An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania General Form of Irrevocable Trust Agreement

Description

How to fill out General Form Of Irrevocable Trust Agreement?

If you wish to compile, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal needs are organized by categories and claims or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose the payment plan you prefer and submit your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Pennsylvania General Form of Irrevocable Trust Agreement with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to download the Pennsylvania General Form of Irrevocable Trust Agreement.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the template for the appropriate city/state.

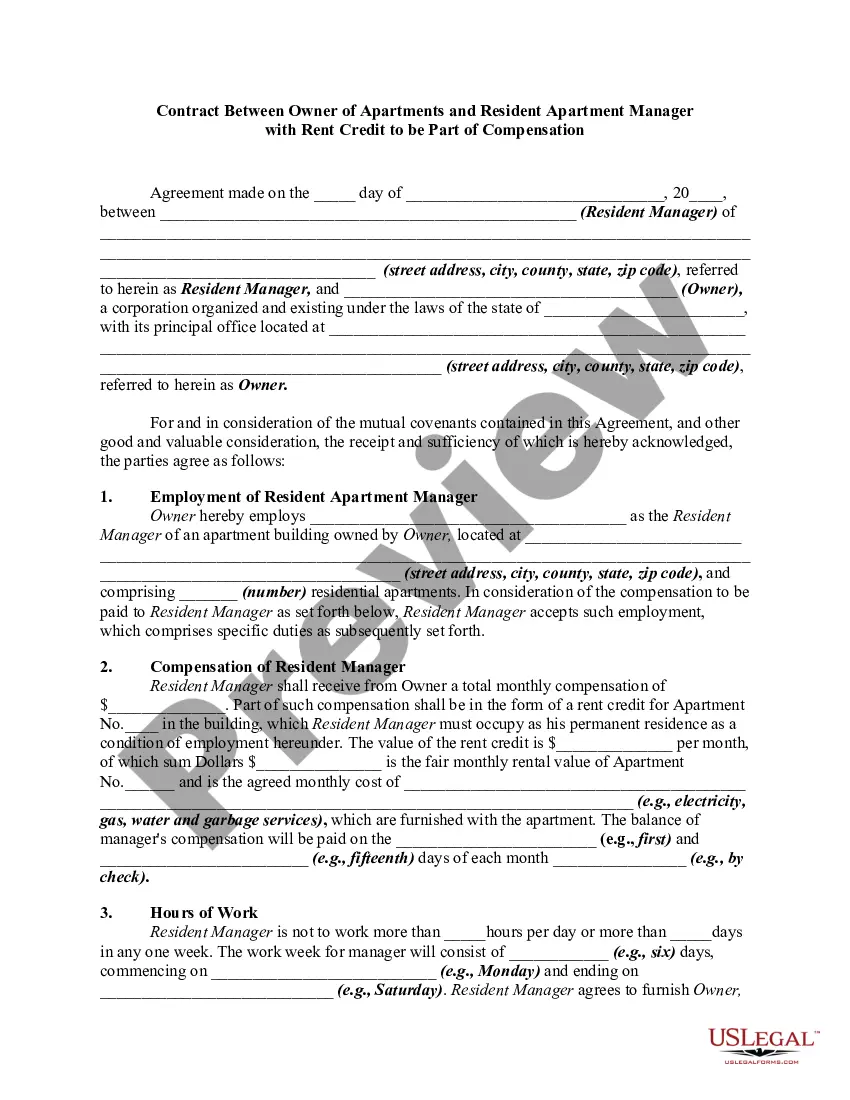

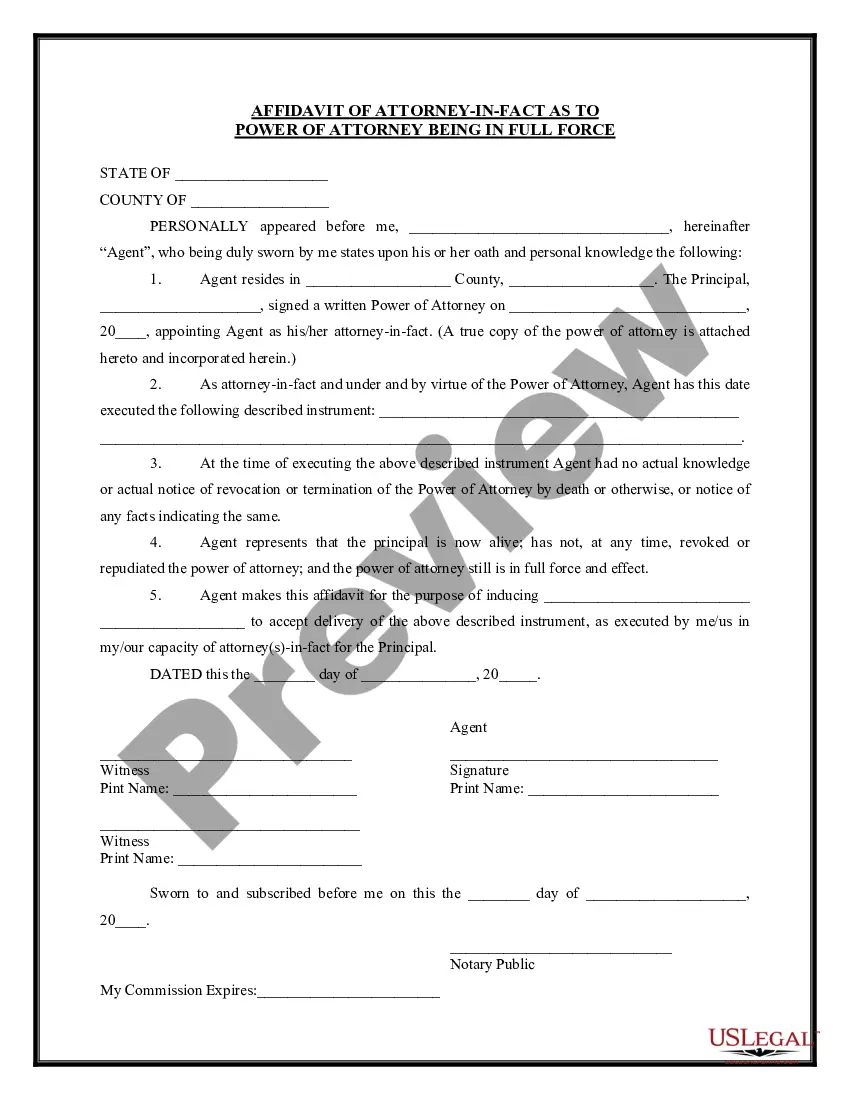

- Step 2. Use the Preview feature to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form design.

Form popularity

FAQ

To write an irrevocable trust document, begin by identifying the assets you wish to place in the trust and the beneficiaries you intend to benefit. It is vital to follow the Pennsylvania General Form of Irrevocable Trust Agreement to ensure all legal requirements are met. You can simplify this process by utilizing platforms like US Legal Forms, which provide templates and guidance tailored to Pennsylvania laws.

An irrevocable trust agreement is a legal document that establishes a trust that cannot be altered or revoked after its creation. This type of trust allows you to transfer assets to beneficiaries while removing them from your taxable estate. The Pennsylvania General Form of Irrevocable Trust Agreement ensures that your intentions are clearly outlined, providing both clarity and security for your loved ones.

Writing a Pennsylvania General Form of Irrevocable Trust Agreement involves a few essential steps. Start by specifying the trust's purpose, including details about the assets being transferred and the beneficiaries. Next, include the names of the trustee and successor trustees, outlining their powers and responsibilities. Finally, it’s wise to seek legal assistance or use online platforms like US Legal Forms to access reliable templates and ensure your document meets all legal requirements.

When creating a Pennsylvania General Form of Irrevocable Trust Agreement, avoid including assets that you may need access to later, like your primary residence or personal bank accounts. Additionally, refrain from placing assets that could generate high taxes or liabilities into the trust. It’s important to consider the implications of including business interests, as they might complicate management or result in unintended taxation. Consulting an expert can help ensure you make the right decisions about what belongs in your trust.

The PA 41 form must be filed by all estates and trusts that have income allocated to beneficiaries. This includes individuals who have created an irrevocable trust using the Pennsylvania General Form of Irrevocable Trust Agreement. Maintaining compliance with tax regulations is crucial for trust administration. Consulting with a tax professional or using US Legal Forms can help clarify any questions you may have about this filing requirement.

Yes, you can create an irrevocable trust yourself, especially using the Pennsylvania General Form of Irrevocable Trust Agreement. However, it is important to ensure that all legal requirements are met. Mistakes in documentation or compliance may lead to complications. Consider using a platform like US Legal Forms for assistance and guidance to streamline this process.

You can write your own irrevocable trust, but it's important to proceed with caution. Using the Pennsylvania General Form of Irrevocable Trust Agreement can help ensure that you meet all legal requirements and avoid potential pitfalls. While DIY trusts are possible, consulting with an attorney or using a trusted platform like USLegalForms can provide peace of mind that your trust is correctly structured and enforceable.

Yes, properly structured irrevocable trusts can help avoid Pennsylvania inheritance tax. When assets are transferred to an irrevocable trust, they are no longer considered part of your estate for tax purposes. However, it’s essential to consult with a legal expert to ensure your Pennsylvania General Form of Irrevocable Trust Agreement meets all requirements for tax benefits.

The three common types of irrevocable trusts include charitable trusts, special needs trusts, and life insurance trusts. Each type serves a distinct purpose and provides specific benefits. For instance, a charitable trust allows you to support a cause while potentially benefiting from tax advantages, while a special needs trust helps secure the financial future of a loved one with disabilities. Understanding these types can help you choose the right Pennsylvania General Form of Irrevocable Trust Agreement.

Filling out a trust agreement involves several straightforward steps. First, you need to gather all essential information about the assets you wish to place in the trust. Then, use the Pennsylvania General Form of Irrevocable Trust Agreement to clearly outline the terms, including the trustee, beneficiaries, and distribution details. Finally, ensure that the agreement is signed and notarized to make it legally binding.