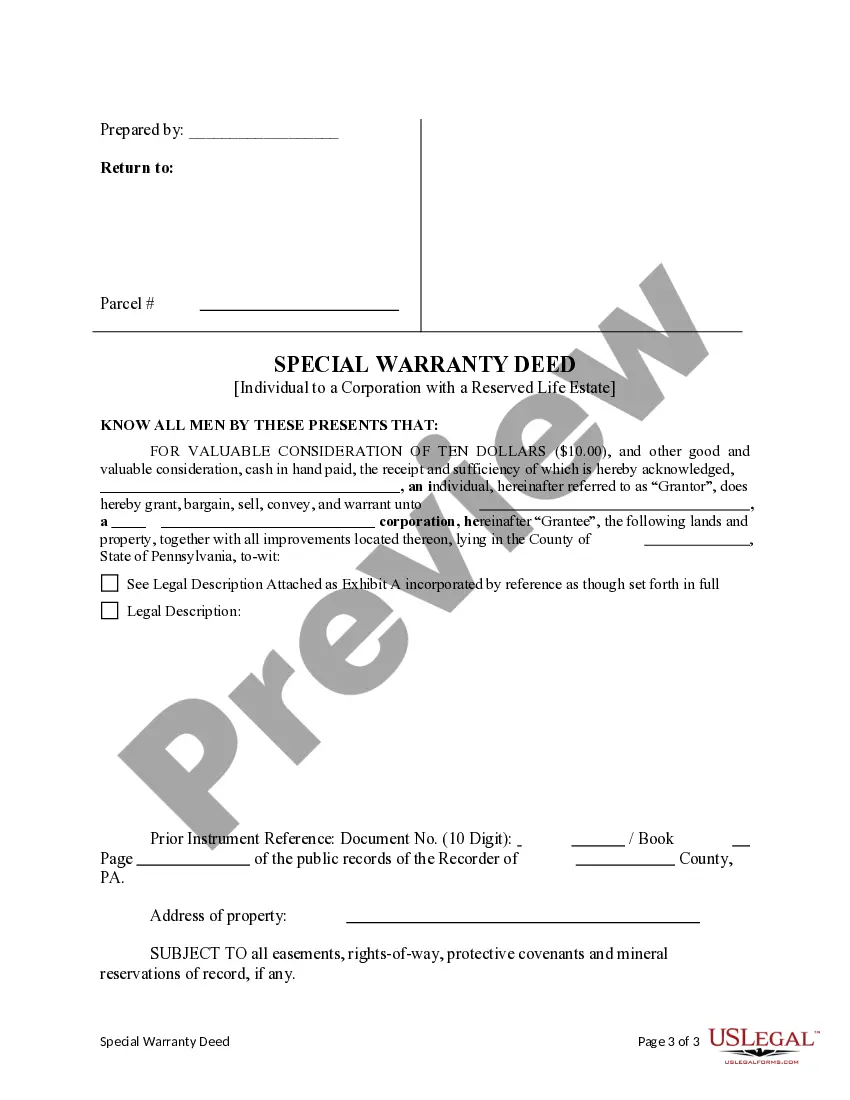

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a corporation. Grantor conveys and specially warrants the described property to the Grantee subject to a reserved life estate. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Pennsylvania Special Warranty Deed from an Individual to a Corporation with a Reserved Life Estate

Description

How to fill out Pennsylvania Special Warranty Deed From An Individual To A Corporation With A Reserved Life Estate?

The work with papers isn't the most uncomplicated task, especially for people who almost never deal with legal paperwork. That's why we recommend using correct Pennsylvania Special Warranty Deed from an Individual to a Corporation with a Reserved Life Estate samples made by professional attorneys. It allows you to prevent troubles when in court or dealing with official institutions. Find the templates you want on our site for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template page. Right after getting the sample, it’ll be saved in the My Forms menu.

Customers without an active subscription can quickly create an account. Follow this brief step-by-step guide to get your Pennsylvania Special Warranty Deed from an Individual to a Corporation with a Reserved Life Estate:

- Make sure that file you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this template is what you need or utilize the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after finishing these easy actions, it is possible to fill out the form in a preferred editor. Recheck completed details and consider asking a legal professional to review your Pennsylvania Special Warranty Deed from an Individual to a Corporation with a Reserved Life Estate for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

The State of Pennsylvania charges 1% of the sales price and the municipality and school district USUALLY charge 1% between them for a total of 2% (i.e. 2% X 100,000 = $2,000). By custom, the buyer and seller split the cost. 1% to buyer, 1% to seller; however payment is dictated by the sales contract.

If you give your house to your children, the tax basis will be $150,000.PA INHERITANCE TAX ISSUES: In Pennsylvania, there is no gift tax. However, to avoid PA Inheritance Taxes (the rate is 4.5% for assets passed to children or grandchildren), you must live at least one year from the time the gift was made.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

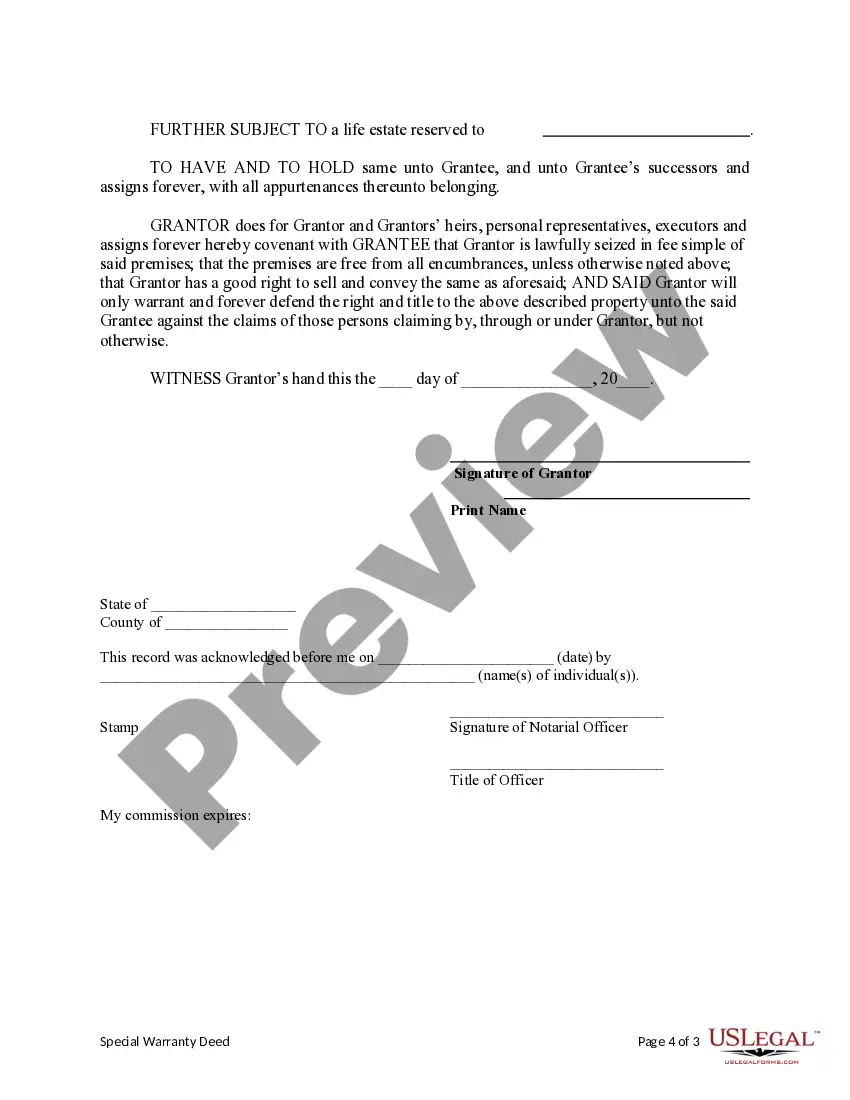

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

To make the form legally binding, you must sign it in front of a notary public. You must then file your signed and notarized deed with the county office that's in charge of recording property documents. Once the grantee signs the warranty deed, he/she legally has ownership and claim to the property.