Pennsylvania Complaint regarding Group Insurance Contract

Description

How to fill out Complaint Regarding Group Insurance Contract?

It is feasible to spend time online looking for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can obtain or generate the Pennsylvania Complaint regarding Group Insurance Contract from this service.

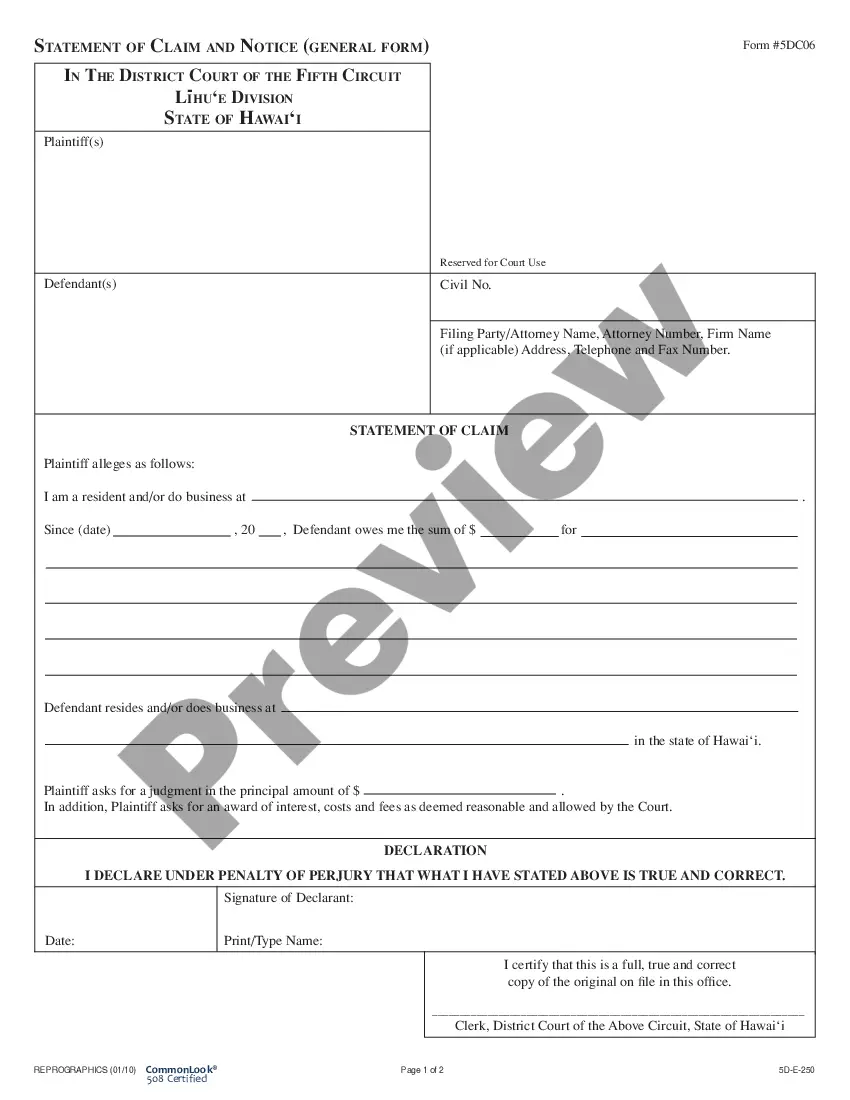

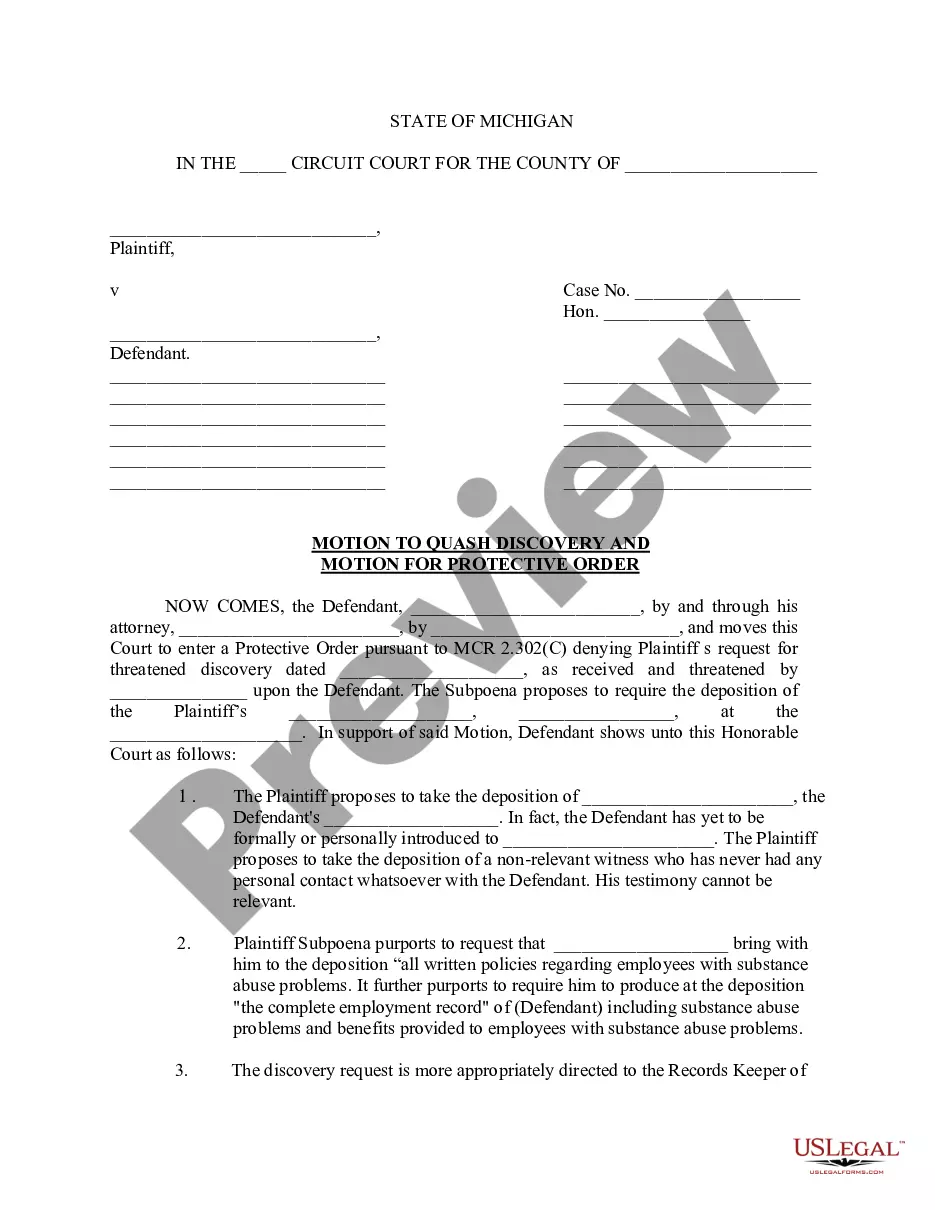

If available, utilize the Preview button to review the document format as well. If you want to find another version of the form, use the Lookup field to find the format that fits your needs. Once you have found the format you want, click Buy now to continue. Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can fill out, edit, sign, and print the Pennsylvania Complaint regarding Group Insurance Contract. Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can fill out, edit, print, or sign the Pennsylvania Complaint regarding Group Insurance Contract.

- Every legal document format you acquire is yours indefinitely.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the area/region of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

State exactly what you want done and how long you're willing to wait for a response. Be reasonable. Don't write an angry, sarcastic, or threatening letter. The person reading your letter probably isn't responsible for the problem, but may be very helpful in resolving it.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Be reasonable, not angry or threatening, in your letter. Remember, the person reading your letter may not be directly responsible for your problem, and can possibly help resolve it.

The Office of Market Regulation is responsible for regulating the behavior of insurance companies, agencies, agents and other licensees' in Pennsylvania's Insurance Marketspace.

Send the complaint through Email to complaints@irdai.gov.in.

Michael Humphreys - Insurance Commissioner - Pennsylvania Insurance Department | LinkedIn.

You may request a Statement of Complaint Form by mail, by calling the Professional Compliance Office Hotline at 1-800-822-2113 (if you are calling from within Pennsylvania) or at 1-(717) 783-4849 (if you are calling from outside Pennsylvania).

What to Say Include your name, address and phone numbers at home and work. If it is not possible to type your letter, be sure your handwriting is easy to read. Make your letter brief and to the point. ... State what you feel should be done about the problem and how long you are willing to wait to get the problem resolved.