Under the Fair Credit Reporting Act, whenever credit or insurance for personal, family, or household purposes, or employment involving a consumer is denied, or the charge for such credit or insurance is increased, either wholly or partly because of information contained in a consumer report from a consumer reporting agency, the user of the consumer report must:

notify the consumer of the adverse action,

identify the consumer reporting agency making the report, and

notify the consumer of the consumer's right to obtain a free copy of a consumer report on the consumer from the consumer reporting agency and to dispute with the reporting agency the accuracy or completeness of any information in the consumer report furnished by the agency.

Pennsylvania Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Or Insurance Based On Information Received From Consumer Reporting Agency?

Have you been in a situation the place you require files for both organization or personal uses just about every time? There are a variety of lawful document themes available online, but getting kinds you can depend on isn`t straightforward. US Legal Forms provides 1000s of type themes, like the Pennsylvania Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency, that are published to fulfill federal and state demands.

In case you are presently acquainted with US Legal Forms site and get your account, merely log in. Following that, you can down load the Pennsylvania Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency design.

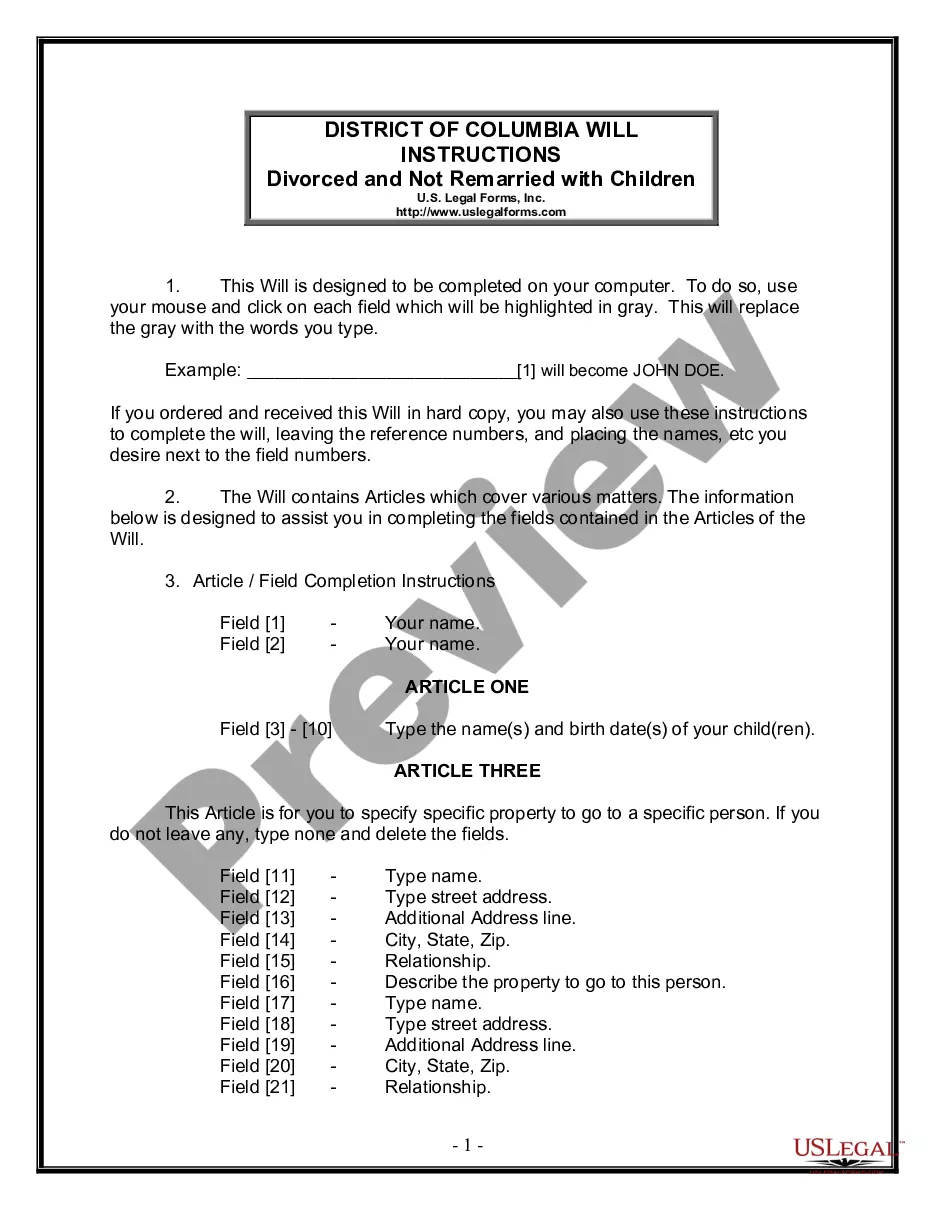

Should you not offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Find the type you will need and make sure it is to the appropriate metropolis/region.

- Take advantage of the Preview option to examine the form.

- Browse the information to ensure that you have chosen the proper type.

- When the type isn`t what you are searching for, make use of the Look for area to find the type that suits you and demands.

- Whenever you obtain the appropriate type, click on Buy now.

- Select the rates strategy you want, fill in the desired information and facts to make your money, and pay for your order using your PayPal or credit card.

- Pick a convenient paper formatting and down load your backup.

Discover all the document themes you have purchased in the My Forms menu. You may get a extra backup of Pennsylvania Notice of Increase in Charge for Credit or Insurance Based on Information Received From Consumer Reporting Agency anytime, if necessary. Just click on the necessary type to down load or print the document design.

Use US Legal Forms, probably the most substantial assortment of lawful types, in order to save time and avoid faults. The service provides expertly manufactured lawful document themes that can be used for an array of uses. Create your account on US Legal Forms and commence making your life a little easier.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) (15 USC 1681) became effective on April 25, 1971. The FCRA is designed to regulate the consumer reporting industry; to place disclosure obligations on users of consumer reports; and to ensure fair, timely, and accurate reporting of credit information.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit report- ing. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the credit reporting industry. It allows you to dispute credit report errors and limits how your credit reports can be used. Companies that violate the FCRA are liable for damages, attorneys' fees, and costs.

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection of consumers' credit information and access to their credit reports.

Section 603(d) defines consumer report to mean ''any written, oral, or other commu- nication of any information by a consumer reporting agency bearing on a consumer's credit worthiness, credit standing, credit ca- pacity, character, general reputation, per- sonal characteristics, or mode of living which is used or ...

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Section 605(h)(1) of the Fair Credit Reporting Act requires that, when providing a consumer report to a person that requests the report (a user), a nationwide consumer reporting agency (NCRA) must provide a notice of address discrepancy to the user if the address provided by the user in its request ?substantially ...