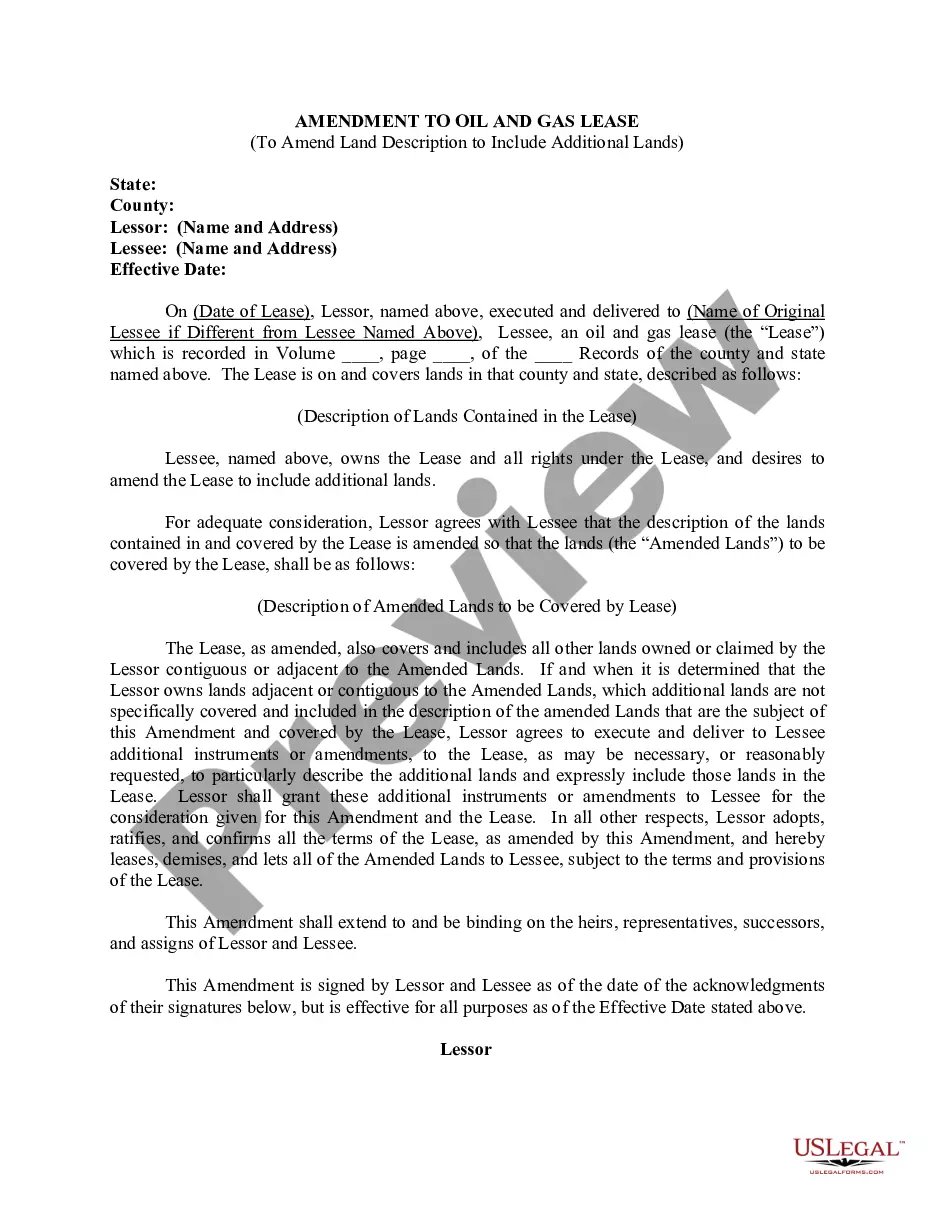

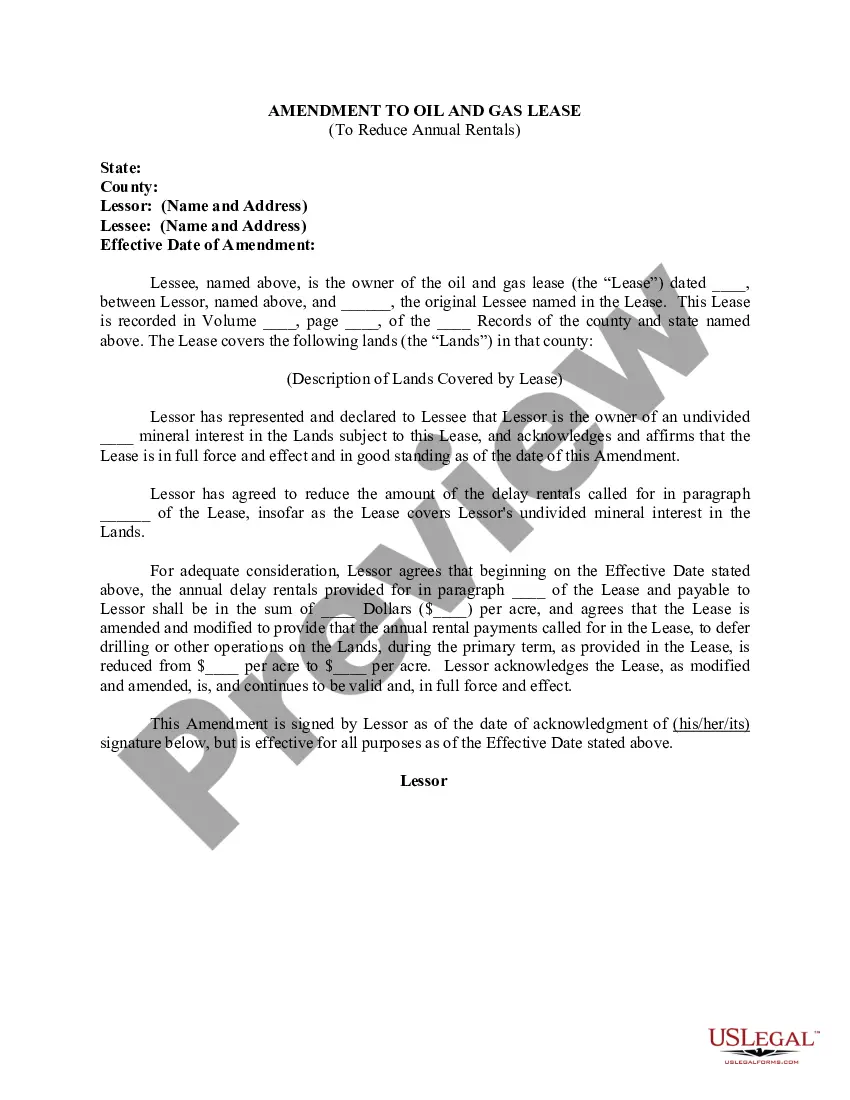

This form is used when the Lessor and Lessee desire to amend the description of the Lands subject to the Lease by dividing the Lands into separate tracts, with each separate tract being deemed to be covered by a separate and distinct oil and gas lease even though all of the lands are described in the one Lease.

Oregon Amendment to Oil and Gas Lease to Reduce Annual Rentals

Description

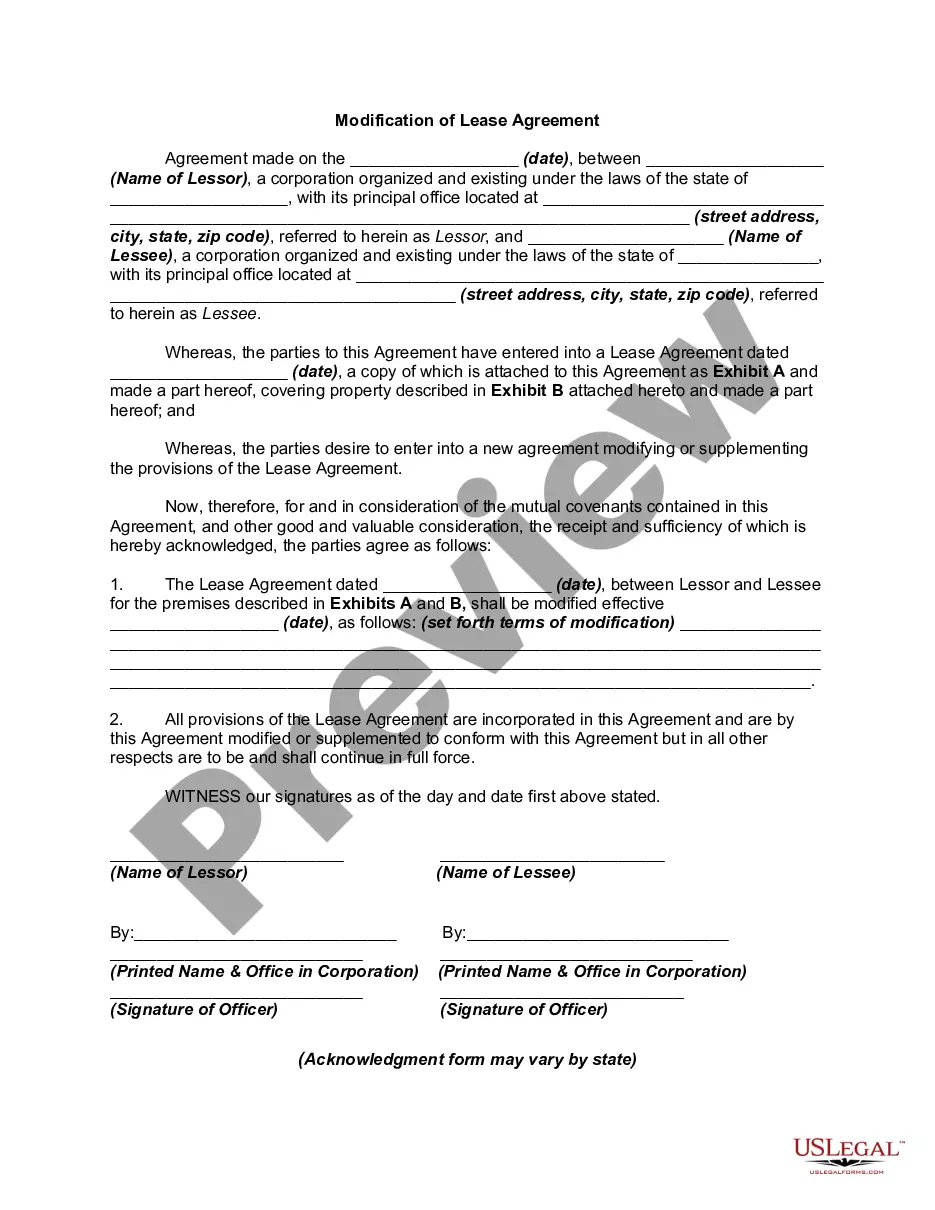

How to fill out Amendment To Oil And Gas Lease To Reduce Annual Rentals?

US Legal Forms - one of the greatest libraries of authorized types in the States - offers a wide array of authorized file themes you may obtain or printing. While using website, you may get 1000s of types for organization and specific purposes, sorted by types, says, or keywords.You can get the newest models of types like the Oregon Amendment to Oil and Gas Lease to Reduce Annual Rentals within minutes.

If you currently have a membership, log in and obtain Oregon Amendment to Oil and Gas Lease to Reduce Annual Rentals through the US Legal Forms library. The Down load key can look on every kind you look at. You have access to all formerly acquired types within the My Forms tab of your profile.

In order to use US Legal Forms the very first time, listed here are easy directions to get you began:

- Make sure you have selected the proper kind for your town/state. Go through the Preview key to review the form`s content. See the kind explanation to ensure that you have selected the correct kind.

- In the event the kind doesn`t match your specifications, use the Search field at the top of the display to get the one who does.

- Should you be content with the shape, validate your decision by clicking on the Get now key. Then, pick the costs strategy you want and give your references to register on an profile.

- Method the purchase. Utilize your credit card or PayPal profile to finish the purchase.

- Select the formatting and obtain the shape on your product.

- Make changes. Fill out, edit and printing and indicator the acquired Oregon Amendment to Oil and Gas Lease to Reduce Annual Rentals.

Each and every template you added to your money does not have an expiration time and is yours for a long time. So, in order to obtain or printing yet another copy, just check out the My Forms portion and click on around the kind you require.

Gain access to the Oregon Amendment to Oil and Gas Lease to Reduce Annual Rentals with US Legal Forms, one of the most substantial library of authorized file themes. Use 1000s of professional and status-certain themes that fulfill your organization or specific requires and specifications.

Form popularity

FAQ

A ?special warranty? is a covenant made by the lessor to defend the lessee against encumbrances or clouds on the oil and gas title created by the lessor during his ownership of the estate. The protection offered by this warranty is therefore limited to those title defects caused or created by the lessor himself.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

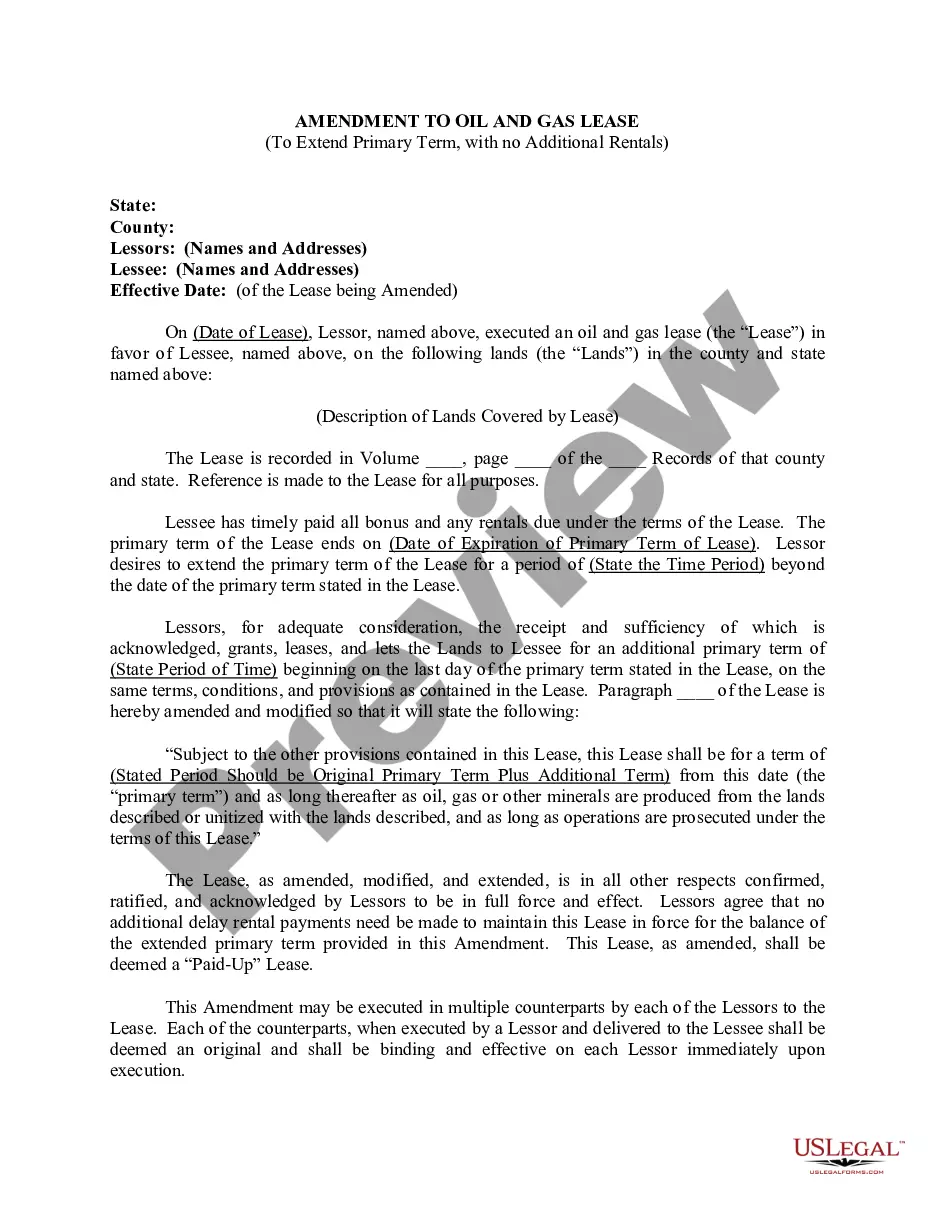

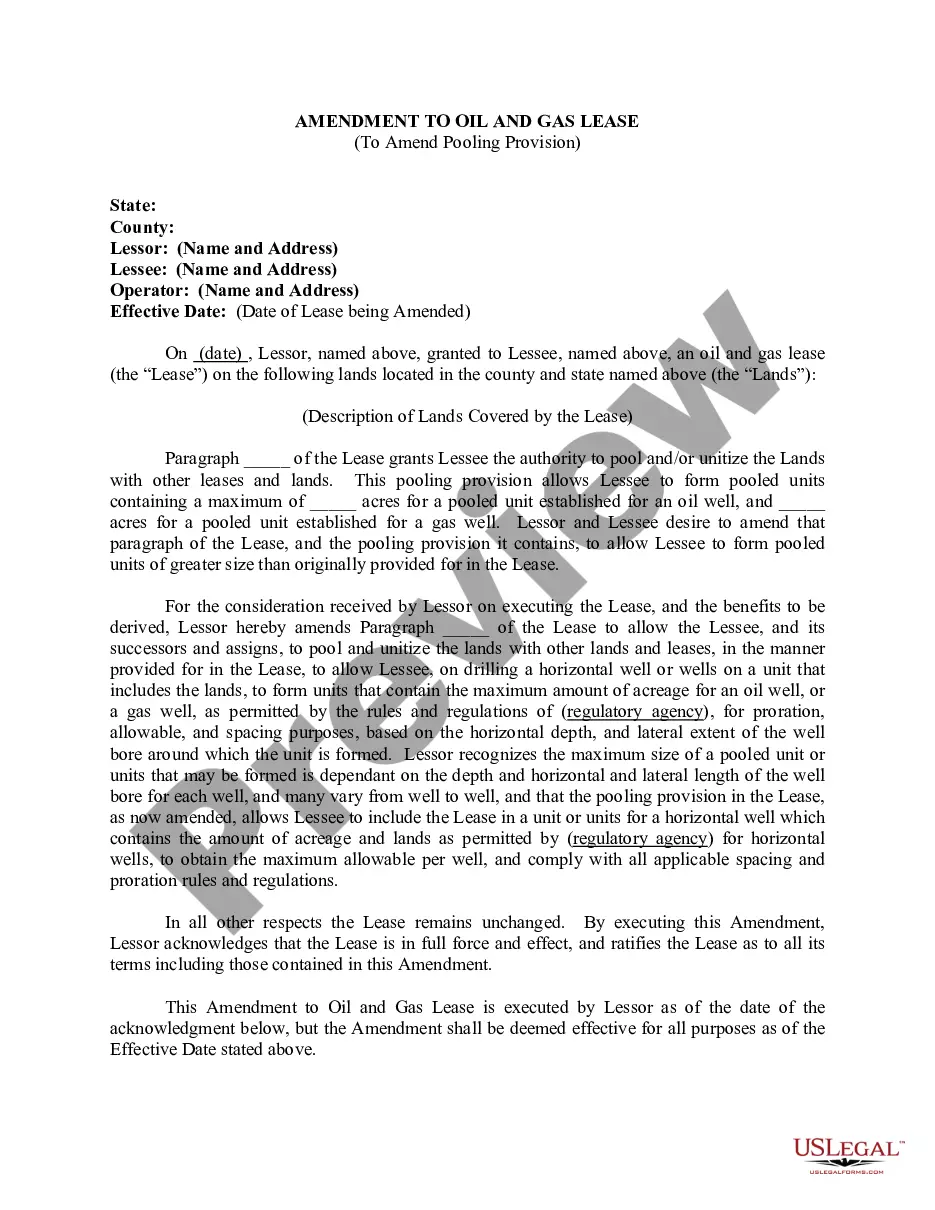

Savings clauses are the safety nets in most oil and gas leases that keep leases alive in after the primary term and in absence of production. These include continuous drilling, continuous operations, shut-in royalty, force majeure, retained acreage provisions, pooling, Pugh (rolling vs.

Granting Clause: This clause specifies: (a) the land that is being leased; (b) which minerals are being leased (oil, gas, uranium, etc.); and (c) and what rights the production company has to use the surface land in an effort to produce the leased minerals.

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

Granting Clause: The clause in the deed that lists the grantor and the grantee and states that the property is being transferred between the parties.

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

To report royalty income, you will have fill in Schedule E as well as your Form 1040. If you have received income from royalties, use Form 1099-MISC at the end of the year. Report all other payments you receive as well. This includes rent payments for your lease and bonuses you received as part of the agreement.