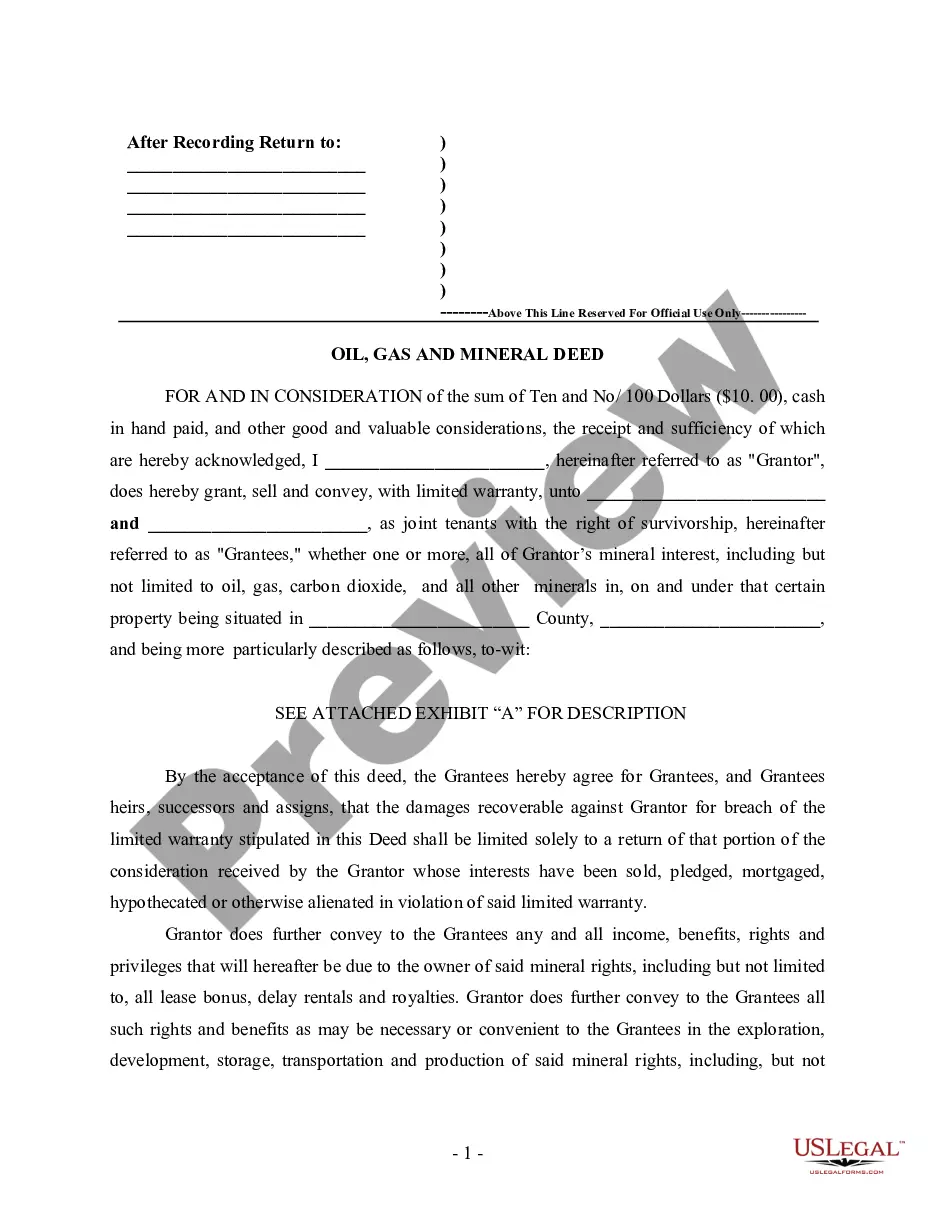

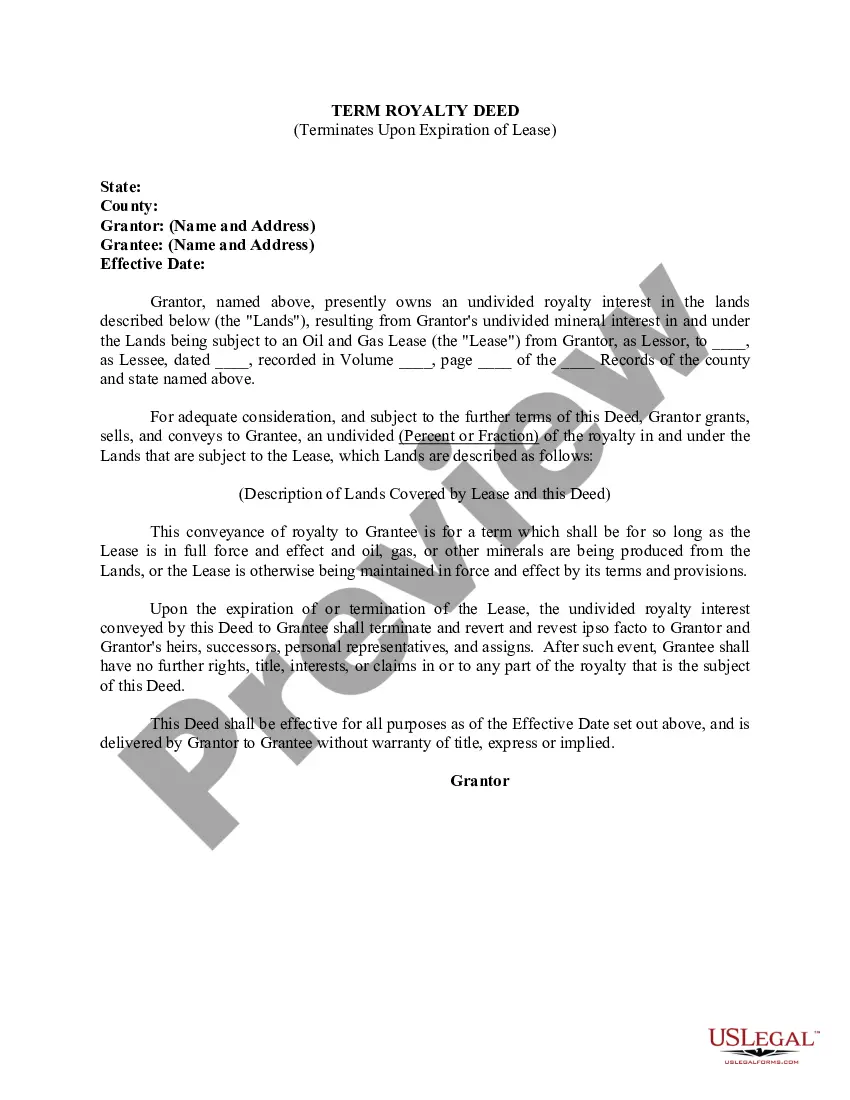

Oregon Term Royalty Deed for Term of Existing Lease

Description

How to fill out Term Royalty Deed For Term Of Existing Lease?

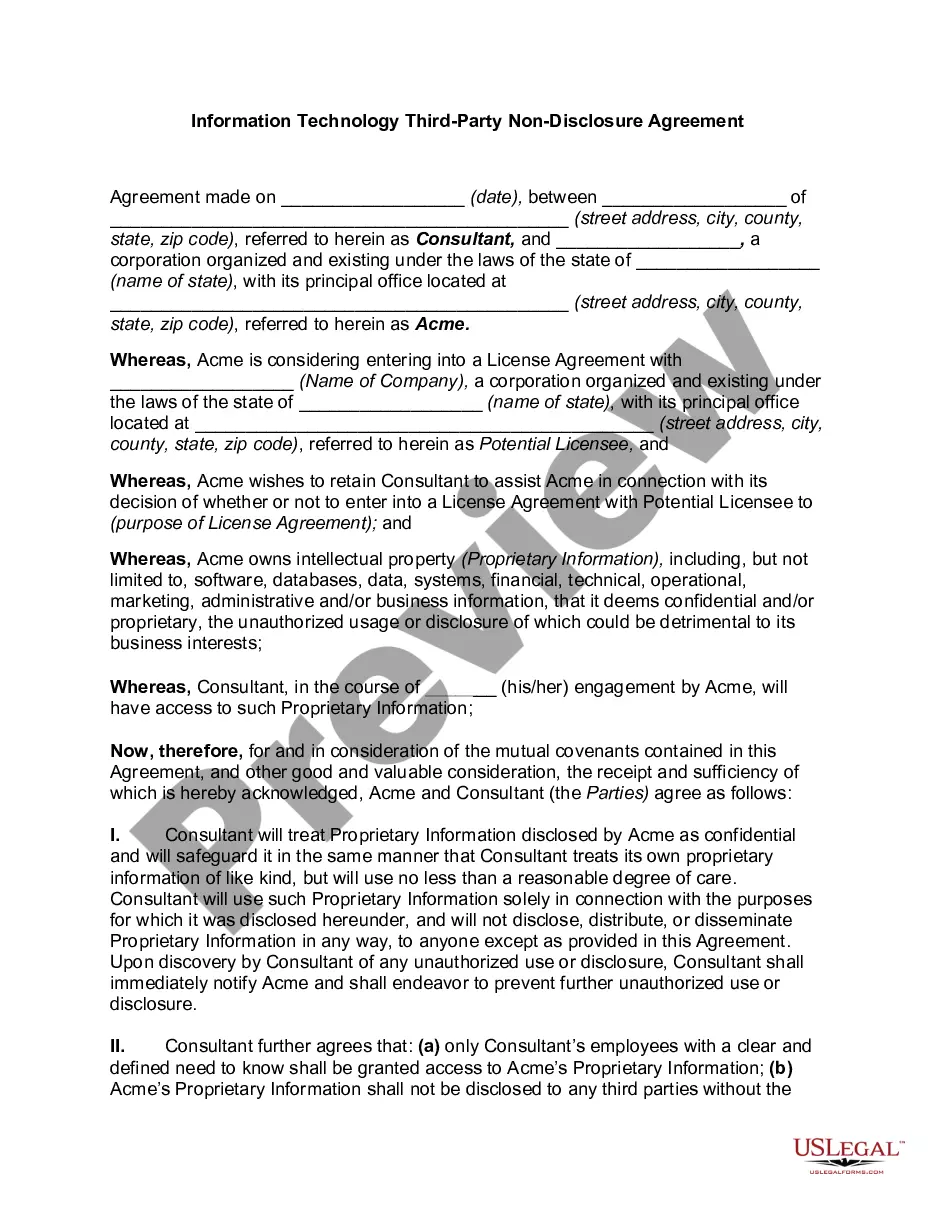

Discovering the right authorized record design might be a have a problem. Of course, there are a variety of themes available on the net, but how will you find the authorized type you will need? Utilize the US Legal Forms internet site. The service gives 1000s of themes, like the Oregon Term Royalty Deed for Term of Existing Lease, which you can use for company and personal needs. Each of the forms are inspected by experts and meet federal and state demands.

Should you be presently authorized, log in to the bank account and click the Obtain switch to find the Oregon Term Royalty Deed for Term of Existing Lease. Use your bank account to check through the authorized forms you may have acquired in the past. Go to the My Forms tab of your own bank account and have one more copy of your record you will need.

Should you be a fresh customer of US Legal Forms, listed below are simple directions so that you can adhere to:

- First, make sure you have chosen the proper type for your personal area/region. You can look over the form making use of the Review switch and study the form description to guarantee it will be the best for you.

- In case the type will not meet your needs, take advantage of the Seach industry to get the proper type.

- Once you are positive that the form would work, go through the Acquire now switch to find the type.

- Choose the pricing plan you would like and type in the needed details. Create your bank account and buy the transaction utilizing your PayPal bank account or charge card.

- Select the document formatting and obtain the authorized record design to the gadget.

- Comprehensive, revise and print out and indication the acquired Oregon Term Royalty Deed for Term of Existing Lease.

US Legal Forms is the greatest library of authorized forms where you will find various record themes. Utilize the service to obtain skillfully-produced paperwork that adhere to status demands.

Form popularity

FAQ

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

When the mineral interest owner becomes inactive or simply abandons the parcel of land and stops exploring or exploiting oil and gas and other resources ? as well as the oil and gas wells ? present beneath the land for an extended period, the rights may become abandoned. As a result, the mineral rights expire.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Non-Apportionment Rule The rule?followed in the majority of states?that royalties accruing under a lease on property that has been subdivided after the lease grant are not to be shared by the owners of the various subdivisions but belong exclusively to the owner of the subdivision where the producing well is located.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

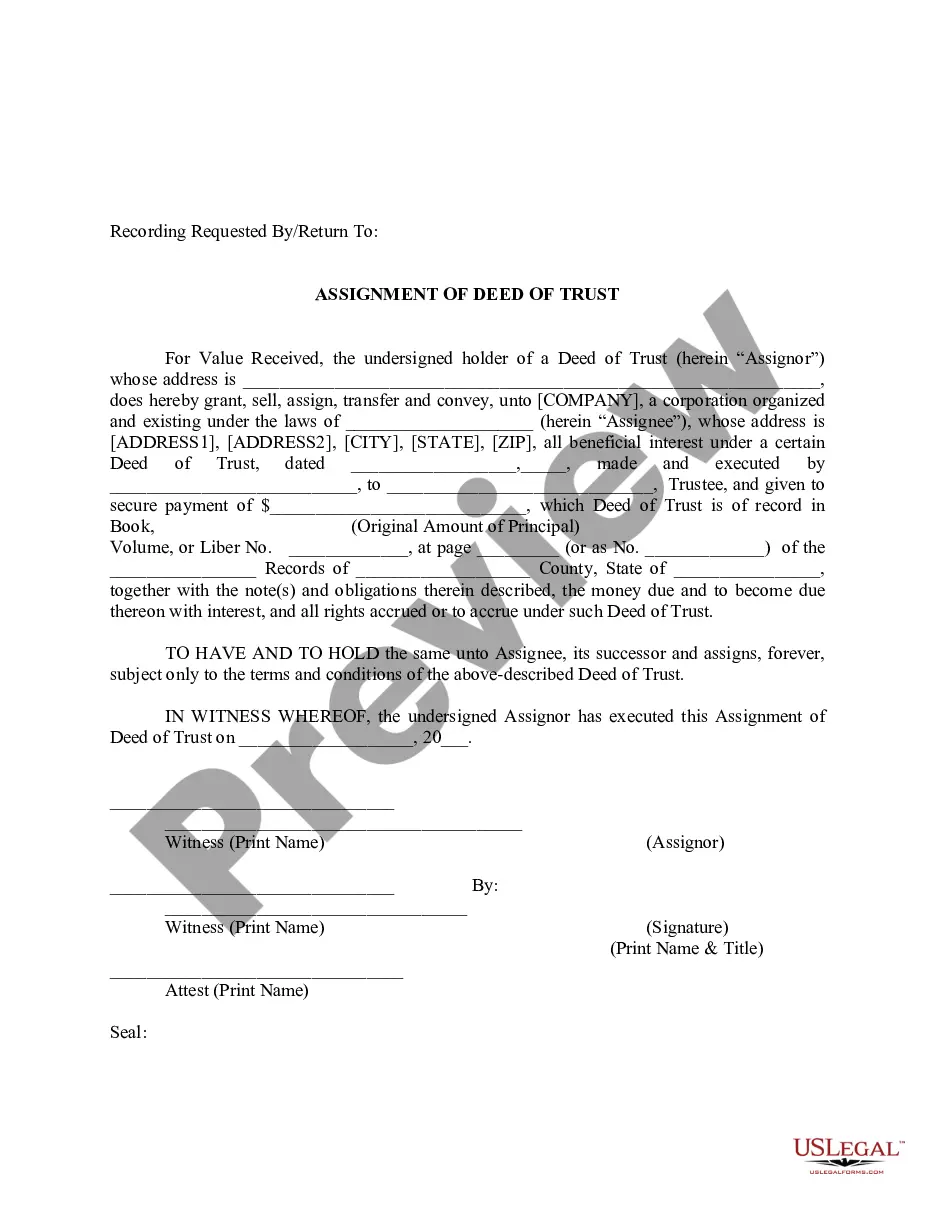

After confirming your legal ownership with an attorney at law, you need to draw up a deed of transfer form in your name and register it with the county records office as the mineral owner.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.