Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

US Legal Forms - one of the most important repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest editions of forms such as the Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust in just a few minutes.

If you already have a monthly membership, Log In and download the Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust from the US Legal Forms library. The Download button will be visible on every form you encounter. You are able to access all previously obtained forms within the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the file format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Every template you add to your account remains valid indefinitely and is yours permanently. Thus, if you wish to download or print another copy, simply head to the My documents section and click on the document you need. Access the Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your region/county.

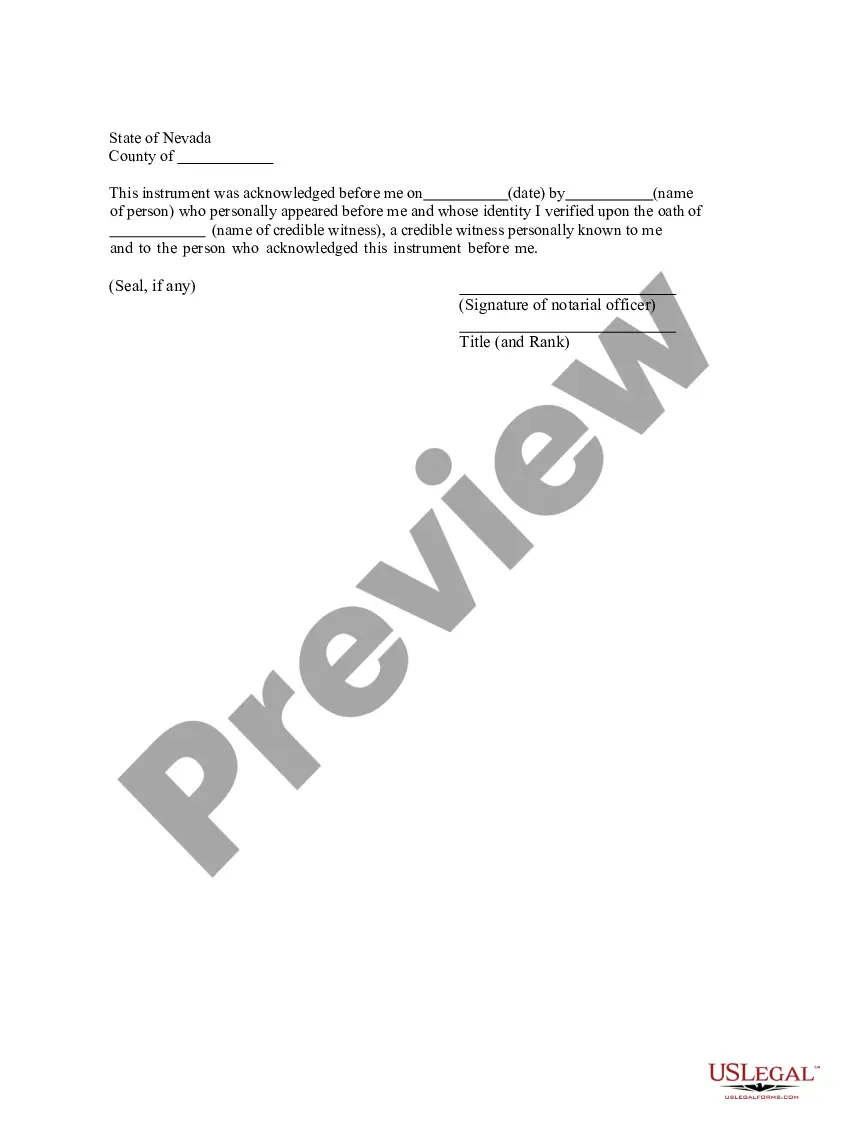

- Click on the Review button to examine the details of the form.

- Check the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Writing an amendment to a trust requires clarity and precision. First, you must clearly identify the trust being amended and specify the particular changes you wish to make. When crafting the Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, ensure that you include the effective date of the amendment and have it signed by the trustor. Consider using platforms like US Legal Forms to access templates that can guide you in creating a legally sound amendment.

To terminate an irrevocable trust in Pennsylvania, one must usually follow specific legal protocols. This can involve filing a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, subject to the trust's terms and state law. Working with an experienced attorney can streamline this process and ensure compliance with all legal requirements. Each trust has unique stipulations, so individual circumstances will dictate the best approach.

The 5 year rule in the context of an irrevocable trust generally discusses how assets are treated for tax purposes. If you make a gift to an irrevocable trust, it may not qualify for a tax exclusion unless it has been in place for five years. This timeframe is crucial when considering a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Understanding these intricacies can help you manage your estate effectively.

Terminating an irrevocable trust often involves a legal process that may require court approval. In Pennsylvania, one can initiate a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to facilitate this termination. Factors such as the trust terms and the needs of the beneficiaries play a vital role. Always seek expert advice to navigate this complex process.

An irrevocable trust cannot easily be undone, as it is designed to be permanent. However, one can consider a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust if circumstances change. This process allows for specific adjustments under certain conditions. It’s important to consult with legal professionals to explore all options.

An amendment to the agreement signifies a legal adjustment to the stipulations of an existing document. In the context of trust law, this amendment allows you to clarify or change specific provisions. When discussing a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you gain the flexibility to adapt your estate planning to reflect significant life changes.

An amendment to the trust agreement is a formal alteration to the trust's primary terms. This document outlines modifications such as adding or removing beneficiaries, altering trustee powers, or changing the property contained in the trust. Thus, a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust helps ensure that your trust aligns with your current wishes.

An amendment to a trust refers to a change made to the original trust document. This process allows you to modify the terms of the trust to better suit your needs or circumstances. When you create a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you can facilitate changes regarding the management or distribution of assets held in the trust.

Individuals earning income above a specific threshold must file a PA tax return. This requirement applies to those involved in managing a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust if the trust generates income. Always check specific state guidelines to determine your filing obligations.

Yes, you can amend your trust by yourself, provided you follow the necessary legal procedures. For a Pennsylvania Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, ensure your amendment is clearly documented and executed per state laws. However, seeking legal advice could prevent potential issues.