Oregon Self-Employed Utility Services Contract

Description

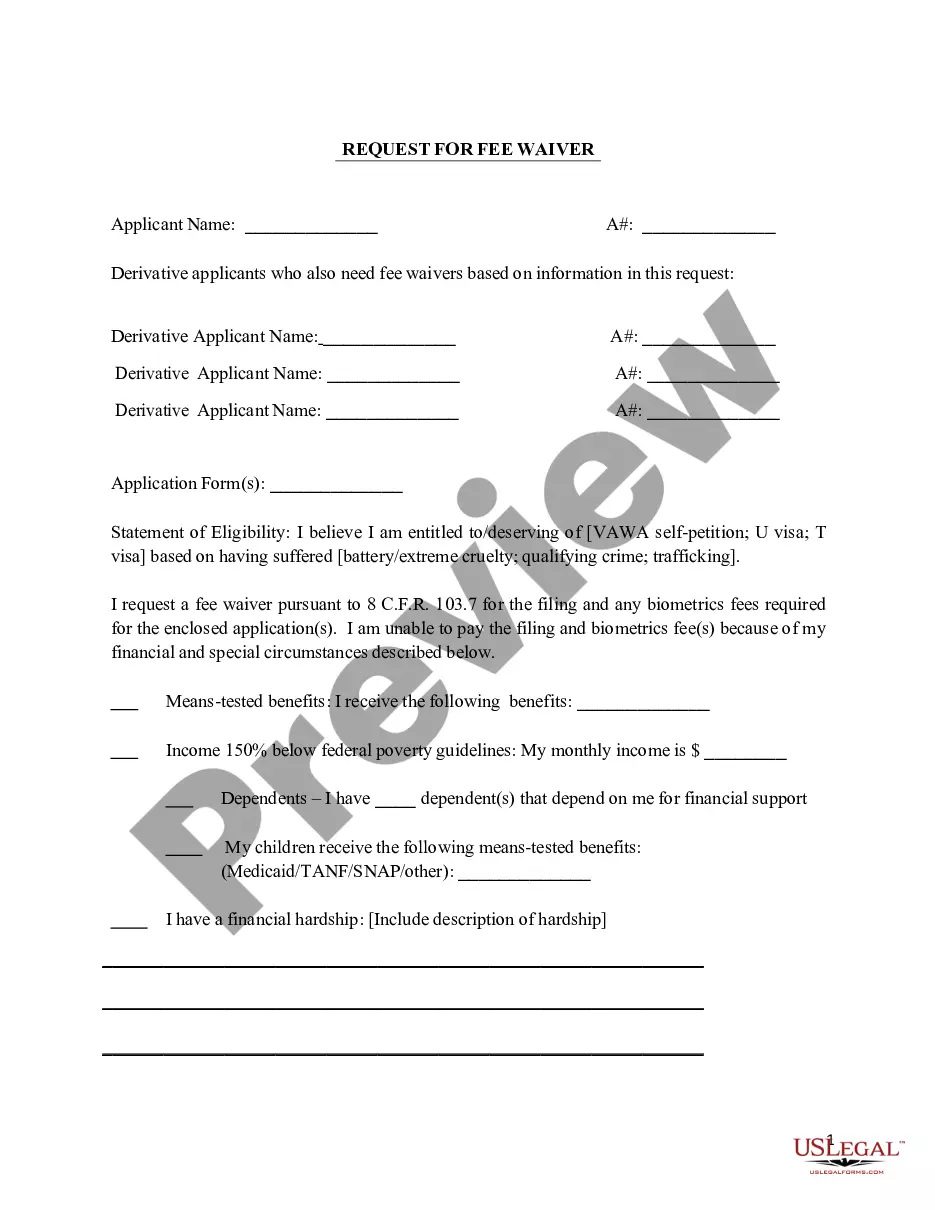

How to fill out Self-Employed Utility Services Contract?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Oregon Self-Employed Utility Services Contract within minutes.

If you already possess a subscription, Log In and download the Oregon Self-Employed Utility Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

If you're planning to use US Legal Forms for the first time, here are simple steps to get started: Make sure you have selected the correct form for your city/county. Click the Review option to examine the form’s content. Check the form description to confirm that you have chosen the right form. If the form does not meet your needs, use the Search section at the top of the page to find one that does. If you are content with the form, confirm your choice by clicking the Acquire now button. Then, select the payment plan you prefer and provide your details to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Oregon Self-Employed Utility Services Contract. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- Access the Oregon Self-Employed Utility Services Contract with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In Oregon, a handyman can perform some electrical work, but there are strict regulations. For extensive electrical tasks, a licensed electrician is required by law. When drafting your Oregon Self-Employed Utility Services Contract, it is essential to clarify the scope of your services and ensure compliance with local regulations to avoid legal issues.

An independent contractor in Oregon is an individual or business that offers services to clients under a contractual agreement. Unlike employees, independent contractors maintain control over their work and typically operate their businesses. When creating your Oregon Self-Employed Utility Services Contract, it is important to define your role clearly to ensure clients understand your status and the services you provide.

Determining your status as an independent contractor involves several factors. The level of control you have over how you perform your work is crucial, as well as whether you decide your work hours and methods. Additionally, if you work for multiple clients and are responsible for your taxes, you likely qualify as an independent contractor, which is vital to specify in your Oregon Self-Employed Utility Services Contract.

In Oregon, an independent contractor is typically someone who provides services to clients without being an employee. Key qualifications include having the freedom to set your work hours, using your tools for the job, and being responsible for your business expenses. Understanding these criteria is essential when drafting your Oregon Self-Employed Utility Services Contract, as it helps define your status and responsibilities.

To establish yourself as an independent contractor in Oregon, you need to take several steps. First, register your business, which could involve obtaining a business license. Next, create a solid Oregon Self-Employed Utility Services Contract that outlines your services, rates, and responsibilities. This contract not only formalizes your role but also protects your rights and clarifies your obligations.

In Oregon, the amount of work you can perform without a contractor license varies based on the type of services provided. Generally, if the total project value is below a certain threshold, a license may not be required. However, it is wise to check specific regulations and consider creating an Oregon Self-Employed Utility Services Contract to protect your business and clarify your scope of work.

Yes, contract work is generally considered a form of self-employment. Contractors operate their own businesses and are responsible for their taxes and business expenses. For those engaged in contract work, knowing how to draft an Oregon Self-Employed Utility Services Contract is important for protecting your rights and outlining your responsibilities.

Self-employed individuals work for themselves and manage their own businesses, while contracted workers are hired by clients to complete specific projects. Self-employed persons may operate under various business models, whereas contracted workers often work under an agreement for a limited duration. Understanding these distinctions is crucial when forming an Oregon Self-Employed Utility Services Contract.

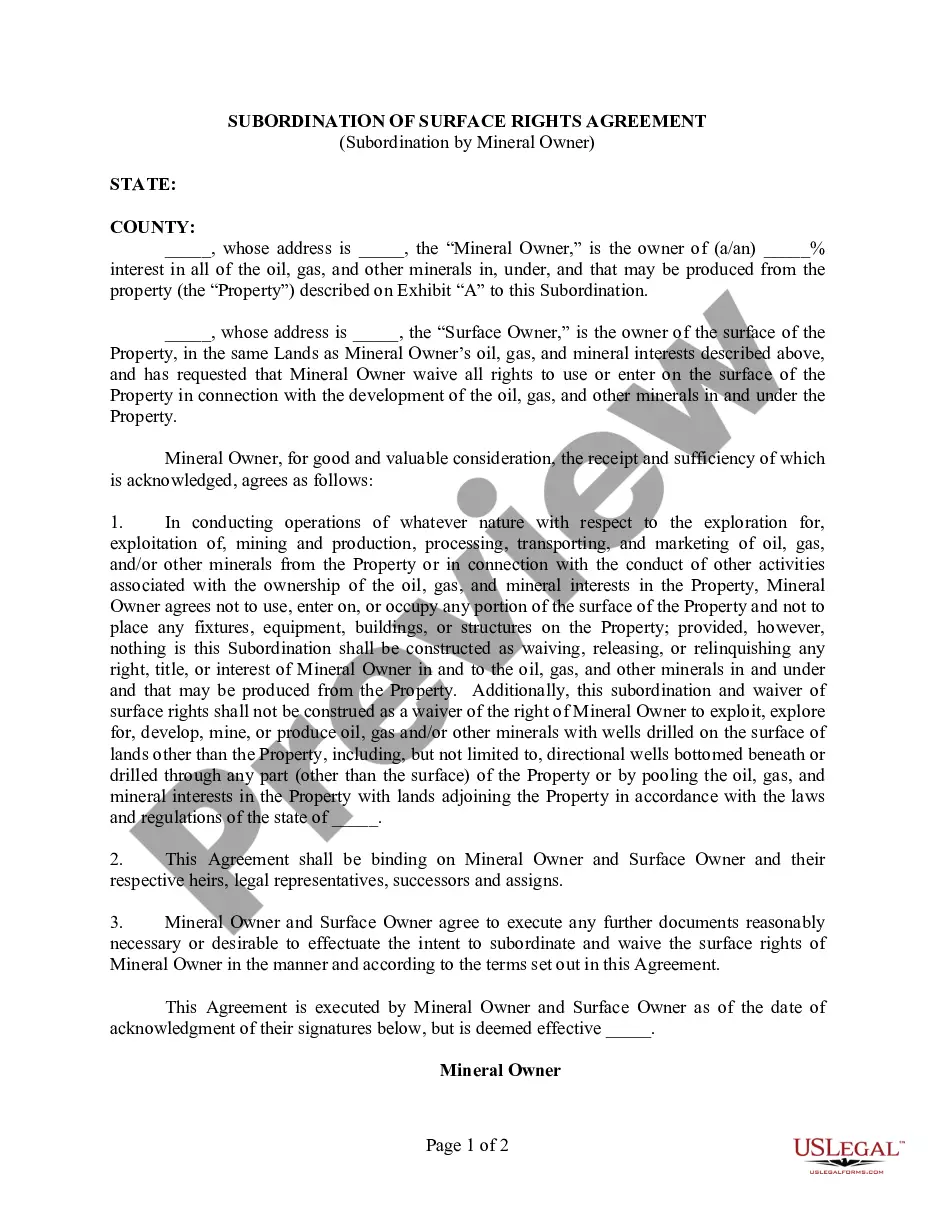

An independent contractor agreement in Oregon is a legal document that outlines the relationship between a contractor and a client. This agreement typically includes details about the services provided, payment terms, and confidentiality clauses. Utilizing an Oregon Self-Employed Utility Services Contract can simplify this process and ensure compliance with state laws.

Absolutely, as a self-employed individual, having a contract is essential. Contracts provide legal protection and clarify the scope of work and payment terms. An Oregon Self-Employed Utility Services Contract can help formalize your agreements and ensure that you and your clients are on the same page.