This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

Oregon Detailed Tax Increase Clause

Description

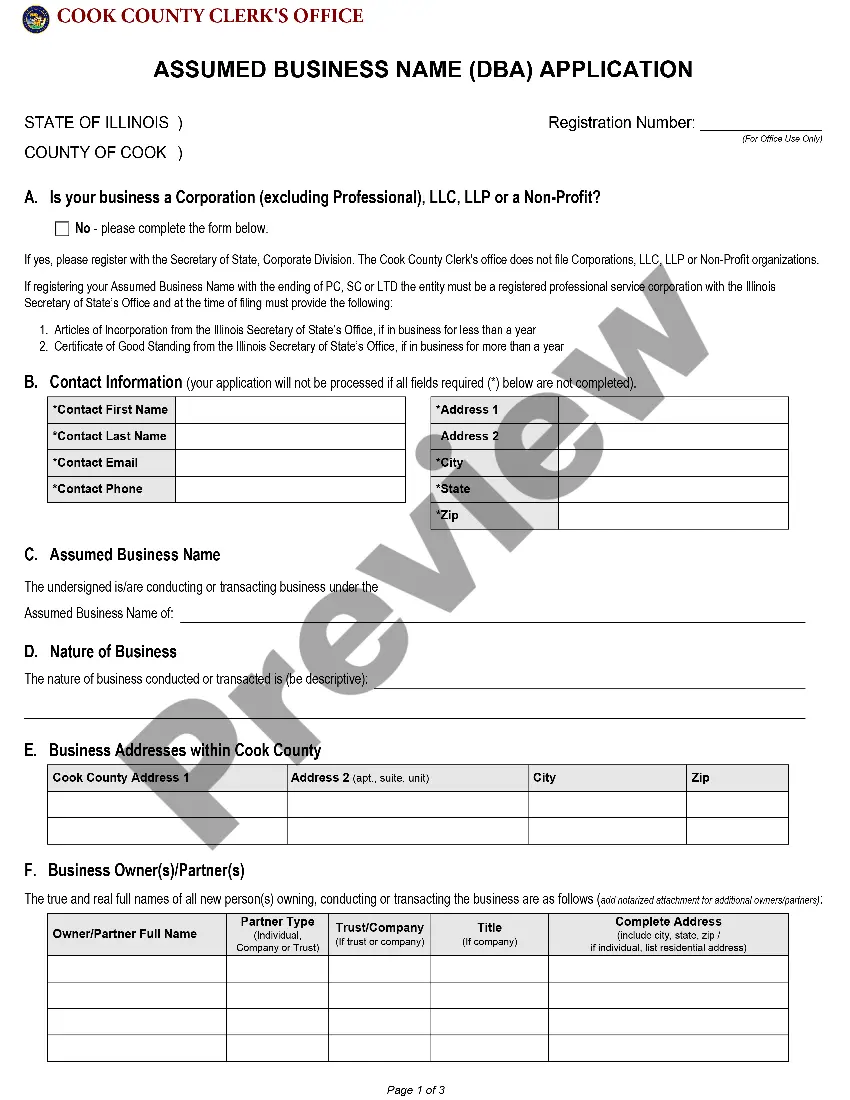

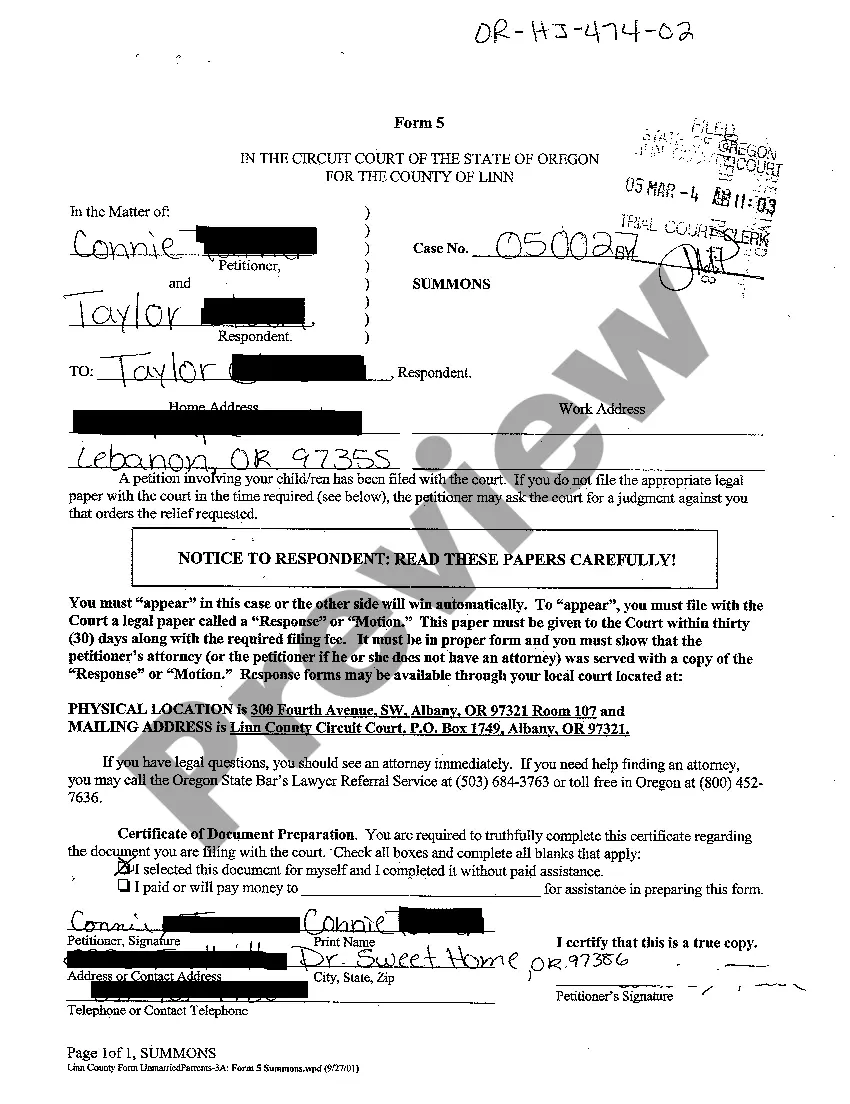

How to fill out Detailed Tax Increase Clause?

Are you currently inside a placement in which you will need paperwork for either business or individual uses just about every day time? There are a lot of lawful file templates available on the Internet, but getting versions you can rely on is not effortless. US Legal Forms offers thousands of type templates, like the Oregon Detailed Tax Increase Clause, that happen to be created to meet federal and state requirements.

Should you be already informed about US Legal Forms site and have an account, just log in. Next, it is possible to down load the Oregon Detailed Tax Increase Clause format.

Should you not provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is for that appropriate metropolis/county.

- Utilize the Review button to analyze the form.

- Look at the explanation to ensure that you have chosen the right type.

- If the type is not what you are seeking, take advantage of the Lookup field to get the type that fits your needs and requirements.

- When you obtain the appropriate type, simply click Acquire now.

- Opt for the costs prepare you need, submit the desired information and facts to produce your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Pick a hassle-free paper format and down load your duplicate.

Get each of the file templates you may have purchased in the My Forms food list. You may get a more duplicate of Oregon Detailed Tax Increase Clause whenever, if required. Just select the necessary type to down load or printing the file format.

Use US Legal Forms, the most considerable collection of lawful kinds, in order to save time as well as avoid blunders. The assistance offers skillfully made lawful file templates that you can use for an array of uses. Create an account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

However, the renewal and passage of new bonds and levies at a percentage of assessed property value keeps taxes high and leads to yearly increases for homeowners. Check out this Q&A from Oregon Live for an in-depth look at how property taxes are calculated in Portland.

Real estate taxes are over $10,000 annually in San Francisco, Santa Clara, and Sunnyvale, CA. This is the highest average annual payment of real estate taxes studywide. Meanwhile, average home values range from $1.36 million to $1.58 million in these cities.

Clackamas County The largest city here is Lake Oswego, which has a population of about 40,000. The median annual property tax homeowners in Clackamas County pay is $4,590, the highest in the state.

How does Oregon's tax code compare? Oregon has a graduated individual income tax, with rates ranging from 4.75 percent to 9.90 percent. There are also jurisdictions that collect local income taxes. Oregon has a 6.60 percent to 7.60 percent corporate income tax rate and levies a gross receipts tax.

Taxable value limitation The limit is based on a property's maximum assessed value (MAV). MAV can't increase by more than 3 percent each year, unless there are changes to the property, such as the addition of a new structure, improvement of an existing structure, or subdivision or partition of the property.

Oregon Property Tax Exemption for People 65 Years of Age and Older Initiative (2020)

Measure 50, passed in 1997, cut taxes, introduced assessed value growth limits, and replaced most tax levies with permanent tax rates. It transformed the system from one primarily based on levies to one primarily based on rates.