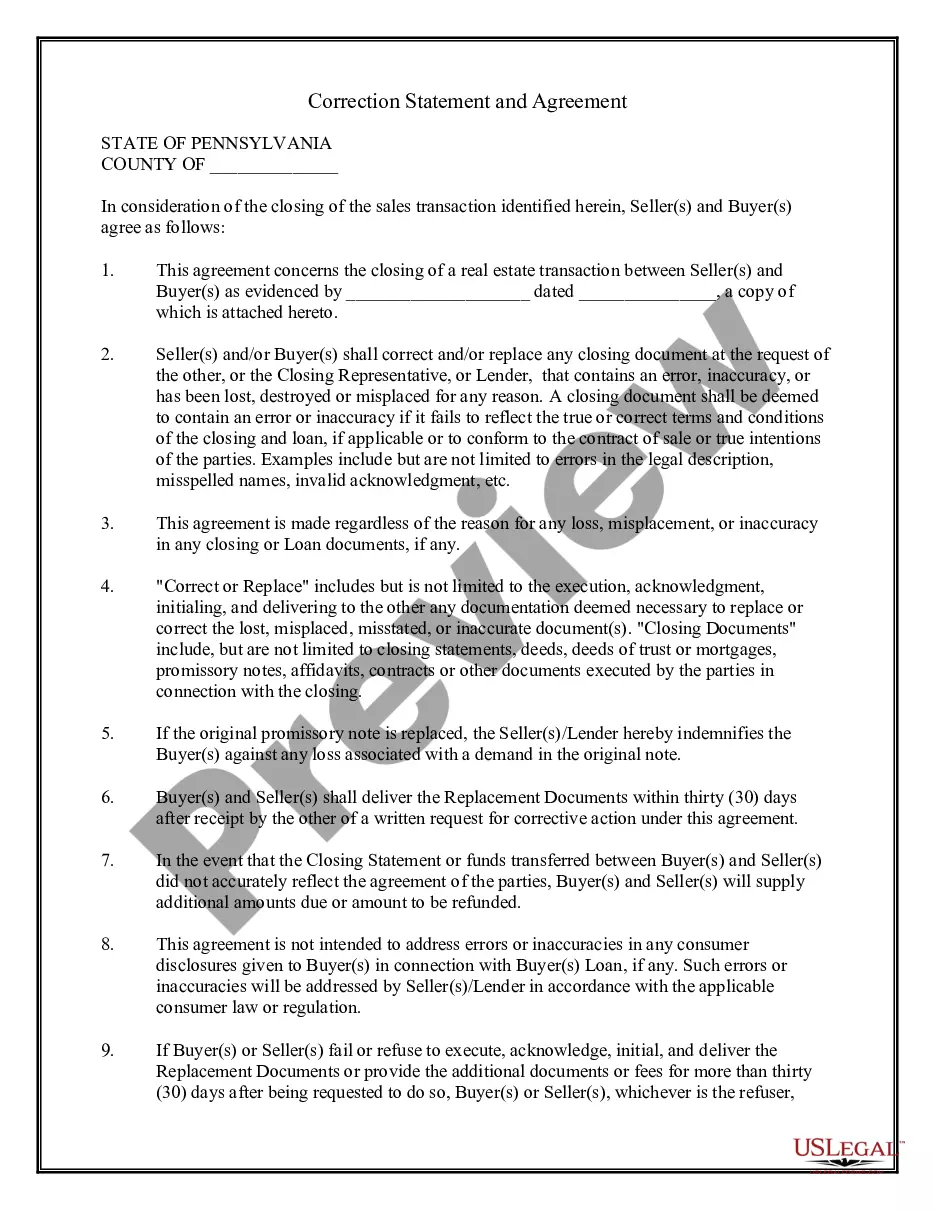

Pennsylvania Correction Statement and Agreement

What is this form?

The Correction Statement and Agreement form is a legal document used in real estate transactions. It allows both the buyer and seller to acknowledge their agreement to correct any errors in closing documents, or to provide replacement documents if those are lost or misplaced. This form ensures a smoother closing process by addressing potential inaccuracies, thereby minimizing disputes after the transaction is completed.

What’s included in this form

- Identification of the parties involved in the transaction.

- Details of the original sales transaction, including a reference to the attached contract.

- Agreement to correct or replace any document with errors or that are lost.

- Liability clauses for failure to execute corrections.

- Signatures of both buyer and seller, along with notary acknowledgment.

Situations where this form applies

This form is essential during the closing phase of a real estate transaction, particularly when there are discrepancies in the closing documents. Use it if you discover errors, such as misprints in names or property descriptions, or if important documents have been lost or misplaced after signing. It is a proactive measure to ensure clarity and legality in the final agreements between buyer and seller.

Who needs this form

- Real estate buyers and sellers engaged in a property transaction.

- Closing agents or representatives who need a structured protocol for handling document errors.

- Parties looking to protect themselves from potential issues arising from inaccuracies in closing documentation.

How to prepare this document

- Identify all parties involved in the transaction by entering their names and addresses.

- Reference the original sales transaction by providing its date and attaching the appropriate documents.

- Clearly outline the agreement on correcting or replacing documents.

- Include signatures from both the buyer and seller, along with dates.

- Ensure the form is notarized before submission, if required.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately identify all parties involved in the transaction.

- Not referencing the correct original document or transaction date.

- Leaving the form unsigned or incomplete where required.

- Assuming notarization is unnecessary without confirming local requirements.

Benefits of completing this form online

- Convenience of immediate form access and digital downloads.

- Easy to fill out online with clear guidance provided.

- Reliability and assurance that the form meets legal requirements.

Looking for another form?

Form popularity

FAQ

At your mortgage closing, you meet with various legal representatives to sign your mortgage and other documents, make any required payments and receive the keys to your new property.You give a certified or cashier's check to cover the down payment (if applicable), closing costs, prepaid interest, taxes and insurance.

Both buyers (if a married couple), or notarized power of attorney documentation permitting the present buyer to sign for the non-present one. Photo ID (passport or state-issued ID) List of your residences over the past 10 years. Sufficient payment to cover closing costs (usually a bank check or wire transfer)

If that date passes and the sale has not closed, either party can back out of the deal. For example, a buyer's penalty for missing the closing date might include paying a portion of the seller's mortgage to compensate the seller for keeping her property longer than planned.

Seller's real estate agentYour agent is tasked with facilitating the closing process and making sure that both parties have taken care of unfinished businesssometimes including pre-signing documentationbefore coming to the table at closing.