Oregon Professional Fundraiser Services Contract - Self-Employed

Description

How to fill out Professional Fundraiser Services Contract - Self-Employed?

Finding the appropriate valid document template can be a challenge. Certainly, there is a multitude of templates available online, but how do you locate the correct form you require? Use the US Legal Forms website.

The service offers thousands of templates, including the Oregon Professional Fundraiser Services Agreement - Self-Employed, which can be utilized for both business and personal purposes. All of the documents are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Oregon Professional Fundraiser Services Agreement - Self-Employed. Utilize your account to search through the legal documents you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you require.

Complete, edit, print, and sign the obtained Oregon Professional Fundraiser Services Agreement - Self-Employed. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to download professionally crafted files that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

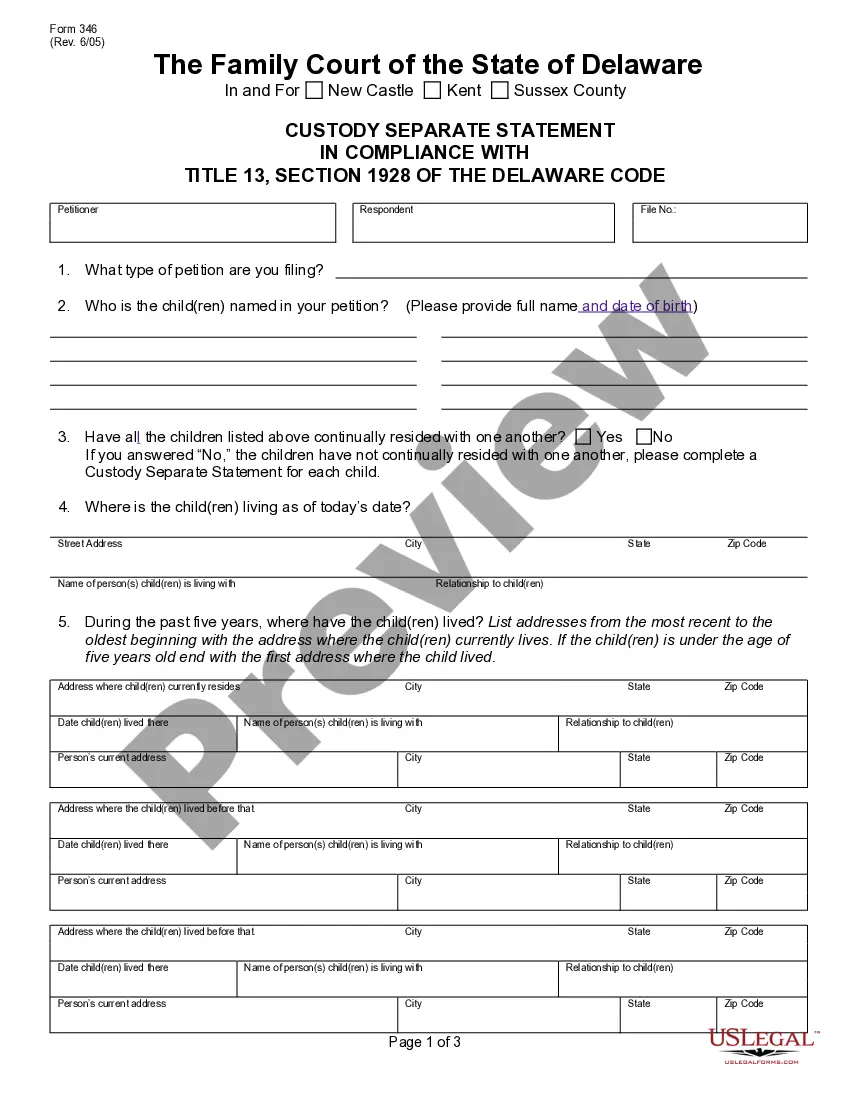

- First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and read the form description to make sure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Purchase now button to buy the form.

- Select the pricing plan you want and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the valid document template onto your device.

Form popularity

FAQ

The 33% rule for nonprofits suggests that at least 33% of a nonprofit's budget should be spent on direct services rather than administrative costs. This guideline helps maintain a balance between operational needs and mission-driven work. Fulfilling this rule can enhance trust among donors and stakeholders. To create a clearer financial plan, consider using the Oregon Professional Fundraiser Services Contract - Self-Employed to guide your operations.

The 33 percent rule refers to a guideline where a nonprofit organization should allocate at least 33% of its funding to direct charitable activities. This rule supports the idea that a significant portion of donations should directly benefit the cause. Adhering to this rule can increase donor confidence and ensure sustainability. Employing the Oregon Professional Fundraiser Services Contract - Self-Employed can help organizations focus their financial strategies effectively.

The IRS establishes several rules for nonprofit organizations, including maintaining tax-exempt status and adhering to specific reporting requirements. Nonprofits must operate primarily for charitable purposes and provide public benefit. It is critical for organizations to keep detailed records and file annual returns to avoid penalties. Utilizing resources like the Oregon Professional Fundraiser Services Contract - Self-Employed ensures compliance with these IRS regulations.

A professional fundraiser is an individual or organization that is hired to conduct fundraising activities on behalf of a nonprofit. They typically possess expertise in soliciting donations, managing campaigns, and organizing events. It's essential that professional fundraisers comply with state regulations, including the Oregon Professional Fundraiser Services Contract - Self-Employed, to ensure ethical practices are followed. This way, both the nonprofit and the fundraiser can operate transparently.

The 80 20 rule, also known as the Pareto Principle, suggests that 80% of a nonprofit's fundraising generally comes from 20% of its donors. This principle highlights the importance of identifying and nurturing relationships with key supporters. By focusing on this small group, your organization can maximize its fundraising efficiency. Using the Oregon Professional Fundraiser Services Contract - Self-Employed can streamline your engagement with these vital contributors.

The 33 rule for nonprofit organizations states that at least 33% of the organization's total income must come from contributions and donations, rather than other sources like grants or fundraising activities. This guideline encourages nonprofits to build strong relationships with their supporters. Following this rule can enhance transparency and trust. For those interested in compliance, consider the Oregon Professional Fundraiser Services Contract - Self-Employed to structure your fundraising efforts.

The CT 12 form in Oregon is a registration form that professional fundraisers must submit to the Oregon Secretary of State. This form helps the state monitor fundraising activities and ensure compliance with state regulations. When engaging in fundraising activities, particularly under the Oregon Professional Fundraiser Services Contract - Self-Employed, it’s crucial to complete the CT 12 to maintain transparency and legal standing.

A professional fundraiser is an individual or organization that is hired to solicit donations on behalf of a nonprofit. Their expertise helps nonprofits maximize fundraising efforts, ensuring compliance with legal requirements, such as those outlined in the Oregon Professional Fundraiser Services Contract - Self-Employed. This can significantly increase the effectiveness of your fundraising campaigns and build long-lasting donor relationships.

The rule of 7 in fundraising suggests that potential donors need to see or hear your message about seven times before they make a decision to donate. By consistently communicating your mission and goals, you strengthen the chances of engaging donors effectively. Implementing strategies aligned with the Oregon Professional Fundraiser Services Contract - Self-Employed can help ensure your messaging reaches and resonates with your audience multiple times.

Yes, a nonprofit can hire 1099 employees, commonly known as independent contractors. Utilizing 1099 employees allows nonprofits to engage skilled professionals without the expenses associated with traditional employment. However, it is crucial to ensure that these individuals meet the IRS criteria for independent contractors. When considering the Oregon Professional Fundraiser Services Contract - Self-Employed, nonprofits should carefully assess their contracts to secure compliance and protect their interests.