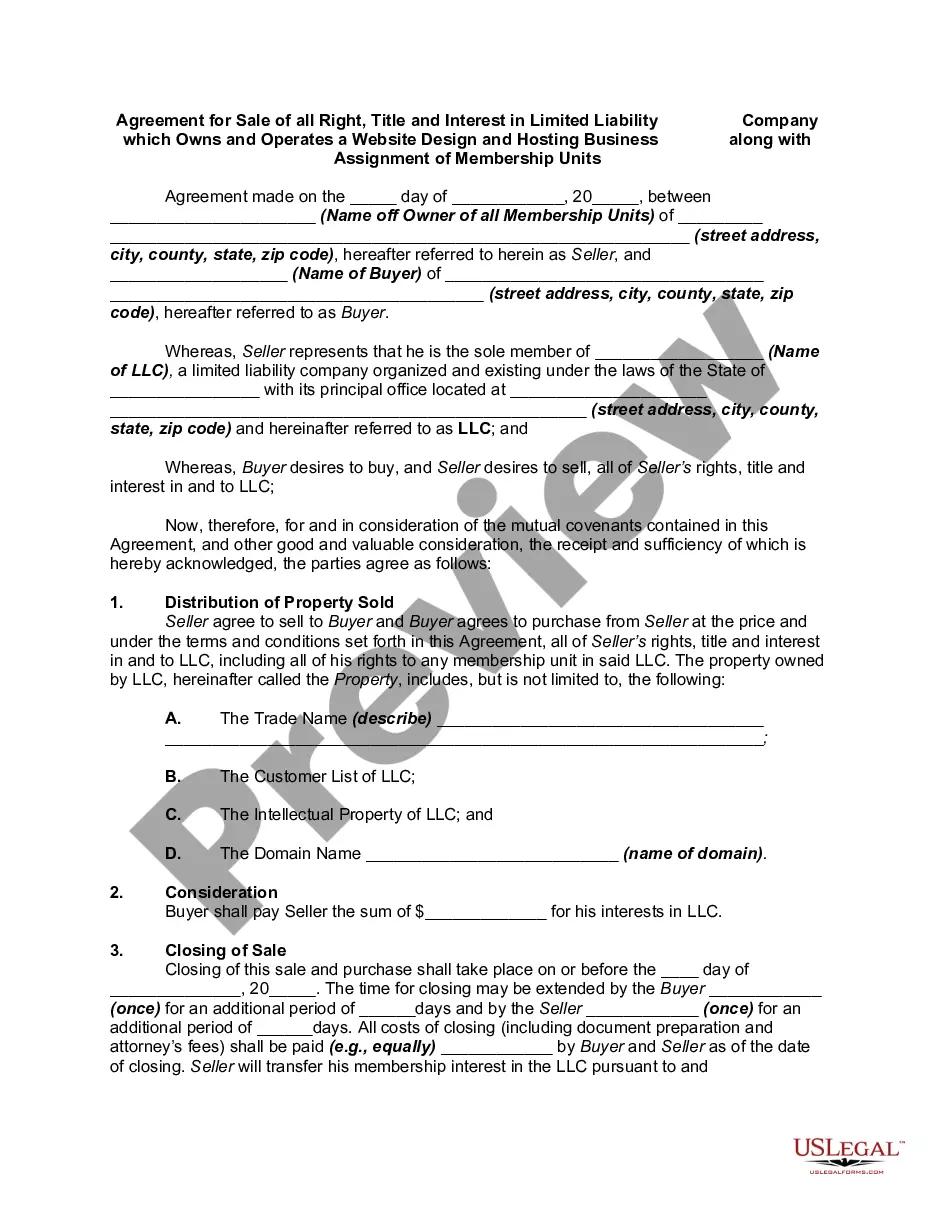

Pennsylvania Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC

Description

A distributional interest in a limited liability company is personal property and may be transferred in whole or in part. The following form is a agreement whereby the sole member of the LLC transfers his 100% interest as such member to another party.

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

If you want to total, acquire, or printing authorized record templates, use US Legal Forms, the most important assortment of authorized kinds, which can be found on the Internet. Take advantage of the site`s basic and handy look for to find the paperwork you need. Various templates for organization and person purposes are categorized by categories and claims, or search phrases. Use US Legal Forms to find the Pennsylvania Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC with a handful of click throughs.

In case you are previously a US Legal Forms client, log in to your bank account and click the Acquire button to have the Pennsylvania Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC. You may also accessibility kinds you previously saved from the My Forms tab of the bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape to the correct city/country.

- Step 2. Take advantage of the Preview method to look through the form`s information. Do not forget about to read through the information.

- Step 3. In case you are not satisfied with the type, make use of the Lookup field at the top of the monitor to locate other types in the authorized type design.

- Step 4. Upon having found the shape you need, click the Purchase now button. Select the prices strategy you choose and add your credentials to sign up to have an bank account.

- Step 5. Process the transaction. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Choose the file format in the authorized type and acquire it on your gadget.

- Step 7. Full, modify and printing or sign the Pennsylvania Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC.

Each authorized record design you get is the one you have for a long time. You may have acces to every type you saved in your acccount. Select the My Forms section and select a type to printing or acquire once again.

Contend and acquire, and printing the Pennsylvania Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC with US Legal Forms. There are millions of professional and state-specific kinds you can use to your organization or person requires.

Form popularity

FAQ

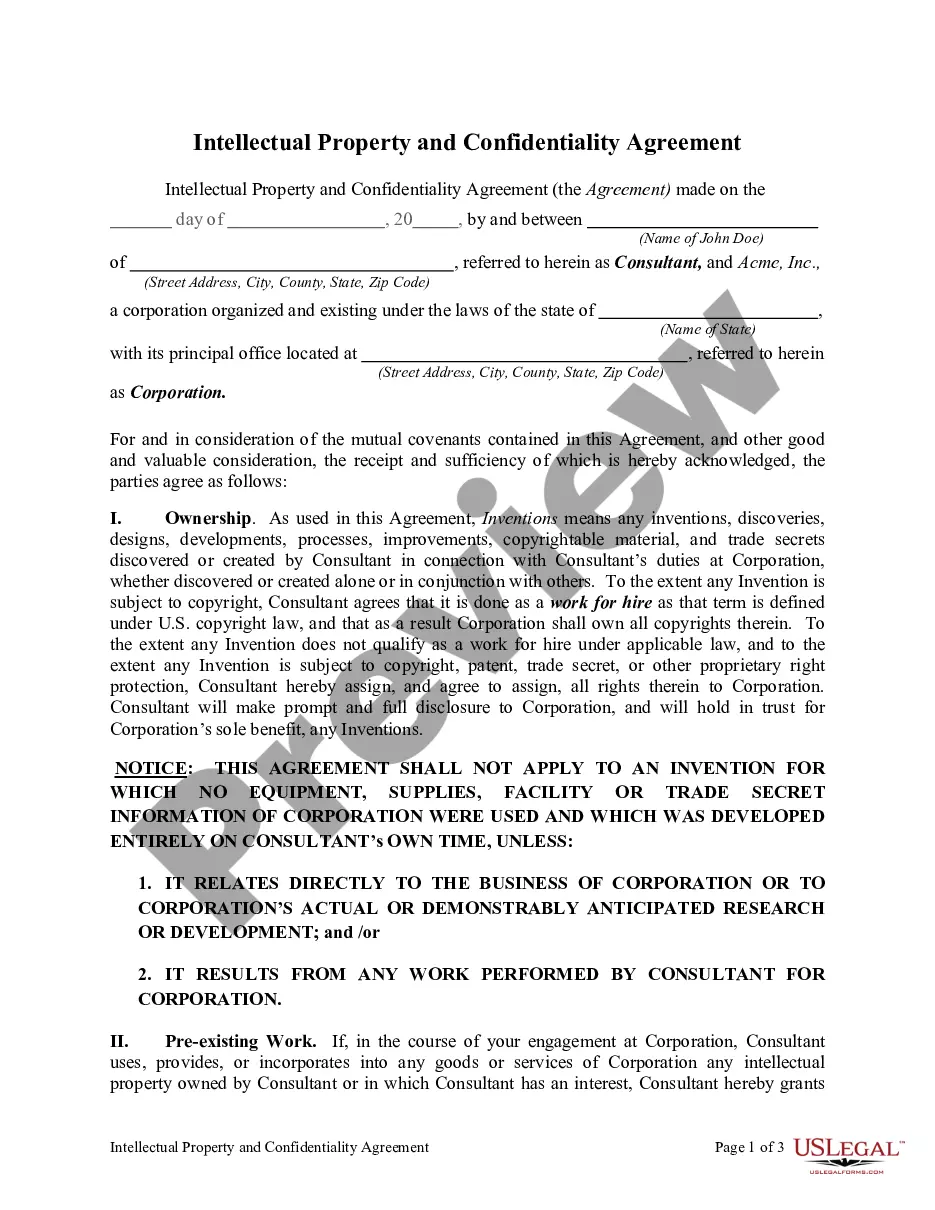

James Publishing, 1995). The owners of an LLC are called ?members.? A member can be an individual, partnership, corporation, trust, and any other legal or commercial entity.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.

More Definitions of MIPA MIPA means that certain Membership Interest Purchase Agreement, dated as of the Agreement Date, between Seller and Buyer Parent.

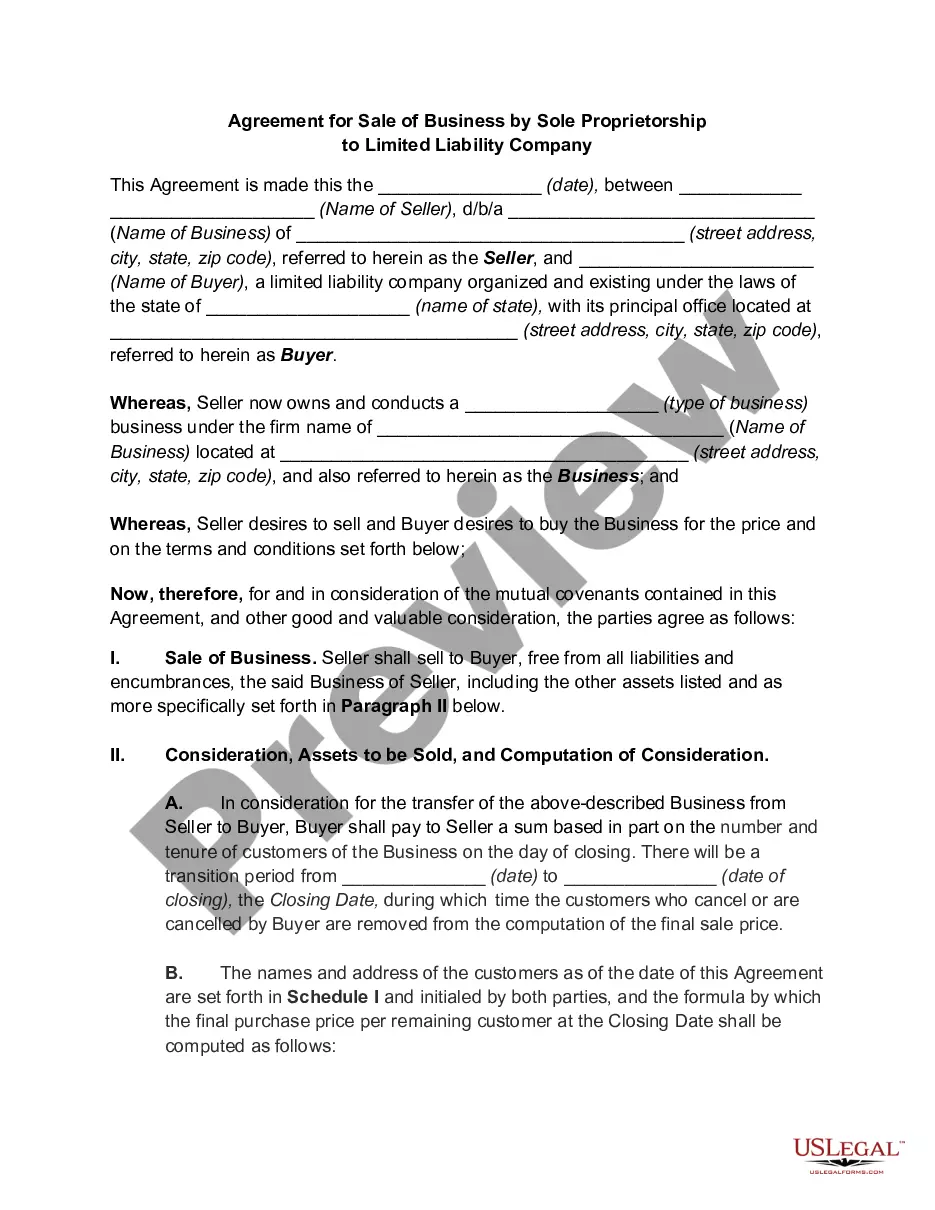

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures.

An ?SPA? is a ?Stock Purchase Agreement.? This is similar to a MIPA, but is used to transfer stock in a corporation, rather than membership interests in an LLC. The key terms in the SPA will include a purchase price, representations and warranties of both parties, and instructions for closing.

The last step of an M&A process is known as the sale and purchase agreement or SPA. It's time to finalize the agreement and sale price of the firm once a buyer has completed the entire due diligence process and evaluated the company's current condition for sale.

A MIPA sells the membership interest of the LLC. This is different from an Asset Purchase Agreement (APA) where only specific assets and not liabilities of the company are sold. When the membership interest of an LLC is purchased, both assets and liabilities are transferred from seller to buyer.

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Though it's not required by Pennsylvania law, any good lawyer will recommend having a written operating agreement for your LLC.