Pennsylvania Promissory Note - Satisfaction and Release

Description

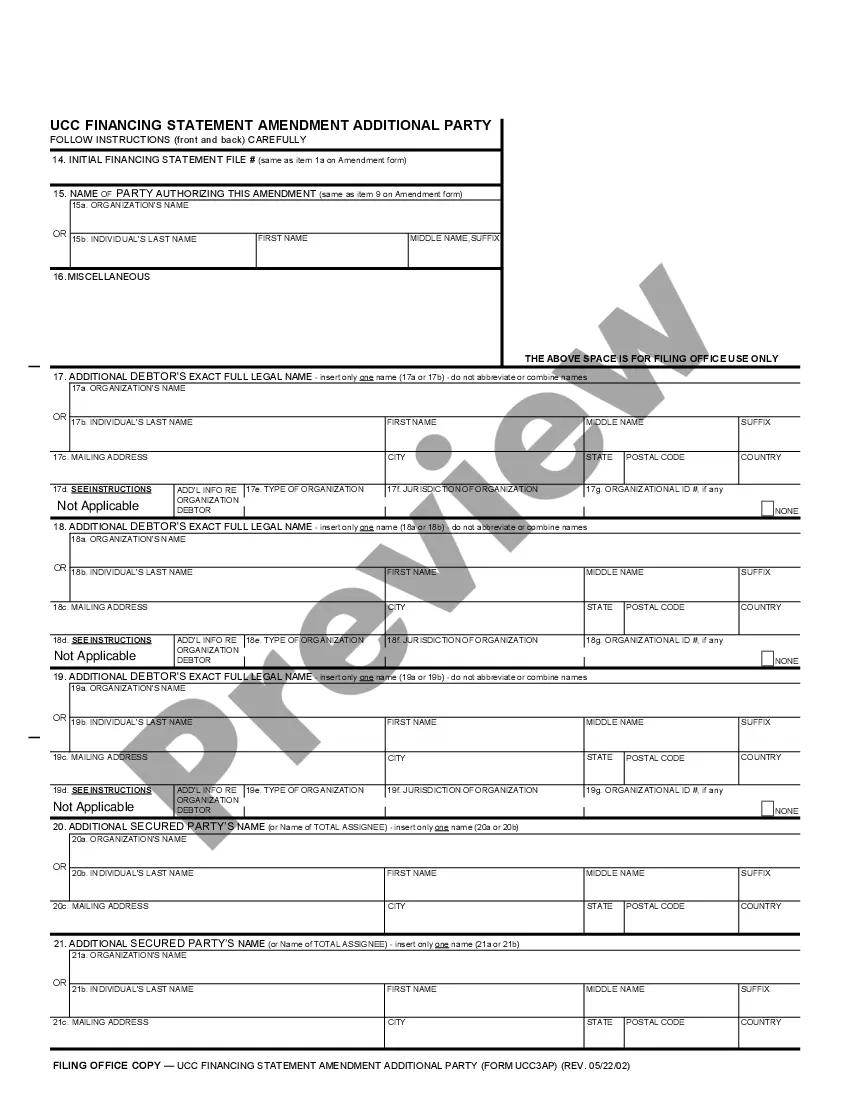

How to fill out Promissory Note - Satisfaction And Release?

Finding the appropriate legal document format can be challenging. Obviously, there are numerous templates available online, but how do you obtain the specific legal form you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Pennsylvania Promissory Note - Satisfaction and Release, suitable for business and personal requirements. All of the documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Pennsylvania Promissory Note - Satisfaction and Release. Take advantage of your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for the region/state. You can review the document using the Preview option and consult the form description to confirm it is the right one for your needs. If the document does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are certain that the document is suitable, click on the Get now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and settle the transaction using your PayPal account or credit card. Select the file format and download the legal document to your device.

- Fill out, modify, and print the acquired Pennsylvania Promissory Note - Satisfaction and Release.

- US Legal Forms is the largest collection of legal documents that provides various file templates.

- Utilize the service to obtain professionally designed paperwork that adheres to state regulations.

Form popularity

FAQ

The satisfaction and release of a promissory note is a formal process that indicates the borrower has fulfilled their obligations under the agreement. This release cancels the original promissory note, offering peace of mind to both parties. By executing a Pennsylvania Promissory Note - Satisfaction and Release, you ensure that your financial records reflect the completion of the repayment process.

In Pennsylvania, the elements of promissory estoppel include a clear promise, reliance on that promise, and resulting detriment. Courts recognize that when a party makes a commitment, and another party takes action based on that commitment, they may have legal grounds for recourse if the promise is not fulfilled. Therefore, if you are dealing with a Pennsylvania Promissory Note - Satisfaction and Release, understanding these elements is crucial. Utilizing platforms like US Legal Forms can help you draft or review your promissory note, ensuring you're protected against potential breaches.

The rules for promissory notes encompass several legal requirements. Typically, the document must include the borrower's and lender's names, a clear statement of the debt amount, and repayment terms. Adhering to these rules is essential for the validity of the Pennsylvania Promissory Note - Satisfaction and Release to safeguard your interests.

Cancellation and release of a promissory note occur when a debtor fulfills their obligation, resulting in the note being invalidated. This process safeguards both the lender's and borrower's interests, ensuring that all legal claims against the debtor are extinguished. When executing a Pennsylvania Promissory Note - Satisfaction and Release, this step is crucial to achieving closure.

A release of promissory note form acts as legal proof that a borrower has repaid their debt and that the lender no longer holds any rights to the promissory note. This form is crucial for documenting the conclusion of a financial obligation. Using a well-structured release form ensures compliance with the Pennsylvania Promissory Note - Satisfaction and Release standards.

To correctly fill out a promissory demand note, start by entering the date at the top of the document. Next, include the names of the borrower and lender, along with their addresses. Clearly state the amount borrowed, the repayment terms, and any applicable interest rates, ensuring you understand the Pennsylvania Promissory Note - Satisfaction and Release conditions.

Terminating a Pennsylvania promissory note generally involves paying off the entire amount owed according to the terms of the note. Once you’ve made the final payment, request a termination notice or satisfaction letter from the lender. This document confirms the conclusion of your agreement and ensures that you are no longer liable. With the help of platforms like US Legal Forms, you can simplify the termination process and ensure all legal paths are followed.

To effectively release a promissory note in Pennsylvania, you need to secure a written acknowledgment from the lender stating that all obligations have been met. This release document acts as a protective measure against any future claims associated with the note. After obtaining the release, store it safely with your financial records. Resources such as US Legal Forms can help guide you through drafting the necessary release documents smoothly.

In Pennsylvania, a promissory note typically remains valid for four years, which is the statute of limitations for written contracts. This means that if the terms of the note are not enforced within this time frame, the lender may lose the right to collect on the debt. To maintain clarity, it's crucial to keep records of payments and communications. For more detailed assistance regarding your Pennsylvania promissory note, consider using tools from US Legal Forms.

To discharge a Pennsylvania promissory note, you must fulfill the terms agreed upon by both parties. This often involves making the final payment as specified in the note. After payment, it's advisable to obtain a release document from the lender, confirming that the note has been satisfied. This ensures you have proof of discharge, protecting you from any future claims related to the note.