Oregon Loan Modification Agreement - Multistate

Description

How to fill out Loan Modification Agreement - Multistate?

If you wish to comprehensive, download, or print out legal file templates, use US Legal Forms, the biggest variety of legal forms, that can be found on the web. Use the site`s simple and easy convenient research to get the documents you need. Numerous templates for organization and person reasons are categorized by groups and says, or keywords. Use US Legal Forms to get the Oregon Loan Modification Agreement - Multistate with a handful of clicks.

Should you be currently a US Legal Forms consumer, log in to the profile and click the Down load option to obtain the Oregon Loan Modification Agreement - Multistate. Also you can access forms you in the past delivered electronically inside the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your correct area/country.

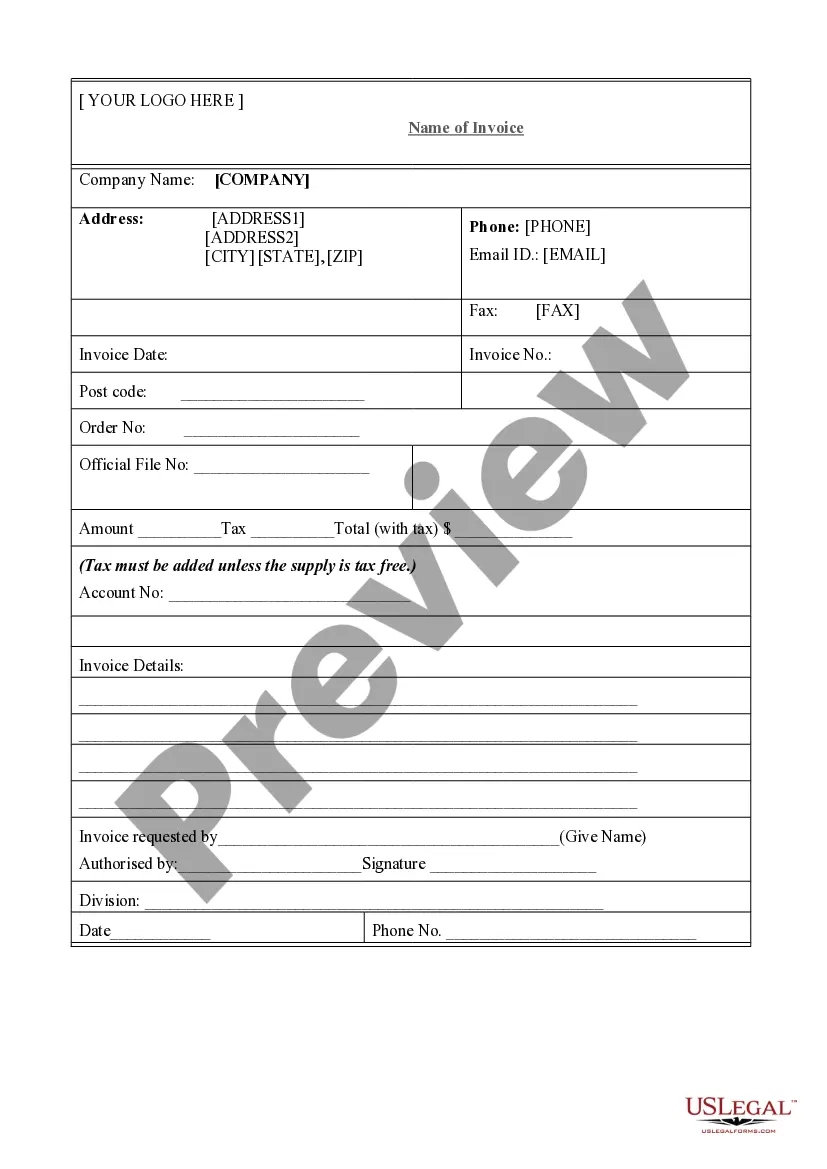

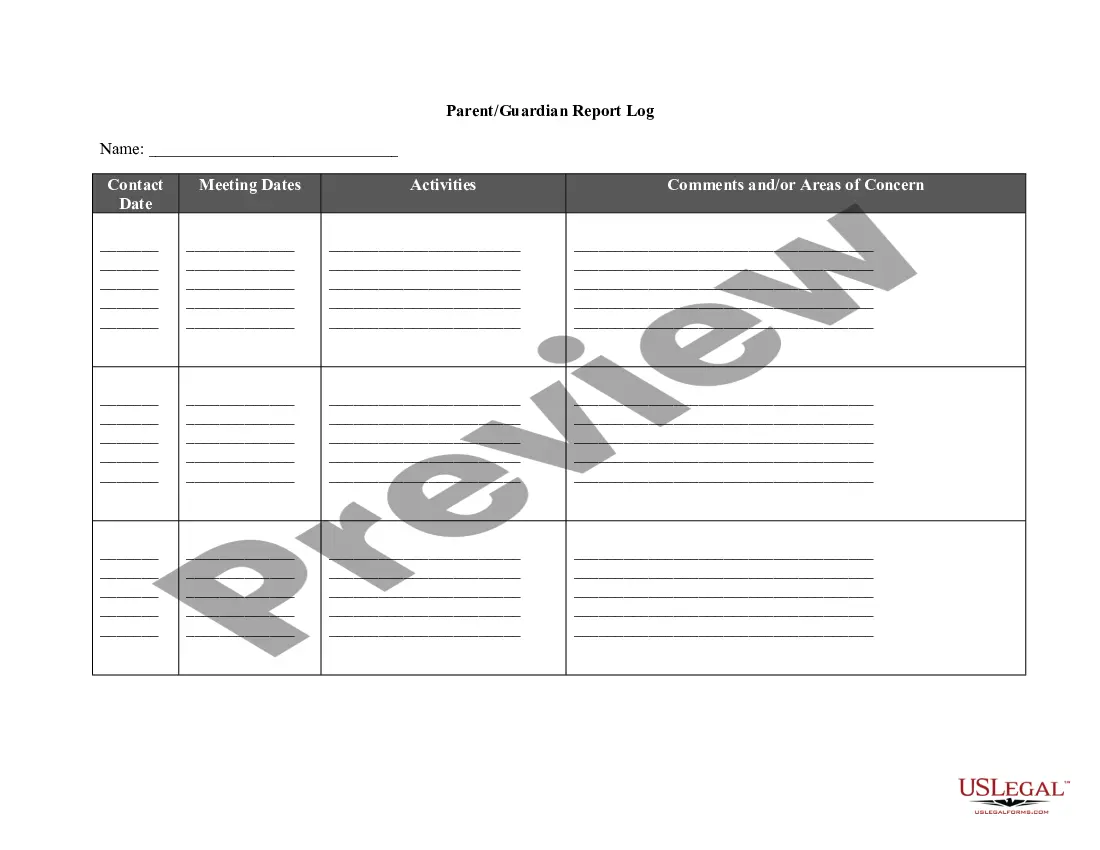

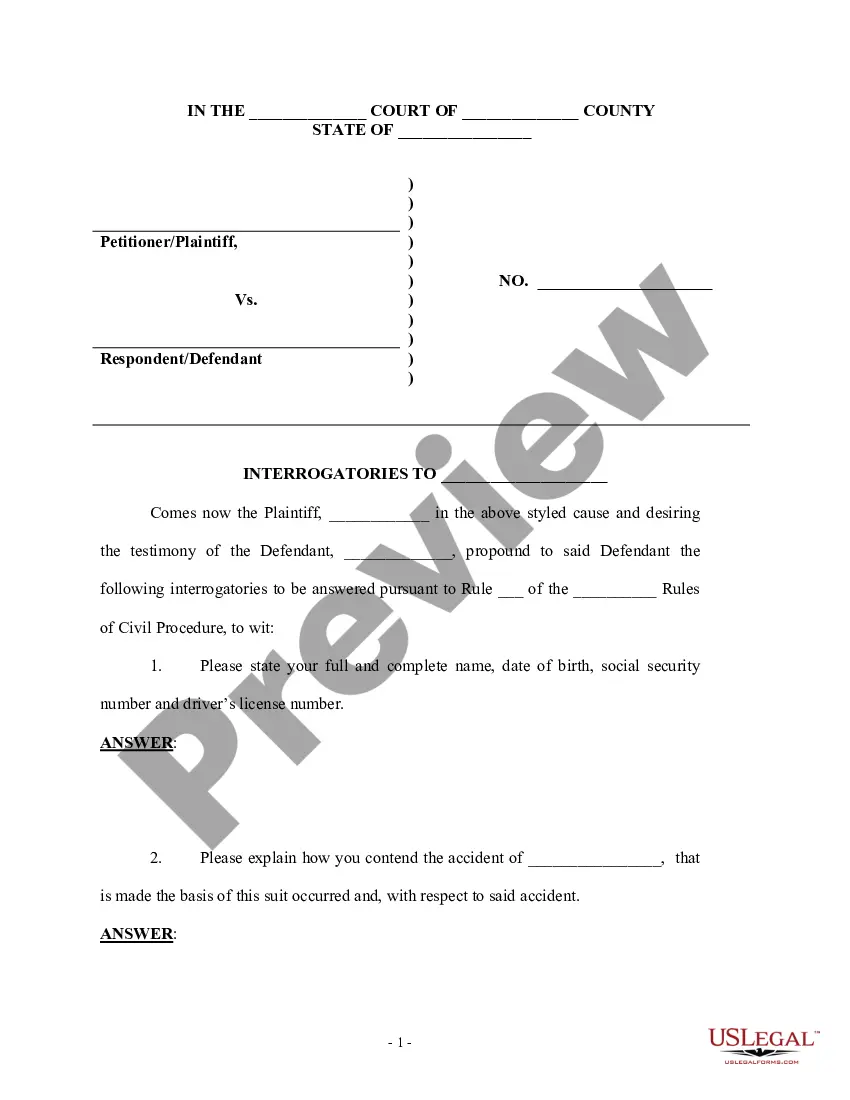

- Step 2. Make use of the Preview method to examine the form`s information. Do not forget about to read through the description.

- Step 3. Should you be unsatisfied together with the develop, utilize the Look for area near the top of the monitor to find other types of your legal develop format.

- Step 4. Once you have identified the shape you need, go through the Acquire now option. Pick the pricing plan you prefer and add your qualifications to register for an profile.

- Step 5. Process the financial transaction. You can use your credit card or PayPal profile to complete the financial transaction.

- Step 6. Choose the formatting of your legal develop and download it in your product.

- Step 7. Full, change and print out or indication the Oregon Loan Modification Agreement - Multistate.

Every legal file format you get is the one you have forever. You possess acces to every develop you delivered electronically in your acccount. Go through the My Forms segment and select a develop to print out or download yet again.

Compete and download, and print out the Oregon Loan Modification Agreement - Multistate with US Legal Forms. There are many skilled and condition-distinct forms you may use to your organization or person requirements.

Form popularity

FAQ

Could be reported as a settlement: Because you're changing the terms of your loan, some lenders may report your loan modification to the credit bureaus (Experian, TransUnion and Equifax) as a settlement, which can wreak havoc on your credit scores and remain on your credit reports for several years.

Recordation is necessary to ensure that the modified mortgage loan retains its first lien position and is enforceable in ance with its terms at the time of the modification, throughout its modified term, and during any bankruptcy or foreclosure proceeding involving the modified mortgage loan; or.

The modification can reduce your monthly payment to an amount you can afford. Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Given that the modification is non-substantial, the carrying amount is based on the original effective interest rate. The directly attributable transaction costs are capitalised as part of the new carrying amount and amortised over the remaining term of the modified loan.

Required documentation for a loan modification usually includes a formal application, pay stubs, financial statements, proof of income, bank statements, and tax returns, as well as a hardship statement.

If a lender chooses to make a loan modification after an event of default, the default will remain withdrawn after the modification is implemented. Alternatively, if the lender decides the forbearance option, preexisting defaults will stay outstanding.

A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable. Borrowers seeking a modification have to provide proof of hardship to their mortgage lender or servicer. Unlike forbearance, loan modifications are a permanent solution.