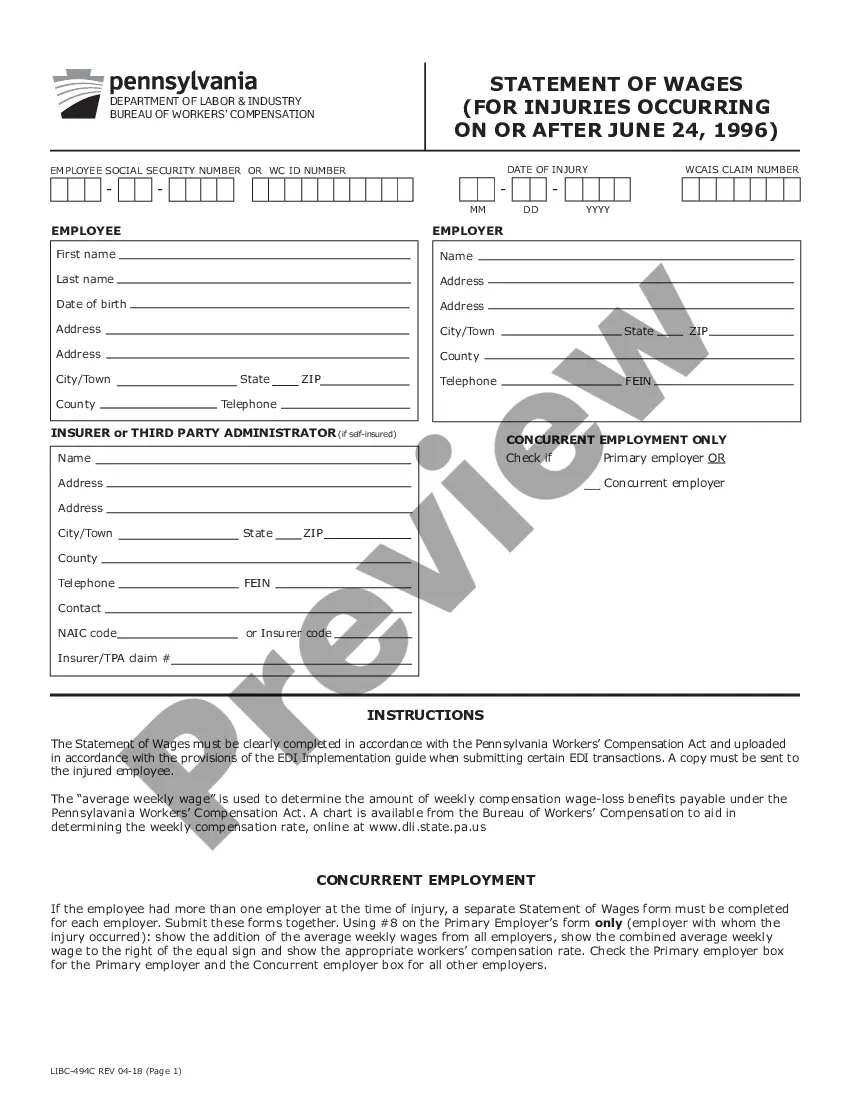

The Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996) is a document issued by the Pennsylvania Department of Labor & Industry that is used to establish the wage rate for workers who have been injured on the job. The Statement of Wages is used to determine the amount of workers' compensation benefits that the injured worker will receive. The statement is based on the employee's wages, hours worked, and other factors. There are two types of Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996): the Initial Statement of Wages and the Amended Statement of Wages. The Initial Statement of Wages is issued when the worker first files for workers' compensation benefits. The Amended Statement of Wages is issued when the worker has received a raise, changed jobs, or when additional information is needed for the calculation of the worker's benefits.

Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996)

Description

How to fill out Pennsylvania Statement Of Wages (For Injuries Occurring On Or After June 24, 1996)?

How much time and resources do you typically spend on composing formal paperwork? There’s a greater opportunity to get such forms than hiring legal specialists or wasting hours browsing the web for a suitable template. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996).

To obtain and prepare a suitable Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996) template, adhere to these easy steps:

- Look through the form content to ensure it meets your state regulations. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Pennsylvania Statement of Wages (For injuries Occurring On or After June 24, 1996) on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

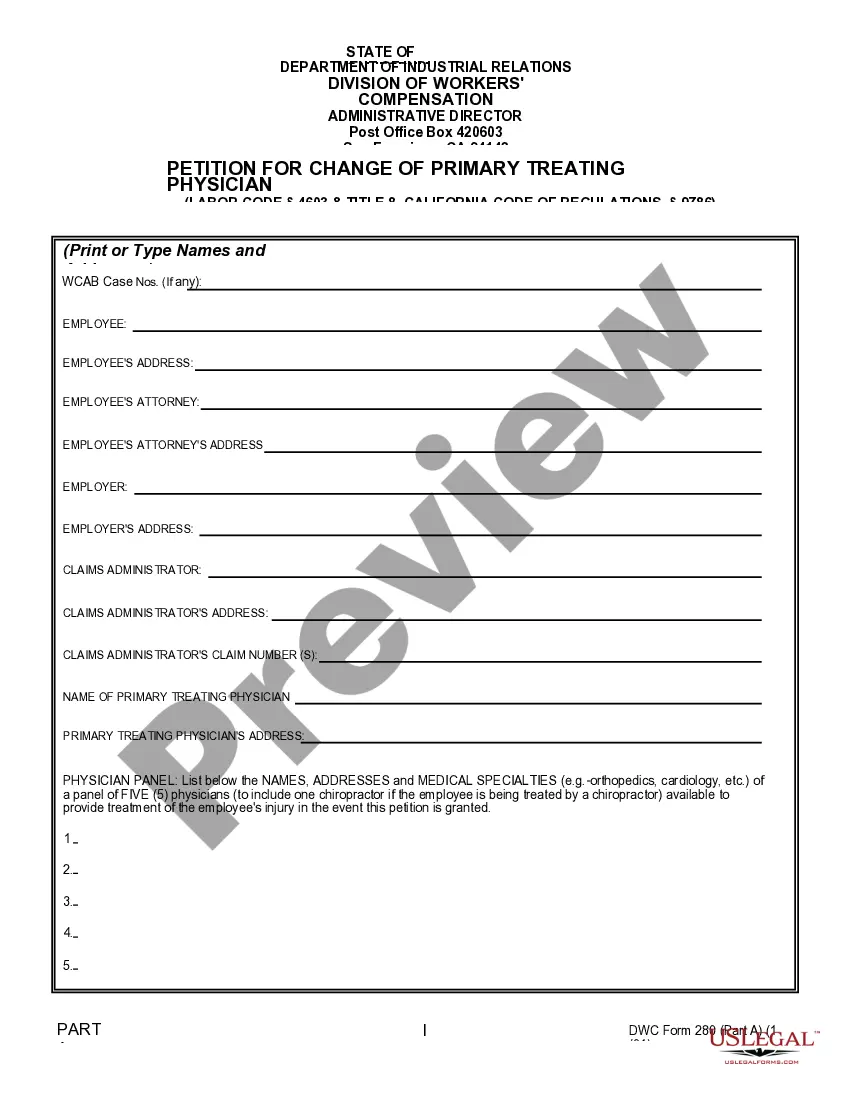

SECTION 306 (f.1)(1)(i) The employer shall provide payment in ance with this section for reasonable surgical and medical services, services rendered by physicians or other health care providers, including an additional opinion when invasive surgery may be necessary, medicines and supplies, as and when needed.

Section 305(d) provides: ?when any employer fails to secure the payment of compensation under this act as provided in sections 305 and 305.2, the injured employee or his dependents may proceed either under this act, or in a suit for damages at law as provided by Article II.?

Section 306(a. 2) of the WC act requires the insurer to request an impairment rating evaluation within 60 days of the employe's receipt of 104 weeks of total disability benefits. The Department has interpreted this section to allow an insurer to request an evaluation 60 days prior to the expiration of the 104 weeks.

The Pennsylvania Workers' Compensation Act provides wage loss and medical benefits to compensate employees suffering from work- related injuries or diseases. The Act also provides for death benefits to the dependents of workers who die as a result of a work-related injury or disease.

Under Pennsylvania workers' compensation law, the exclusive remedy provision means that an employer cannot be held accountable for workplace injuries caused by the employer's negligence.

Section 314. (a) At any time after an injury the employe, if so requested by his employer, must submit himself at some reasonable time and place for a physical examination or expert interview by an appropriate health care provider or other expert, who shall be selected and paid for by the employer.

Any individual filing misleading or incomplete information knowingly and with the intent to defraud is in violation of Section 1102 of the Pennsylvania Workers' Compensation Act, 77 P.S. §1039.2, and may also be subject to criminal and civil penalties under 18 Pa.

In Pennsylvania, the statute of limitations for workers' compensation claims is three years from the date of injury. If you have been injured at work and denied either medical benefits or wage loss benefits under the workers' compensation law, you must file a Claim Petition within three years of the date of injury.

Section 319 of the Pennsylvania Workers' Compensation Act provides the statutory authority for the Employer to subrogate to a third party action. The Employer's subrogation interest is a creature of statute, as opposed to an equitable or contractual right to subrogation.