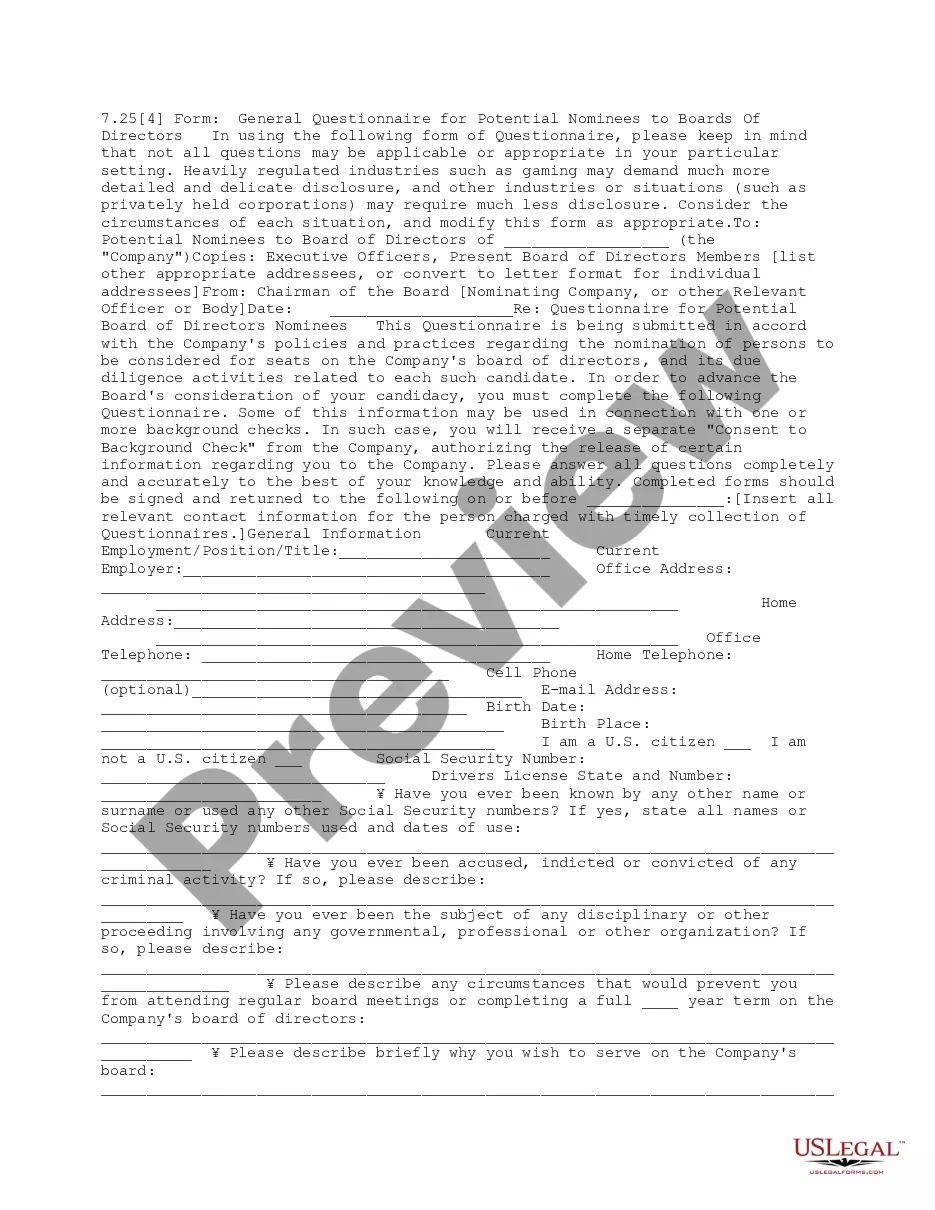

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from directors and officers of the listed company. Also, this questionnaire is to be answered by every non-employee director and proposed non-employee director of the company regarding business transactions.

Oregon Questionnaire for Nonemployee Directors

Description

How to fill out Questionnaire For Nonemployee Directors?

You might spend hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

It is easy to access or create the Oregon Questionnaire for Nonemployee Directors from this service.

If you want to obtain an additional variation of the form, utilize the Search field to find the template that aligns with your requirements and preferences.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Oregon Questionnaire for Nonemployee Directors.

- Every legal document template you receive is yours indefinitely.

- To obtain another copy of any purchased form, proceed to the My documents tab and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have selected the appropriate document template for your desired state/region.

- Review the form description to confirm that you have chosen the correct form.

Form popularity

FAQ

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Independent contractors, freelancers, sole proprietors, and self-employed individuals are examples of nonemployees who would receive a 1099-NEC. The recipient uses the information on a 1099-NEC to complete the appropriate sections of their tax return.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Oregon will require Forms 1099-NEC and 1099-K be filed with the state electronically. The filing threshold will be if required to file federally and file over 10 returns.

There is a new Form 1099-NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee.

Mail Form WR and payment to:Oregon Department of Revenue. PO Box 14800. Salem OR 97309-0920.Oregon Department of Revenue. PO Box 14260. Salem OR 97309-5060. IMPORTANT Mail your Form WR separately from your 2010 4th quarter Form OQ. Make a copy for your records.

Nonemployee compensation (also known as self-employment income) is the income you receive from a payer who classifies you as an independent contractor rather than as an employee. This type of income is reported on Form 1099-MISC, and you're required to pay self-employment taxes on it.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Form 1099-NEC is used to report non-employee compensation of $600 ore more for the year, to the IRS and the recipient. Non-employees include freelancers, independent contractors, small businesses, and professionals who provide services. The compensation being reported must be for services for a trade or business.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.