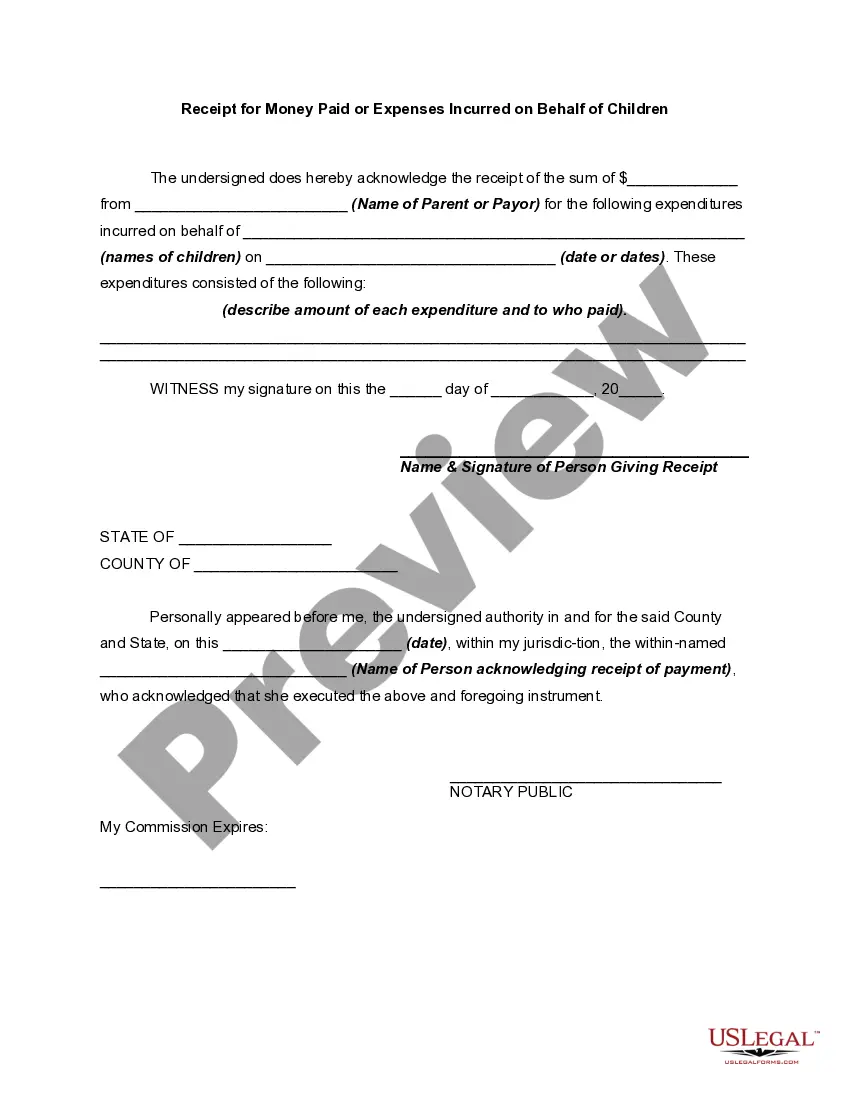

Pennsylvania Receipt for Money Paid on Behalf of Another Person

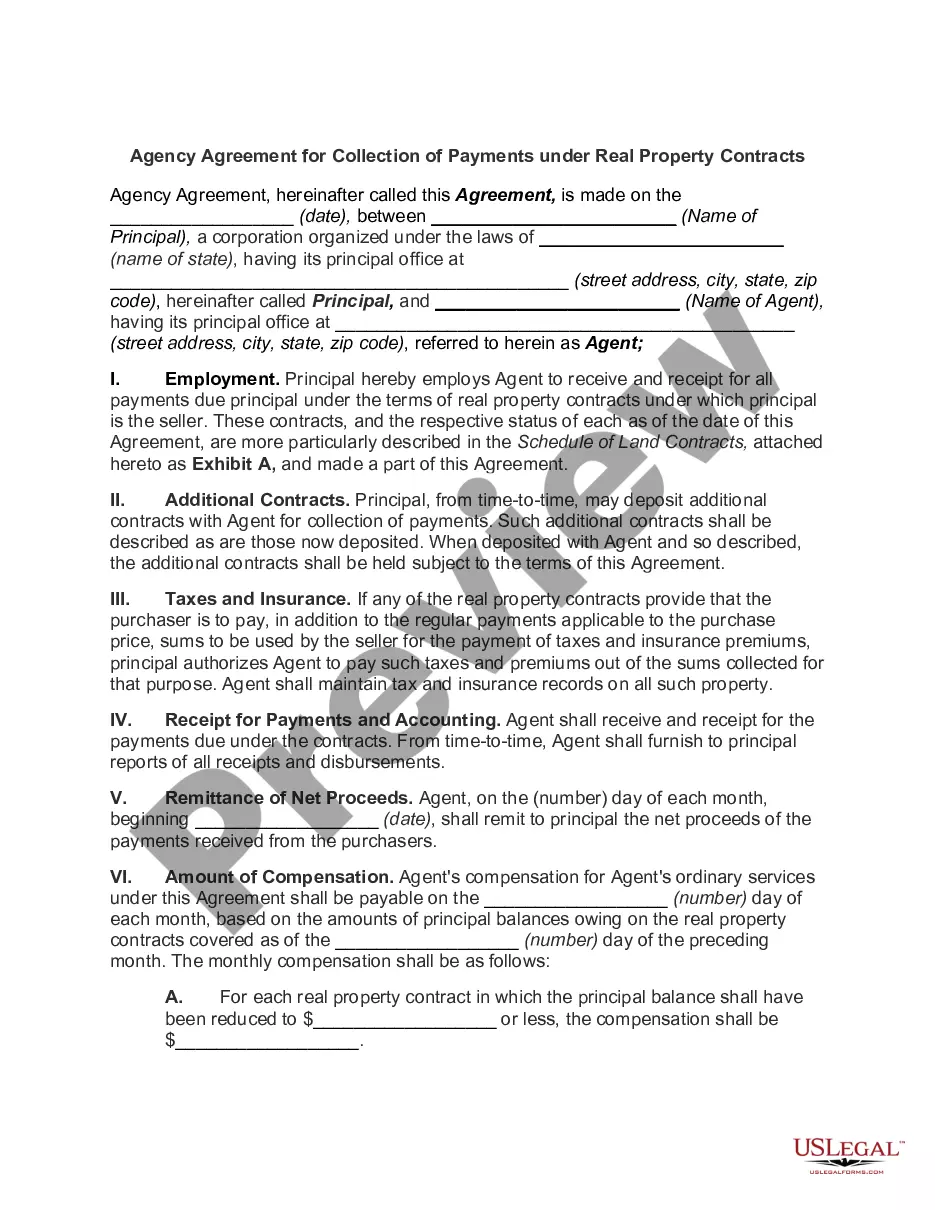

Description

How to fill out Receipt For Money Paid On Behalf Of Another Person?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Pennsylvania Receipt for Money Paid on Behalf of Another Individual in a matter of seconds.

If you already have a subscription, Log In to your account and download the Pennsylvania Receipt for Money Paid on Behalf of Another Individual from the US Legal Forms library. The Download option will be visible for each document you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Pennsylvania Receipt for Money Paid on Behalf of Another Individual. Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and select the document you wish.

- If you're using US Legal Forms for the first time, here are some simple instructions to get started.

- Ensure you have selected the appropriate form for your city/county.

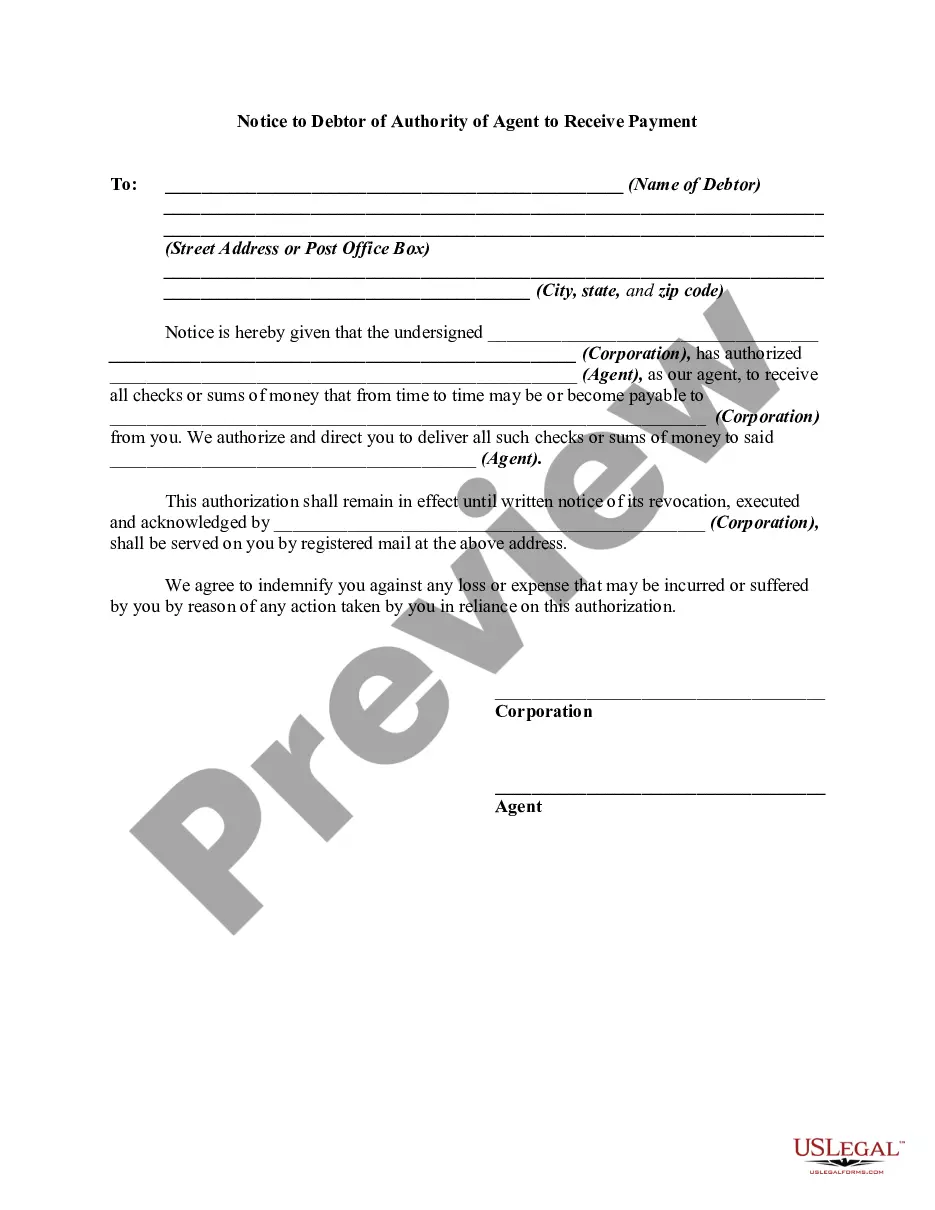

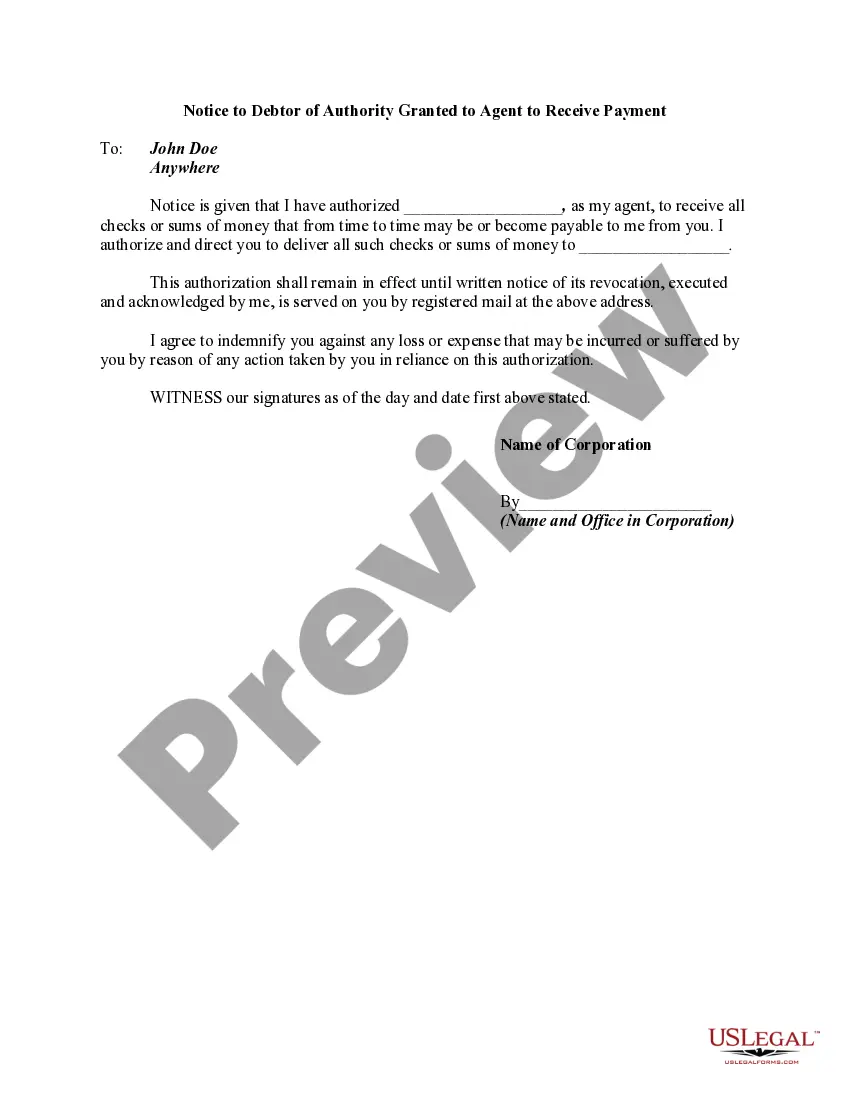

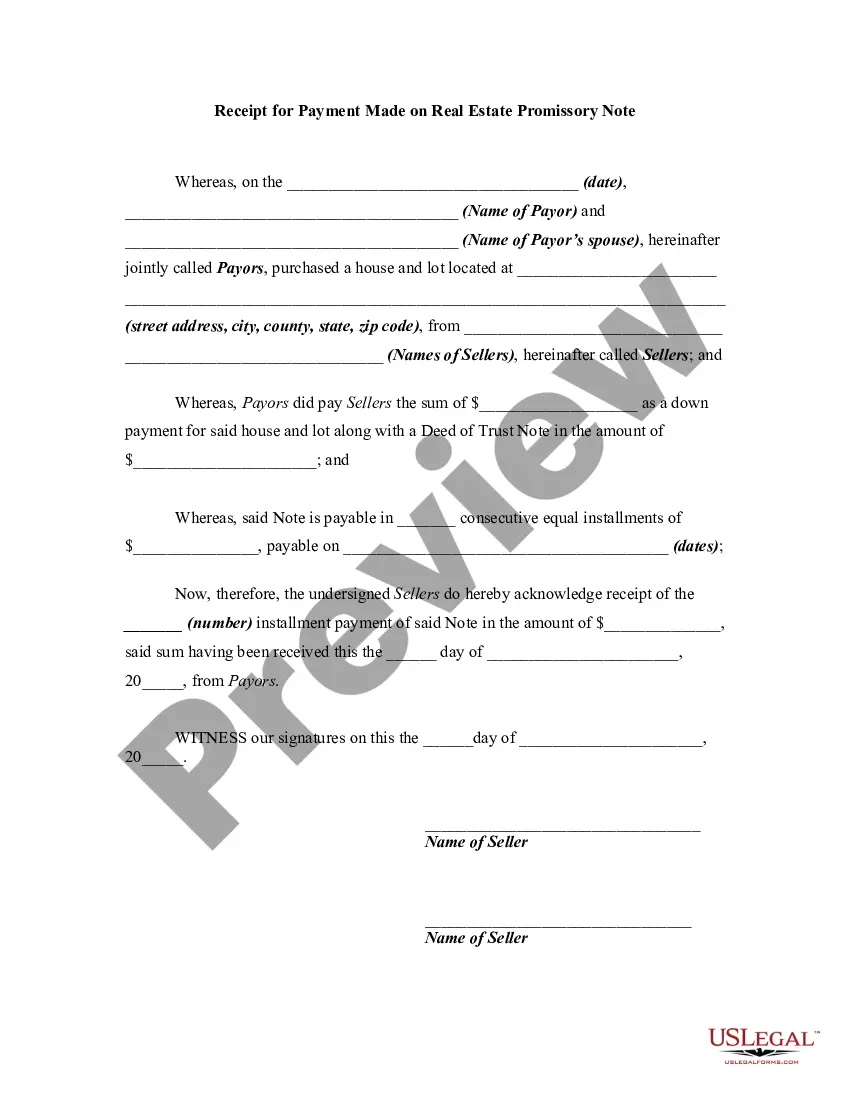

- Use the Preview option to review the document's content.

- Check the form's description to confirm you have chosen the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

The following amounts are also deductible: Any estimated taxes you paid to state or local governments during the year, and. Any prior year's state or local income tax you paid during the year.

Go to the myPATH web site and select "Make A Payment" then enter in the information on the prompts. 2. Telephone. Call 1-800-2PAYTAX (1-800-272-9829).

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Note: Pennsylvania does not permit a resident credit for income taxes or wage taxes paid to another state on Pennsylvania source income or income from intangible sources that cannot be sourced to any state using Pennsylvania sourcing rules.

Pennsylvania offers a variety of tax incentives, credits and programs to eligible Pennsylvania residents and businesses. These tax credits, economic development programs refund/rebate opportunities and incentive programs provide economic assistance and tax reductions to individual and business taxpayers.

Online, by Phone or MailOnline. New electronic payments options are now available through myPATH.By Phone Credit or Debt. You can also make state tax payments by calling ACI Payments Inc at 1-800-2PAYTAX (1-800-272-9829).By Phone ACH.Mail.

MyPATH provides many self-service options such as the ability to register an account, file returns, pay balances, and manage your account online. Users are also able to review correspondence received from the department, submit correspondence, and communicate electronically with department representatives.

HARRISBURG, Pa (WHTM) The Pennsylvania Department of Revenue is encouraging taxpayers to use the free online option to file. Taxpayers can visit mypath.pa.gov to file their Pennslyvania tax returns.

MyPATH is a free, user-friendly option that allows most taxpayers to seamlessly file the Pennsylvania Income Tax Return (PA-40) and make income tax payments, as well as offering other services. The deadline to submit 2020 personal income tax returns is April 15, 2021.