Pennsylvania Estate Refund Policy is a set of regulations governing the refund of taxes, fees, or other payments made to the Pennsylvania Department of Revenue by a deceased individual's estate. The policy applies when taxes, fees, or other payments have been paid by the estate, but the deceased individual is entitled to a refund of those payments. The policy applies to all deceased individuals who died on or after January 1, 2017. Pennsylvania Estate Refund Policy includes three types of refunds: 1) Refund of estate taxes; 2) Refund of inheritance taxes; and 3) Refund of use taxes. For a refund of estate taxes, the estate must submit a written request for a refund to the Pennsylvania Department of Revenue, along with the original or a certified copy of the decedent's death certificate. The estate must also submit the original or a copy of the estate tax return and the original or a copy of the estate's fiduciary income tax return. For a refund of inheritance taxes, the estate must submit a written request for a refund to the Pennsylvania Department of Revenue, along with the original or a certified copy of the decedent's death certificate, the original or a copy of the inheritance tax return, and evidence of payment of the tax. For a refund of use taxes, the estate must submit a written request for a refund to the Pennsylvania Department of Revenue, along with the original or a certified copy of the decedent's death certificate, the original or a copy of the use tax return, and evidence of payment of the tax. Pennsylvania Estate Refund Policy is designed to ensure that the estate of a deceased individual is not overburdened with taxes, fees, or other payments paid on behalf of the deceased individual.

Pennsylvania Estate Refund Policy

Description

How to fill out Pennsylvania Estate Refund Policy?

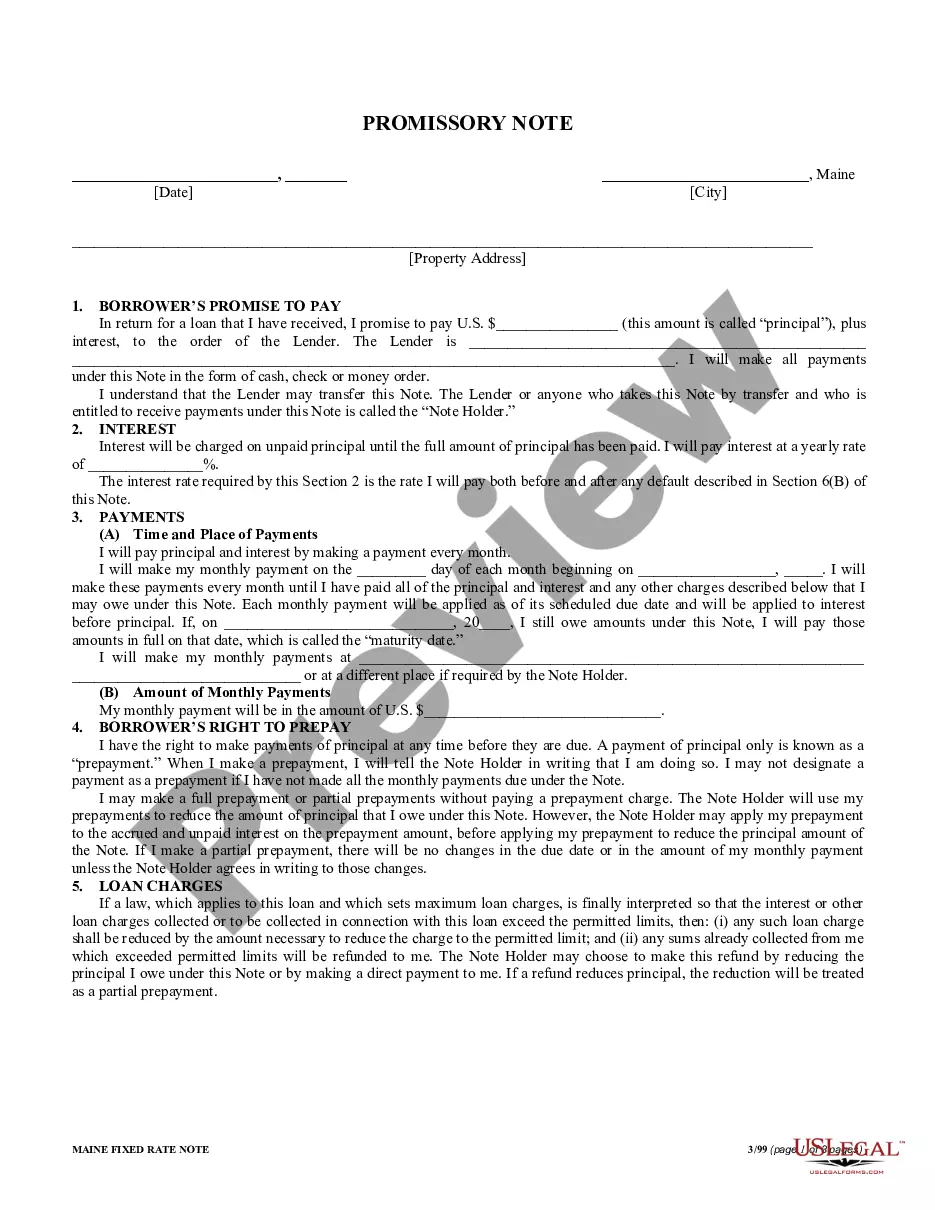

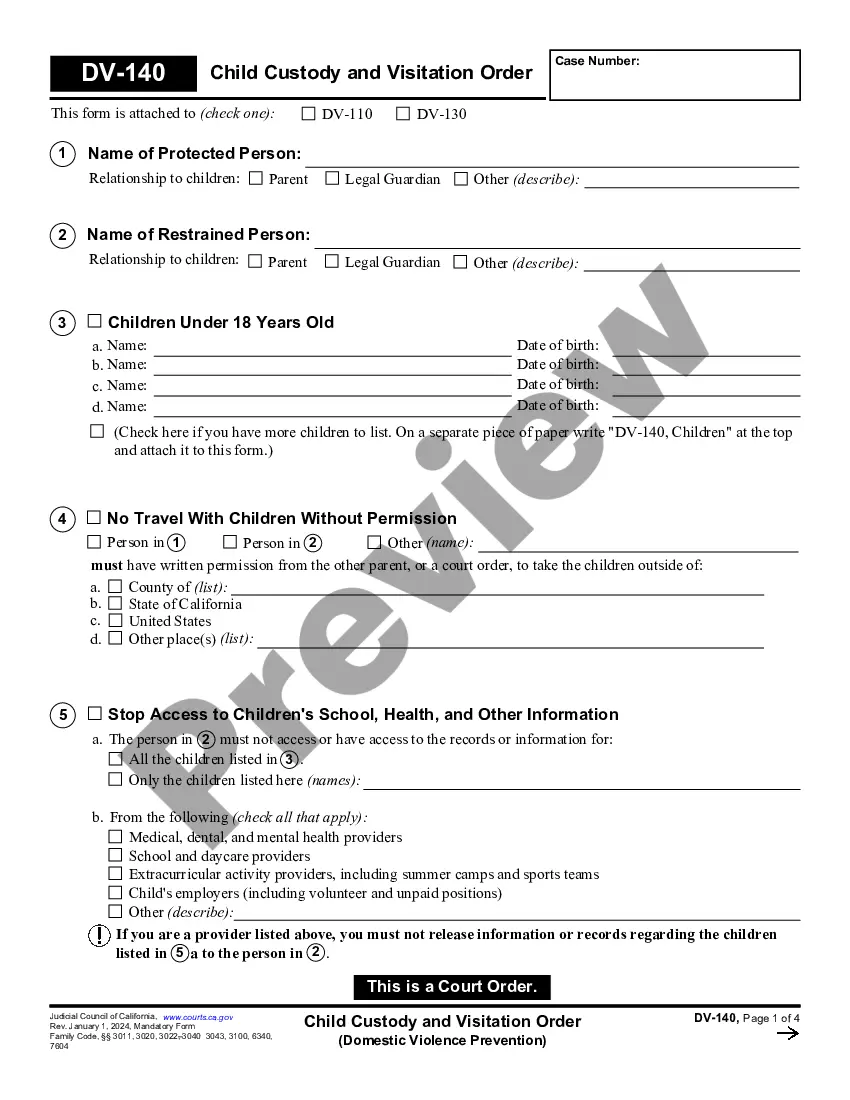

How much time and resources do you typically spend on composing official paperwork? There’s a better way to get such forms than hiring legal specialists or wasting hours browsing the web for a suitable blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Pennsylvania Estate Refund Policy.

To obtain and prepare an appropriate Pennsylvania Estate Refund Policy blank, follow these simple steps:

- Examine the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Pennsylvania Estate Refund Policy. If not, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your Pennsylvania Estate Refund Policy on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as often as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

If the decedent and his or her current spouse are their parents, the children are entitled to an inheritance only after the surviving spouse inherits $30,000 and half of the balance of the estate. But if the children were born out of marriage or during a previous relationship, their share shifts to half of the estate.

Intestate succession without a will distributes the estate as follows: If the deceased has no children or spouse, their parents take the estate. If the deceased is married but has no children, their spouse takes the estate. If they have children but no living spouse, the children share the estate equally.

An inheritance tax return must be filed in duplicate with the Register of Wills of the county in which the decedent was a resident at the time of death. Tax on property transferred is due within nine months of the decedent's death.

Pennsylvania is one of the few states that collect inheritance taxes on decedents' property. If you are a resident of Pennsylvania or own assets in the state, then the people or entities that will inherit your property might be required to pay a tax on what they will inherit, depending on how they were related to you.

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

Though there is no estate tax, there is an inheritance tax in Pennsylvania. The percentage paid depends on the relationship between the heir and the decedent. No tax is applied to transfers to a surviving spouse or to a parent from a child under the age of 21.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).