Oregon Cleaning Services Contract - Self-Employed

Description

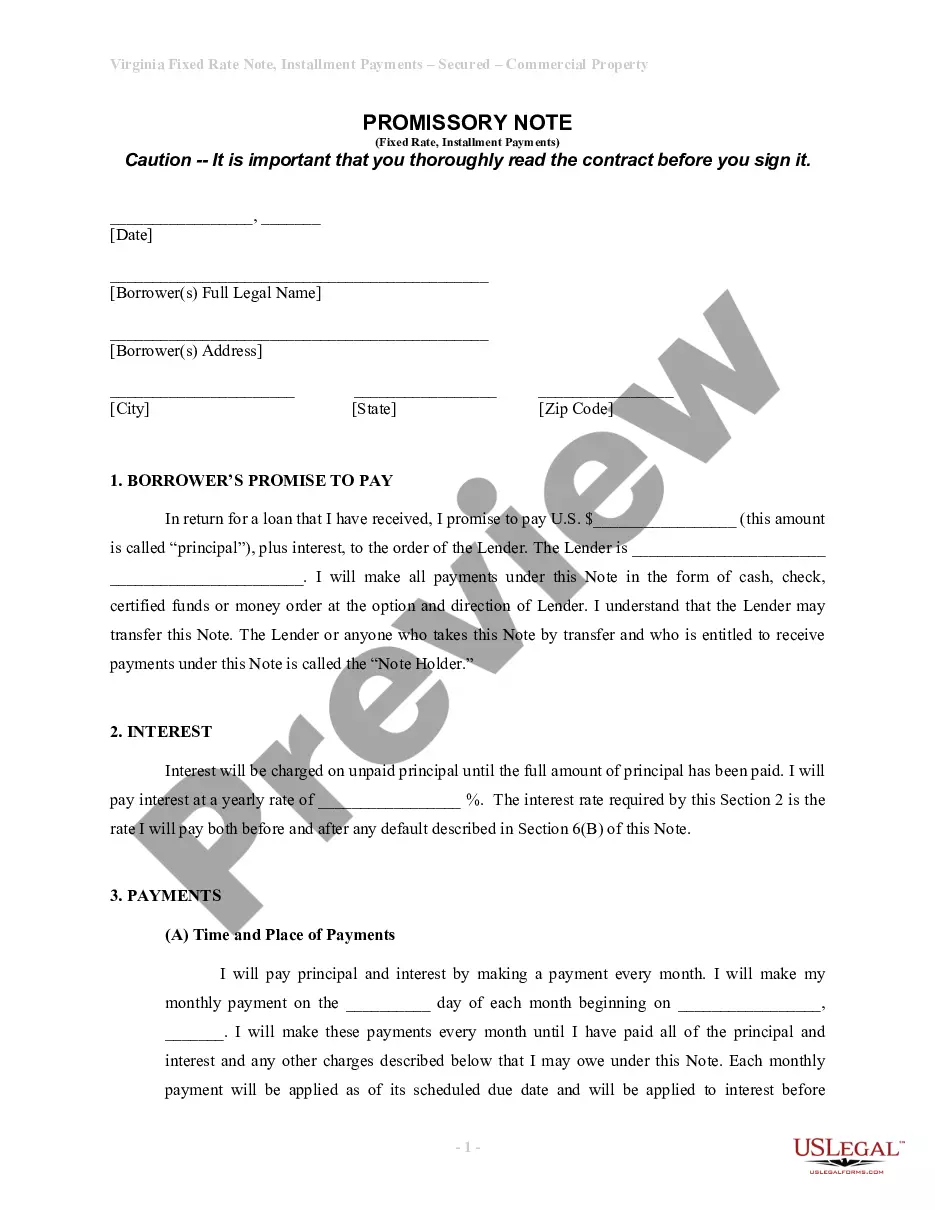

How to fill out Cleaning Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal template designs that you can download or print.

By utilizing the website, you will access thousands of templates for commercial and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of documents like the Oregon Cleaning Services Contract - Self-Employed in moments.

If the document does not meet your needs, utilize the Search box at the top of the page to find one that does.

Once you are satisfied with the document, confirm your choice by clicking the Purchase Now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you already possess a subscription, Log In and download the Oregon Cleaning Services Contract - Self-Employed from the US Legal Forms library.

- The Download button will appear on every document you view.

- You gain access to all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are some simple steps to get you started.

- Ensure you have selected the correct document for your city/state. Click the Review button to examine the content of the document.

- Review the description to confirm you have chosen the appropriate document.

Form popularity

FAQ

To write a contract agreement for cleaning services, start with the names of both parties and the effective date of the agreement. Clearly describe the cleaning services to be performed, along with the payment terms and frequency of service. Additionally, specify any materials or equipment that will be provided. By incorporating these details, an Oregon Cleaning Services Contract - Self-Employed can help protect both parties and ensure clarity in the working relationship.

To write a simple contract agreement, begin by identifying the parties involved and stating the purpose of the contract. Include specific terms, such as the scope of work, payment details, and timelines. Clarity is key, so use straightforward language and avoid vague terms. An effective Oregon Cleaning Services Contract - Self-Employed can serve as a great template for such agreements.

In Oregon, labor laws generally do not apply to 1099 independent contractors, including those engaged in cleaning services. However, you must comply with specific regulations that govern your independent status. It is crucial to understand your responsibilities regarding taxes, benefits, and protections. When you create an Oregon Cleaning Services Contract - Self-Employed, ensure that it clearly distinguishes your independent role.

Independent contractors in Oregon may not need a business license at the state level, but local jurisdictions might have different requirements. A business license can help you comply with local laws and increase your professional image. When working under an Oregon Cleaning Services Contract - Self-Employed, it’s wise to check your city or county’s regulations, as compliance can avoid potential pitfalls in your work.

In Oregon, the amount of work you can perform without a contractor license varies by project type. For most cleaning projects, you may operate without a license, but it’s crucial to understand local regulations that govern your specific services. Always ensure you comply with all applicable laws, especially when engaging in an Oregon Cleaning Services Contract - Self-Employed to protect yourself and your clients.

Setting up a cleaning contract involves defining the scope of work, payment terms, and duration of the agreement. Start by outlining the services you offer and what the client can expect. For an Oregon Cleaning Services Contract - Self-Employed, consider utilizing a template or service like uslegalforms, which can simplify the process and ensure your contract meets state regulations.

While you may not be legally required to register as an independent contractor, doing so can provide you with important protections and benefits. Registering your business can lend credibility and establish a formal presence in the marketplace. If you’re working under an Oregon Cleaning Services Contract - Self-Employed, taking this step can help you navigate tax obligations and potential legal issues more effectively.

Yes, you can issue a 1099 form to someone without a business license, as long as they meet criteria established by the IRS. However, having a business license often indicates professionalism and compliance with local regulations. This is especially true when working on an Oregon Cleaning Services Contract - Self-Employed, where adherence to local laws enhances trust and credibility.

To become a subcontractor for cleaning services, start by gaining experience in the cleaning industry and networking with established companies. You’ll want to demonstrate your skills and build a portfolio. Additionally, utilizing an Oregon Cleaning Services Contract - Self-Employed can clarify your obligations and ensure a smooth working relationship with primes or contractors hiring subcontractors.

Yes, as an independent contractor in Oregon, you usually need a business license. This requirement can vary based on your location and the services you provide. Having a valid business license can bolster your reputation and make your Oregon Cleaning Services Contract - Self-Employed more credible in the eyes of potential customers.