Oregon Stone Contractor Agreement - Self-Employed

Description

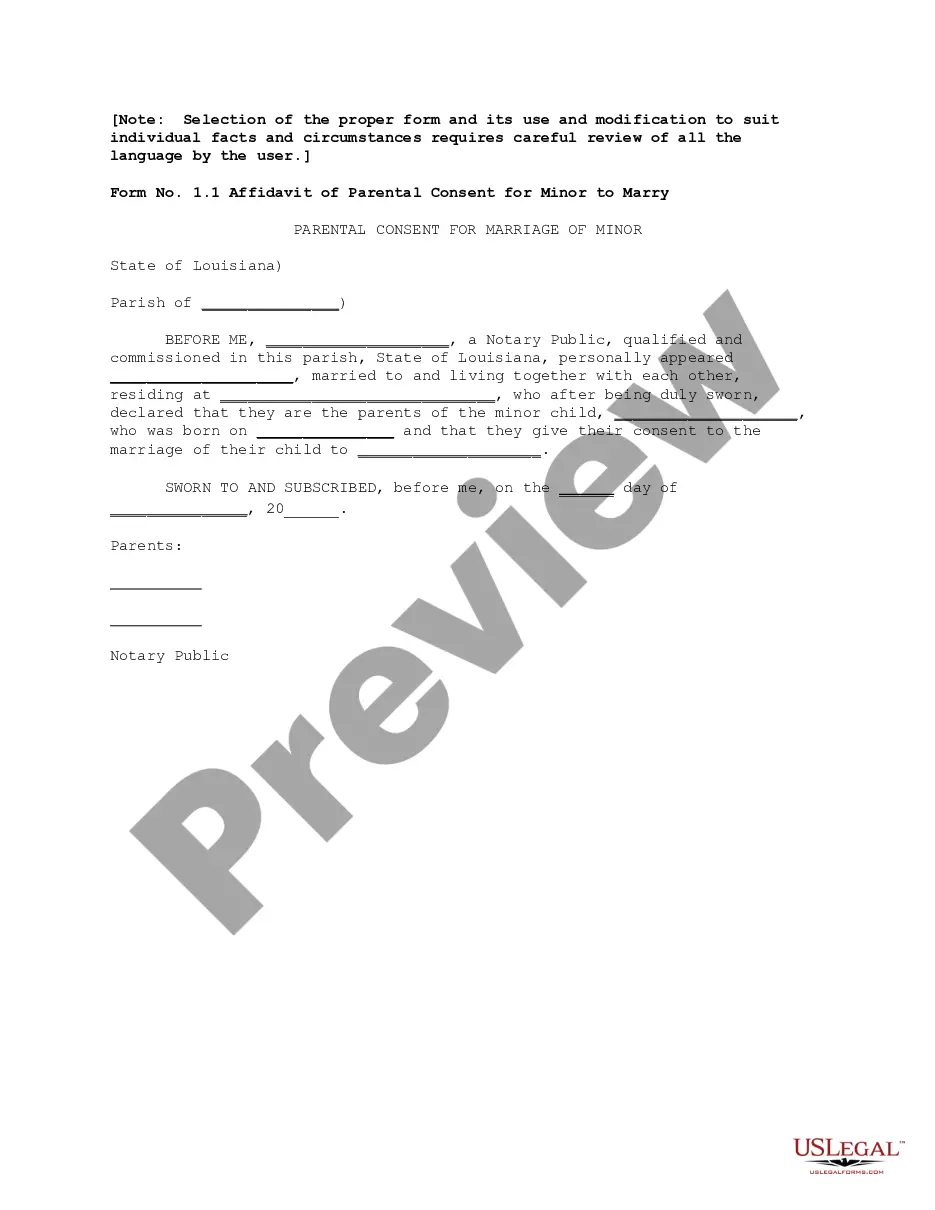

How to fill out Stone Contractor Agreement - Self-Employed?

Finding the appropriate legal document template can be quite a challenge. Clearly, there are numerous templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Oregon Stone Contractor Agreement - Self-Employed, that you can use for business and personal needs. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Oregon Stone Contractor Agreement - Self-Employed. Use your account to check the legal forms you have purchased previously. Visit the My documents tab in your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, make sure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to ensure this is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Get now button to acquire the form. Choose the pricing plan you want and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Oregon Stone Contractor Agreement - Self-Employed.

The process is straightforward, allowing you to manage your legal documentation efficiently.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to download properly crafted documents that comply with state requirements.

- The platform provides a user-friendly interface for easier navigation.

- Templates are tailored to suit different business and personal needs.

- Professional review ensures compliance with legal standards.

- Access forms conveniently from your account dashboard.

Form popularity

FAQ

Writing an independent contractor agreement involves several key components. Begin with the titles and contact information of both parties, then describe the work to be performed. Clearly outline payment terms and deadlines, and establish confidenitality clauses if necessary. By structuring your agreement thoughtfully, you reinforce the terms of your Oregon Stone Contractor Agreement - Self-Employed.

To fill out an independent contractor form, start with basic information such as your name, address, and Social Security number. Include the nature of the work, payment terms, and the duration of the agreement. Ensure that you follow any specific format or requirements mentioned in the Oregon Stone Contractor Agreement - Self-Employed. Accurate details help clarify expectations for both parties.

Yes, independent contractors do file as self-employed individuals. They report their income through a Schedule C form when filing taxes. It's important to maintain records of all earnings and expenses related to your work. This filing method supports the flexibility that comes with your Oregon Stone Contractor Agreement - Self-Employed.

Filling out an independent contractor agreement requires clear input from both parties. Start by including the names and addresses of the contractor and the hiring party. Next, detail the scope of work, payment terms, and deadlines. Lastly, specify any confidentiality or non-compete clauses, ensuring all terms align with your Oregon Stone Contractor Agreement - Self-Employed needs.

Creating an independent contractor agreement in Oregon is straightforward. Start by outlining key elements such as the scope of work, payment terms, and deadlines. Utilizing a template for an Oregon Stone Contractor Agreement - Self-Employed can greatly simplify this process, ensuring crucial aspects are included. Platforms like UsLegalForms provide easy access to professional templates, making it easy for you to draft a comprehensive agreement that meets legal requirements.

Yes, a contractor is generally considered self-employed in Oregon. As a self-employed individual, the contractor operates independently, managing their business and making decisions without direct oversight from an employer. This classification applies to those who work under an Oregon Stone Contractor Agreement - Self-Employed, allowing them flexibility in their projects and clients. Understanding this status is important for tax purposes and benefits eligibility.

The independent contractor agreement in Oregon establishes the relationship between a contractor and a client. This legally binding document details the terms of engagement, including payment, responsibilities, and duration of the project. An Oregon Stone Contractor Agreement - Self-Employed helps to clarify expectations, protecting both parties involved. By utilizing this agreement, you ensure a smoother collaboration and minimize potential disputes.