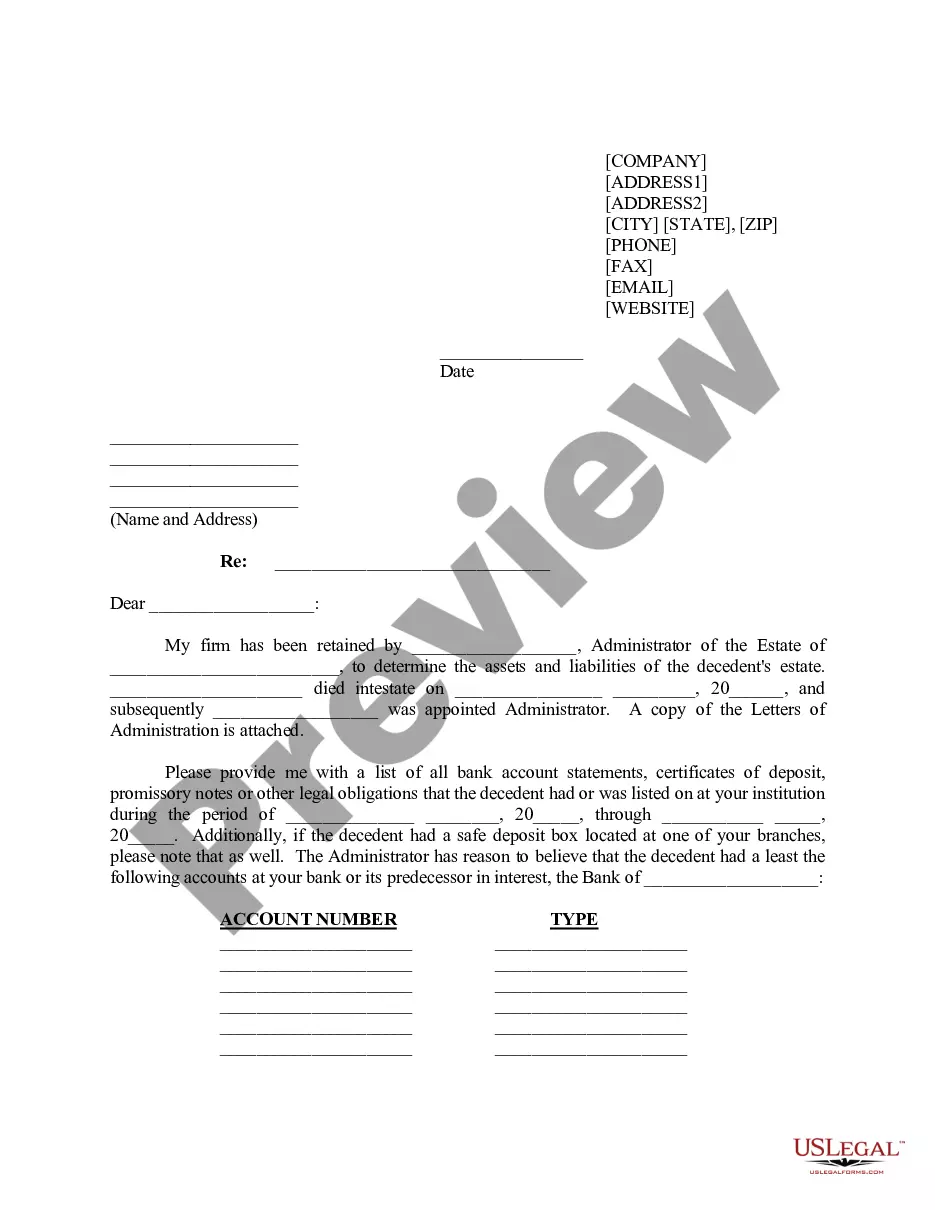

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

You can spend multiple hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by experts.

You can easily download or print the Pennsylvania Letter of Instruction to Investment Firm Concerning Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent from the service.

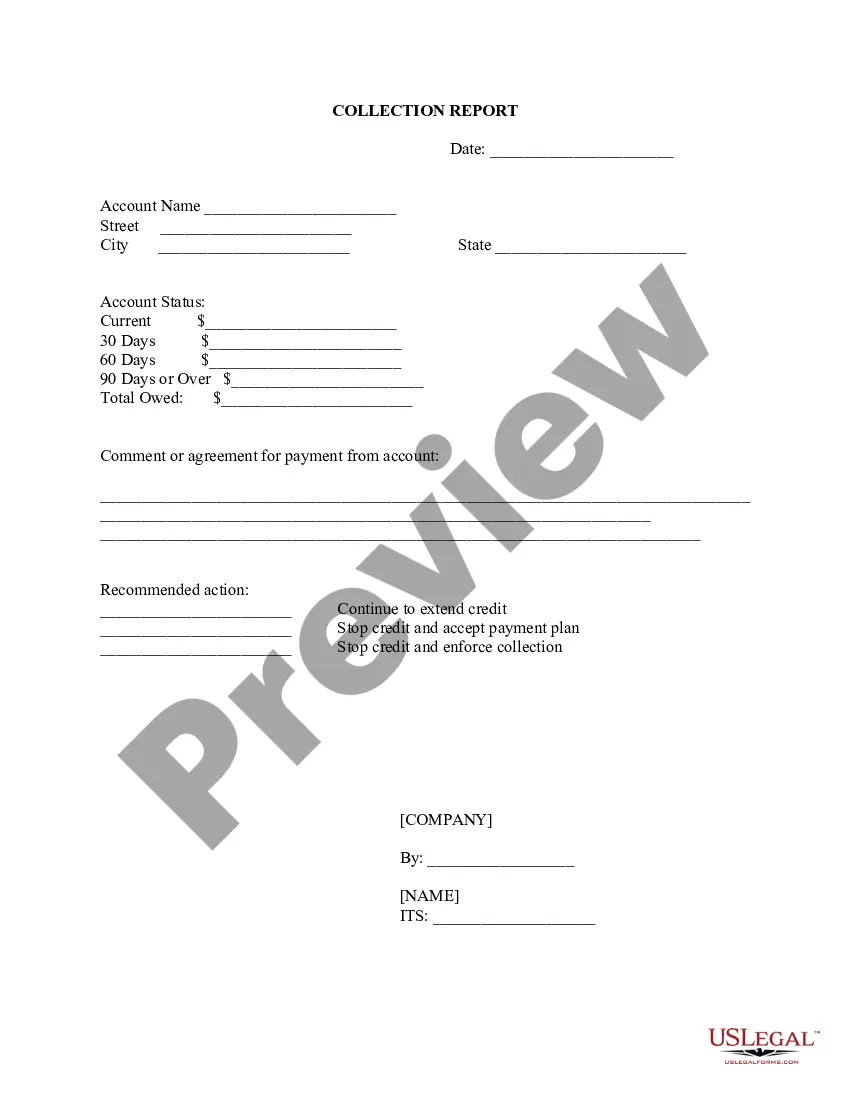

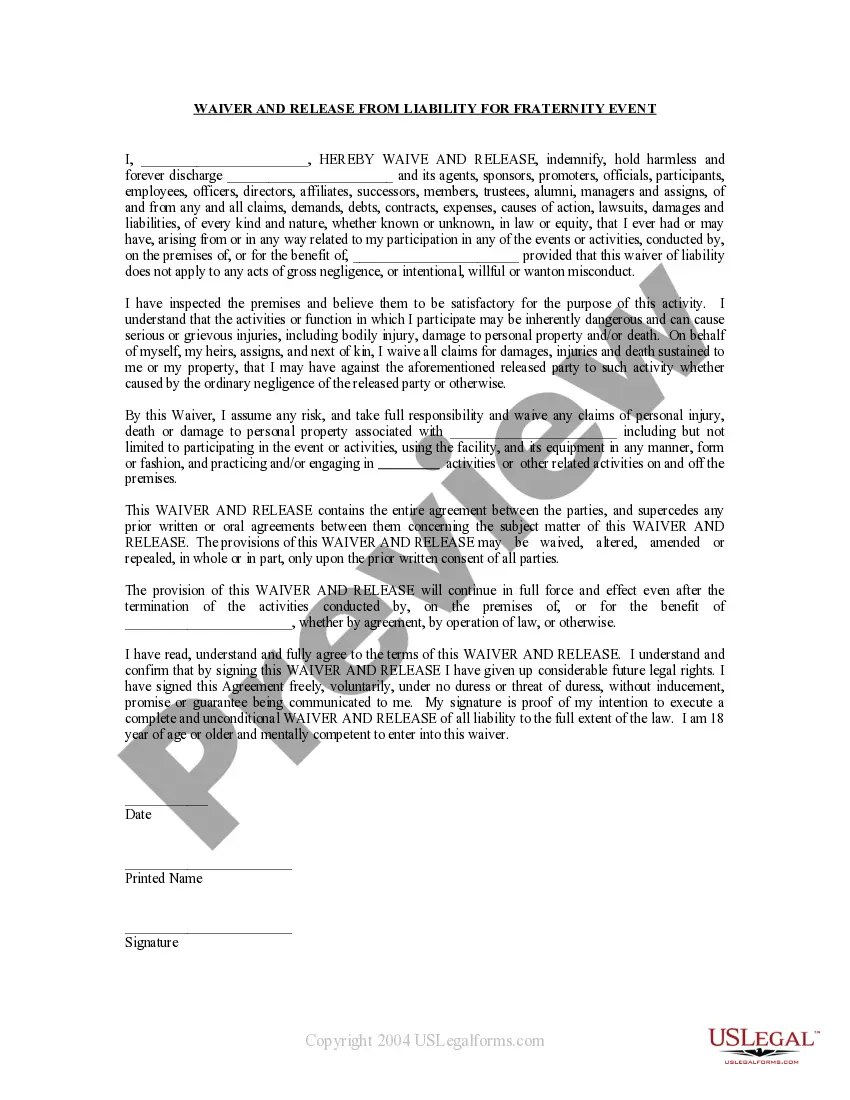

If available, utilize the Review option to inspect the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download option.

- Then, you can complete, modify, print, or sign the Pennsylvania Letter of Instruction to Investment Firm Concerning Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- Every legal document template you purchase is your property indefinitely.

- To obtain another copy of any purchased template, visit the My documents tab and click on the respective option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/region you choose.

- Review the template details to ensure you have picked the right one.

Form popularity

FAQ

A trust may not completely avoid Pennsylvania inheritance tax, but it can help optimize tax liability depending on how it is structured. Assets transferred into a trust may still incur inheritance tax upon the owner's death, but the distribution process can offer strategies for efficient handling. Using a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent ensures clarity in asset transfer, potentially enhancing tax strategies.

An executor is a person named in a will to administer the estate after a person dies, whereas letters of administration are issued by the court to appoint an administrator when there is no will. The executor acts based on the will’s directives, while the administrator operates under the court's jurisdiction. Both roles can involve drafting a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent to manage financial accounts.

Yes, a trust can help avoid probate in Pennsylvania. Assets held in a properly funded trust pass directly to beneficiaries without going through the probate process. This can streamline asset distribution and may reduce costs, making it beneficial for families who wish to manage estate transitions effectively. Ensure to communicate these intents in a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

The purpose of a letter of administration is to grant legal authority to an administrator to manage a deceased person's estate. This includes paying funeral expenses, settling debts, and distributing assets to beneficiaries. It serves as a vital document in the overall probate process and may include drafting a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent to direct the handling of financial accounts.

Letters of administration do not have a specific expiration date in Pennsylvania; however, their effectiveness can diminish over time if the estate is not settled. It is essential for the appointed administrator to act promptly to manage and distribute the estate's assets. If issues arise or if assets remain unsold or undocumented, it may be necessary to reappoint a new administrator or issue a new Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Letters of administration in Pennsylvania provide the legal authority required to settle an estate when a person dies without a will. This process ensures that all assets, such as bank accounts and investments, are properly managed and transferred. Executors or administrators can draft the Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent to facilitate asset transfers in compliance with legal requirements.

In Pennsylvania, letters of administration are legal documents issued by the probate court. They authorize an individual, typically an executor or administrator, to manage and distribute the assets of a deceased person's estate. By obtaining these letters, the executor or administrator can handle the estate's financial matters, including investments, debts, and any transfers, such as the Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Transferring assets into a trust after death typically requires the executor or trustee to follow specific legal procedures to change the ownership of the deceased's assets. A well-prepared Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent provides clear directives that help ensure compliance with the law and clarity throughout the process.

To move assets into a trust, you must change the title of the property or account to reflect the trust's name. Utilizing a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline this transition by instructing the investment firm on how to execute the transfers effectively.

The initial steps to claim a trust and start settling an estate involve gathering necessary documents, including the trust agreement and the death certificate. Understanding the process is simplified when using a Pennsylvania Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, which outlines the executor's authority and the steps to proceed.