Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a wide variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor in seconds.

If you already have a membership, Log In and download the Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the payment. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours permanently. So, to download or print another version, just visit the My documents section and click on the form you need. Access the Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

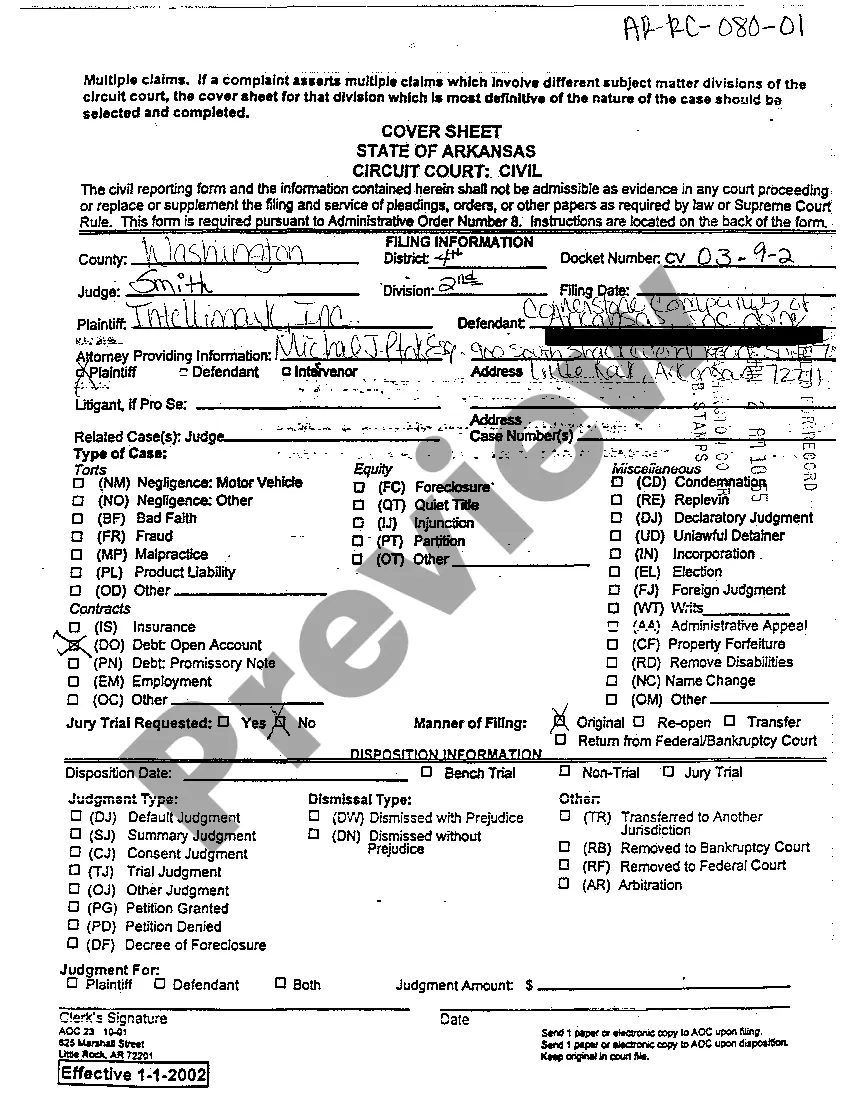

- Make sure you have selected the correct form for your city/state. Click on the Preview button to review the form's content.

- Read the form summary to ensure you have chosen the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, independent contractors, including Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractors, usually need a business license. This requirement can vary by location, so it is essential to check with your local city or county government. Obtaining a business license not only adds credibility to your services but also ensures compliance with local regulations.

As an Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor, you are subject to self-employment tax on your net earnings. This tax covers Social Security and Medicare, and it typically amounts to approximately 15.3%. You should calculate this tax when filing your federal tax return. It's also wise to set aside funds throughout the year to ensure you're prepared for this obligation.

Filling out Schedule C as an Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor requires you to gather your income and expenses. Start by reporting your total income from your x-ray services. Next, list your business expenses, such as equipment, supplies, and advertising costs. Make sure to keep track of your receipts and documentation to support your claims.

Establishing yourself as an independent contractor involves several key steps. First, you need to define your business structure and register your business name if necessary. Next, obtain any required licenses or certifications relevant to your field, such as those for an Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor. Finally, consider utilizing platforms like USLegalForms to access the necessary legal documents and contracts that can help you formalize your independent contractor status and protect your interests.

In Oregon, an independent contractor is typically someone who provides services under their own business name, maintains control over how their work is performed, and is not subject to the control of an employer. Specifically, an Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor must meet certain criteria set forth by state law, including having a written contract and the ability to work for multiple clients. This classification allows for greater flexibility and autonomy in your professional practice. Knowing these requirements can help you secure your status as an independent contractor.

The new federal rule on independent contractors clarifies the criteria used to determine whether a worker qualifies as an independent contractor or an employee. This rule emphasizes the importance of economic dependence and the degree of control a worker has over their work. For those considering becoming an Oregon Self-Employed X-Ray Technician Self-Employed Independent Contractor, understanding this rule is essential. It helps you navigate your legal responsibilities and rights while maximizing your business opportunities.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

File an unemployment claim 200bUse the Contact Us form or visit unemployment.oregon.gov. Looking for work? WorkSource Oregon can help you find a job, training and other free resources. 200b200b200b200b200bWe have helped more than 1500 Oregonians receiving unemployment insurance (UI) benefits successfully start their own business.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.