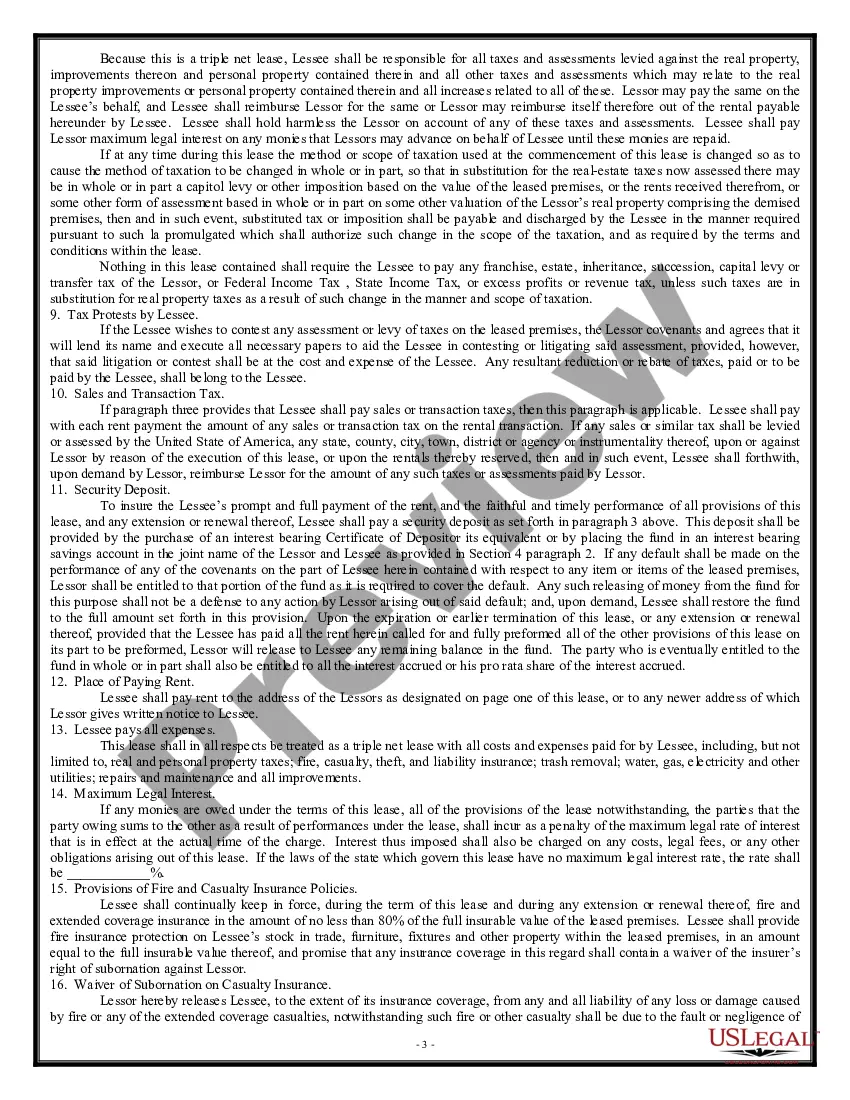

One downside of a Pennsylvania Space, Net, Net, Net - Triple Net Lease is that tenants bear the full risk of property-related expenses. Unexpected costs for repairs or increases in property taxes may impact your budget significantly. Additionally, if the property value declines, you could end up spending more than anticipated on maintenance and operational costs.

Obtaining a Pennsylvania Space, Net, Net, Net - Triple Net Lease starts with identifying a suitable property. Begin by researching available commercial spaces that fit your needs. Once you find a potential property, negotiate the lease terms with the landlord, ensuring you understand your responsibilities regarding taxes, insurance, and maintenance.

The term net net in a lease signifies that the tenant is responsible for two of the three main costs associated with property ownership: property taxes and insurance. The landlord typically covers maintenance costs. This lease structure can be a beneficial option for tenants in the Pennsylvania Space, Net, Net, Net - Triple Net Lease context, as it provides clarity on financial obligations while allowing tenants to control more aspects of the property.

The terms NN and NNN refer to different types of lease agreements in commercial real estate. In a NN lease, the tenant is responsible for paying property taxes and insurance, while the landlord covers maintenance costs. Conversely, in a NNN lease, the tenant takes on additional responsibilities, including maintenance. Understanding these distinctions is crucial in navigating the Pennsylvania Space, Net, Net, Net - Triple Net Lease market.

A triple net lease can significantly affect your taxes since tenants are responsible for paying property taxes directly. This arrangement may also lead to potential tax deductions on the operational expenses incurred, benefiting the tenant in the long run. Understanding these financial implications helps in better tax planning and compliance. Consult a tax professional to maximize benefits tied to a Pennsylvania Space, Net, Net, Net - Triple Net Lease.