Oregon Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

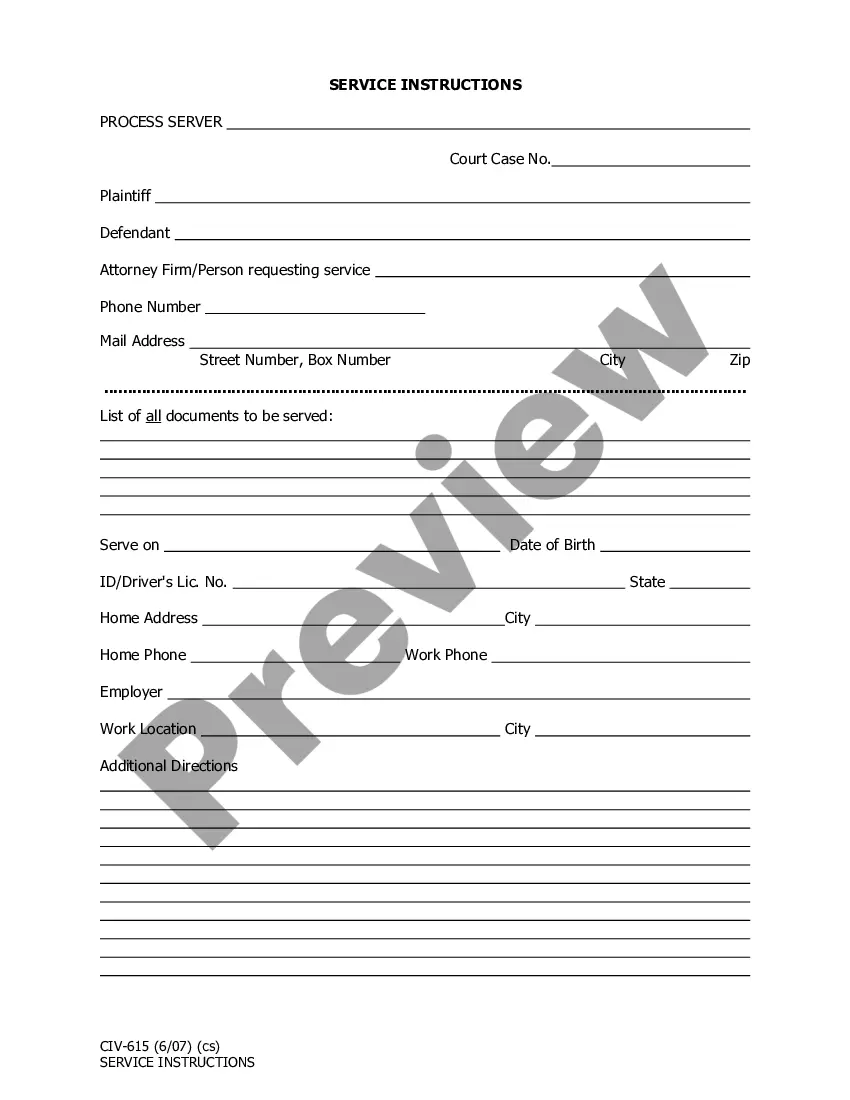

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

It is possible to commit time on the Internet attempting to find the legal file design that suits the state and federal requirements you need. US Legal Forms gives a large number of legal forms that are evaluated by pros. You can easily obtain or produce the Oregon Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan from our support.

If you already possess a US Legal Forms bank account, you may log in and click on the Download button. Following that, you may full, change, produce, or sign the Oregon Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Every legal file design you buy is your own permanently. To have one more version of any bought form, visit the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms web site the first time, stick to the easy directions under:

- Initially, make sure that you have selected the correct file design to the county/city of your choice. Read the form outline to ensure you have chosen the appropriate form. If accessible, make use of the Preview button to search throughout the file design at the same time.

- If you would like discover one more model of your form, make use of the Search area to find the design that suits you and requirements.

- Once you have identified the design you would like, simply click Acquire now to proceed.

- Select the rates program you would like, key in your credentials, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal bank account to cover the legal form.

- Select the formatting of your file and obtain it for your product.

- Make modifications for your file if needed. It is possible to full, change and sign and produce Oregon Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

Download and produce a large number of file themes utilizing the US Legal Forms web site, that provides the greatest variety of legal forms. Use professional and state-specific themes to deal with your business or specific requirements.

Form popularity

FAQ

A security interest on a loan is a legal claim on collateral that the borrower provides that allows the lender to repossess the collateral and sell it if the loan goes bad. A security interest lowers the risk for a lender, allowing it to charge lower interest on the loan.

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.

Security Interest vs Lien Security interest and lien are two legal interests creditors can have over a borrower's property or assets to secure debt payment. Here are some key differences between them: Scope: It can be taken over real and personal property, while liens typically take over real property.

A lien is a security interest or legal claim against property that is used as collateral to satisfy a debt. In other words, liens enable creditors to assert their rights over property.

In the U.S. the term "security interest" is often used interchangeably with "lien". However, the term "lien" is more often associated with the collateral of real property than with of personal property. A security interest is typically granted by a "security agreement".