Oregon Farm Hand Services Contract - Self-Employed

Description

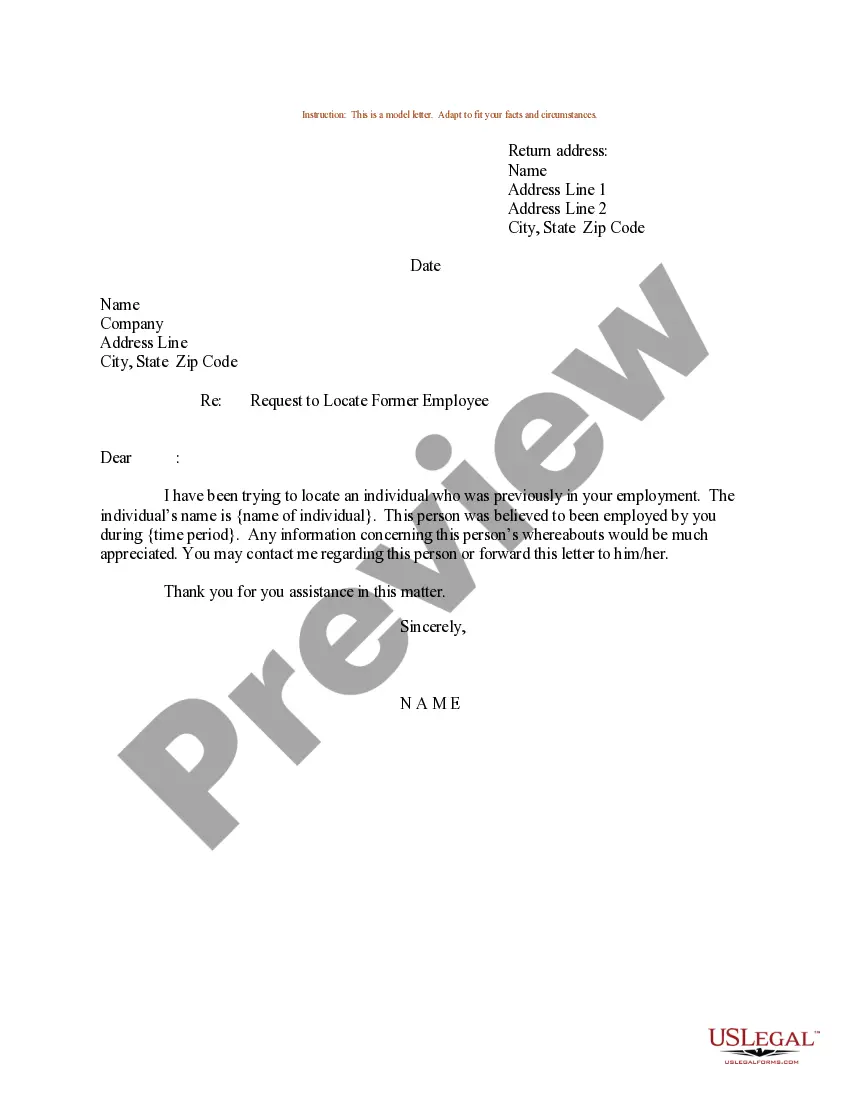

How to fill out Farm Hand Services Contract - Self-Employed?

If you require extensive, download, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site’s straightforward and user-friendly search to find the documents you need. Various templates for commercial and personal use are categorized by type and jurisdiction, or keywords. Use US Legal Forms to locate the Oregon Farm Hand Services Contract - Self-Employed in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Oregon Farm Hand Services Contract - Self-Employed. You can also access forms you previously obtained in the My documents section of your account.

If you are using US Legal Forms for the first time, refer to the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary. Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative models in the legal form catalog. Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for the account. Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Oregon Farm Hand Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- You have access to every form you acquired in your account.

- Select the My documents section and choose a form to print or download again.

- Compete and download, and print the Oregon Farm Hand Services Contract - Self-Employed with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal requirements.

Form popularity

FAQ

New rules for the self-employed include adjustments to tax regulations and benefits eligibility. As a self-employed individual working under an Oregon Farm Hand Services Contract - Self-Employed, staying informed about these changes can impact your financial planning. Utilizing resources like uslegalforms can aid in understanding these regulations and help you stay compliant.

employed person can indeed have a contract, and it is highly recommended. An Oregon Farm Hand Services Contract SelfEmployed not only formalizes your agreements but also protects your interests. This written agreement can streamline your work relationships and ensure clarity in your professional engagements.

Yes, labor laws do apply to 1099 independent workers in Oregon, but in different ways than to traditional employees. Under an Oregon Farm Hand Services Contract - Self-Employed, you are afforded certain protections, yet you also face unique responsibilities. Understanding these laws can help you navigate your rights and obligations effectively.

Absolutely, contract work is a form of self-employment. When you engage in work through an Oregon Farm Hand Services Contract - Self-Employed, you take on the responsibility of managing your own business matters, including taxes and expenses. This arrangement allows you to build your own clientele and set your own rates.

The terms self-employed and independent contractor are often used interchangeably, but there are subtle differences. An Oregon Farm Hand Services Contract - Self-Employed can encompass both terms, emphasizing your role in managing your own business. Generally, it depends on the context, but highlighting your self-employment status can provide a clearer picture of your work arrangement.

Yes, contract workers are typically classified as self-employed. When you enter into an Oregon Farm Hand Services Contract - Self-Employed, you operate independently, managing your own schedule and responsibilities. This classification often comes with benefits like flexibility, but also requires you to handle your own taxes and insurance.

Yes, as a self-employed individual, you can certainly have a contract. An Oregon Farm Hand Services Contract - Self-Employed helps clarify the terms of your work, responsibilities, and payment. It's crucial to outline these elements to avoid misunderstandings and ensure fair compensation.

It is possible to issue a 1099 form to someone without a business license, but it is not recommended. When providing Oregon Farm Hand Services Contract - Self-Employed, having a business license enhances your assessments and ensures compliance. Always ensure that independent contractors you hire meet all local regulations for a smooth transaction.

Generally, independent contractors in Oregon are required to obtain a business license, depending on the nature of their work and location. A valid business license demonstrates compliance with local regulations, which is important for providing services outlined in an Oregon Farm Hand Services Contract - Self-Employed. It’s advisable to check with your local city or county office to understand specific requirements for your area.

To establish yourself as an independent contractor, start by choosing a business name, then register it with the appropriate state agencies. Next, you may want to create a professional website and utilize online platforms to promote your services, like Oregon Farm Hand Services Contract - Self-Employed. Additionally, building a network of clients and maintaining a solid portfolio can enhance your credibility and attract more business.