Oregon Survey Assistant Contract - Self-Employed

Description

How to fill out Survey Assistant Contract - Self-Employed?

If you seek to be thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's user-friendly and efficient search function to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Oregon Survey Assistant Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again.

Compete and download, and print the Oregon Survey Assistant Contract - Self-Employed with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Oregon Survey Assistant Contract - Self-Employed.

- You can also access forms you have previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions provided.

- Step 1. Ensure you have selected the form for the correct city/state.

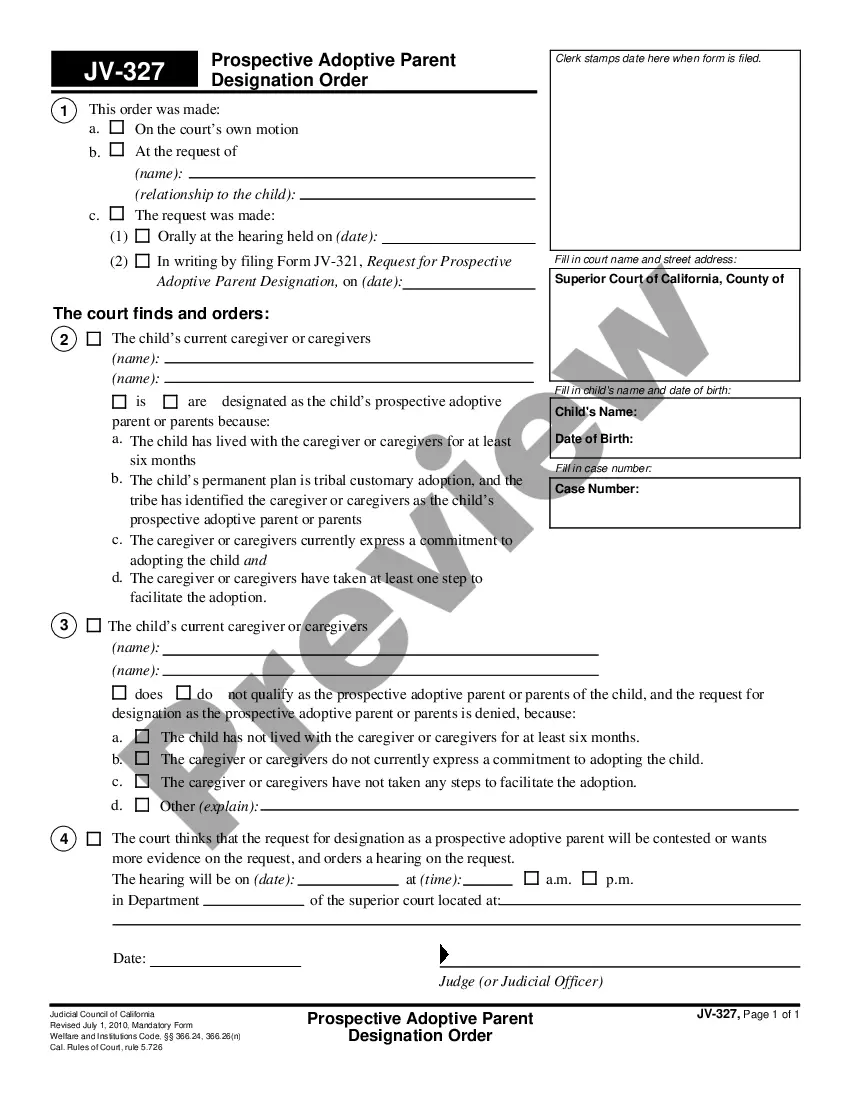

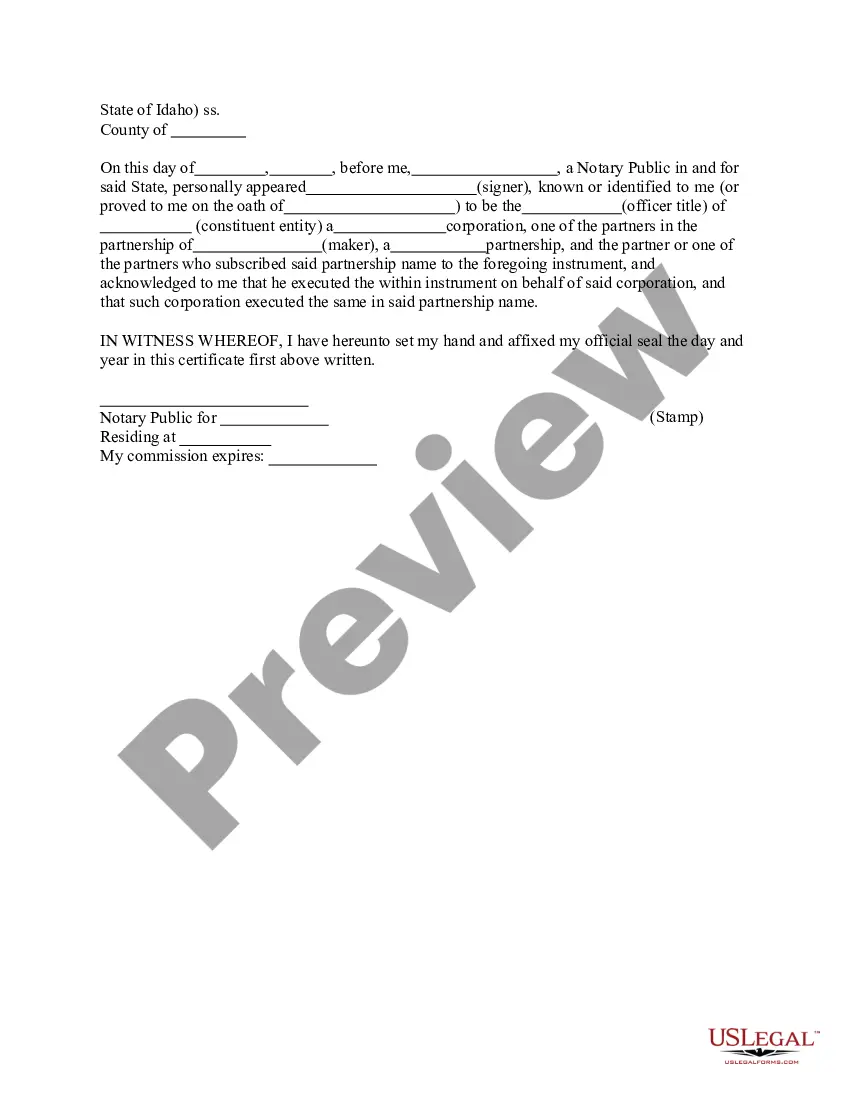

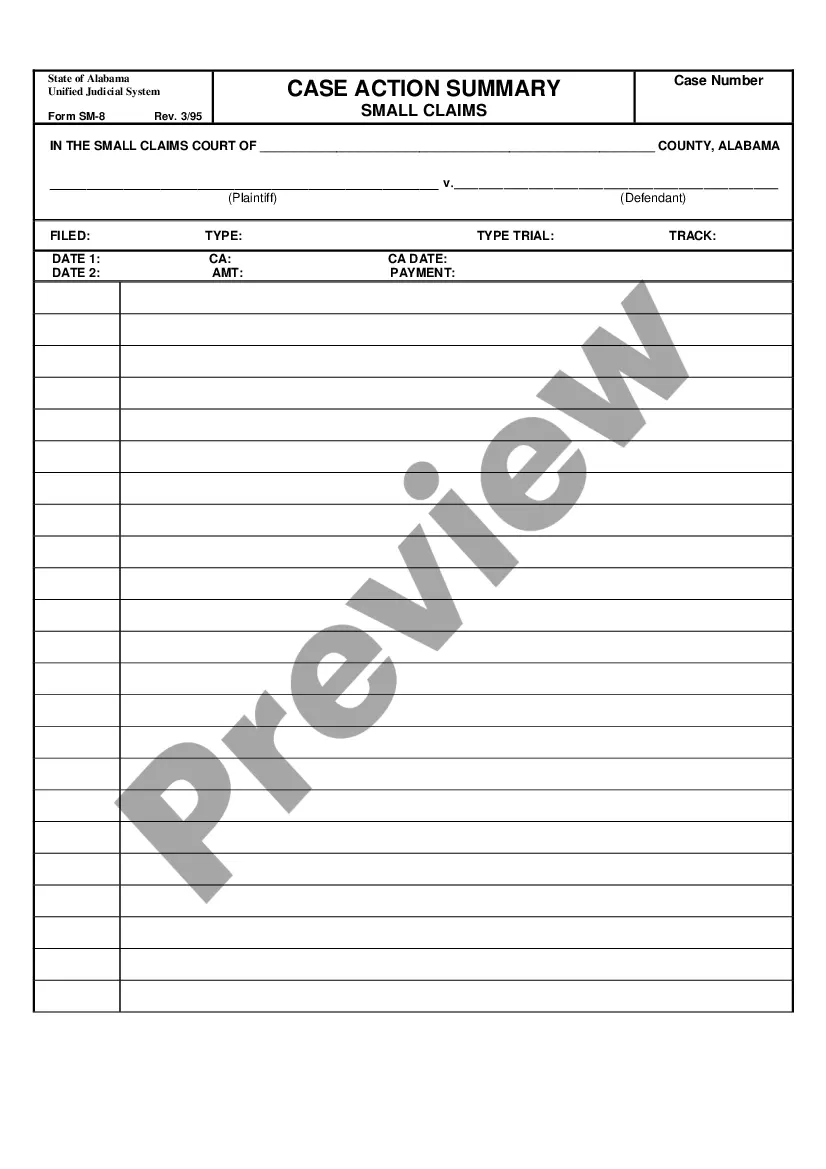

- Step 2. Use the Preview option to review the form's details. Remember to read through the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternate versions of the legal form template.

- Step 4. Once you have found the form you want, click the Download now button. Choose the payment plan you prefer and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Survey Assistant Contract - Self-Employed.

Form popularity

FAQ

To write a self-employment contract, start by clearly defining the nature of your services and expectations from both parties. Incorporate specifics such as payment methods, timelines, and any relevant conditions that pertain to your Oregon Survey Assistant Contract - Self-Employed. Using platforms like U.S. Legal Forms can simplify this process, offering templates and guidance to ensure compliance with legal standards.

Yes, you can certainly write your legally binding contract, including an Oregon Survey Assistant Contract - Self-Employed. To ensure its validity, include all necessary components like the terms of service, signatures from both parties, and any legal requirements specific to your state. Creating your contract gives you flexibility to personalize agreements based on your work and needs.

When drafting a contract for a 1099 employee, ensure you include essential details like job responsibilities, payment structure, and work timelines. It is crucial to specify that this is an Oregon Survey Assistant Contract - Self-Employed, which will highlight the independent nature of the work relationship. Including such elements provides clarity and helps avoid disputes in the future.

Writing a self-employed contract involves clearly defining the scope of work, payment terms, and deadlines between you and your client. Start by outlining the services you will provide and include any specific requirements necessary for your Oregon Survey Assistant Contract - Self-Employed. Remember to include clauses about confidentiality and termination to protect both parties involved.

To show proof of your self-employment, you can provide documents like a business license, tax returns, or bank statements that reflect your business income. Additionally, you may present your Oregon Survey Assistant Contract - Self-Employed, which outlines your work terms and client agreements. Gathering these documents can help establish your independent status clearly to clients or tax authorities.

The earnings of self-employed land surveyors can vary widely in Oregon based on experience, location, and type of projects. On average, they may earn a substantial income, especially when managing multiple contracts at once. By leveraging the Oregon Survey Assistant Contract - Self-Employed, surveyors can ensure transparent agreements that reflect their expertise, which may enhance their earning potential.

Yes, it is illegal to remove survey stakes in Oregon without proper authorization. Survey stakes serve as vital markers for property boundaries and project layouts. By understanding the regulations surrounding land surveying and utilizing the Oregon Survey Assistant Contract - Self-Employed, you can navigate these legal matters effectively.

Self-employed surveyors in Oregon often earn competitive rates that can vary based on experience and project type. Many factors can influence your earnings, including your business model and the demand for your services. Utilizing the Oregon Survey Assistant Contract - Self-Employed ensures you set clear terms and payment structures, potentially increasing your income.

Certainly, you can be a self-employed land surveyor in Oregon. This status allows for greater flexibility in choosing projects and managing your time. With the right documentation, such as the Oregon Survey Assistant Contract - Self-Employed, you can protect both your interests and those of your clients.

Yes, you can start your own land surveying business in Oregon. To do so, it is essential to understand the requirements for establishing this type of business. Using the Oregon Survey Assistant Contract - Self-Employed can help you outline crucial aspects like fees, services offered, and client agreements, making the process smoother.