Pennsylvania Loan Assumption Agreement

Description

How to fill out Loan Assumption Agreement?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible on the web, but how do you locate the legal form you need? Utilize the US Legal Forms website. This service provides a plethora of templates, including the Pennsylvania Loan Assumption Agreement, which you can use for both professional and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Pennsylvania Loan Assumption Agreement. Use your account to search through the legal forms you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, make sure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to ensure it is suitable for you. If the form does not meet your needs, use the Search area to find the right one. Once you are certain that the form is appropriate, click the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Pennsylvania Loan Assumption Agreement.

Utilize US Legal Forms to simplify the process of obtaining legal documents that meet your requirements.

- US Legal Forms is the largest repository of legal templates.

- You can find various document templates.

- Utilize the service to download properly crafted documents.

- All documents comply with state regulations.

- Easily navigate through your purchased forms.

- Receive expert-reviewed legal forms.

Form popularity

FAQ

USDA, FHA, and VA loans are assumable when certain criteria are met. The buyer need not be a military member to assume a VA loan. Buyers must still qualify for the mortgage to assume it.

Most conventional mortgages are not assumable, but many government-backed loans (FHA, VA, USDA) are. The lender must approve you assuming the mortgage, and at the closing, you must compensate the old borrower for the amount they've paid off.

Assuming a mortgage By having your mortgage assumed, you (the seller) are simply transferring your current mortgage to your buyer. Assuming a mortgage makes sense if you are selling your home without buying another.

The purchaser wishing to assume the TD Canada Trust mortgage must qualify for the mortgage under normal mortgage application criteria. To discuss your mortgage situation and the best option to meet your needs, please visit your local branch for assistance.

"Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility. The word "assumption" is used when a buyer assumes personal liability for an existing debt.

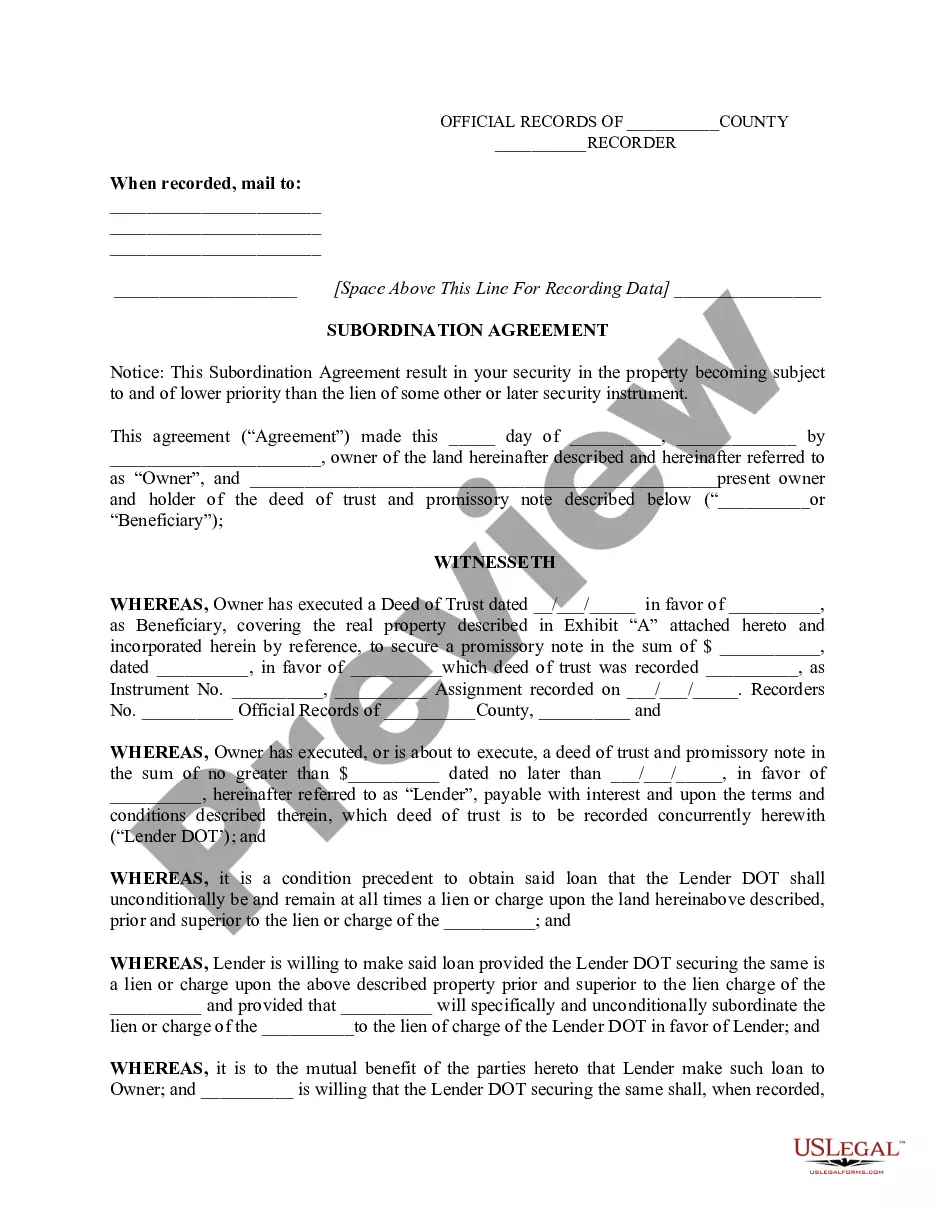

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Assuming a mortgage may not be as common, but they are still a viable option for Canadian buyers and sellers. If you've done your research, asked all the important questions, and the benefits outweigh the risks, it could be the perfect fit for you!

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.